April 26, 2024

The Week’s Biggest Winner & Loser

Arm Holdings (ARM)

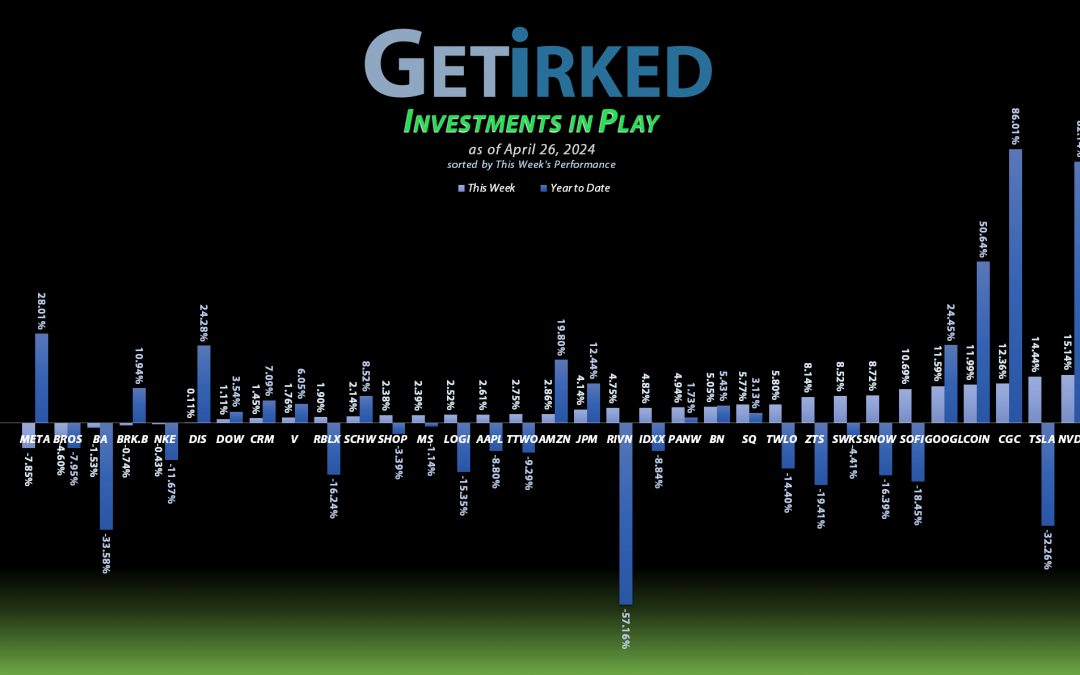

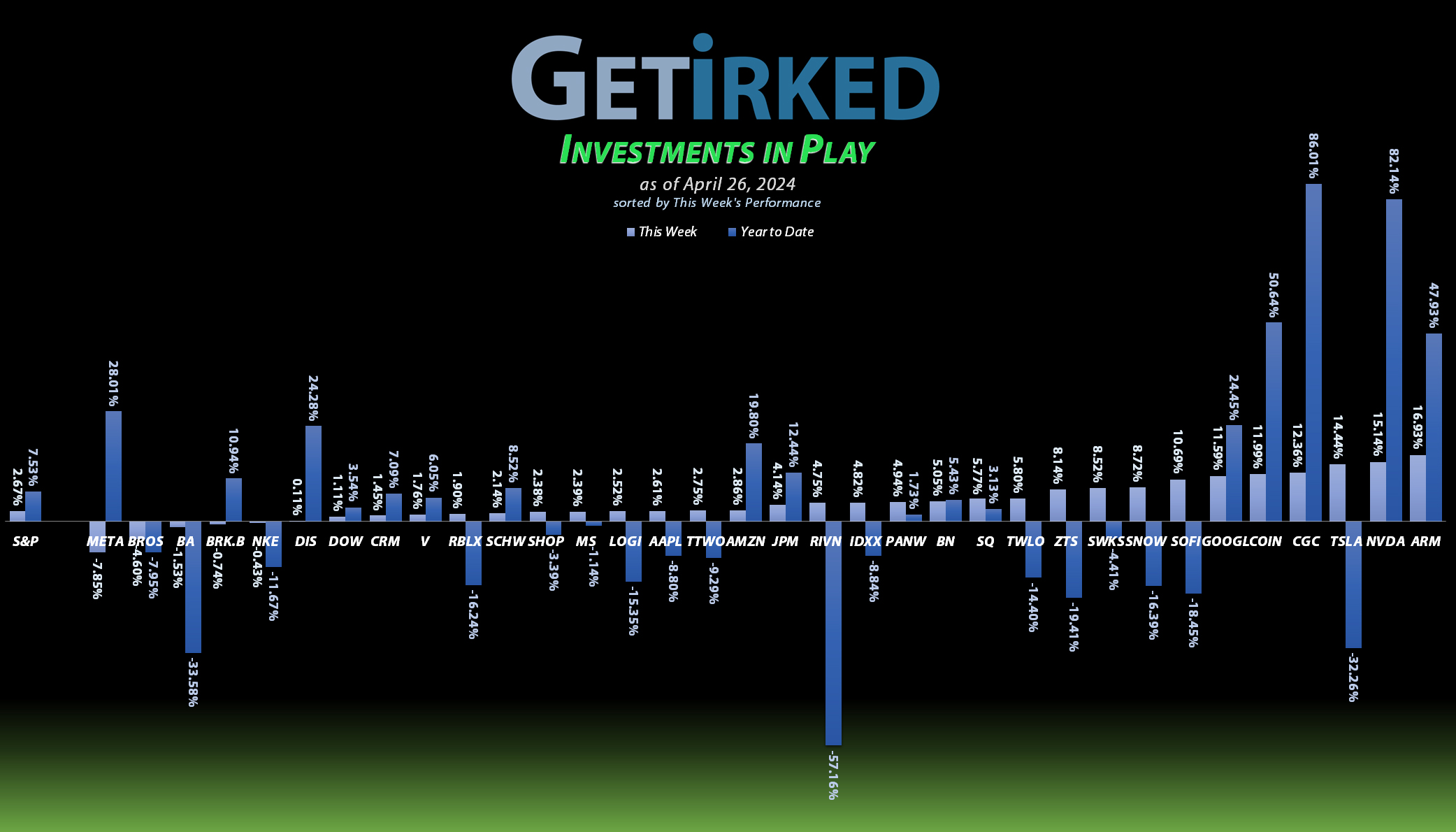

When Meta (META), Microsoft (MSFT), and Alphabet (GOOGL) already reported increased cap-ex spend on artificial intelligence (AI), the sector really exploded. As a result, any company with any connection to AI saw a significant boost with Arm Holdings (ARM) seeing even more of a rally than the mackdaddy Nvidia (NVDA)! Arm rallied +16.93% this week alone, easily coming in as the Week’s Biggest Winner.

Meta (META)

Meta (META) reported a truly stellar quarter during its earnings report, but CEO Mark Zuckerberg came out and dropped the bomb… again. Zuck announced that Meta was planning to spend upwards of $40 billion investing in artificial intelligence! Now, while investors should cheer this investment as AI will do a lot for Meta’s bottom line, I think everyone was so burned by the endless metaverse spend in 2022 that investors just couldn’t handle the idea of Zuckerberg whipping out the company’s credit card again. As a result, Facebook sold off -7.85% and came in as the Week’s Biggest Loser.

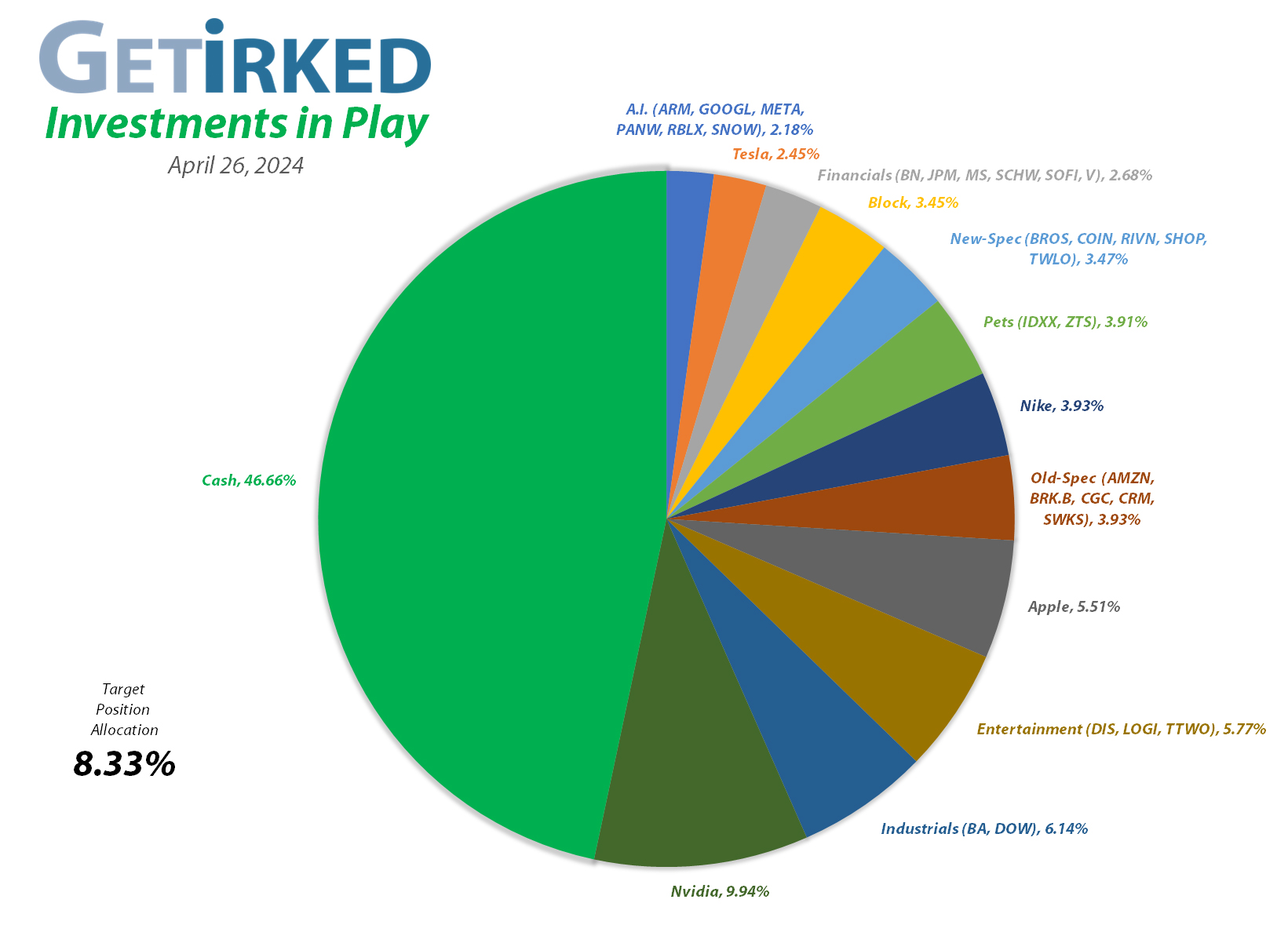

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+2236.54%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$565.75)*

Apple (AAPL)

+907.31%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$86.99)*

Logitech (LOGI)

+663.98%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+612.86%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$182.25)*

Block (SQ)

+563.80%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+482.73%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.05)*

Tesla (TSLA)

+468.49%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$39.37)*

IDEXX Labs (IDXX)

+440.74%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+379.35%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$7.60)*

Dow (DOW)

+349.06%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$2.25)*

Amazon (AMZN)

+266.57%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+211.40%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.08

Disney (DIS)

+194.44%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$18.15)*

JP Morgan (JPM)

+146.96%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$81.50)*

Morgan Stan (MS)

+127.47%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $40.80

Meta (META)

+118.52%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: (-$323.00)*

Take Two (TTWO)

+115.79%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Arm Hldgs (ARM)

+110.38%*

1st Buy 9/14/2023 @ $57.28

Current Per-Share: (-$24.50)*

SoFi (SOFI)

+107.12%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Alphabet (GOOGL)

+87.92%*

1st Buy 9/16/2022 @ $101.93

Current Per-Share: (-$5.31)*

Berkshire (BRK.B)

+83.40%*

1st Buy 8/2/2019 @ $199.96

Current Per-Share: (-$2,281.99)*

Visa (V)

+52.03%*

1st Buy 5/9/2022 @ $194.00

Current Per-Share: (-$284.13)*

Brookfield (BN)

+36.40%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.03

Schwab (SCHW)

+21.42%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $61.76

Zoetis (ZTS)

+18.62%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $133.55

Coinbase (COIN)

+11.09%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.73

Palo Alto N (PANW)

+7.93%

1st Buy 2/22/2024 @ $270.00

Current Per-Share: $270.00

Dutch Bros (BROS)

-13.49%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.05

Roblox (RLBX)

-14.57%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.15

Shopify (SHOP)

-18.85%

1st Buy 2/12/2024 @ $91.00

Current Per-Share: $87.90

Snowflake (SNOW)

-23.57%

1st Buy 2/12/2024 @ $231.00

Current Per-Share: $206.90

Twilio (TWLO)

-32.64%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-62.18%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $23.90

Canopy (CGC)

-77.41%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

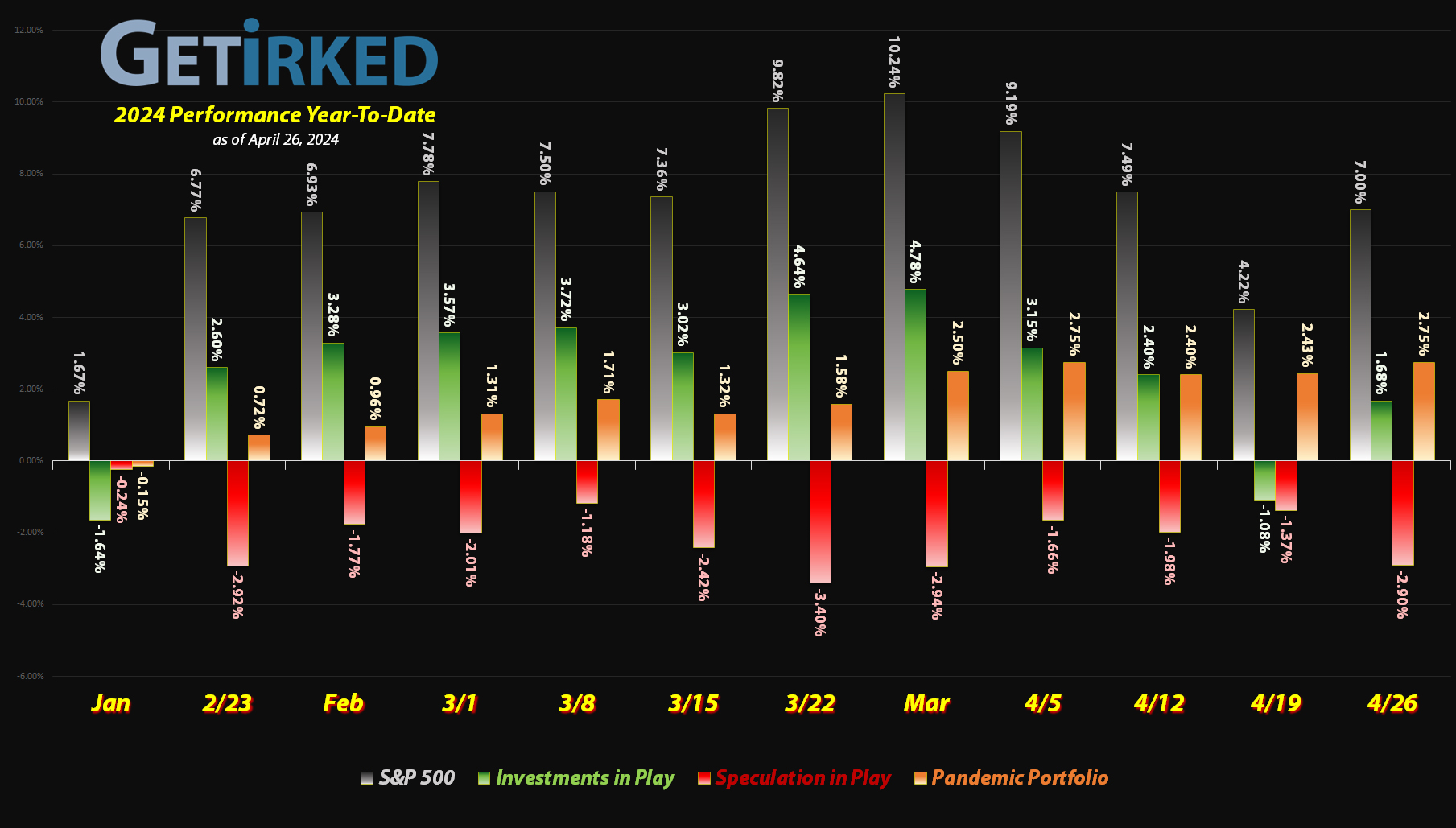

Alphabet (GOOGL): Profit-Taking

When Google (okay… Alphabet (GOOGL)) blew out its quarter in a big way on Thursday evening, it gapped high up at the open, blowing away its all-time high by a significant margin and triggering my next sell order which sold 39.73% of my position at $174.33, removing all remaining capital plus some profits from my position.

The sale locked in +71.03% in gains selling some of the shares I bought for $101.93 when I initially opened the position on September 16, 2022, and lowered my per-share “cost” -$71.38 from $66.07 to -$5.31 (a negative per-share cost indicates all capital has been removed in addition to $5.31 per share added to the portfolio’s bottom line in addition to each share’s current value).

With no capital left in this position and Alphabet announcing a decent 0.45% during its earnings call, I have no additional sell targets for GOOGL at this time. Additionally, given Google’s stellar performance, I’ve raised my next buy target to $140.89, above a recent point of support as well as many key moving averages.

GOOGL closed the week at $171.95, down -1.37% from where I took profits Friday.

Tesla (TSLA): Added to Position

Tesla’s (TSLA) downdraft continued this week when, on Monday, the company announced it would be further cutting prices on its electric vehicles (EV) in China with competitors also following suit. TSLA opened gap-down on Monday, triggering my next buy which added 0.61% at $141.69, locking in a -17.38% discount replacing some of the shares I sold for $171.49 back on February 1, 2023.

The buy also raised my per-share “cost” +10.22% from -$43.85 to -$39.37 (a negative per-share cost indicates all capital has been removed in addition to $39.37 per share added to the portfolio’s bottom line in addition to each share’s current value).

While Tesla completely imploded its earnings report, CEO Elon Musk doubled-down on robotaxis and also stated that a cheaper vehicle was a priority with expectations it would be unveiled as early as the end of 2024. Despite a disastrous report, Tesla’s stock positively exploded higher following its earnings report, a testament to why I always add to positions at key support levels even if it looks like there’s nothing but bad news awaiting us.

From here, my next buy target is $124.89, above a past point of support, where will I continue adding in very small quantities as it’s hard to determine how low Tesla could go from here. My next sell target is $294.96, just under the high Tesla saw in 2023.

TSLA closed the week at $168.29, up +18.77% from where I added Monday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.