April 26, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

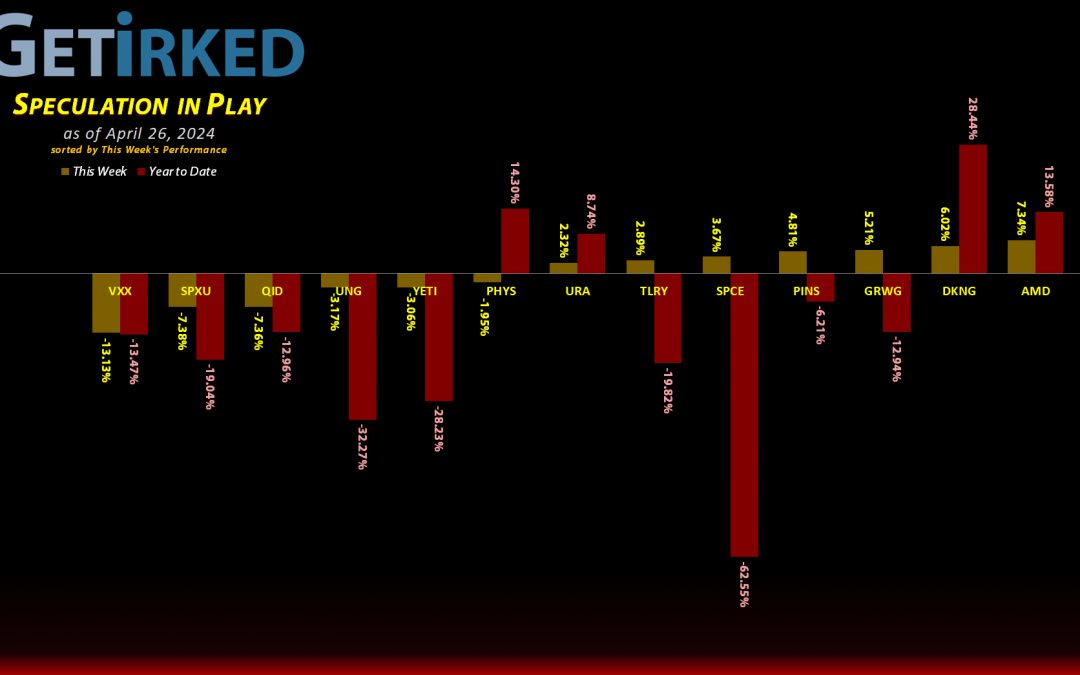

The Week’s Biggest Winner & Loser

Palantir Tech (PLTR)

This week saw the resurgence of all things artificial intelligence (AI) thanks to Meta (META), Alphabet (GOOGL), and Microsoft (MSFT) all announcing huge capital expenditures during their earnings calls. As a result, all AI popped including Palantir Technologies (PLTR) which was the Week’s Biggest Winner after rallying +10.01%.

U.S. Natural Gas (UNG)

Skipping all of the short positions as I do for both Winners & Losers, this Week’s Biggest Loser was the U.S. Natural Gas Fund (UNG). A combination of warmer-than-typical weather and a plentiful supply, UNG continues to plumb its lows, dropping -3.17% this week.

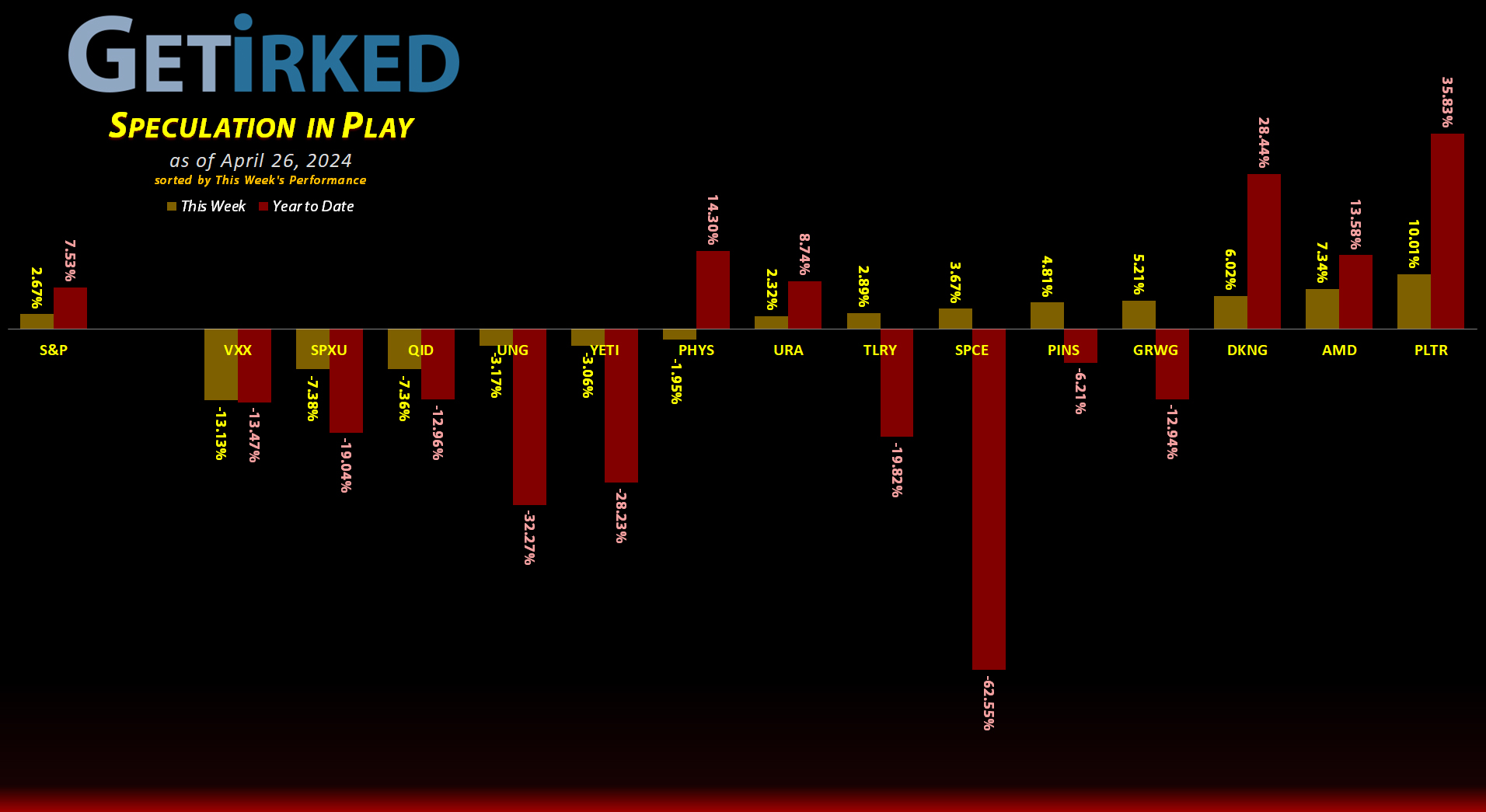

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+789.44%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$556.01)*

Pinterest (PINS)

+422.32%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+383.73%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+163.37%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.20

Virgin Galactic (SPCE)

+71.66%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$1.60)*

Palantir (PLTR)

+59.54%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+51.31%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+47.27%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Sprott Gold Trust (PHYS)

+24.25%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-22.35%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $17.30

Short SPY (SPXU)

-26.10%

1st Buy: 3/9/2023 @ $73.75

Current Per-Share: $48.04

Short QQQ (QID)

-29.15%

1st Buy: 3/7/2023 @ $101.00

Current Per-Share: $67.33

U.S. Natural Gas (UNG)

-48.34%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-83.62%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Volatility “Fear” Index (VXX): Added to Position

On Friday, volatility once again exited the markets following Microsoft’s (MSFT) and Alphabet / Google’s (GOOGL) outstanding earnings which caused the Barclays Short-Term VIX Futures ETN (VXX) to trigger my next buy target which added 4.21% to my position at $13.49.

Every time I throw more money on the fire in this position, I feel the need to emphasize that I am fully aware that I may lose all the money I put into this position. I know exactly what I’m willing to risk losing in advance – this is a stupid, stupid speculative play and I am well aware of that which is why I’m playing it in my dedicated Speculation in Play portfolio.

The buy lowered my per-share cost -1.42% from $17.55 down to $17.30. From here, my next buy target is $12.26, lower than VXX’s all-time low at a price calculated using the Fibonacci Method, and my next sell target will be my cost basis at $17.30 where I dramatically reduce the size of the position.

VXX closed the week at $13.43, down -0.44% from where I added Friday.