October 27, 2023

The Week’s Biggest Winner & Loser

Logitech (LOGI)

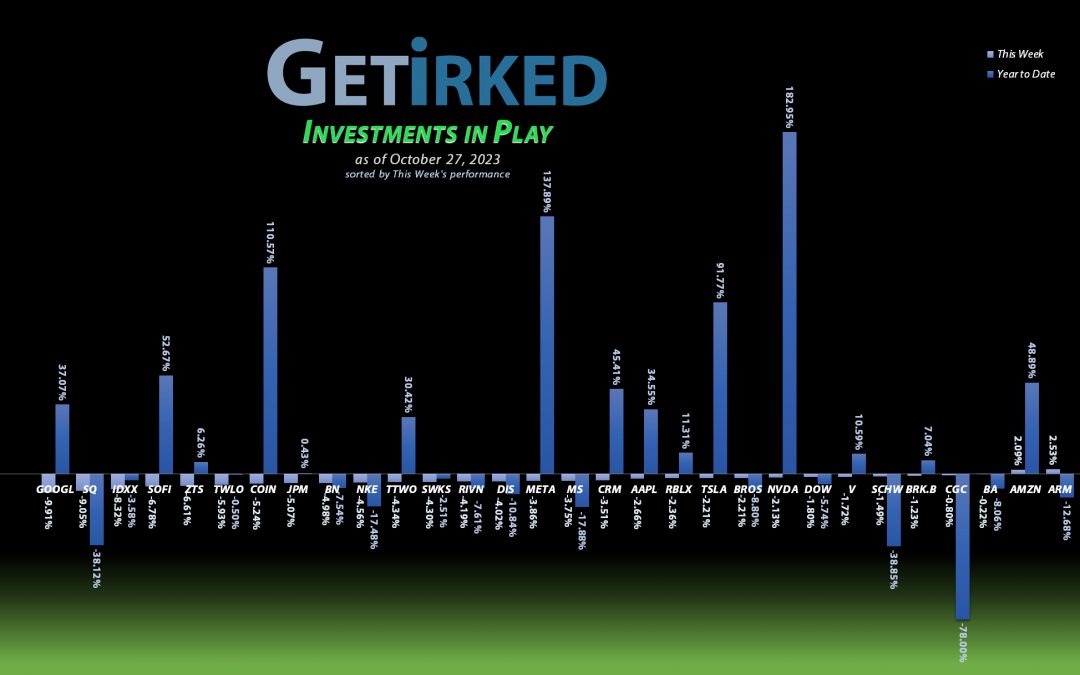

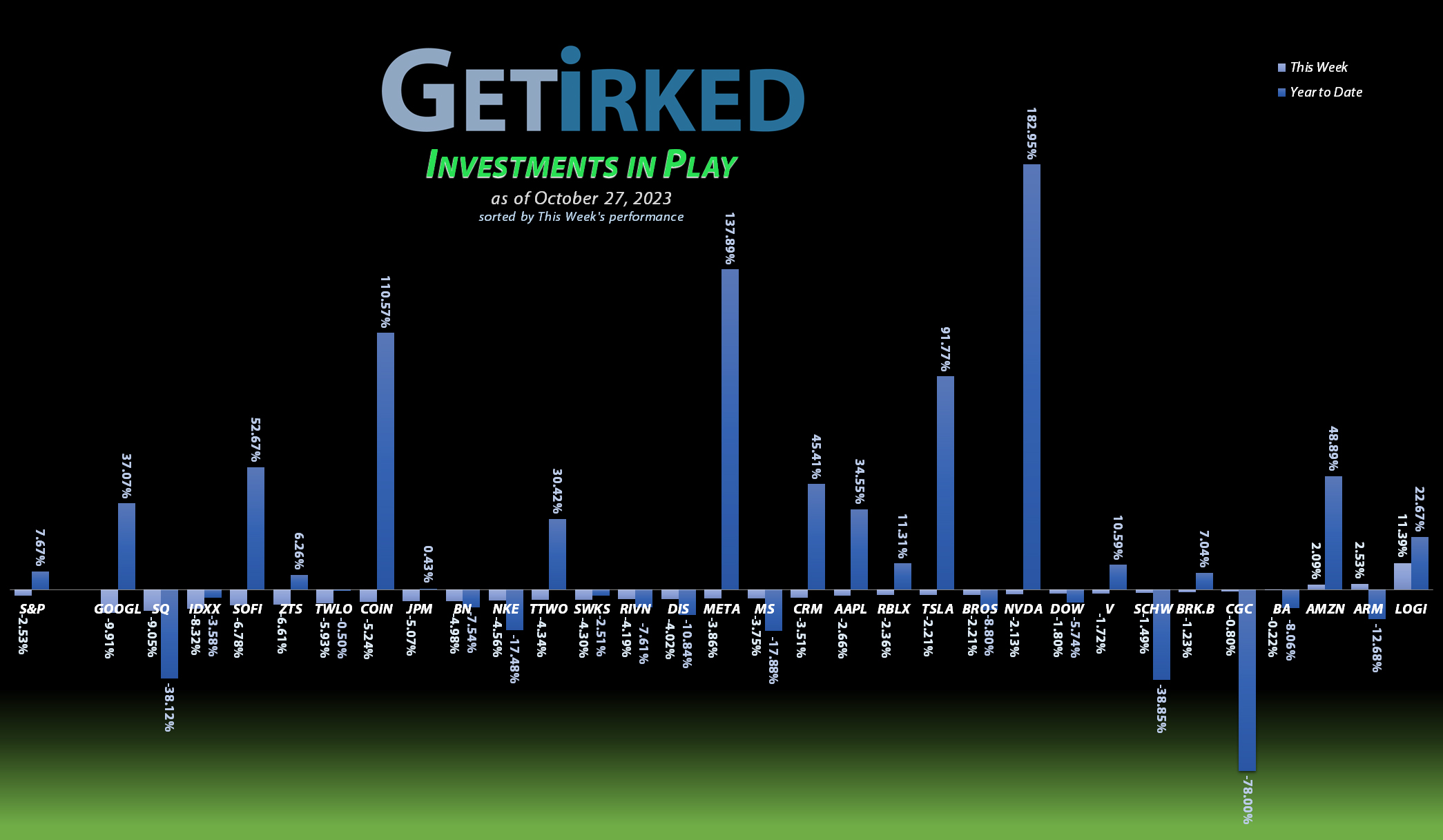

Logitech (LOGI) reported positively blowout earnings for the quarter. In fact, the earnings were so good that LOGI ignored the fact that the stock market was crashing and actually rallied +11,39%, easily finishing the week as its Biggest Winner.

Alphabet (GOOGL)

Just like a good earnings report can send a company skyrocketing to the moon, a terrible miss with shaky guidance can positively destroy a stock. Traders and investors sent Google / Alphabet’s (GOOGL) stock through the floor after the company released discouraging and unconfident guidance about the state of Artificial Intelligence at the behemoth. GOOGL crashed -9.91% and swung as this Week’s Biggest Loser.

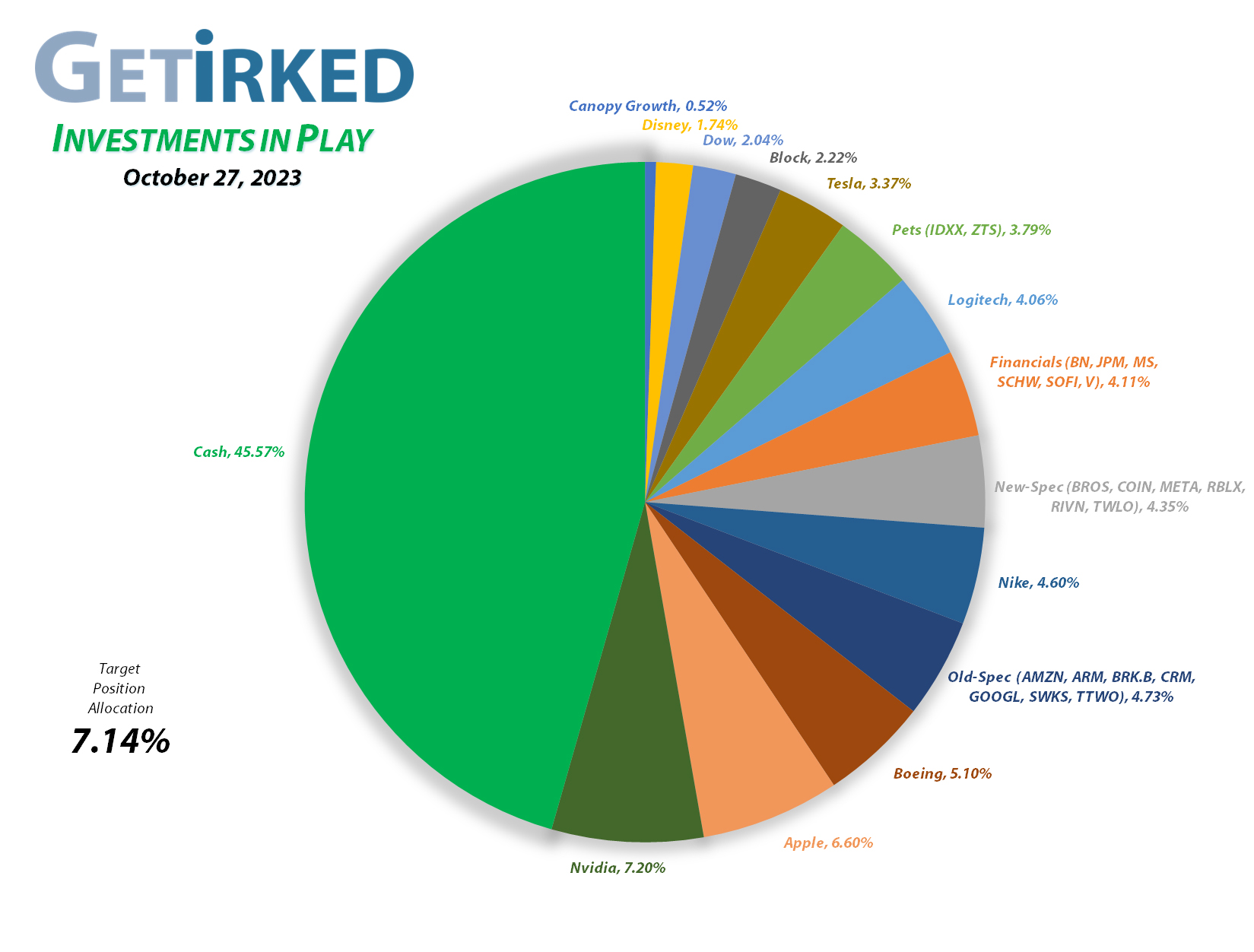

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1384.94%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$259.28)*

Apple (AAPL)

+898.51%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.48)*

Boeing (BA)

+629.73%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Logitech (LOGI)

+642.58%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($3.35)*

Tesla (TSLA)

+551.92%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Skyworks (SWKS)

+422.80%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.48)*

Block (SQ)

+422.66%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$63.41)*

Nike (NKE)

+390.18%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

IDEXX Labs (IDXX)

+374.76%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Dow (DOW)

+285.60%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.326)*

JP Morgan (JPM)

+172.89%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $49.73

Amazon (AMZN)

+155.45%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Disney (DIS)

+160.69%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Salesforce (CRM)

+122.88%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Take Two (TTWO)

+100.87%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+95.80%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

SoFi (SOFI)

+80.80%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Berkshire (BRK.B)

+76.67%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Alphabet (GOOGL)

+48.99%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Visa (V)

+32.07%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.60

Zoetis (ZTS)

+9.75%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.19

Morgan Stan (MS)

+2.39%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $68.75

Arm Hldgs (ARM)

-7.66%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $53.15

Brookfield (BN)

-8.67%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $31.95

Schwab (SCHW)

-21.29%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.68

Dutch Bros (BROS)

-25.28%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Roblox (RLBX)

-27.57%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.80

Twilio (TWLO)

-44.50%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-46.27%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-65.97%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-87.12%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Block (SQ): Added to Position

When a European fintech company reported consumers were drastically cutting back on spending, the news caused all of the American fintech companies to sell off, too, with Block (SQ) taking the brunt of it.

Block fell through my next buy target which filled on Friday at $40.26, adding 2.53% to my position and locking in a -58.64% discount replacing some of the shares I sold for $97.34 on June 17, 2020.

The buy raised my per-share “cost” +3.92% from -$66.00 to -$63.41 (a negative per-share cost indicates all capital has been removed in addition to $63.41 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $35.64, around a point of support, and my next sell target is $80.26, just under the high Block saw in July.

SQ closed the week at $40.00, down -0.65% from where I added Friday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.