April 18, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Current Position Performance

Aurora Cannabis (ACB)

+722.49%

Canopy Growth (CGC)

+196.63%

Tencent Music (TME)

+114.96%

AMD (AMD)

+64.01%

Groupon (GRPN)

+48.59%

Yeti (YETI)

+21.11%

EventBrite (EB)

+10.40%

Cronos Group (CRON)

+8.57%

Tradeweb Mkts (TW)

+3.69%

Iridium Comm (IRDM)

+0.57%

BiliBili (BILI)

-1.36%

New Age Bev (NBEV)

-5.73%

TransEnterix (TRXC)

-8.77%

Nio (NIO)

-13.28%

Gossamer Bio (GOSS)

-13.88%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

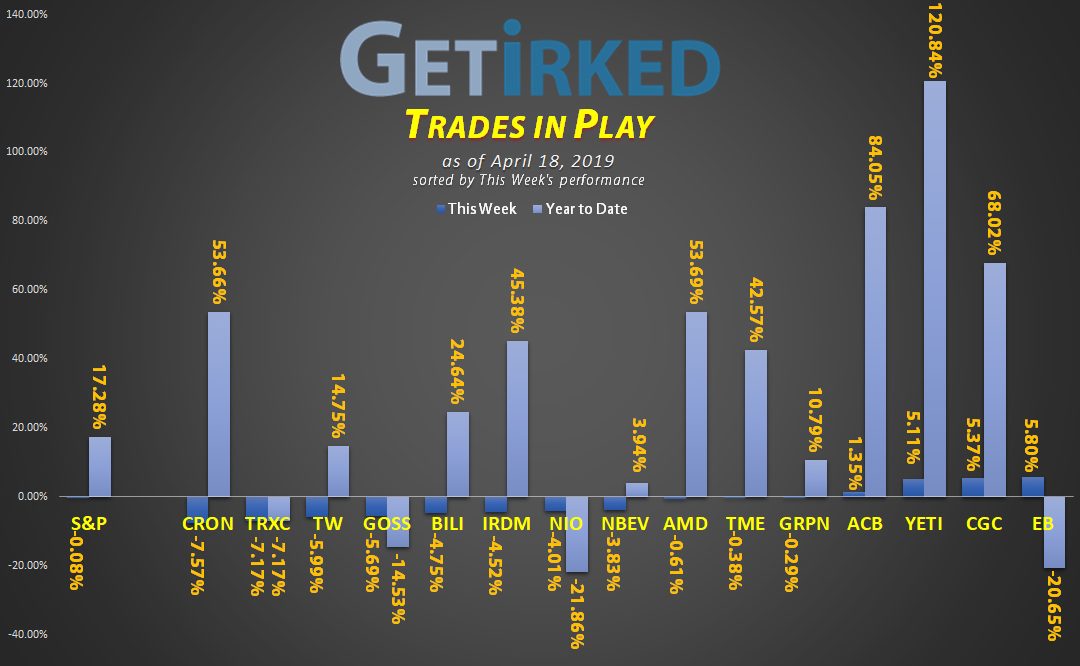

Highlights from the Week

Biggest Winner: EventBrite (EB)

Maybe the bottom for EventBrite (EB) is in? EB solidified last week’s bottom by heading +5.80% higher this week. Granted, EB is still down -20.65% on the year from releasing a horrendous earnings report and growth forecast, but that’s not when we picked it up.

We’re up +10.40% by Buying in Stages and picking this one up while it was bottoming.

Biggest Loser: Cronos Group (CRON)

Cronos Group (CRON) was the cannabis darling, but thanks to Canopy Growth Corporation (CGC) announcing its acquisition (or option to acquire) Acerage Holdings (ACRGF) and grabbing a foothold into the American market, Cronos is losing its appeal.

We still think Cronos has potential thanks to Altria’s (MO) investment in the company, but CRON has definitely lost some of its shine, dropping -7.57% this week.

This Week’s Trades

Advanced Micro Devices (AMD): Adding to Position

We added to our AMD position during Monday’s sell-off at $27.28, replacing some of the shares we sold last week when analysts predicted AMD might see a pullback.

Our per-share cost is $16.89 giving us a +64.01% gain from AMD’s weekly close at $27.69.

Cronos Group (CRON): Adding to Position

Cronos Group (CRON) sold off with the rest of the cannabis sector early in the week allowing us to add to our position at $15.89, creating a per-share cost basis of $14.44.

CRON closed the week at $15.68 with our position +8.57%.

Gossamer Bio (GOSS): Adding to Position

Gossamer Bio (GOSS) continues to show the dangers of Initial Public Offerings (IPOs) as it dropped below its February 2019 IPO price of $16.00 on Thursday, triggering a buy order of ours at $16.08 and lowering our per-share cost to $18.86.

With new IPOs social media company Pinterest (PINS) and technology video communications company Zoom (ZM) going public on Thursday, it’s quite possible the hot money in GOSS pulled out to switch to more-exciting pastures.

We’re going to continue to work with our GOSS position, focusing on the potential of Gossamer’s reputed offerings in the space.

GOSS closed the week at $16.24 with our position down -13.88%.

Insys Therapeutics (INSY): *Closed Position*

Insys Therapeutics (INSY) implemented a change in leadership with Andrew Long entering as CEO and Saeed Motahari stepping down on Monday, disconcerting investors already struggling with the cannabis sell-off, and causing the stock to plummet more than 11% to nearly $4.00, triggering our stop-loss to sell our order at $4.36 at the open before the collapse.

This kind of dramatic drop, particularly in companies with low stock prices and/or exposure to volatile spaces like cannabis, emphasizes the importance of using stop-loss orders to protect profits.

Rather than having to question whether or not to close the position in the heat of the moment, stop-loss orders remove FOMO by requiring traders and investors to develop their strategy in advance using objective analytics without emotion playing a factor.

We closed out our INSY position with an overall profit of +30.67%.

INSY closed the week at $4.21, down -3.44% from our sale price.

Nio (NIO): Adding to Position

Nio (NIO), the Chinese electric car manufacturer, sold off on Monday along with a number of other speculative companies, suggesting institutional investors are freeing up their speculative cash to buy into the week’s popular IPOs such as social media network, Pinterest (PINS).

We added to our position at $4.73 and $4.56 a share, lowering our per-share cost to $5.52.

Nio closed the week at $4.79 with our position down -13.28%.

Tradeweb Markets (TW): Selling & Buying

Tradeweb Markets (TW) – the fresh-faced IPO specializing in digitizing exchanges – continues to be a volatile high-flyer, jumping nearly 6% in Monday’s trading to a daily (and all-time) high of $44.25.

We took some profits at $43.68 when our stop-loss triggered during a sharp pullback. The sale lowered our per-share cost more than 5% to $37.41 from $39.50.

Later in the week, Tradeweb pulled back even more likely due to the Pinterest and Zoom IPOs we mentioned above, allowing us to replace the shares we sold at $38.88 when it dropped to $38.67 on Wednesday, creating a per-share cost of $37.90 or a reduction of 4.05% from our initial per-share cost while retaining the same position size.

We have buy orders in place at lower levels to add to our position should Tradeweb pull back further.

TW closed the week at $39.30 with our position up +3.69%.

TransEnterix (TRXC): Adding to Position

TransEnterix (TRXC) once again made a dive for $2.00 as we predicted it might when we lightened up when it crossed over $2.40 last week. We added to our position at $2.03 on Thursday, lowering our per-share cost to $2.30.

TransEnterix has been struggling for quite a long time at this point, and with its repeated and regular testing of the $2.00 support line, we’re getting a bit nervous that a lack of positive news might result in the failure of that support.

Along these lines, we’re planning to substantially lighten up or even close our position entirely when/if TRXC bounces again from these levels to above our cost basis.

TRXC closed the week at $2.10 with our position down -8.77%.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.