Originally posted October 18, 2018. Last revised: March 8, 2021

Now, You Can Watch and Read this Article!

Click the video to learn about cash on the sidelines or read the article below!

Buying in Stages

If you’ve been researching investing or trading stocks, you’ve likely heard the advice “Buy in Stages” but what, exactly, does that mean?

Research & Planning

Although it’s not exciting, a good trader or investor spends more time researching and planning than he or she does actually executing the trades themselves. The amount of time you will spend actually buying or selling will vary widely depending on whether you’re trading or investing, of course, but the research and planning stages will still be significant.

The research stage involves choosing the right stock for the intended outcome, determining its price action and previous support/resistance levels, and deciding that you will use it for your trade or investment.

The planning stage is when you decide your buying stages.

The Benefits of Buying in Stages

The amateur investor won’t buy in stages, instead thinking that going “all-in” with their entire position all at once is a good way to reduce commission fees and to avoid Fear Of Missing Out (FOMO) on an investment’s upside. However, with a little experience, investors discover that the chances the first buy is the best possible price are virtually non-existent.

In fact, even with the decades of experience under my belt, I find that it seems like the entire market is watching me, waiting for me to buy, and then deciding… at that very moment… to sell everything leaving me with an instant loss (although that could be just in my head).

Buying in Stages allows the investor to capture some of their position in case an investment immediately goes up, but also leaves the possibility of adding to the position at lower prices open to lower the overall cost-per-share of the investment.

How to Buy in Stages

Step 1: Pick your position size.

Easy enough – how much do you want to buy of a stock?

For ease of calculation, let’s say you want to buy $4,000 worth of GW Pharmaceuticals (GWPH), the prescription drug cannabis company, as it pulls back from its nearly $180 highs to a significant Fibonacci Retracement support level of $166.87 in September 2018.

Rather than buying the entire $4,000 worth all at once, divide your position into four $1,000 parts with the intention of making four separate buys at different levels.

You can elect to divide your position into more than four different buys – it’s up to you – however I typically use four as each buy will offer a substantial portion of my desired position size without being so large that I’m over-exposed to any one price.

Step 2: Pick your stages.

What stages you choose to buy additional positions at is dependent on a number of factors:

- How aggressive or conservative are you about the stock?

- What are the market conditions like – is it an overall uptrend, downtrend or sideways movement?

- Are you more of a chartist (technical analysis) or a fundamentalist (performance of the underlying company)?

For the sake of the simplification, we’re going to assume you’re not a chartist who uses technical analysis. You can still pick your stages. The simplest way is to use percentage price drops. Personally, before I learned technical analysis, I used basic percentage drops, usually price drops of 5%, 10% and 15% drops from my initial purchase price.

A 15% price drop is quite significant and highly unlikely which makes the 5-10-15 strategy very conservative. Stocks don’t typically drop 15% unless you’re in a market sell-off, at least, not stocks anyone should actually want to buy. If you’re more aggressive about the stock, you can choose different stages: 2.5%, 5% and 7.5%; 1.25%, 2.5% and 3.75% – the choice is entirely up to you.

However, in the case of GW Pharma in late September of 2018, it turns out the 5-10-15 strategy was spot on… for better or worse.

Step 3: Execute your plan.

Let’s say you made your first buy in GWPH at $170 on October 1, 2018.

Using our 5-10-15 strategy:

- Your second buy is at $161.50. ($170 * 95%)

- Your third buy is at $153.00. ($170 * 90%)

- Your fourth buy is at $144.50. ($170 * 85%)

Personally, I enter all my buy orders as Good Till Canceled (GTC) limit buys all at once following my initial purchase and then closely follow the market and the company, checking news at least once a day to protect against bad news events that specifically affect the stock or the sector so I can cancel additional buys if the company itself suddenly has bad news.

In the case of GWPH, the market crashed due to fears of the Federal Reserve increasing rates willy-nilly in the coming quarters, causing GWPH (and the rest of the market) to drop in price.

Your second buy would have executed at $161.50 the next day on October 2. Your third buy executed at $153.00 a few days later on October 5 followed by your fourth and final buy at $144.50 on October 10.

The Results of Buying in Stages

If you had bought your entire $4,000 position in GWPH all at once at $170, your position would be down 13.39% at GWPH’s current price (according to the chart) of $147.23, a paper loss of $535.60.

By buying in stages, your cost-per-share is $157.25 (the average of your four position buys).

Due to the market action, your position is still at a loss, however instead of being down 13.39%, the position is down 6.37% or a paper loss of $254.80, less than half the loss of buying all at once at $170.

What’s the Downside to Buying in Stages?

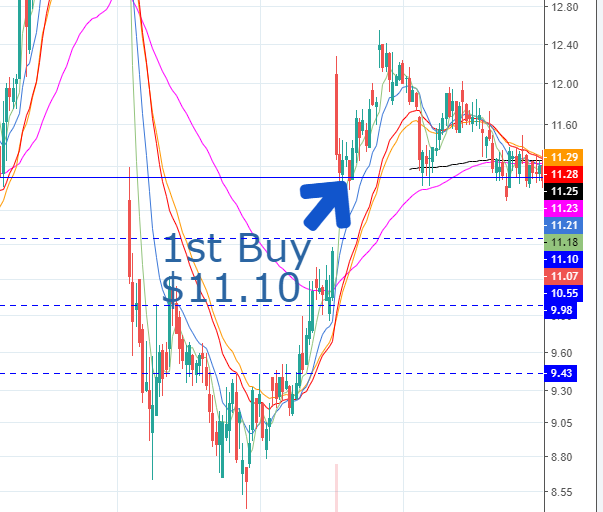

Let’s take a real-world example that happened to me. I wanted to buy a position of a small-cap stock I researched after it popped over $12.00 a share in August 2016. I made my first buy of four at $11.10 (solid blue line on the chart) making my follow up levels $10.55, $9.98, and $9.43 (dashed blue lines):

Now, let’s reveal the company and the full chart after. The company was Square (SQ), the financial technology play servicing small businesses.

Here’s what happened after my first buy:

As you can see from this example, the downside of Buying in Stages is that sometimes you won’t get as much of a position as you wanted if the stock actually goes the direction you want – up. I was only able to buy 1/4 of what I wanted in SQ, however by sticking to my discipline, I prevented exposing myself to significant downside risk.

At the time, Square had a very low market cap and regularly fluctuated from the mid-$10s to under $9. Buying in Stages protected me against downside risk in case the stock price dropped 5% or more from my initial purchase.

Buying in Stages reinforces the importance of removing emotion from your investing. Sometimes, a stock will go down after you buy. Sometimes, a stock will go up. The problem is that no one can predict the future – a disciplined investor sticks to his or her rules to avoid downside risk.

When a stock shoots to the moon before you can buy more, this is a High Quality Problem – you don’t have as much of a gain as you initially wanted, but you still have a gain! Take the extra capital you were intending to invest and find the next Square and buy that one in stages, too.

Why Using Rules Works

By sticking to disciplined rules, you maintain your investing capital. As long-term investors, the huge gains are great, but we’re here to make money for the long-term.

Losing your investing capital by buying all at once and suffering significant losses ensures you won’t make any money at all. Buying in Stages can limit your upside at times, but, in the long run, leaving capital free to invest at much lower levels offers long-term investors a lot more strategies to take in an ever-changing stock market.