Summing Up The Week

The market spent the week whipsawing on every news catalyst, initially seeing a negative reaction to the move in the yen, Japan’s weakened currency, then popping on the back of the Fed’s dovish comments only to give it all back at the end of the day.

The deciding catalyst came in the form of the nonfarm payroll report on Friday, capping off the week with a decidedly…

Let’s take a look at the news that moved the markets this week…

Market News

Yen weakens to 160 against USD for 1st time since 1990

On Sunday evening, the Japanese yen weakened to 160.03 against the U.S. dollar for the first time since 1990 when it touched 160.15, reported CNBC.

In a press conference Friday, Bank Of Japan (BOJ) Governor Kazuo Ueda said exchange rate volatility would only affect monetary policy if there was a “significant” impact on the economy. “If yen moves have an effect on the economy and prices that is hard to ignore, it could be a reason to adjust policy,” Ueda said, according to a Reuters translation.

The challenge facing Japan is while a weak yen is good for their exports, the country imports nearly 100% of its energy needs. Since oil is priced in U.S. dollars, whenever the yen weakens against the greenback, this causes extreme inflation for Japanese citizens.

At a certain point, the BOJ will have no choice to defend its currency by either increasing interest rates, selling U.S. Treasurys, or some combination of the two, which could potentially cause a stock market selloff or even a crash.

Consumer Confidence drops to 21-month low

On Tuesday, the consumer confidence index dropped for the third straight month, touching a 21-month low, reported MarketWatch. Survey respondents pointed to the inflated prices at the gas pump and grocery store in addition to new concerns about a potentially-weakening job market as the cause.

“Elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runners-up,” said Dana Peterson, chief economist at the Conference Board which administers the survey each month. “Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income.”

Fed leaves rates unchanged, believes no additional rate hikes

On Wednesday, the FOMC announced that they would leave the benchmark interest rate unchanged, as expected, and Federal Reserve Chairman Jerome Powell said that additional hikes would be very unlikely, reported CNBC. When economic and inflation data indicated the disinflationary trajectory may have ceased, many pundits theorized that the Federal Reserve would not only be restrained from making cuts, but would potentially have to implement additional hikes.

However, in Powell’s press conference, he tried to assure markets that additional hikes were improbable. “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” he said. “I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.”

Initially, the S&P 500 rallied on the back of his remarks, but ended up rolling over to close the day down.

U.S. added 175K jobs in April, Unemployment rose to 3.9%

On Friday, the nonfarm payrolls report showed the U.S. economy added 175,000 in April versus 240,000 estimated by Dow Jones while unemployment ticked up to 3.9% from the 3.8% expected, reported CNBC.

This is one of those strange data points where bad news – a weakening job market – is actually good news. Pundits were concerned that if the job market came in hot and unemployment came in low, the Federal Reserve might have to implement a rate hike in an effort to cool off the economy. Despite this having a very small probability of happening, this report helped reduce the chances of another rate hike to near zero.

Additionally, hourly earnings rose 0.2% from the previous month and 3.9% from last year, both of which were below estimates. Wages are one of the stickiest parts of inflation so seeing the numbers coming down from estimates is actually a good sign that inflation may finally be cooling.

As a result of the data, the yield on the 10-year U.S. Treasury – a key benchmark to track for many investors – fell below 4.5% and stocks rallied significantly at the market open as it looks like the Fed’s fight against inflation may be back to bearing fruit.

Next Week’s Gameplan

Next week should be interesting with fairly little in the way of known market news catalysts. We certainly have additional earnings reports which will be interesting to follow on an idiosyncratic basis, but with no significant catalysts, the market momentum will be left to whichever of the “animal spirts” takes control.

Will there be further downside ahead? Will markets make a stab for their all-time highs? Your guess is as good as mine, and this is precisely the reason I always have a plan for both directions: where am I going to add to my positions and where am I going to take profits?

Regardless, you can know one thing for certain: I’ll be right back here next Friday giving you an update of all the market-moving news you need to know, friends!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Bitcoin’s Crashing like I Warned. What’s Next?

Bitcoin continued to demonstrate weak price action throughout the week before imploding on Tuesday, slicing through support at $59,648.33 and not finding new support until deep into the air gap at $56,500.00 on Thursday. It’s likely this isn’t long-lasting support as the next region of real support is a range between $50,500 and $52,000, quite a bit lower than here. As I said at the beginning of April, my analysis indicated that April would be a red month after 7 consecutive green months.

While there is no guarantee that one red month will be followed by another, May has historically been a very bad time for Bitcoin and all crypto, so there may be significantly more downside ahead, particularly since Bitcoin still has drawn down less than -25% from its all-time highs and my analysis suggested a minimum selloff of more than -40% and as deep as in excess of -85%.

The Bullish Case

Bulls point to the pattern that Bitcoin has held since 2023 where brief selloffs were buying opportunities. I even read one bullish analyst who asked, “Do you think this time is different?”

Yes. Yes, I do think this time is different.

Why?

This is Sparta… *cough* … this is Bitcoin. If there’s one thing I’ve learned from intensely studying this painfully volatile asset for nearly a decade, it’s this:

Bitcoin can and will do whatever the heck it wants to despite any Bulls or Bears saying that’s not possible by providing technical analysis arguing the contrary move. Bitcoin, more than any other asset, makes fools of Bulls and Bears… just not all at the same time.

The Bearish Case

Bears argue that this pullback is far from over. With Bitcoin in the air gap with no real support, even most Bulls agree that a pullback to $50K is a near-certainty with some saying Bitcoin will pull back to $40K before heading higher. The Bears believe Bitcoin will head significantly lower with at least one Bear on X predicting: “Bitcoin will be below $16k in 2 weeks.”

Bitcoin Trade Update

Current Allocation: 1.833% (+77.44% since Last Update)

Current Per-Coin Price: $63,151.46 (-5.33% since Last Update)

Current Profit/Loss Status: -6.43% (-2.06% since Last Update)

As I said last week, I expected a substantial selloff and I got it. Throughout Bitcoin’s substantial pullback, I made a total of 6 buys which lowered my per-coin cost -5.33% from $66,707.07 to $63,151.46. Additionally, the buys increased my allocation +77.44% from 1.033% to 1.833%.

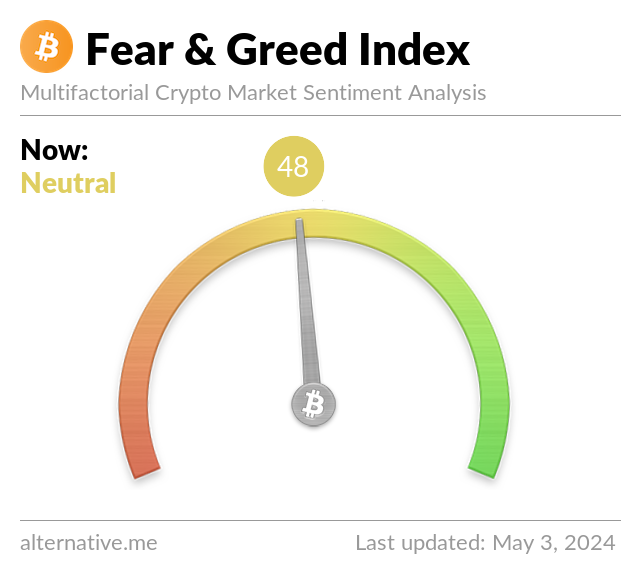

From here, it’s a waiting game. If Bitcoin really has found support before making new all-time highs, then what I have is what I have. However, I feel that is incredibly unlikely. There is still far too much bullish sentiment in the space, and the more I review the data, the more I believe that we priced in the halving in advance, something that has never happened before.

With no bullish catalysts in the immediate future, I have no choice but to think Bitcoin’s got much further to fall before it finds its bottom.

Stay frosty, my friends. 😀👍

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.167% @ $58,256

0.167% @ $56,809

0.167% @ $55,489

0.167% @ $54,455

0.167% @ $53,016

0.167% @ $51,666

0.167% @ $50,773

0.167% @ $49,806

0.233% @ $48,433

0.500% @ $47,061

Not Your Keys, Not Your Crypto…

In light of brokerage failures in 2022, I no longer keep any of my crypto on an exchange and I only keep enough USD on the exchanges I use to execute my next few buys. I use multiple cold wallets from the brands Ledger and Trezor to hold my crypto (click the links to access the direct sites, and I receive no affiliate benefits from these links).

Additionally, I have now divided my allocated USD between two different exchanges – Gemini and Coinbase – in case one (or both) becomes insolvent. Disclaimer: We both receive a bonus if you use my Gemini referral link to open an account.

I do not trust anyone in the space, even with Coinbase (COIN) being publicly traded (and one of my own Investments in Play positions).

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (possible moves include drops of -90% or more and gains of +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March , Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January 2021, Bitcoin dropped -32% to a low of $28,732.00.

- In February, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April , Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June , Bitcoin crashed -56% to a low of $28,800.00.

- In November, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In November 2022, Bitcoin crashed -78% to a low of $15,460.00.

- In April 2023, Bitcoin rallied +101% to a high of $31,050.00.

- In June, Bitcoin dropped -20% to a low of $24,750.00

- In July, Bitcoin rallied +29% to a high of $31,862.21.

- In September, Bitcoin dropped -22% to a low of $24,900.00.

- In January 2024, Bitcoin rallied +97% to a high of $49,102.29.

- Later in January, Bitcoin dropped -22% to a low of $38,501.00.

- In March, Bitcoin rallied +92% to a new all-time high of $73,835.57.

- In May, Bitcoin dropped -23% to a low of $56,500.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.