September 8, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

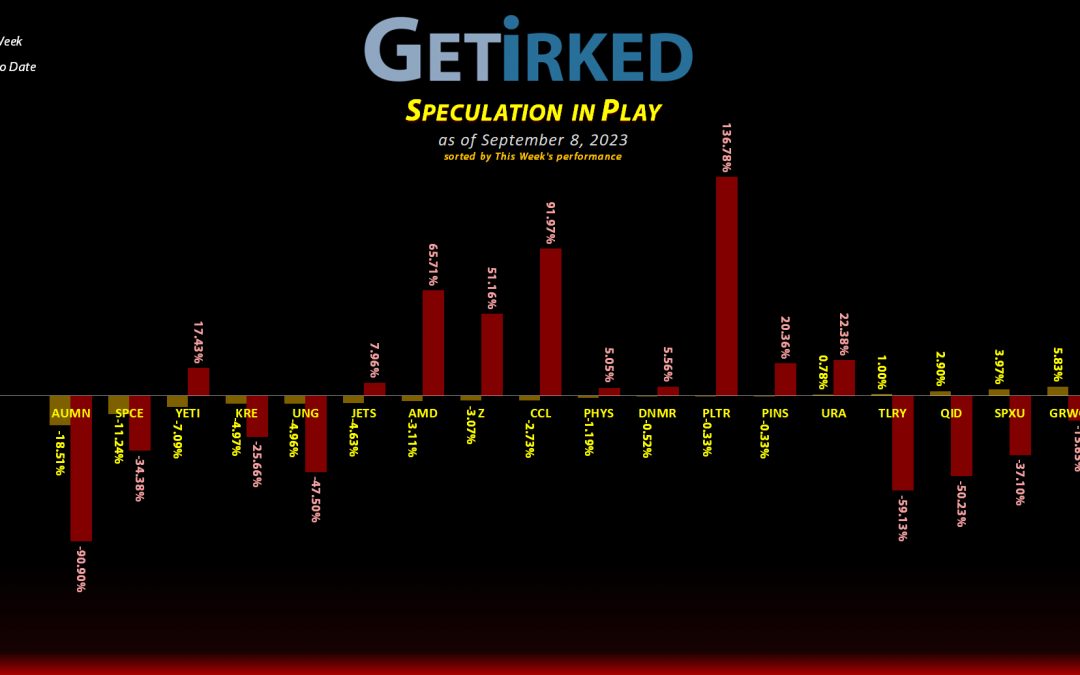

The Week’s Biggest Winner & Loser

DraftKings (DKNG)

Whether it was the return of NFL Football or simply the company’s own outstanding performance, DraftKings (DKNG) won this week’s bet with a +7.53% gain in a pretty disappointing week for stocks, certainly earning its place as the week’s Biggest Winner.

Golden Minerals (AUMN)

If there’s one thing Golden Minerals (AUMN) knows how to do, it’s lose value, and, wow, this company has lost almost all of its value.

In fact, Golden Minerals dropped another -18.51% this week on no news I could find, bringing its Year-To-Date losses to an astounding -90.90%.

On the bright side, there’s not a whole lot further it can drop before it’s no longer part of the portfolio, but, wow, what a Biggest Loser it is, now for two weeks in a row… yikes.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+616.15%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+394.37%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+377.18%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+104.79%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.55)*

Airlines ETF (JETS)

+86.81%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+67.43%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+53.42%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($10.76)*

Uranium ETF (URA)

+38.74%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+9.90%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+5.40%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

+0.56%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

DraftKings (DKNG)

-3.64%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Palantir (PLTR)

-5.96%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Short SPY (SPXU)

-12.16`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.25

Short QQQ (QID)

-17.77%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.95

U.S. Natural Gas (UNG)

-18.73%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-60.76%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Grow Gen. (GRWG)

-76.85%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Danimer Sci (DNMR)

-77.78%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Golden Mine. (AUMN)

-89.64%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-96.58%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Tilray Brands, Inc. (TLRY): Reopened Position

In light of last week’s news where the FDA advised cannabis be descheduled from a schedule-1 narcotic along the likes of heroin and LSD down to the schedule-3 level with testosterone and Tylenol with Codeine, on Tuesday, I decided it was time to reopen a speculative position of mine, a golden oldie, cannabis manufacturer Tilray Brands, Inc. (TLRY).

Really, really longtime readers will remember this one from the cannabis sector first mania way back in 2018 where Tilray rocketed to a high of $300.00/shr in September before crashing back to Earth and eventually hitting a low of $1.50/shr earlier this year, an astronomical -99.50% drop from peak to trough.

I had jumped in on the way down and made a decent amount of profits by buying in with an average price of $114.99 on 9/21/2018 and 9/24/2018 before getting the heck out of dodge with at $174.83 a few weeks later on 10/16/2018, locking in a +52.04% gain.

Why reopen Tilray?

Unlike Canopy Growth (CGC), the much larger (and completely devastated) cannabis position in my Investments in Play portfolio, Tilray Brands has established itself as the better-managed competitor. Its renowned CEO, Irwin Simon, has overseen a number of turnaround stories in the past and has guided Tilray into acquiring a variety of alcohol manufacturers and distribution chains which will be key when cannabis beverages are legalized.

My reopening buy filled at $3.18 on Tuesday, locking in a -98.18% discount from where I closed the position at $174.83 on 10/16/2018. Since I’m using the profits from my original position in 2018, that gives me a per-share cost of -$10.76 (a negative per-share cost indicates all capital has been removed in addition to $10.76 per share added to the portfolio’s bottom line in addition to each share’s current value).

Risk Management Remains Key

Despite last week’s news catalyst, the cannabis sector remains incredibly volatile and there is always the potential for Tilray to go bankrupt. Accordingly, I’ve planned this entire investment out in advance (as I always do) so that, even if Tilray’s stock gets zeroed out – I will still have made 20% on my original investment.

From here, my next buy target is $2.57, a key level of support Tilray has made recently in its epic travels from sky-high to down low. My first sell target is $55.01 – which might sound positively astronomical – but TLRY was just there a little more than 2 years ago in February 2021. Of course, it might not get up there again for years (if ever) but that’s the sell target for the moment since I am playing with the House’s Money.

TLRY closed the week at $3.02, down -5.03% from where I reopened it.

Virgin Galactic (SPCE): Added to Position

After months of seemingly holding the $3.00 mark, Virgin Galactic (SPCE) broke to new, even-lower lows on Thursday, triggering my next buy order which added 9.09% to my position at $2.40.

The buy locked in a -94.05% discount on shares sold for $40.36 on January 26, 2021 and raised my per-share “cost” +$0.45 from -$3.00 to -$2.55 (a negative per-share cost indicates all capital has been removed in addition to $2.55 per share added to the portfolio’s bottom line in addition to each share’s current value).

As always, it’s important to remember that given the volatility and uncertainty in the name, Virgin Galactic is one of the most speculative positions in this entire portfolio. I’m only adding in profits and I’ve calculated the entire trade so that even if SPCE goes bankrupt, I’ll still be up over the lifetime of the investment.

I’m truly not certain if I’d risk any real investment capital in this position if I wasn’t playing with the House’s Money.

From here, my next buy target is at $2.00, a psychological level of support, and my next sell target is $41.50, Virgin Galactic’s first all-time high from way back in February 2020 right before the pandemic crash.

SPCE closed the week at $2.29, down -4.58% from where I added Thursday.