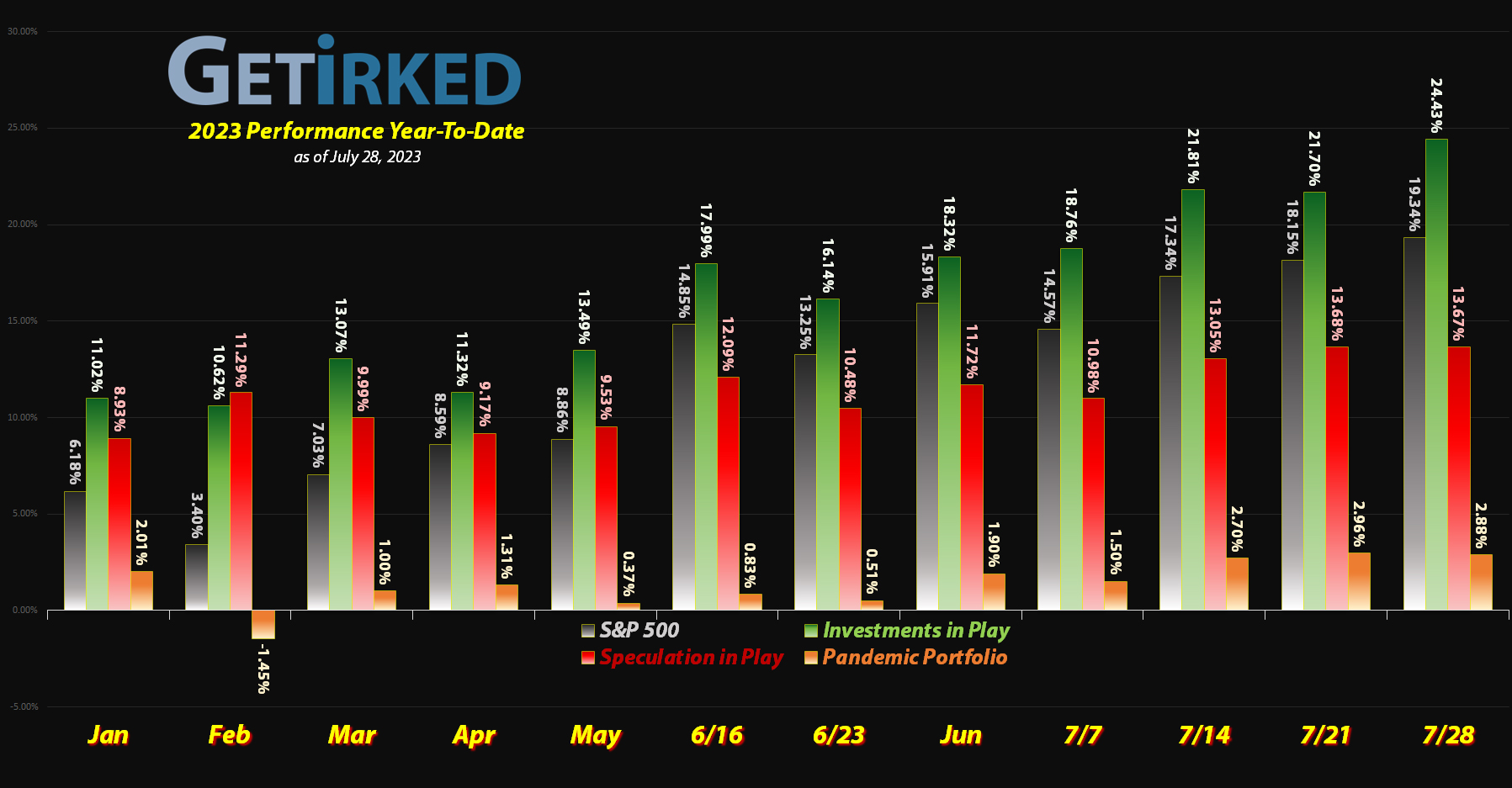

July 28, 2023

The Week’s Biggest Winner & Loser

Canopy Growth (CGC)

Boeing (BA)

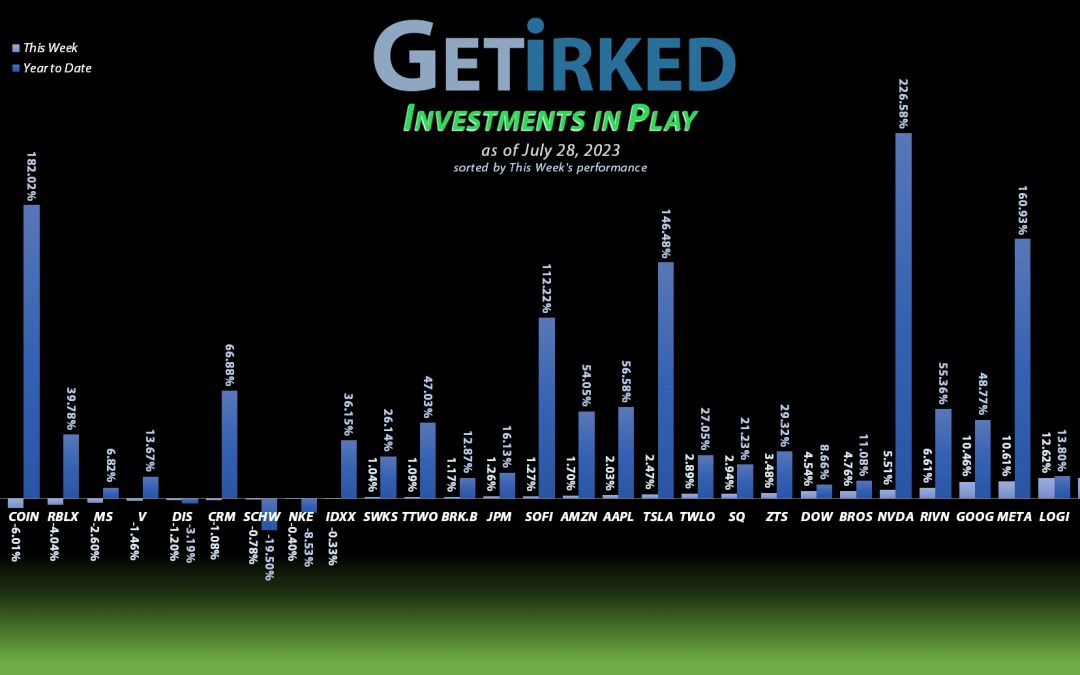

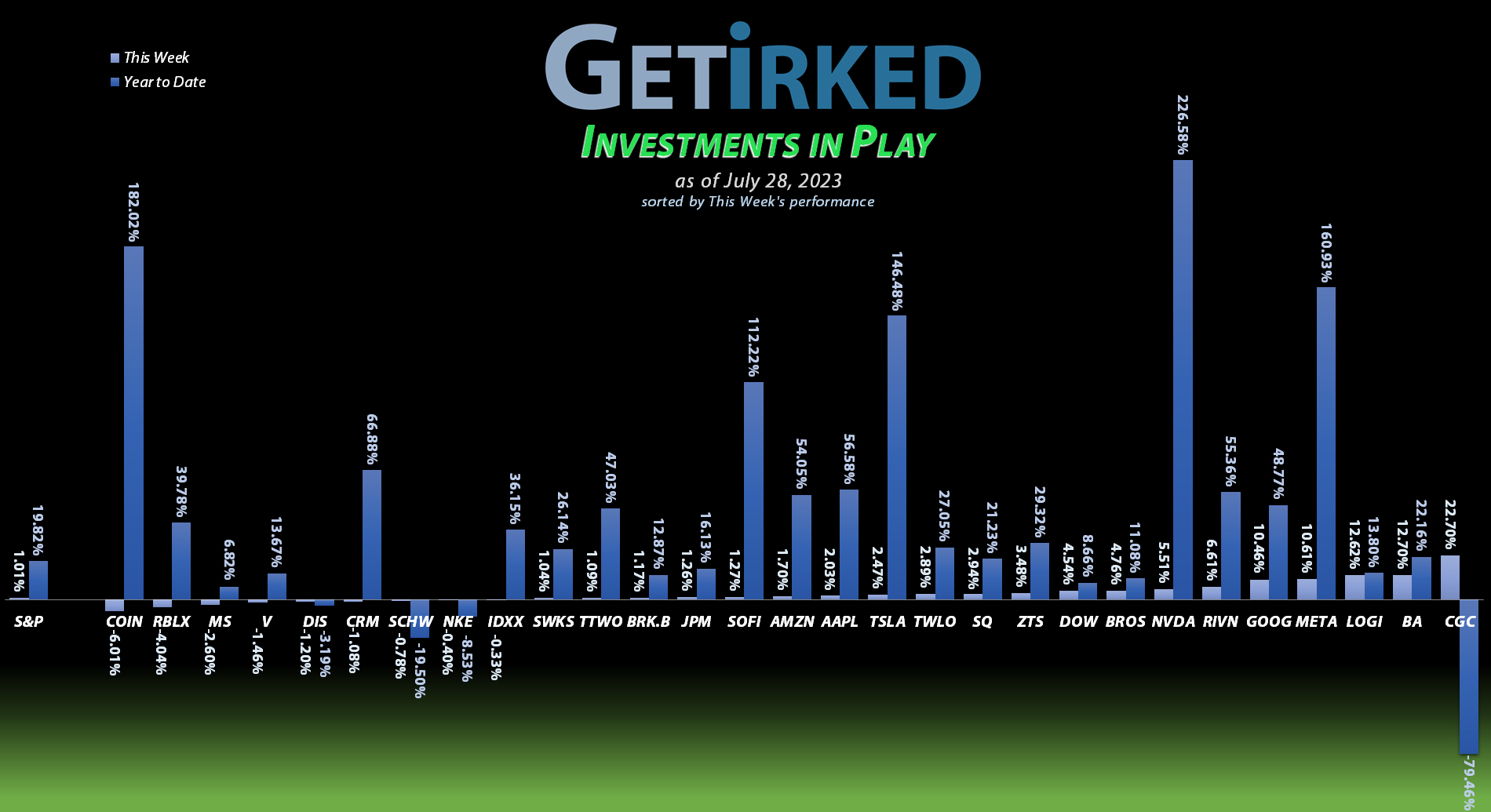

Okay, so Canopy Growth Corporation (CGC) saw a massive dead-cat bounce of +22.70% this week kind of making it the Week’s Biggest Winner on no news. Given that CGC is a penny stock at this point, a 20% move in either direction is, literally, peanuts, so I’m choosing to ignore it as the week’s “biggest winner.”

Instead, let’s take a look at Boeing (BA), the massive airline manufacturer who reported a blowout quarter and gave amazing forward guidance. This venerable institution seems to be finally taking off (pun intended) with unbelievable cashflow expectations for the remainder of this year and for the foreseeable future.

As a result, BA blasted +12.70% and earned its spot as the true Week’s Biggest Winner!

Coinbase (COIN)

Coinbase saw significant profit-taking this week with no true news catalyst. In fact, COIN sold off on Friday when the rest of the market – including crypto like Bitcoin – saw a relief rally following Thursday’s rout.

Coinbase pulled back -6.01% this week, and, in a week that was positive for most stocks, that was more than enough to land this one in the spot of the Week’s Biggest Loser.

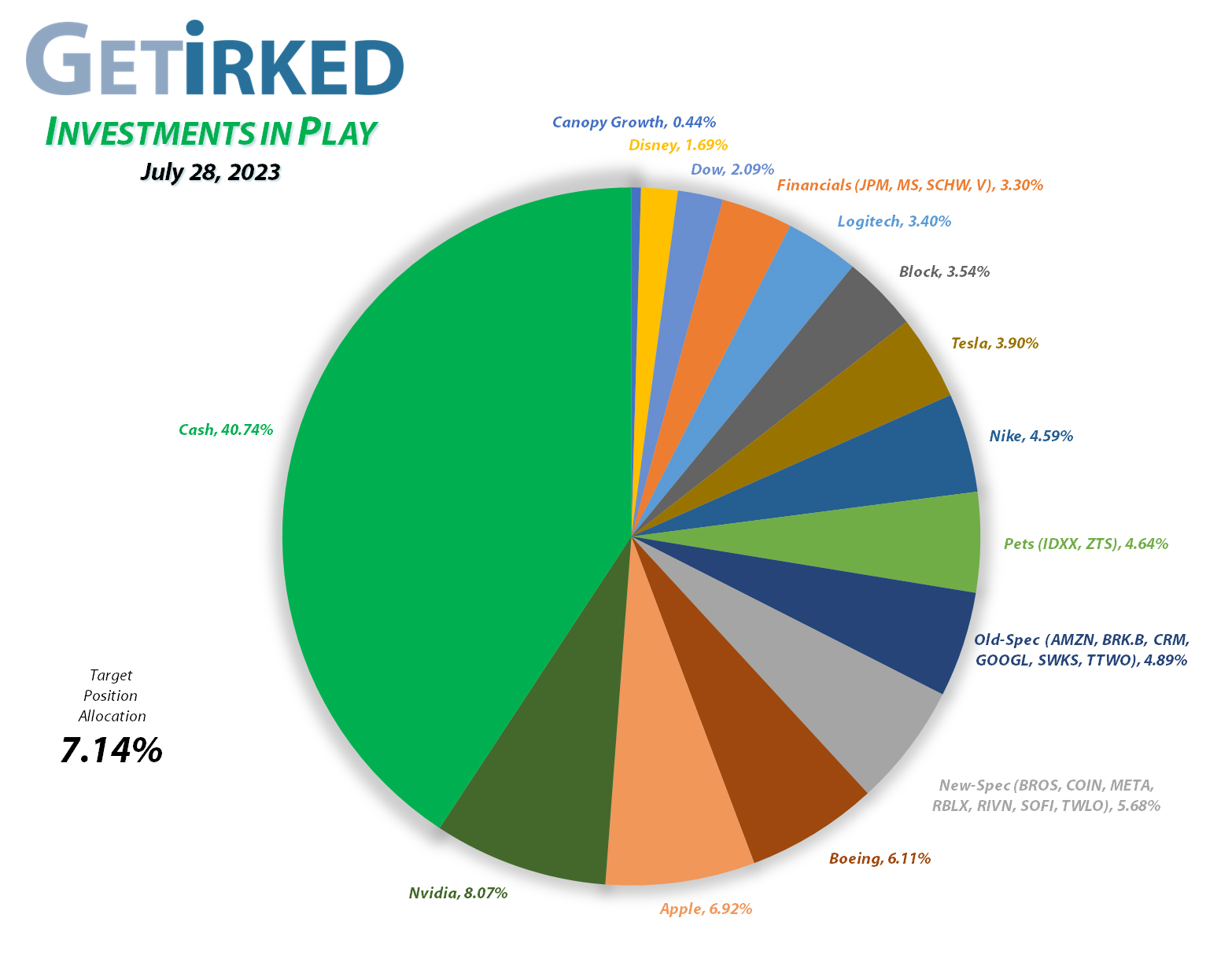

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1508.42%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$204.95)*

Apple (AAPL)

+998.49%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$77.58)*

Boeing (BA)

+733.20%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+679.62%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Logitech (LOGI)

+591.89%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($2.57)*

Block (SQ)

+566.82%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+509.42%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.72)*

IDEXX Labs (IDXX)

+473.46%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+427.09%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.49)*

Dow (DOW)

+324.81%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.33)*

JP Morgan (JPM)

+213.20%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $50.10

Salesforce (CRM)

+155.78%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+149.07%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.87)*

SoFi (SOFI)

+132.06%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.10

Take Two (TTWO)

+126.44%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Meta (META)

+100.24%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Amazon (AMZN)

+97.34%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Berkshire (BRK.B)

+86.30%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Morgan Stan (MS)

+42.33%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Alphabet (GOOGL)

+40.22%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Visa (V)

+35.55%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Zoetis (ZTS)

+33.30%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Schwab (SCHW)

+3.14%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Rivian (RIVN)

-9.59%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Dutch Bros (BROS)

-13.05%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Roblox (RLBX)

-13.20%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.85

Twilio (TWLO)

-29.14%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-54.44%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-87.98%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $3.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

JP Morgan Chase (JPM): Profit-Taking

JP Morgan Chase (JPM) continued to rally in a spectacular fashion this week and became extremely overbought on Monday, motivating me to lock in some gains with a sale that went through at $158.69.

The sale locked in +6.85% in gains on shares I bought for $148.52 back on June 18, 2021, and lowered my per-share cost -15.01% from $58.95 to $50.10. From here, my next profit-taking sell target is $166.70, slightly under a past point of resistance, and my next buy target is $102.26.

JPM closed the week at $156.91, down -1.12% from where I took profits Monday.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) gave a blowout earnings report after the bell on Monday, causing the stock to rocket higher in Tuesday trading. LOGI triggered my next sell order which filled at $68.19, locking in +54.17% in gains on shares I bought for $44.23 on October 2, 2018.

The sale lowered my per-share “cost” -$1.76 from -$0.81 to -$2.57 (a negative per-share cost indicates all capital has been removed in addition to $2.57 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $80.08, right around another potential key level of resistance Logitech has seen in the past, and my next buy target is $55.89, above its most recent low from a few weeks ago.

LOGI closed the week at $71.48, up +4.82% from where I took profits Tuesday.

SoFi Technologies (SOFI): Profit-Taking

Given the run that SoFi Technologies (SOFI) has had combined with the volatility in the markets with the upcoming Federal Reserve meeting, I used a stop-loss limit sell order to lock in some gains if SoFi broke its recent support low which it did on Wednesday morning with my sell order filling at $9.22.

The sale locked in +115.42% in gains on shares I bought for $4.28 on December 28, 2022, and lowered my per-share cost -2.38% from $4.20 to $4.10, now -3.30% lower than SoFi’s all-time low of $4.24. Accordingly, I will start adding back into this position with a buy target at $4.46, slightly above the low SOFI saw in May.

My new sell target is $11.29, a price calculated using the Fibonacci Method and percentage gains based on past earnings reports where I think the stock might pop if it has a good earnings report before the market opens on Monday.

SOFI closed the week at $9.55, up +3.58% from where I took profits Wednesday.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.