May 3, 2024

Risk Disclaimer

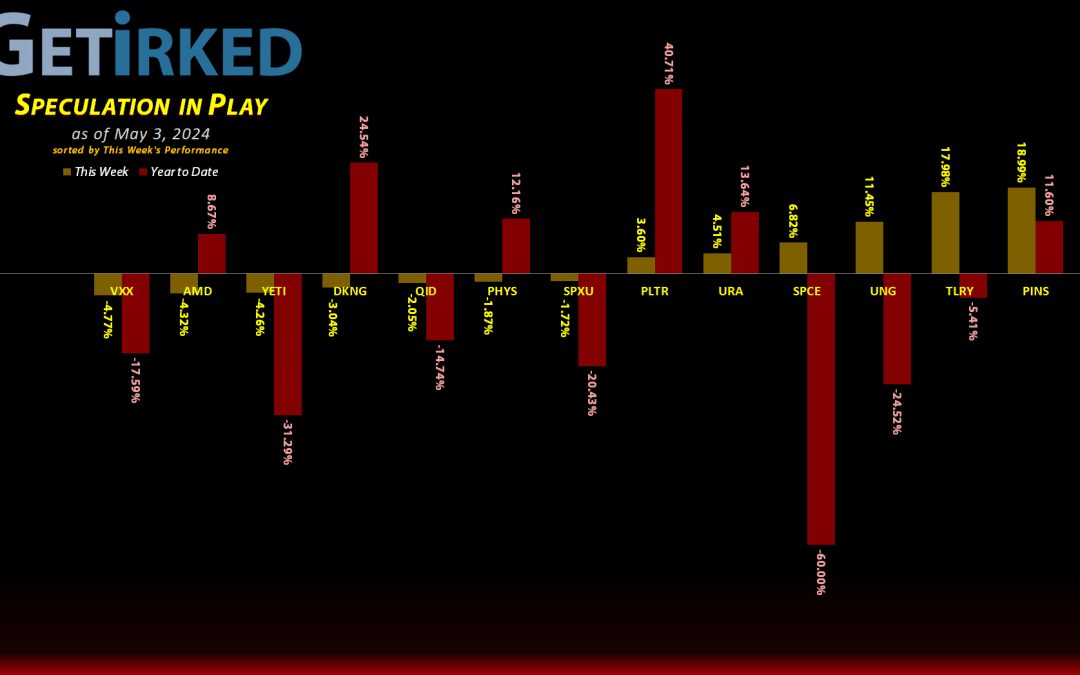

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Grow Generation (GRWG)

With the DEA recommending cannabis be de-scheduled to Schedule-3 from Schedule-1, the entire cannabis sector exploded to the upside once again this week. However, this time, it was the picks-and-shovels provider that saw all the glory! Grow Generation (GRWG) really… grew… (sorry)… popping +21.17% and coming in as the Week’s Biggest Winner.

Advanced Micro D (AMD)

If you’re in the artificial sector and you’re a semiconductor company, just meeting expectations and setting dull forward guidance is simply not going to cut it. After Advanced Micro Devices’ (AMD) CEO Lisa Su raised their year-end guidance to $4 billion when the Street was expecting $6 billion, investors weren’t having it. As a result, AMD dropped -4.77% in a week that was otherwise great for stocks, easily winning the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+781.90%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$556.01)*

Pinterest (PINS)

+456.59%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+380.47%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+175.20%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.20

Virgin Galactic (SPCE)

+73.38%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$1.60)*

Palantir (PLTR)

+65.28%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

Tilray Brands (TLRY)

+50.24%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

DraftKings (DKNG)

+46.61%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Sprott Gold Trust (PHYS)

+21.92%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-24.99%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $17.04

Short SPY (SPXU)

-27.31%

1st Buy: 3/9/2023 @ $73.75

Current Per-Share: $48.04

Short QQQ (QID)

-30.59%

1st Buy: 3/7/2023 @ $101.00

Current Per-Share: $67.33

U.S. Natural Gas (UNG)

-42.39%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-80.15%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

The Volatility “Fear” Index (VXX): Added to Position

When Apple (AAPL) reported a blowout quarter Thursday evening, and, then, the nonfarm payrolls report came in with near-Goldilocks on Friday, the stock market rocketed higher. Conversely, VIX, the Volatility Index also known as “The Fear Index,” plummeted, triggering my next buy order in the VIX Short-Term ETN (VXX) which added +3.97% to my position at $12.79 and lowered my per-share cost -1.50% from $17.30 to $17.04.

As always, let me be clear – this trade in VXX is extremely experimental, hazardous, and quite dumb. Therefore, risk management is critical I am prepared to lose all the money I have in this position entirely.

From here, I do plan to add more to the position at $11.97, slightly below a Fibonacci Retracement level, and I will dramatically reduce my exposure if/when VXX reaches my cost basis at $17.04.

VXX closed the week at $12.78, down -$0.01 from where I added Friday.