Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #52

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

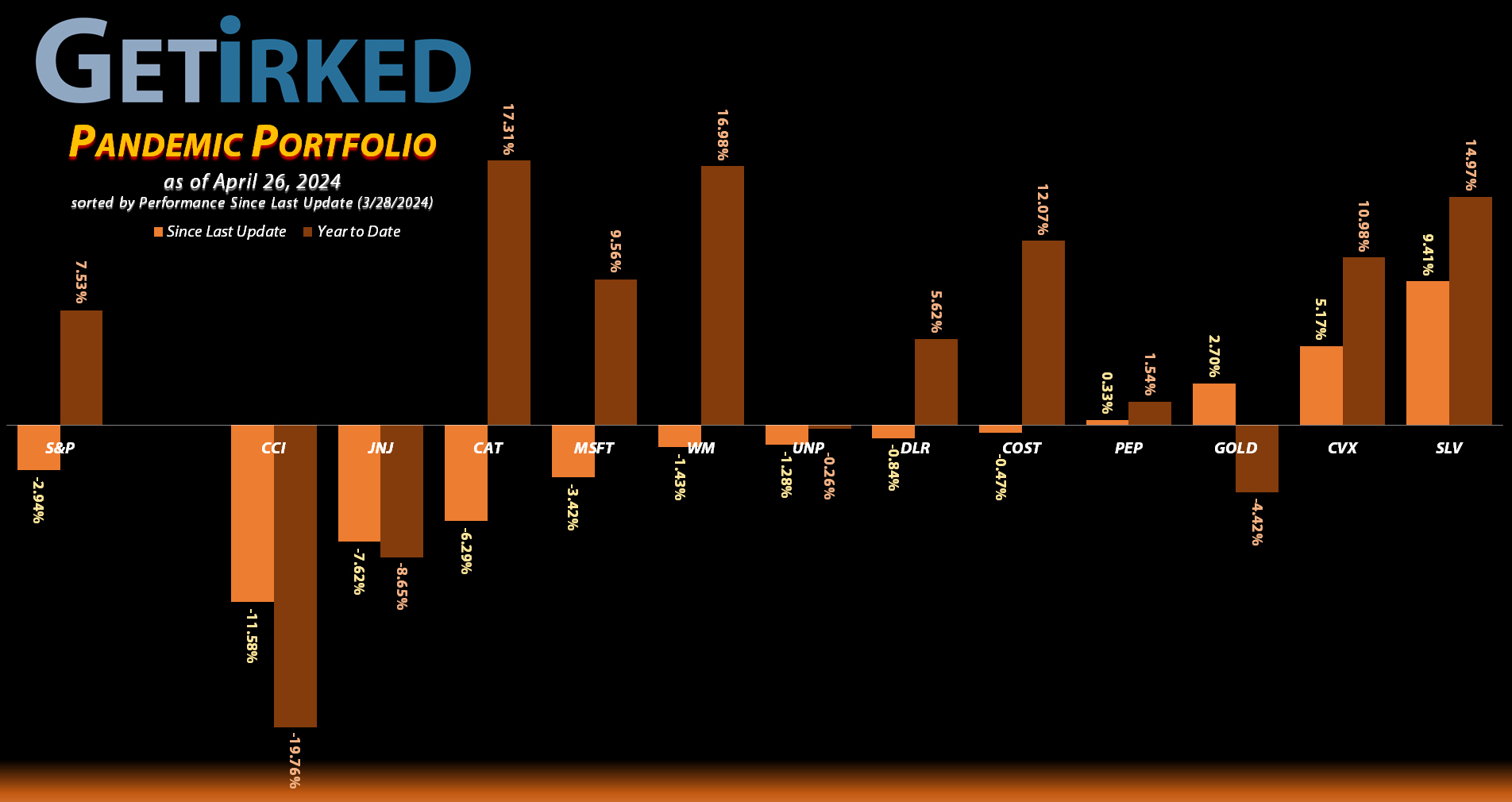

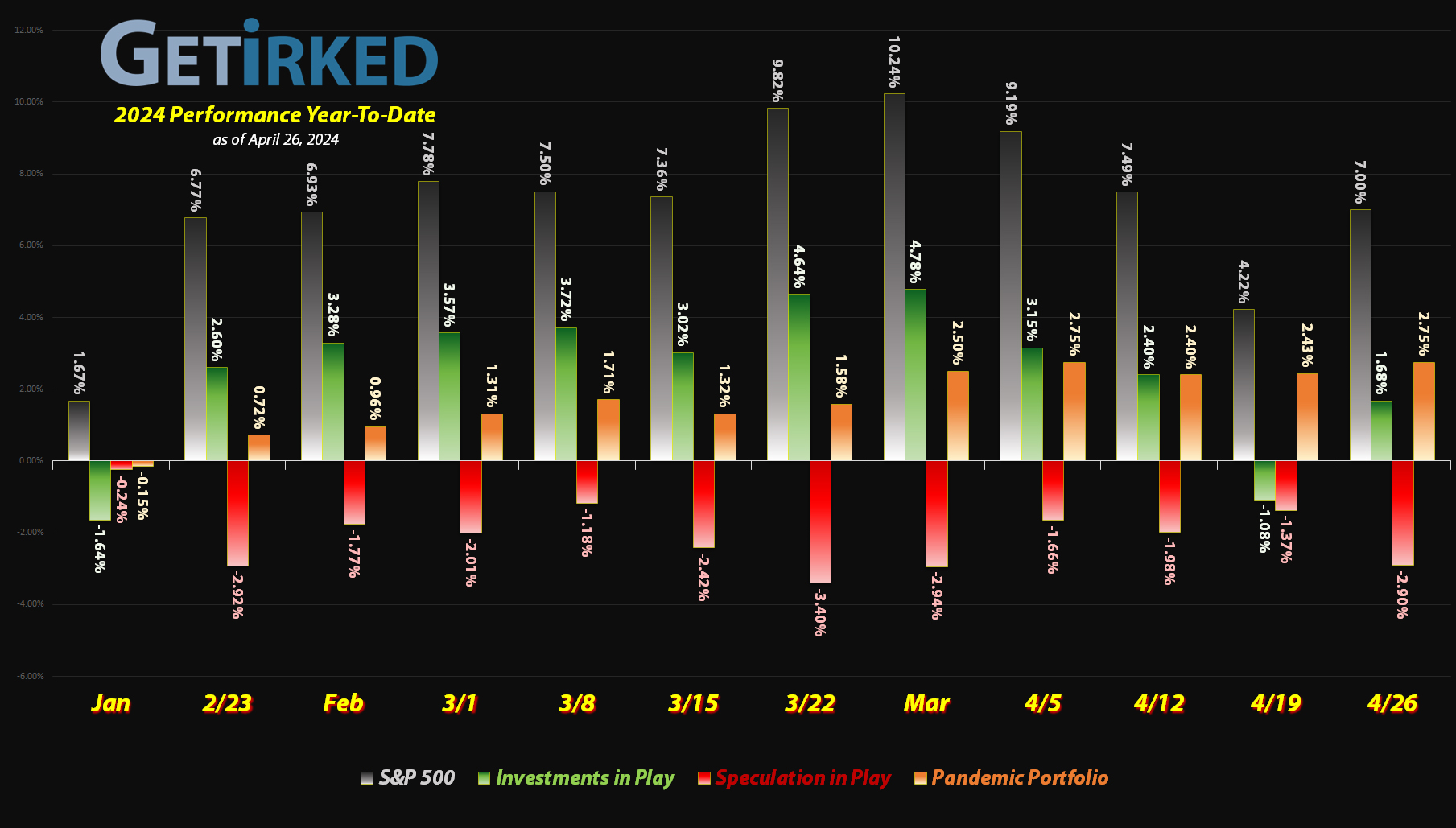

The Portfolio’s Been Rangebound…

The last month has been somewhat uneventful for the Pandemic Portfolio. The majority of positions meandered around their trading ranges, and the ones that broke out were balanced by those that broke down. Chevron (CVX) popped with the rest of the energy space, while Barrick Gold (GOLD) pulled back substantially despite gold remaining strong near all-time highs.

Let’s take a look at the moves I made since our last update…

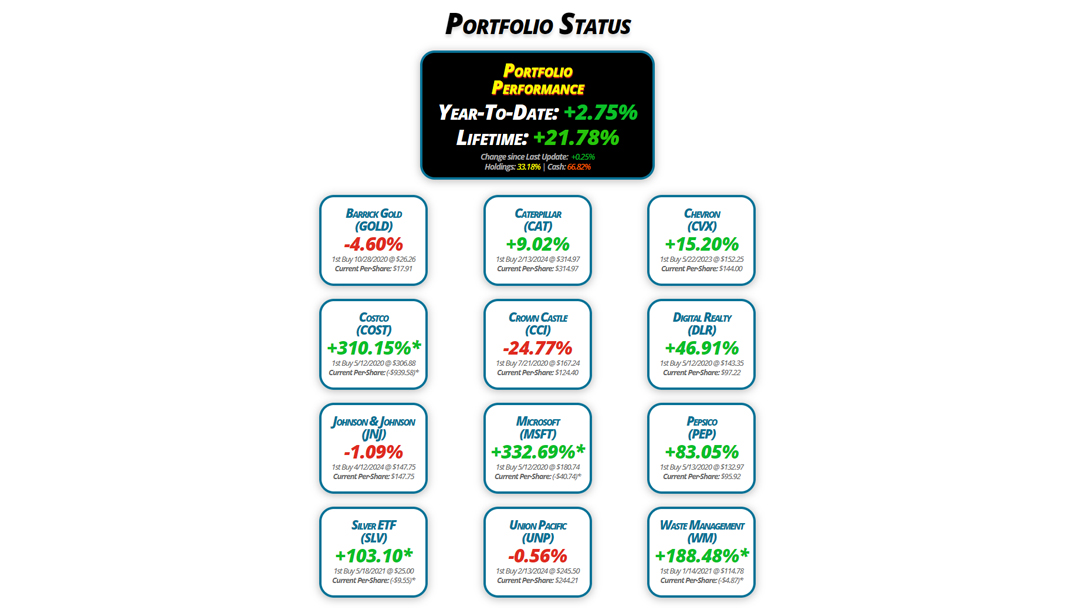

Portfolio Status

Portfolio

Performance

Year-To-Date: +2.75%

Lifetime: +21.78%

Change since Last Update: +0.25%

Holdings: 33.18% | Cash: 66.82%

Barrick Gold

(GOLD)

-4.60%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $17.91

Costco

(COST)

+310.15%*

1st Buy 5/12/2020 @ $306.88

Current Per-Share: (-$939.58)*

Johnson & Johnson

(JNJ)

-1.09%

1st Buy 4/12/2024 @ $147.75

Current Per-Share: $147.75

Silver ETF

(SLV)

+103.10*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: (-$9.55)*

Caterpillar

(CAT)

+9.02%

1st Buy 2/13/2024 @ $314.97

Current Per-Share: $314.97

Crown Castle

(CCI)

-24.77%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $124.40

Microsoft

(MSFT)

+332.69%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$40.74)*

Union Pacific

(UNP)

-0.56%

1st Buy 2/13/2024 @ $245.50

Current Per-Share: $244.21

Chevron

(CVX)

+15.20%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $144.00

Digital Realty

(DLR)

+46.91%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $97.22

Pepsico

(PEP)

+83.05%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $95.92

Waste Management

(WM)

+188.48%*

1st Buy 1/14/2021 @ $114.78

Current Per-Share: (-$4.87)*

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

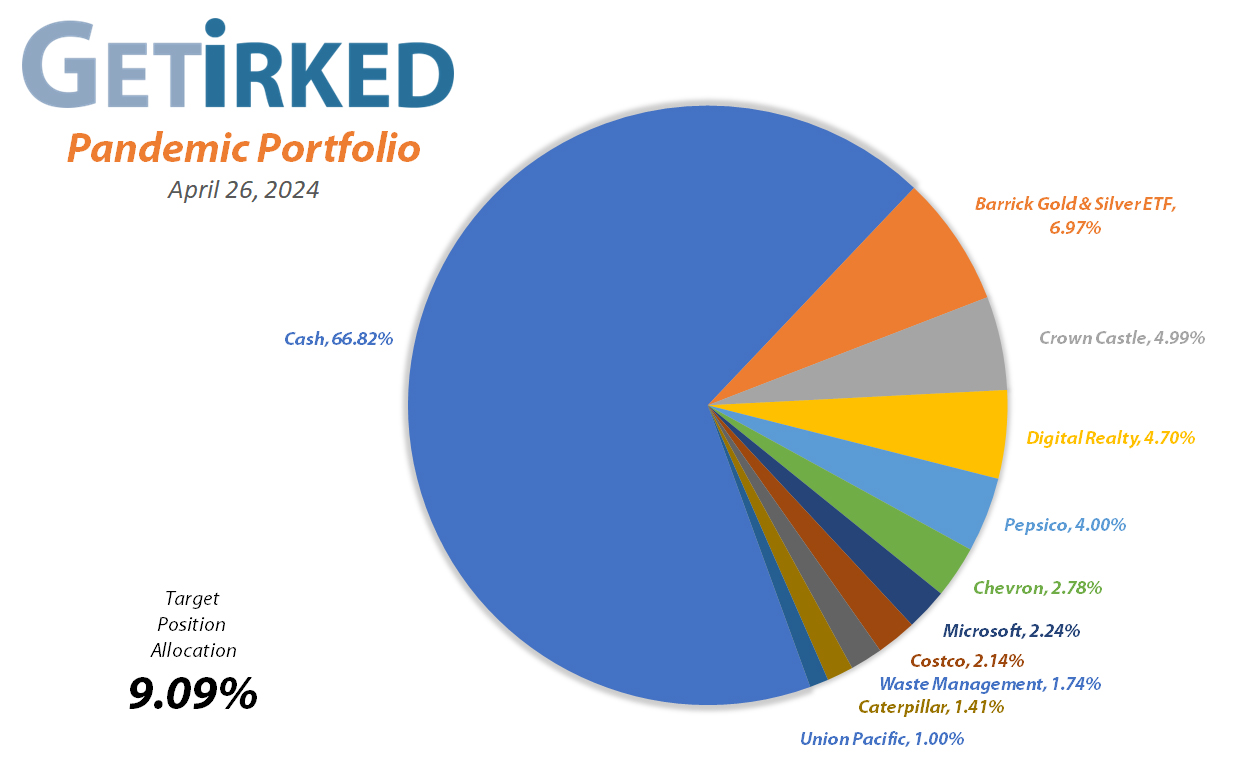

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Strategy Update

Current Price: $17.09

Per-Share Cost: $17.91 (Unchanged since last update)

Profit/Loss: -4.60%

Allocation: 6.46%* (+0.16% since last update)

Next Buy Target: $13.82

How quickly they fall… Barrick Gold (GOLD) and the rest of the mining complex made a good run of it into the end of March only to roll over and collapse throughout April. Despite the yellow metal holding up pretty well in the face of no interest rate hikes, the miners are a shambles.

As a result, I’ve lowered my next sell target to $18.35, a bit below GOLD’s recent high, where I’ll start trimming my position lest I fall prey to Lucy playing football with Charlie Brown again (I’m Charlie Brown in this metaphor). My next buy target is $13.82, slightly above the low GOLD saw earlier in 2024.

Caterpillar (CAT): Strategy Update

Current Price: $343.38

Per-Share Cost: $314.97 (Unchanged since last update)

Profit/Loss: +9.02%

Allocation: 1.41%* (-0.10% since last update)

Next Buy Target: $300.53

On Thursday, April 25, Caterpillar (CAT) blew away its earnings report but gave poor forward guidance which caused the stock to sell off from its lofty highs. However, that being said, CAT still remains substantially above my initial buy of $314.97 made in February on the 13th.

I will continue to target areas of support slightly above Caterpillar’s 200-Day Simple Moving Average which remains way down around $291-292 currently. However, since I want to build this position a bit more aggressively, I have raised my next buy to $300.53, above a point of support Caterpillar saw earlier in 2024.

Chevron (CVX): Strategy Update

Current Price: $165.89

Per-Share Cost: $144.00 (Unchanged since last update)

Profit/Loss: +15.20%

Allocation: 2.78%* (+0.13% since last update)

Next Buy Target: $140.69

Chevron (CVX) beat on earnings on Friday, April 26, but rising refinery costs combined with nearly record-low natural gas pricing will continue to be a drag going forward. That being said, the stock held up remarkably well during trading on Friday, so there’s that, I guess.

From here, I have no plans to change my next buy target from $140.69, above the low CVX just saw in January, and my next sell target also remains the same at $187.81, just under Chevron’s all-time high.

Costco (COST): Strategy Update

Current Price: $729.18

Per-Share Cost: -$939.58* (Unchanged since last update)

Profit/Loss: +310.15%

Allocation: 2.14%* (-0.02% since last update)

Next Buy Target: $676.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Costco (COST) has remained rangebound since it last reported earnings in February, trading down to $697.27 where it found support, rebounding to $741.00 before selling off back down to $702.00. As a result, I’m holding firm with my next buy target at $676.89, the next level of support should Costco break through to lower lows.

Crown Castle (CCI): Dividend Reinvestment

Current Price: $93.58

Per-Share Cost: $124.40 (-1.46% since last update)

Profit/Loss: -24.77%

Allocation: 4.99%* (-0.59% since last update)

Next Buy Target: $85.22

Crown Castle (CCI) paid out its rather substantial quarterly dividend on March 28, 2024 which lowered my per-share cost -1.46% from $126.24 to $124.40. It also beat on earnings back when it reported on April 17, but not by enough of a margin to seriously impress investors.

From here, my next buy target is $85.222, above the low Crown Castle saw in late 2023. Previously, my next buy target had been higher than that, but I changed my mind after seeing CCI’s weakness and realizing I already have a decent allocation in this stock.

My next sell target is $124.99, slightly above my cost basis and below a point of resistance.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $142.83

Per-Share Cost: $97.22 (-0.85% since last update)

Profit/Loss: +46.91%

Allocation: 4.70%* (-0.02% since last update)

Next Buy Target: $86.65

Digital Realty Trust (DLR) paid out its rather substantial quarterly dividend on March 28, 2024 which lowered my per-share cost -0.85% from $98.05 to $97.22. From here, my next buy target is $86.65, near a past point of support, and my next sell target is $153.20, slightly above my cost basis and below a point of resistance.

Johnson & Johnson (JNJ): *New Position*

Current Price: $146.14

Per-Share Cost: $147.75 (Unchanged since started)

Profit/Loss: -1.09%

Allocation: 1.20%* (Unchanged since since started)

Next Buy Target: $143.40

I decided to open a new position in Johnson & Johnson for the Pandemic Portfolio. I know you might be asking, “Isn’t that the company that’s been having so much trouble with accusations that its talcum powder allegedly containing asbestos?”

Yes, that Johnson & Johnson. It also happens to be one of the premiere healthcare companies in the world, has had its stock beaten down to bargain-basement valuations, and pays a very respectable 3.20% dividend yield at these prices.

Since the Pandemic Portfolio has no healthcare exposure after I removed UnitedHealth (UNH), I decided to open a position in JNJ on Friday, April 12 when the stock dipped below my price target, giving me an initial 13.34% allocation at $147.75.

From here, my next buy target is $143.40, above a point of support JNJ just formed after it reported earnings. Of course, I have no sell targets for the moment as I am just building this position.

JNJ is $146.14 as of this update, down -1.09% from where I opened it.

Microsoft (MSFT): Added to Position

Current Price: $406.32

Per-Share Cost: -$40.74* (+$12.61 since last update)

Profit/Loss: +332.69

Allocation: 2.24%* (-0.02% since last update)

Next Buy Target: $371.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

I added some of my profits back into my Microsoft (MSFT) position when it sold off with the rest of the tech sector on Friday, April 19. I added 0.68% to the position at $400.00. I’m adding very small quantities as I believe there may be a much larger pullback in store.

The buy raised my per-share “cost” +$12.61 from -$53.35 to -$40.74 (a negative per-share cost indicates all capital has been removed in addition to $40.74 per share added to the portfolio’s bottom line in addition to each share’s current value).

On Thursday, April 25, Microsoft reported a blowout earnings quarter. Unlike Alphabet / Google (GOOGL) which rocketed past its all-time highs following its blowout earnings the same night, MSFT remains under its all-time high, likely due to its already-rich valuation.

From here, I still have no sell targets for this position as it’s smaller than I’d like and I’m looking to rebuild it. My next buy target is $371.89, slightly above a past point of support as well as Microsoft’s 200-Day Simple Moving Average.

MSFT is $406.32 as of this update, up +1.58% from where I added.

Pepsico (PEP): Dividend Reinvestment

Current Price: $175.58

Per-Share Cost: $95.92 (-0.72% since last update)

Profit/Loss: +83.05%

Allocation: 3.99%* (+0.03% since last update)

Next Buy Target: $155.98

Pepsico (PEP) paid out its quarterly dividend on Tuesday, April 2, which, after reinvestment, lowered my per-share cost -0.72% from $96.62 to $95.92. PEP also blew away earnings expectations on April 23, after which it briefly sold off… a baffling move… before rocketing higher to finish off the month.

From here, my next buy target is $155.98, slightly above the low Pepsico saw in late 2023 and my next sell target is $196.16, just under Pepsico’s all-time high.

iShares Silver ETF (SLV): Profit-Taking

Current Price: $24.89

Per-Share Cost: -$9.55* (-$5.55 since last update)

Profit/Loss: +103.10%*

Allocation: 0.51%* (-0.05% since last update)

Next Buy Target: $20.15

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Silver (SLV) finally got on its horse early in April, not enough to remotely catch up to the respective performance in gold, mind you, but at least it’s rallying. On Tuesday, April 2, SLV hit my next sell target at $23.75, selling 16.67% of the position and locking in +42.22% in gains on shares I bought for $16.70 back on August 31, 2022.

The sale lowered my per-share “cost” -$5.55 from -$4.00 to -$9.55 (a negative per-share cost indicates all capital has been removed in addition to $9.55 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $27.45, below a past point of resistance, and my next buy target is $20.15, above the low SLV saw earlier in 2024.

SLV is $24.89 as of this update, up +4.80% from where I took profits.

Union Pacific (UNP): Dividend Reinvestment

Current Price: $242.84

Per-Share Cost: $244.21 (-0.53% since last update)

Profit/Loss: -0.56%

Allocation: 1.00%* (-0.01% since last update)

Next Buy Target: $221.03

Union Pacific (UNP) paid out its quarterly dividend on Tuesday, April 2, which, after reinvestment, lowered my per-share cost -0.53% from $245.50 to $244.21. On Thursday, April 25, UNP reported a blowout quarter with excellent forward guidance, causing the stock to rally from where it had slid toward the end of April.

Given the incredible support UNP saw at its recent low, I have raised my next buy target to $221.03, above a past point of support, and, since this position is still very new, I have no sell targets at this time.

Waste Management (WM): Dividend Reinvestment

Current Price: $210.07

Per-Share Cost: -$4.87 (+0.41% since last update)

Profit/Loss: +188.48%

Allocation: 1.74%* (-0.02% since last update)

Next Buy Target: $198.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Waste Management (WM) paid out its quarterly dividend on March 28, 2024, which, after reinvestment raised my per-share “cost” +0.41% from -$4.89 to -$4.87 (a negative per-share cost indicates all capital has been removed in addition to $4.87 per share added to the portfolio’s bottom line in addition to each share’s current value).

Why did my cost basis raise after receiving a dividend?

Whenever all capital has been removed from a position, a dividend reinvestment adds more shares to the position, not more profits. So, the profit in the position is divided by more shares and raises the per-share cost even though the value of the entire position is also increased by the new shares from the dividend.

On April 24, Waste Management once again knocked earnings out the park with an excellent report as well as stellar forward guidance, cementing this play in the Pandemic Portfolio. As a result of its continuously impressive performance, I have raised my next buy target to $198.89, just above a recent low, and I still have no additional sell targets on this position.

* Target allocation for each position in the portfolio is 9.09% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.