Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #41

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

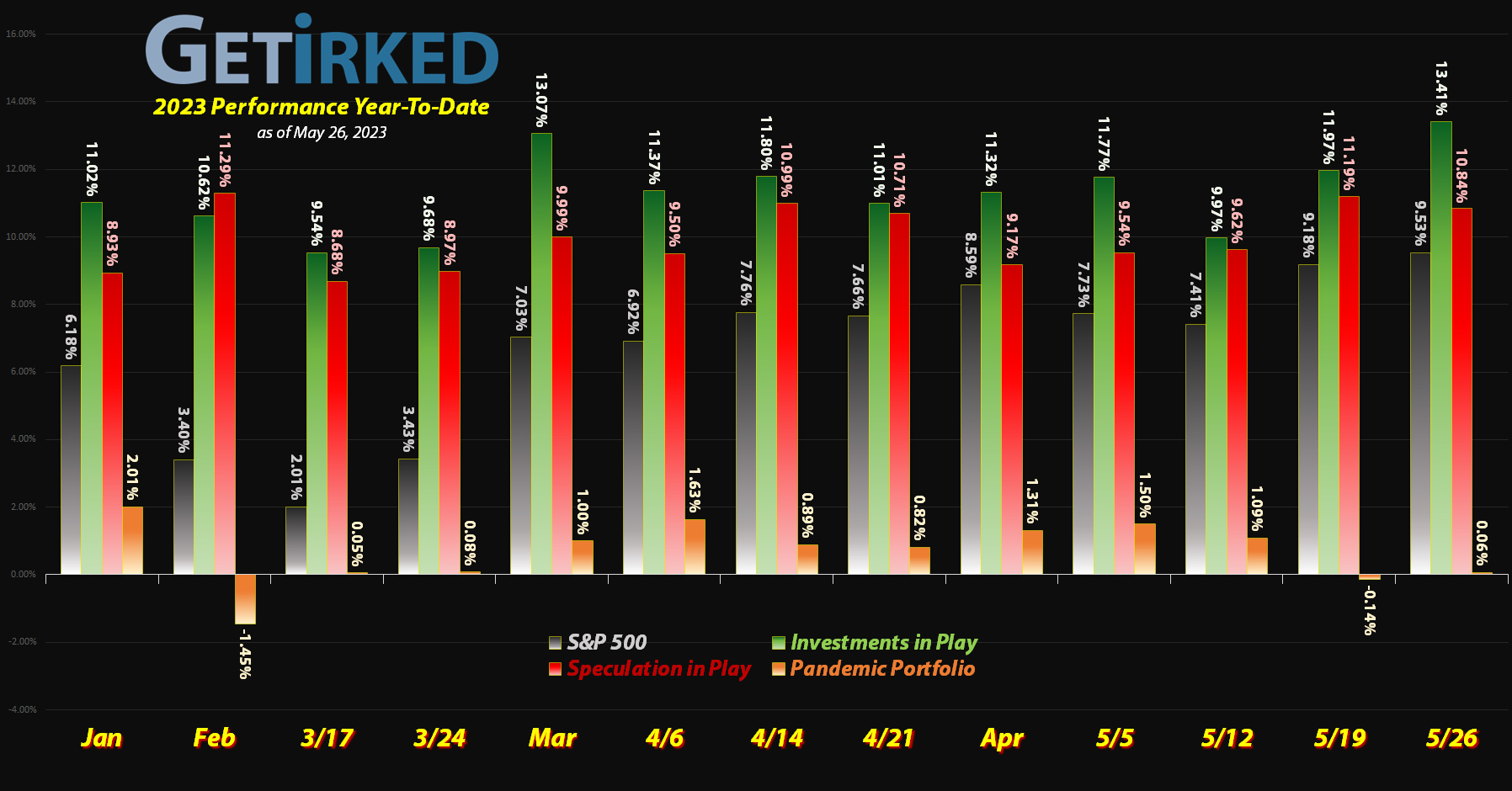

Time to get a little more aggressive…

The Pandemic Portfolio’s been struggling since 2021. As this is the case for the vast majority of portfolio’s out there, I am more frustrated with how challenging it has seemed to put more cash to work in this portfolio – this portfolio’s cash position is in excess of 60% and even with the ability to earn 4.5%-5% on that cash, that’s simply far too large of a cash position.

Accordingly, I’ve started eyeing new companies to add to the portfolio and, as you’ll see in this update, the first one, Chevron (CVX), has made its appearance.

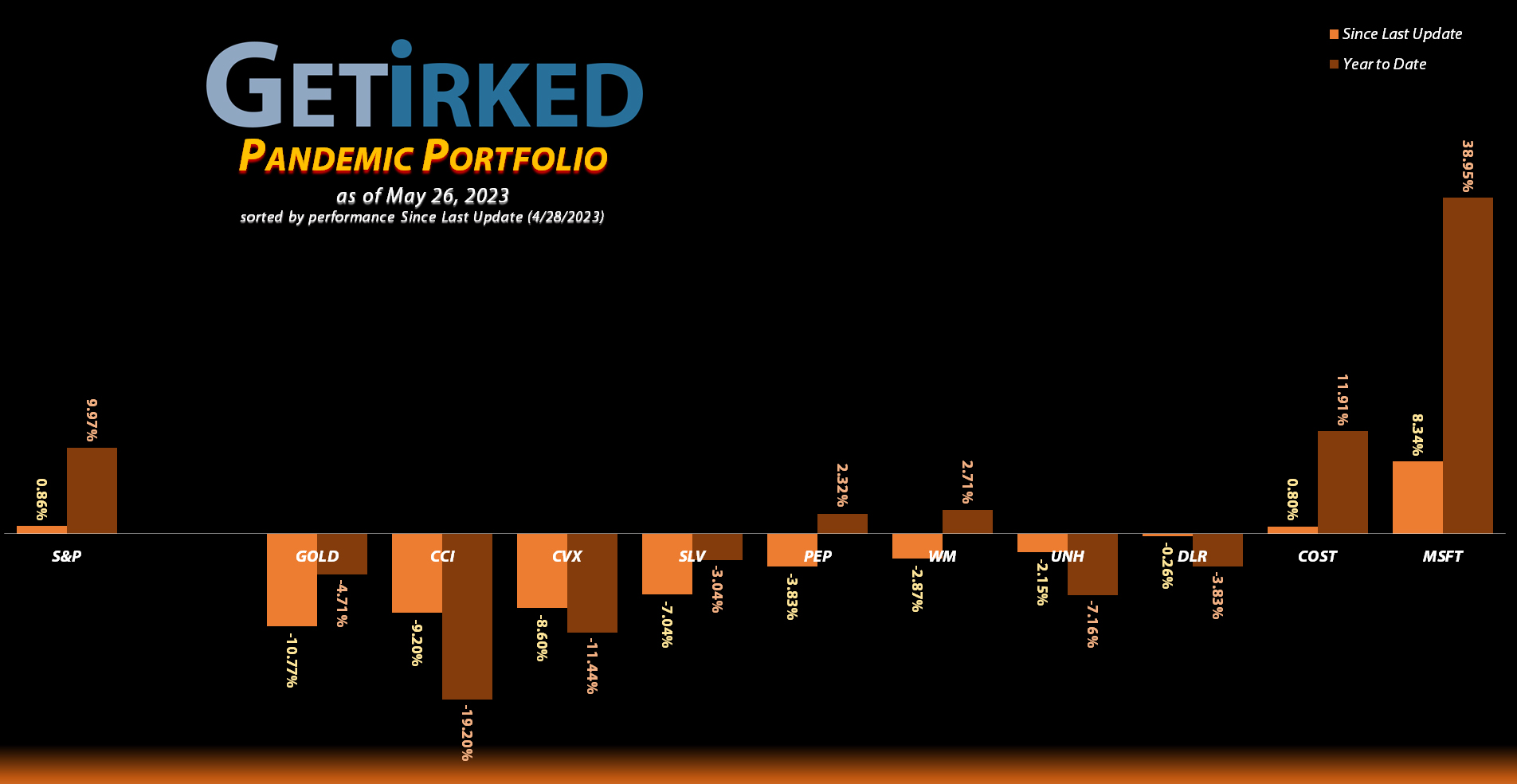

Since the last update, Real Estate Investment Trusts (REITs) have remained under fire as investors fret over the potential collapse of the Commercial Real Estate (CRE) market. Precious metals like gold and silver got hit hard when the Federal Reserve maintained its hawkish stance, with all of the metals selling off significantly from their recent overbought highs. In short, it’s been a busy month.

Let’s take a look at the moves since the last update…

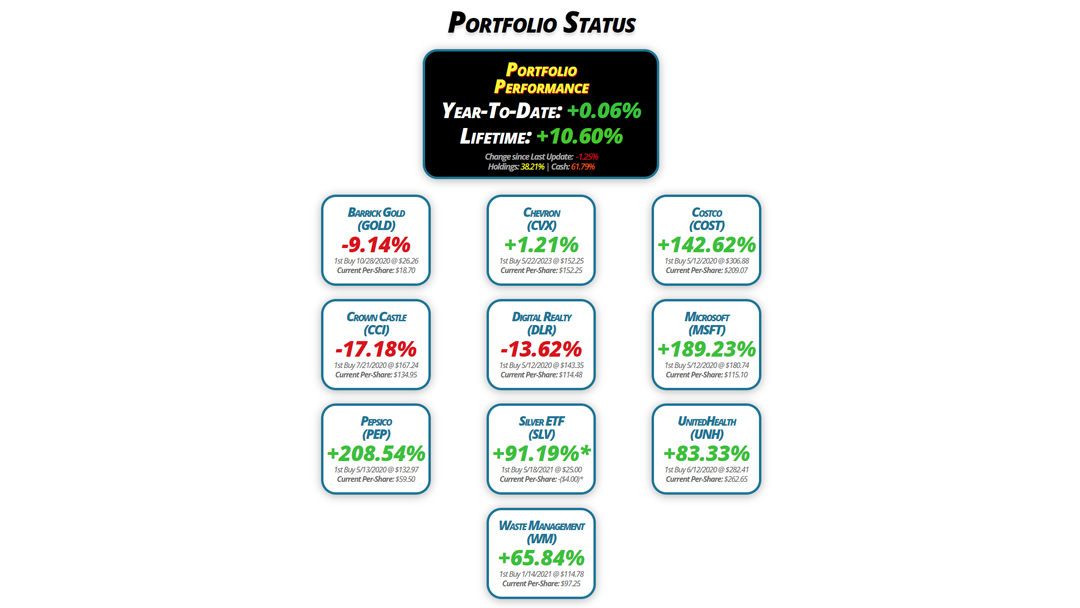

Portfolio Status

Portfolio

Performance

Year-To-Date: +0.06%

Lifetime: +10.60%

Change since Last Update: -1.25%

Holdings: 38.21% | Cash: 61.79%

Barrick Gold

(GOLD)

-9.14%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.70

Crown Castle

(CCI)

-17.18%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $134.95

Pepsico

(PEP)

+208.54%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.50

Chevron

(CVX)

+1.21%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $152.25

Digital Realty

(DLR)

-13.62%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $114.48

Silver ETF

(SLV)

+91.19%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Waste Management

(WM)

+65.84%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $97.25

Costco

(COST)

+142.62%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.07

Microsoft

(MSFT)

+189.23%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $115.10

UnitedHealth

(UNH)

+83.33%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $262.65

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

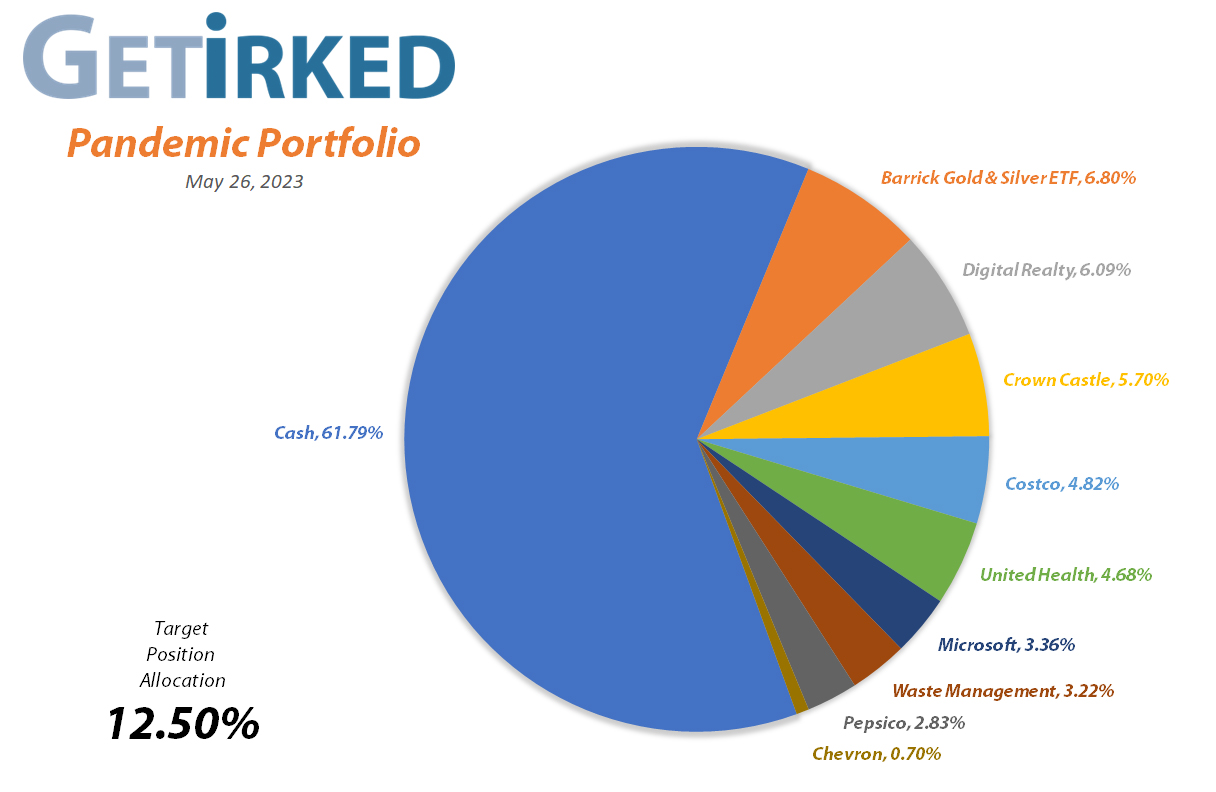

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Profit-Taking

Current Price: $16.99

Per-Share Cost: $18.70 (-0.27% since last update)

Profit/Loss: -9.14%

Allocation: 6.22%* (-1.01% since last update)

Next Buy Target: $15.51

Barrick Gold (GOLD) popped briefly after reporting earnings after the close on Tuesday, May 2, triggering my next sell order Wednesday morning at $19.75. The sale locked in +11.90% in gains on shares I bought for $17.65 back last year on June 30 and lowered my per-share cost -0.27% from $18.75 to $18.70.

From here, my next buy target is $15.51, above a recent point of support, and my next sell target is $19.96, right around a past point of resistance.

GOLD is $16.99 as of this update, down -13.97% from where I took profits.

Chevron (CVX): *New Position*

Current Price: $154.09

Per-Share Cost: $152.25 (*New Position*)

Profit/Loss: +1.21%

Allocation: 0.70%* (*New Position*)

Next Buy Target: $141.05

Having pulled back nearly 20% from its all-time high earlier in 2023, I decided to open a position in the oil and gas mega-company, Chevron (CVX) on Monday, May 22 with an initial purchase at $152.25.

Long-time readers of my Speculation in Play portfolio may recognize this name as I only just closed the position entirely earlier this year – an incredibly successful investment purchased during the March 2020 selloff when Chevron collapsed into the $50s.

I decided it was time for Chevron to graduate to become a large investment and it’s a perfect candidate for the Pandemic Portfolio what with its juicy dividend of nearly 4% annually even at its current prices. Chevron has a myriad of long-term prospects. Not only will it likely be decades before humans wean themselves off of oil, Chevron’s renewable energy division will only continue to grow into the future.

From here, my next buy target is $141.05, above a recent point of support, and, of course, I have no sell targets, yet, as I am only building the position.

CVX is $154.09 as of this update, up +1.21% from where I bought.

Costco (COST): Dividend Reinvestment

Current Price: $507.26

Per-Share Cost: $209.07 (-0.21% since last update)

Profit/Loss: +142.62%

Allocation: 4.82%* (+0.11% since last update)

Next Buy Target: $466.89

Costco (COST) paid out its quarterly dividend on Monday, May 22, which lowered my per-share cost -0.21% from $209.50 to $209.07.

Costco’s quarterly dividend certainly isn’t much to write home about at roughly 0.8% annually, however rumors are swirling that the big bulk retailer is planning to pay out a special dividend very soon as it has now been three years since it last paid one in 2020.

Crown Castle (CCI): Added to Position

Current Price: $111.76

Per-Share Cost: $134.95 (-1.35% since last update)

Profit/Loss: -17.18%

Allocation: 5.70%* (-0.33% since last update)

Next Buy Target: $103.61

Crown Castle (CCI) broke below its 2022 low by quite a margin in the second week of May, triggering my next buy order on Monday, May 8 slightly above its pandemic selloff bottom of $114.18 with a buy that filled at $116.02.

The buy locked in a -20.35% discount replacing shares I sold for $145.66 on December 13, 2022 and lowered my per-share cost -1.35% from $136.79 to $134.95. From here, my next buy target is $103.61, around a past point of support, and my next sell target is $151.93, below CCI’s 2023 high so far.

CCI is $111.76 as of this update, down -3.67% from where I added.

Digital Realty Trust (DLR): Strategy Update

Current Price: $98.89

Per-Share Cost: $114.48 (Unchanged since last update)

Profit/Loss: -13.62%

Allocation: 6.09%* (+0.09% since last update)

Next Buy Target: $86.23

Digital Realty Trust (DLR) came under a lot of selling pressure since the last update along with the rest of the market, particularly the Real Estate Investment Trusts (REIT).

Since I have a bit more confidence in DLR’s exposure to data centers instead of traditional forms of real estate, my next buy target is slightly above Digital Realty’s 2022 lows at $86.23.

Microsoft (MSFT): Profit-Taking

Current Price: $332.89

Per-Share Cost: $115.10 (-34.23% since last update)

Profit/Loss: +189.23%

Allocation: 3.36%* (-1.08% since last update)

Next Buy Target: $225.02

When Microsoft (MSFT) continued to rally on the back of the Artificial Intelligence craze early in May, I decided to take profits on Tuesday, May 2 with a sell order which filled at $308.75, locking in +50.00% in gains on shares I purchased for $205.83 back on October 28, 2020.

The sale also lowered my per-share cost an outstanding -34.23% from $175.00 down to $115.10. From here, my next sell target is $349.47, just under Microsoft’s all-time high where I will remove all remaining capital out of the position, and my next buy target is $225.02, slightly above a key level of support that Microsoft saw at the end of 2022.

MSFT is $332.89 as of this update, up +7.82% from where I took profits.

Pepsico (PEP): Strategy Update

Current Price: $183.58

Per-Share Cost: $59.50 (Unchanged since last update)

Profit/Loss: +208.54%

Allocation: 2.83%* (-0.08% since last update)

Next Buy Target: $161.40

When it looked like the debt ceiling debate might become resolved, Pepsico (PEP) fell under a lot of selling pressure, and despite the ongoing debate, PEP has remained under weakness, likely a result of how dramatically overbought PEP had become since the beginning of 2023.

Thanks to taking profits at higher levels than here, I will stay pat with my next buy target at $161.40 despite Pepsico having found support several times above that point. PEP has a tendency to surprise me with how weak it can actually get, so I’d rather miss an opportunity in this one than buy too early only to have it fall to lower levels.

iShares Silver ETF (SLV): Strategy Update

Current Price: $21.38

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +91.19%

Allocation: 0.58%* (-0.04% since last update)

Next Buy Target: $18.40

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Just like gold and the other precious metals, Silver (SLV) came under a significant amount of selling pressure. In fact, the selling was more powerful in silver likely due to its exposure to the industrial sector where its need will dry up if the global economy heads into recession.

As a result, silver sold off. Since I’m playing with the “house’s money” in this one, I’m in no hurry to replace the shares I sold in early April. I can wait for SLV to test its March lows at $18.40 before adding.

UnitedHealth (UNH): Strategy Update

Current Price: $481.52

Per-Share Cost: $262.65 (Unchanged since last update)

Profit/Loss: +83.33%

Allocation: 4.68%* (-0.05% since last update)

Next Buy Target: -NO BUY TARGET-

I swear the stock market got wind of my decision to close my UnitedHealth (UNH) position entirely because UNH has been under weakness for ever since reporting an excellent quarter in April. I’ve even lowered my selling price target to $527.59, just below its recent high, from around where I had initially planned to sell it around $553.00, just under its all-time high.

Naturally, I still have no plans to add to this position as I am trying to close it out entirely due to my ethical misgivings about the company’s operation, however my investing discipline requires me to sell into strength, not weakness, and UNH seems to be building a base before it makes any moves higher from here.

This one may take awhile.

Waste Management (WM): Strategy Update

Current Price: $161.28

Per-Share Cost: $97.25 (Unchanged since last update)

Profit/Loss: +65.84%

Allocation: 3.22%* (-0.06% since last update)

Next Buy Target: $148.74

After taking substantial profits in Waste Management (WM) over the course of the past nine months, I’ve decided to replace the shares I sold in April at $166.64 at a higher point of support around $148.74, just above the lows that Waste Management saw earlier in 2023.

Despite seeing a bit of weakness since the first few weeks in May, WM found its footing on the 50-Day Moving Average line and bounced, so it might find support. If so, I do plan to take even more off the table slightly above $170, just under WM’s recent high.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.