Originally Published: May 31, 2020. Last Updated: June 7, 2020.

Find the most recent Pandemic Portfolio updates by clicking here.

Starting from Scratch

You’ve paid off your credit card debt, saved up some money, and you’re ready to invest in stocks. That’s great! But the process of going from all-cash to fully-invested can seem daunting or impossible, even.

Where should you start?

First: Line Up a Broker

Thanks to Robinhood kicking off free trading, many high-quality, SIPC-insured brokers offer free trading. In fact, if your broker charges any fees at all – maintenance, commissions, or anything else – you should switch.

You shouldn’t be paying anything for a broker to hold your cash or invest your money.

Personally, I like Charles Schwab and Vanguard. If you click my Charles Schwab link, you may be eligible for a referral bonus provided by Schwab depending on the amount of money you start the account with. Currently, Vanguard Funds does not offer a referral bonus.

Full disclosure: Schwab’s referral program does not give me any benefit – the company believes members will want to refer others because of how great the broker is, not for some kickback.

Second: Deposit your Funds

Second, deposit or transfer the funds, and once they’ve cleared, investigate options for making interest off your uninvested cash. Brokers offer money market funds which will allow you to earn interest on your uninvested cash. Some offer the option of automatically storing your cash in the funds while others will require you to transfer cash in and out of the funds, as needed.

It’s important to note that while money market funds are typically very low risk, they are not protected by the FDIC or SIPC which means in the unlikely event of a bank collapse or a collapse of the money market fund itself, you could lose all the money you kept in that money market fund. It’s very unlikely, but it’s definitely worth keeping in mind if you’re incredibly risk adverse.

Third: What Do You Want to Invest in?

This might sound like a silly question but it isn’t: what do you want to invest in?

For some people, buying the stocks of individual companies feels too risky and takes too much time since investors should pay close attention to each company’s performance over time.

Those investors may prefer investing in Exchange Traded Funds (ETFs) or mutual funds where professional money-managers buy and sell the stocks held in those funds.

If you’re like me, you prefer to buy the stocks of individual companies as the performance of a great company can provide far greater returns than most funds. However, buying the stocks of individual companies brings a lot of risk.

If a company you own stock in doesn’t perform well, your stock may lose value. If the company declares bankruptcy or goes out of business, you could stand to lose your entire investment.

Every investor needs to determine the level of risk they’re comfortable taking on. High-risk investments often offer the greatest possible returns but also may be incredibly volatile and lose money, whereas low-risk investments offer lower returns but often provide greater security and a lower chance of losing money.

However, it’s important to know that no matter what type of investment you choose, you could lose money… potentially all of your money. There is no guaranteed way to make money from any investment.

Fourth: Putting Your Money to Work

Starting a portfolio can certainly feel daunting, particularly during a volatile market. In March 2020, the stock market sold off more than 30% and offered great buying opportunities.

However, what if you missed the opportunity to buy? If you wait, the next big selloff might not take place for many years and you could miss gains that could outpace even the losses the next selloff brings.

The best time to plant a tree was ten years ago, the second best time is today!

There’s an old investing adage that the best time to plant a tree was ten years ago, but the second best time is today. Sure, it would have been nice to invest all your money during the last selloff, but since that didn’t happen, let’s get started now.

I’m not an investment adviser. All investing carries risk and may lose you money.

You need to choose your own tactic and your own companies as I’m not an investment adviser or a professional trader. I’m going to share what I’m doing with my new portfolio, but I have (and will) make mistakes that lose me money.

The strategy I take with any investment is to Buy in Stages. Rather than put all of my money to work at the current level and risk an investment dropping in value, I prefer to buy some at the current level and wait for a drop to add more.

If the investment never drops in value, that’s a high-quality problem and I’ll put the money I had allocated to that investment into a different investment.

Irk’s Pandemic Portfolio

I recently decided to reallocate the amount of funds I put toward ETFs as my long-term results from picking individual stocks has dramatically outperformed any ETF over the same time period.

This left me with funds that need to be invested, but rather than put the funds in existing positions in my Investments in Play portfolio, I wanted to build a new diversified portfolio featuring five stocks of companies that stand to perform well during the current pandemic and recession environment, but also offer long-term growth prospects.

In addition to each being a Best-in-Breed player for their respective sectors, all five provide at least some form of dividend meaning that the position will continue to grow even if the value of the stock stays flat over time.

Just for your own edification, I’m listing the stocks in my Pandemic Portfolio in alphabetical order, not order of preference.

Position #1: Costco (COST) | Retail

Price as of Writing: $308.47

Annual Dividend: $2.80 per share (0.90% yield)

Costco (COST) is the leading big-box membership retailer and is the second biggest retail chain in the world second only to Amazon (AMZN). Costco management practices ESG principles (Environment – Social – Governance) by looking out for its employees, its shareholders, its customers, and its communities.

Key to Costco’s success is how it makes money – it makes almost no money from the items and services it sells. Costco’s profits come from annual membership dues, growth in membership, retention of existing members, and expansion into developing countries.

Position #2: Digital Realty Trust (DLR) | Real Estate / Cloud

Price as of Writing: $143.56

Annual Dividend: $4.48 per share (3.12% yield)

At first glance, investing in a Real Estate Investment Trust (REIT) which owns commercial real estate properties in the middle of a pandemic that’s transformed the world into a Work-From-Home economy might seem like a really bad idea, but that’s where knowing what your companies do and own becomes the top priority.

Digital Realty Trust (DLR) owns data center, colocation, and interconnection properties supporting cloud and information technology services, communications, and social networking including data centers for clients in financial services, manufacturing, energy, healthcare, and consumer products.

As bizarre as this sounds – Digital Realty Trust is not only the best real estate play for the pandemic, it’s also a very legitimate play on the growth of cloud data, Software As A Service (SaaS), and growth in the technology sector over time as more and more companies move from traditional on-site server services to working entirely in the cloud, a move further accelerated by the Work-From-Home trend.

Position #3: Microsoft (MSFT) | Technology

Price as of Writing: $183.25

Annual Dividend: $2.04 per share (1.11% yield)

In the past 5-10 years, Microsoft (MSFT) has transformed itself from being a stodgy software company into a diversified technological powerhouse, dominating everything from Software as a Service (SaaS), cloud data with its Azure service, e-sports and e-gaming with its Xbox video game studios, and much more.

Position #4: Pepsico (PEP) | Consumer Products

Price as of Writing: $131.55

Annual Dividend: $4.09 per share (3.11% yield)

Likely to be the slowest-growing position in the portfolio, Pepsico (PEP) is the maker of Pepsi, but also the owner of a diversified selection of brands including snacks and foods. You probably know their brands but didn’t know Pepsico owned them including Cheetos, Doritos, Fritos, Cap’n Crunch, Pastaroni, Quaker Oats, Rice-a-Roni, Aquafina, Mountain Dew, H2oh!, Gatorade, Manzanita, San Carlos, Agusha, and more.

In this portfolio, Pepsico offers security since, during a recession, food stocks tend to outperform as people must always buy food – no matter how dire their economic situation may be. Plus, Pepsico’s 3.11% dividend yield is nice to have in an investment.

Pepsico is Best-in-Breed in the space, even more so than competitor Coca-Cola (KO) thanks to its excellent management and diversified portfolio of brands which makes the company a lot more than a “sugar water manufacturer.”

Position #5: UnitedHealth (UNH) | Healthcare

Price as of Writing: $304.85

Annual Dividend: $4.32 per share (1.42% yield)

With an aging baby boomer population and continued health risks facing every American, healthcare providers will continue to be a growing sector, and the Best-in-Breed is UnitedHealth (UNH). UnitedHealth Group Incorporated operates four segments in the United States: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx.

While experiencing significant growth over time, the healthcare sector can be particularly volatile as it is often the target of politicians threatening to transform the entire business model. However, now that Joe Biden is the presumptive Democrat nominee going into the 2020 election, concerns for UnitedHealth’s future as a business have all but evaporated.

Irk’s First Moves

I never put money to work during stock market or position rallies, only when the market or stock I’m interested in is selling off (and if it’s a stock-specific selloff, I only buy when the reason doesn’t affect its long-term business model).

A few investing adages particularly relevant to this concept are: “buy when there’s blood in the streets;” “be greedy when others are fearful and fearful when others are greedy;” and “buy on red days, sell on green days.”

Costco (COST) – Opened May 12 @ $306.88

Current Price: $308.47

Per-Share Cost: $306.88

Profit/Loss: +0.52%

Allocation: 1.54% (target allocation: 20%)

Next Buy Target: $290.58

I opened my position in Costco (COST) when it started pulling back on May 12 with my first buy order filling at $306.88 a share.

Costco continued to sell off over the following days, dropping to $294.54 but didn’t hit my second buy target which was around $291.50. After reviewing its past price action, I do think Costco will test the $290.00 level and potentially break through, so my buy target is slightly above that.

Digital Realty Trust (DLR) – Opened May 12 @ $143.35

Current Price: $143.56

Per-Share Cost: $138.38

Profit/Loss: +3.74%

Allocation: 2.151% (target allocation: 20%)

Next Buy Target: $130.50

I opened my position in Digital Realty Trust (DLR) when it pulled back on May 12 with my first buy order filling at $143.35. DLR continued to pull back substantially with me buying more at $139.86 and $131.93, lowering my per-share cost a total of -3.47% to $138.38.

Digital Realty pulled back to a low of $129.20 before bouncing +13.17% to a high of $146.21 and retreating to its current level at $143.56.

My next buy target is $130.50, slightly above the lows of its last pullback.

Microsoft (MSFT) – Opened May 13 @ $180.74

Current Price: $183.25

Per-Share Cost: $179.09

Profit/Loss: +2.32%

Allocation: 1.83% (target allocation: 20%)

Next Buy Target: $178.00

I opened my position in Microsoft during its May 12-14 pullback with my first buy order filling at $180.74. Microsoft reached a low of $175.68 during the selloff before bouncing +6.48% to $187.06.

Microsoft dropped again on May 26-27 where I added to my position at $177.44, lowering my per-share cost marginally by -0.91% to $179.09.

Microsoft’s shown incredible resilience during these selloffs so I’m getting more aggressive adding to the position with my next price target to add more at $178.00.

Pepsico (PEP) – Opened May 13 @ $132.97

Current Price: $131.55

Per-Share Cost: $132.27

Profit/Loss: -0.54%

Allocation: 1.314% (target allocation: 20%)

Next Buy Target: $126.25

I opened my position in Pepsico (PEP) during the market selloff on May 13 with a small starting position which filled at $132.97. A week later, I added a bit more when PEP pulled back at $131.57, lowering my per-share cost -0.53% to $132.27.

Given that Pepsico is historically a very slow-mover and doesn’t bring the same growth prospects as the other positions in the portfolio, I’m taking a very conservative approach in building the position slowly; my next buy target at $126.25, a past point of support.

UnitedHealth (UNH) – Price Target: $293.25

Current Price: $304.85

Per-Share Cost: N/A

Profit/Loss: N/A

Allocation: 0.00% (target allocation: 20%)

Next Buy Target: $277.28

While UnitedHealth (UNH) sold off with the rest of the market from May 12-13, it didn’t pull back as much as I anticipated, dropping to $275.56 and narrowly missing my $273.25 price target before bouncing +8.15% to $300.00. During its next pullback, UnitedHealth dropped to just under $285 before bouncing +8.01% to $309.66.

In reviewing UnitedHealth’s past moves, it regularly pulls back 10% from its highs and given the overvalued nature of the market as a whole and UNH, specifically, I believe we’ll see a pullback of at least that much again, so I raised my price target just slightly to $277.28.

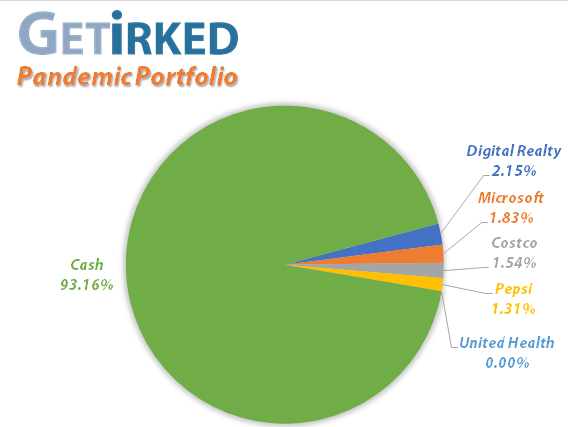

Pandemic Portfolio – Current Status

Profit/Loss: +0.13%

Assets: 6.84%

Cash: 93.16%

Breakdown of Pandemic Portfolio Current Holdings

Stay Tuned for Updates!

Stay tuned for updates to this brand-new portfolio!

Keep in mind that unlike my Investments in Play and Speculation in Play portfolios which receive weekly posts, I only plan to update my Pandemic Portfolio when I’ve made a change to at least one of the positions. In other words, the Pandemic Portfolio updates may come as often as weekly at times, but unless we see volatility return to the markets to the extent we saw in March 2020, the updates will likely be less frequent than my other portfolios.

The Pandemic Portfolio is designed to be a long-term retirement investment portfolio and has only just started; there are no selling targets at this time. This portfolio’s also intended to be one that can be checked on every week or two rather than one that should be watched daily with positions held for a long time horizon. We’re in this for 20-30 years – there’s no need to micro-manage this portfolio.

So, stick around and find out what happens next in this new ongoing journey – investing in the time of a pandemic!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.