February 24, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

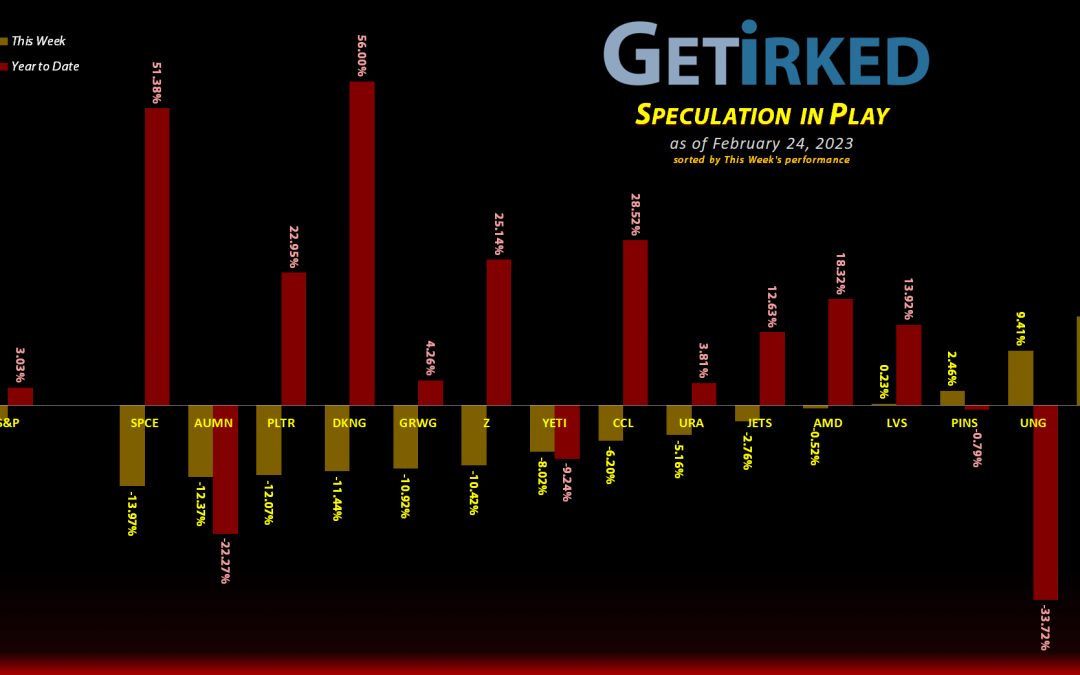

The Week’s Biggest Winner & Loser

Danimer Scientific (DNMR)

One of the biggest stinkers in the entire portfolio in terms of lifetime losses, Danimer Scientific (DNMR) continued to baffle once more, rocketing +15.38% in a very dismal week, easily earning itself the spot of the Week’s Biggest Winner.

Virgin Galactic (SPCE)

Despite not reporting earnings until next week, Virgin Galactic (SPCE) crashed through the stratosphere this week, dropping -13.97%. Given that the week saw a lot of speculative positions get wound down, I’m assuming that’s what caused SPCE to notch another Week’s Biggest Loser on its belt.

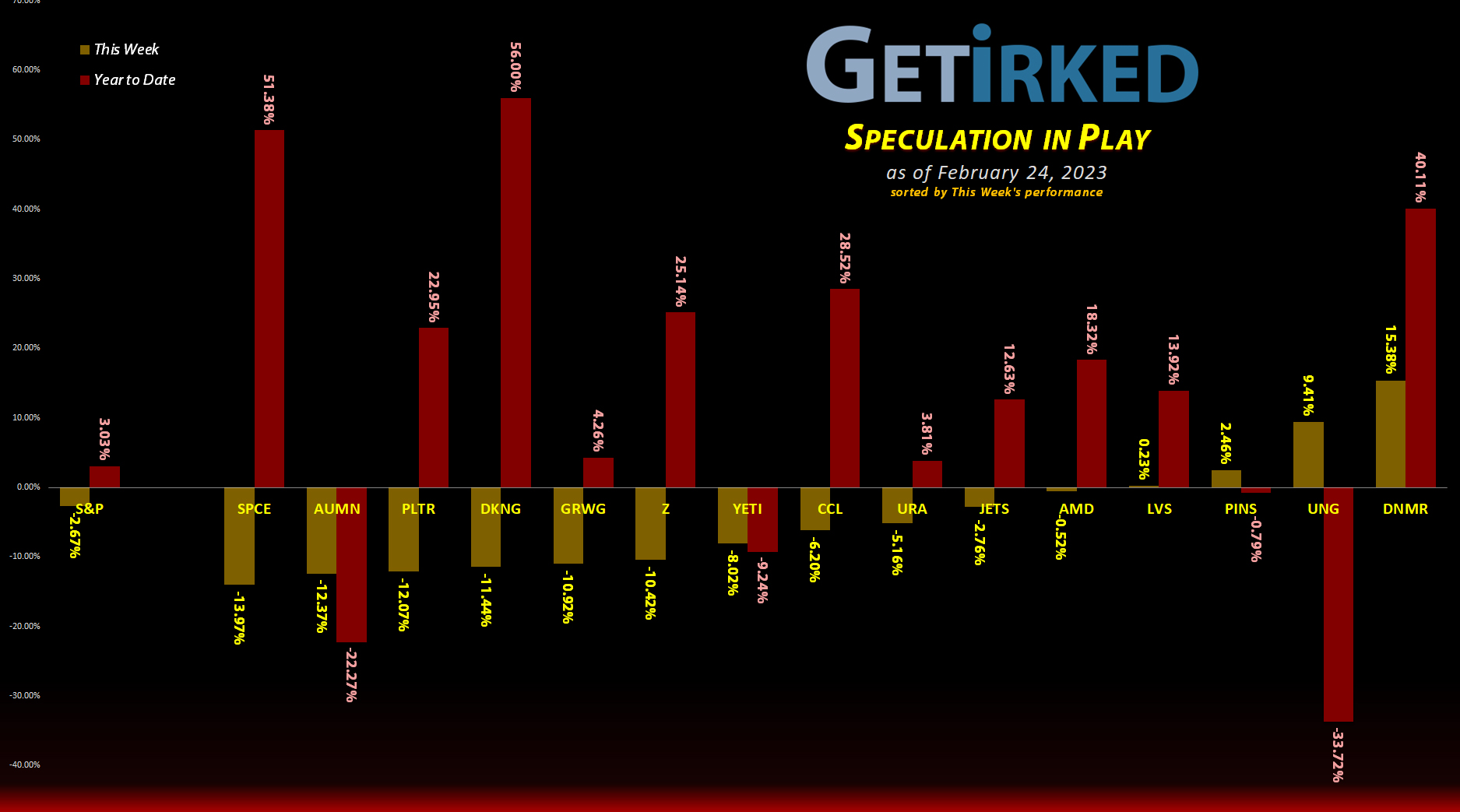

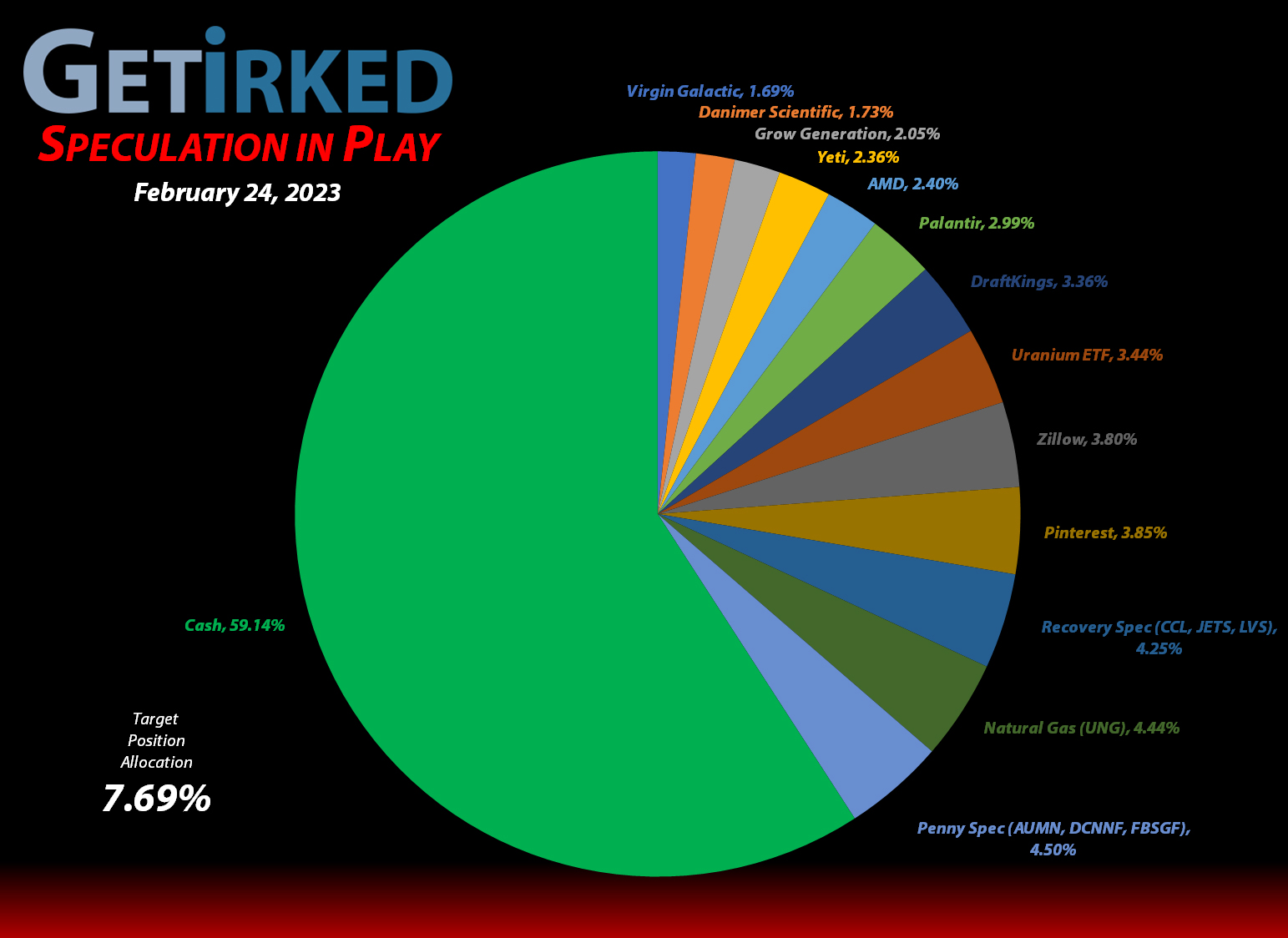

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+544.59%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+360.41%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+356.41%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Las Vegas Sands (LVS)

+164.42%*

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: (-$10.44)*

Virgin Galactic (SPCE)

+163.40%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.60)*

Carnival Cruise (CCL)

+132.62%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Airlines ETF (JETS)

+79.28%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$2.68)*

SPY 3/3 400-398 Puts

+76.96%

Cost: $0.7442

-CLOSED @ $1.3169-

Uranium ETF (URA)

+18.69%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

U.S. Natural Gas (UNG)

-2.91%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.75

Zillow (Z)

-17.20%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Golden Mine. (AUMN)

-29.54%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.3097

DraftKings (DKNG)

-41.98%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $31.35

Canadian Pal (DCNNF)

-46.89%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Palantir (PLTR)

-49.42%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.00

Danimer Sci (DNMR)

-70.18%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-73.42%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $15.65

Fabled Gold (FBSGF)

-80.95%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Golden Minerals (AUMN): Added to Position

When gold sold off to new lows on Thursday, I added to one of my long-standing, ultra-speculative, penny-stock, super-junior, gold miners, Golden Minerals (AUMN), when it tested its recent lows with a buy order which filled at $0.2232 (yes, this stock is so stupidly speculative that the price goes out to the 4th decimal point).

The buy lowered my per-share cost -27.59% from $0.4277 to $0.3097. Again, I must emphasize: I am fully prepared to lose every single penny I have speculated in this position – this is a lottery ticket, not an investment.

From here, my next buy target is $0.1359, slightly above AUMN’s all-time low, and my next sell target is $0.3099, slightly below a key point of resistance Golden Minerals has been experiencing over the past few months.

AUMN closed the week at $0.2182, down -2.24% from where I added Thursday.

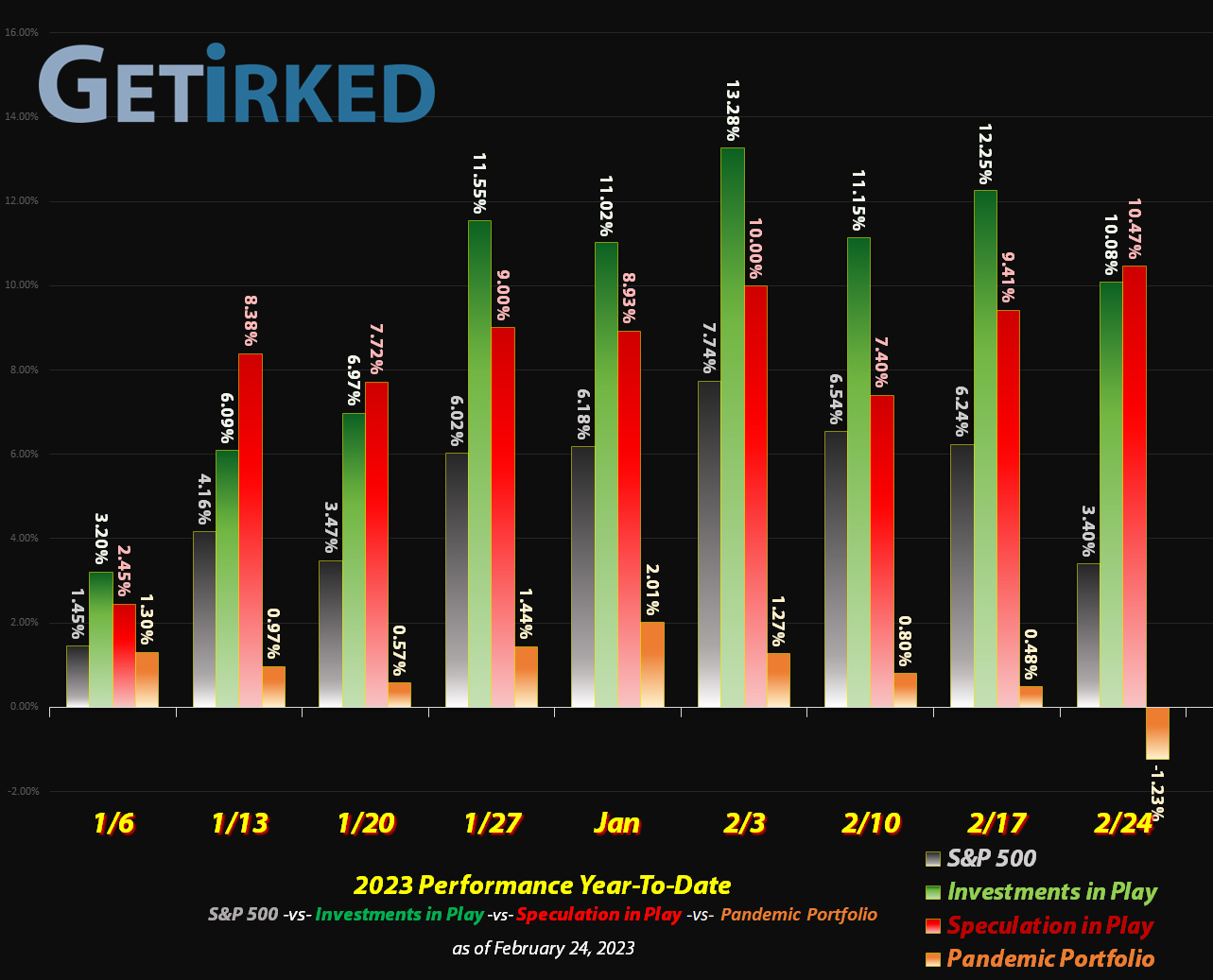

SPY 3/3 Put Spread 400-398: *Closed +76.96% gain*

When the inflation data came in hot on Friday and caused the markets to sell off, my SPY 3/3 400-398 Put Spreads started to become significantly profitable. While I was originally targeting a 100% gain (a double of the money I risked) before I closed the spreads, I decided the prudent course of action was to close the spreads given that there was only a week until expiration and the S&P 500 had become a bit oversold and could bounce within the next couple of days, rendering my spreads worthless.

On Friday, I closed the put spread and since there are two “positions” in a spread, the options I own and the options I sold, it looks like this:

- I bought the SPY 3/3 398 puts I was short for $6.1165 per contract (after fees).

- I sold the SPY 3/3 400 puts I was long for $7.4334 per contract (after fees).

Remembering that contracts are sold in lots of 100, that means my net revenue for each spread I closed was $131.69 or $1.3169. Since my cost was $0.7442 per spread, this means I collected a gain of +76.96% over the course of a month.

Sure, I did leave some money on the table, but I captured 66% of the maximum profit available in the trade and got out without getting my head taken off. As I like to say:

You will always leave money on the table.

If you’re good, you won’t leave ALL of it.

As an end result, the profit from this trade added +1.77% in gains to the entire portfolio’s bottom line. Not bad for a month’s work.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.