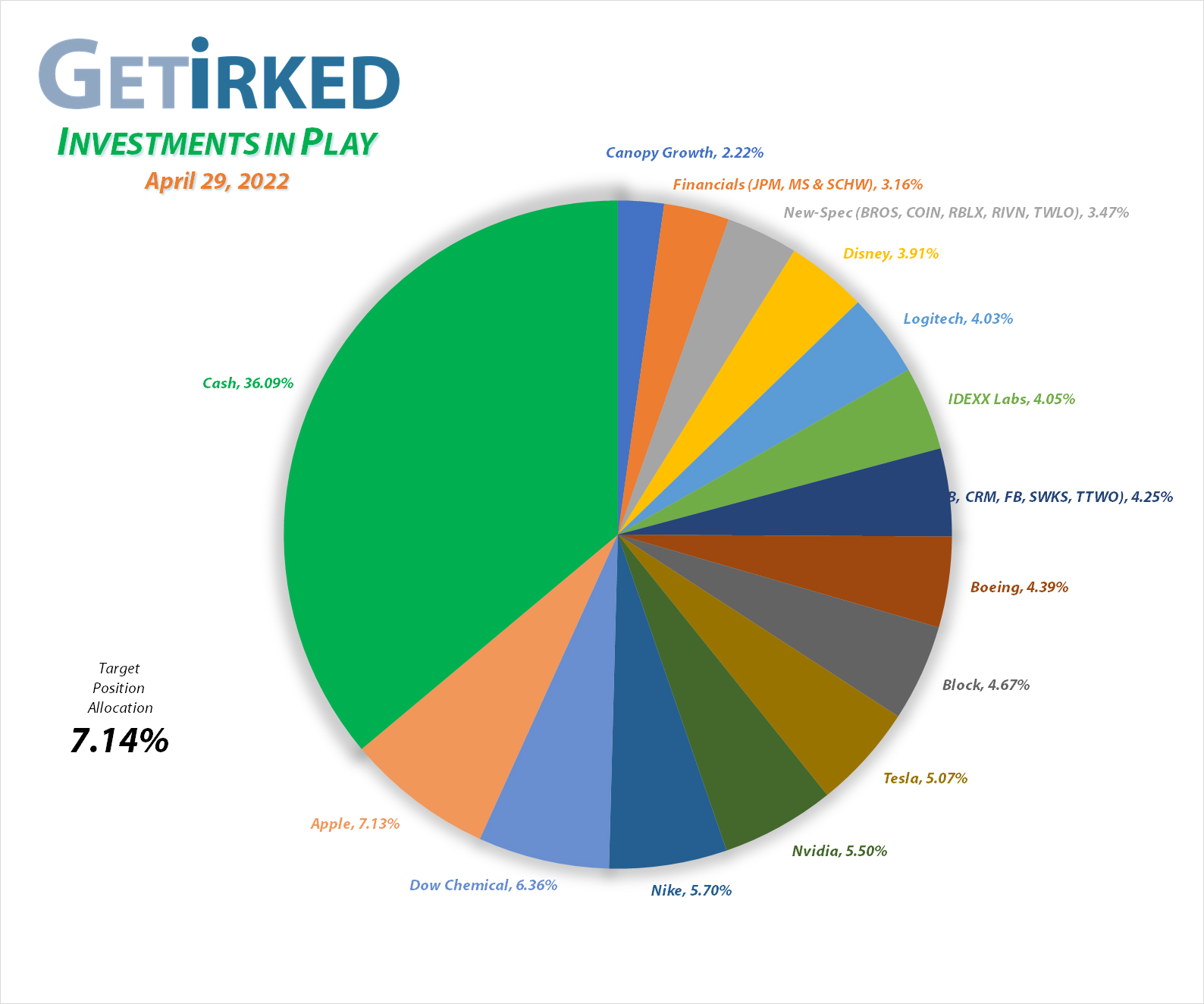

April 29, 2022

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

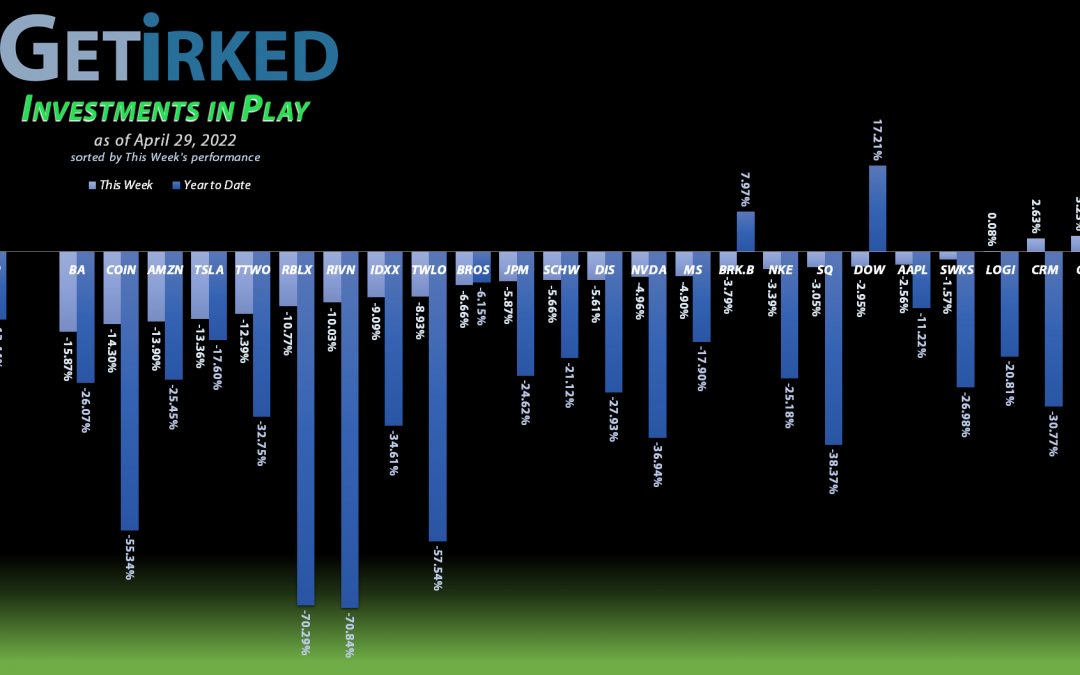

You know the market’s a real horror movie when only the stoners get out alive. Canopy Growth Corp (CGC) and the rest of the cannabis sector caught a bid this week with CGC finishing up +3.23%, enough to earn the Week’s Biggest Winner spot in this ocean of red.

Boeing (BA)

Boeing (BA) is lucky to be one of only two companies in a duopoly making airplanes because, man, what an absolute stinker this company continues to be. A completely destructive quarter left Boeing down -15.87% this week, easily landing it the spot of the Week’s Biggest Smelly Loser.

Portfolio Allocation

Positions

%

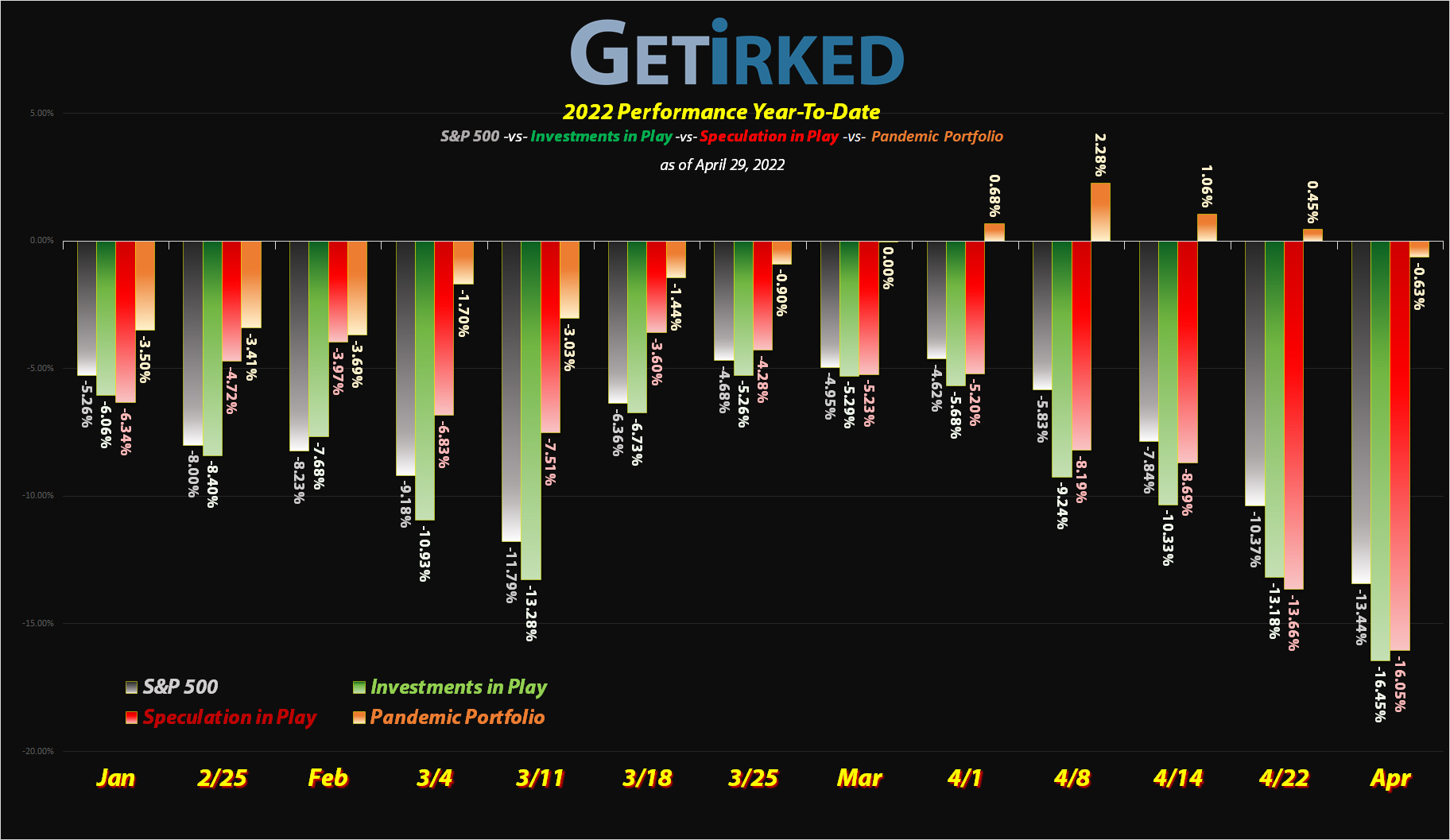

Target Position Size

The “Baskets”

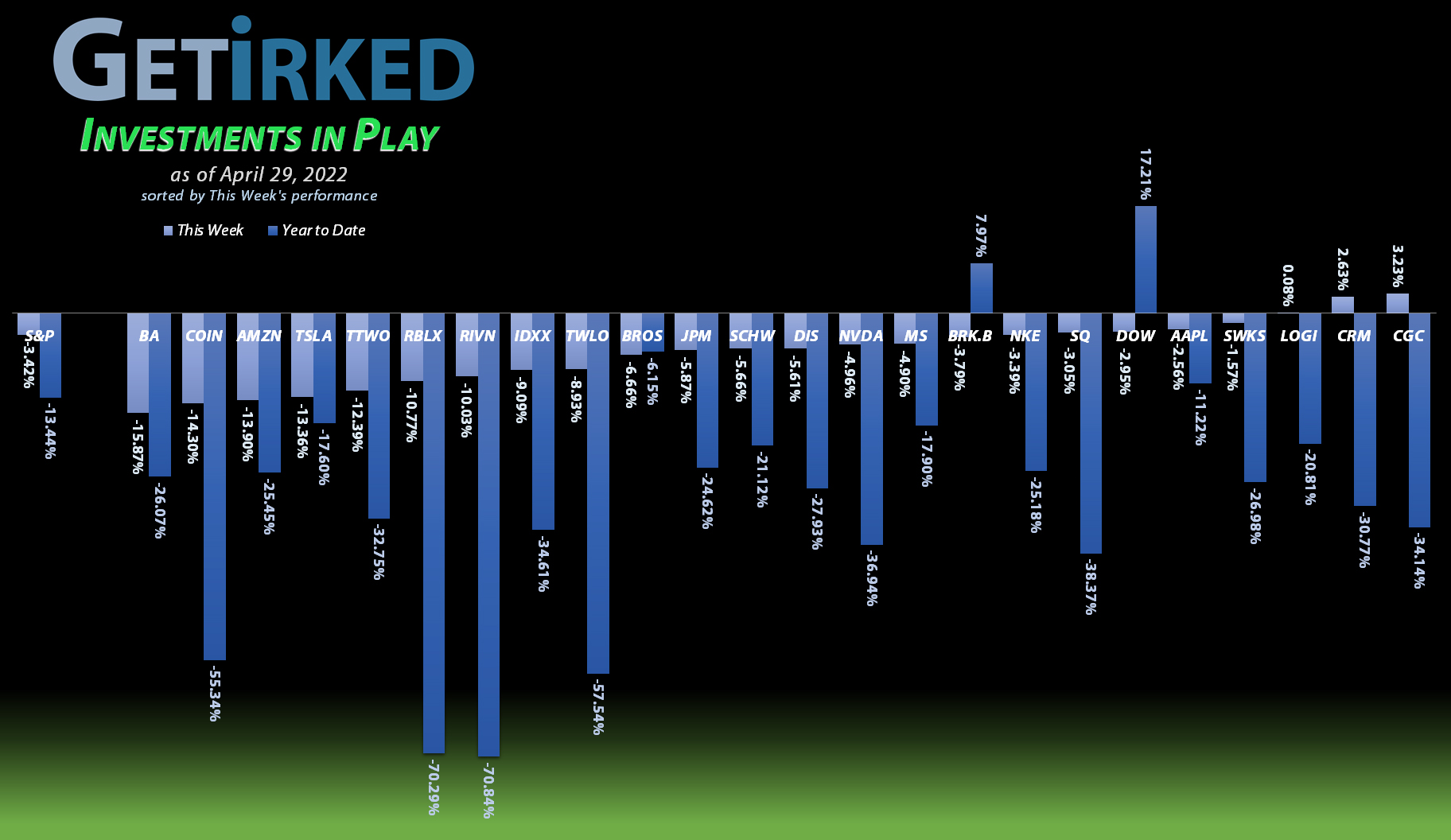

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

Apple (AAPL)

+842.51%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$40.47)*

Tesla (TSLA)

+740.09%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Nvidia (NVDA)

+694.68%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Block (SQ)

+639.55%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$83.75)*

Boeing (BA)

+568.22%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$160.45)*

Logitech (LOGI)

+532.73%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $8.81

Nike (NKE)

+474.07%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$9.59)*

IDEXX Labs (IDXX)

+398.82%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$47.43)*

Skyworks (SWKS)

+388.43%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.85)*

Disney (DIS)

+223.10%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $34.55

Take Two (TTWO)

+158.08%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Amazon (AMZN)

+147.38%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $1,004.78

Dow (DOW)

+94.16%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $34.25

Meta (FB)

+76.63%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Berkshire (BRK.B)

+76.53%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+61.63%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $73.85

Salesforce (CRM)

+53.32%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Dutch Bros (BROS)

+17.95%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $40.50

Morgan Stan (MS)

-3.49%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $83.50

Twilio (TWLO)

-8.37%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $122.03

Schwab (SCHW)

-11.38%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $74.85

Canopy (CGC)

-13.48%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.60

Roblox (RLBX)

-37.13%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $48.75

Rivian (RIVN)

-57.26%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $70.75

Coinbase (COIN)

-58.40%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $270.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Amazon (AMZN): Added to Position

Amazon (AMZN) continued to get slammed with the rest of the tech sector this week, triggering a buy order I had in place which filled Wednesday at $2,726.78. I was slightly apprehensive leaving the buy order in place given that AMZN was set to report earnings on Thursday, but I didn’t want to miss the opportunity in case the earnings report surprised to the upside.

The order raised my per-share cost +$272.83 from $731.95 to $1,004.78. After AMZN reported and an absolutely dismal quarterly report later in the week, I adjusted my future buy targets down much further than initially. From here, my next buy target is $2,286.90, above a past point of support, and I have no sell targets at this time since I’m still rebuilding the position I closed in January 2020.

AMZN closed the week at $2,485.63, down -8.84% from where I added Wednesday.

Apple (AAPL): Profit-Taking

It may seem odd for me to take profits on Apple (AAPL) during a technical bounce off a bad selloff, but that’s exactly what I did on Thursday with a sell order at $163.14. Apple is notorious for popping into a quarter and then selling off dramatically after it reports, and AAPL was scheduled to report earnings Thursday after the bell.

While I am bullish on Apple for the long term, it’s also the biggest position in the portfolio and had exceeded the target allocation by such a margin that it still exceeds the allocation after the sale, so there were multiple reasons to take profits.

The sale locked in a relatively small +5.43% in gains on shares I bought at $154.74 back on January 24 and lowered my per-share cost -$5.86 from -$34.61 to -$40.47 (a negative per-share cost indicates all capital has been removed from the position in addition to $40.47 per share which adds to the portfolio’s bottom line).

From here, my next sell target is $178.30, slightly below AAPL’s last bull rally high, and my next buy target is $142.50; given the market’s rollover on Friday and the reaction to AAPL’s blowout earnings report (the stock sold off in spectacular fashion), I have adjusted my buy target to be even lower than 2022’s current low for the stock.

AAPL closed the week at $157.65, down -3.37% from where I sold on Thursday.

Boeing (BA): Added to Position

No matter what it does, Boeing (BA) simply cannot get out of its own way. On Wednesday morning, Boeing reported yet another disappointing quarter, missing on both commercial and defense revenue streams, causing the stock to collapse to new lows for 2022… and that’s even after the selloff we’d already seen this week.

BA triggered a buy order I had in place which filled at $153.55. The buy locked in a -58.46% discount, replacing some of the shares I sold throughout 2018-19 for an average price of $369.67 and raising my per-share “cost” +$14.95 from -$175.40 to -$160.45 (a negative per-share cost indicates all capital has been removed from the position in addition to $160.45 per share which adds to the portfolio’s bottom line).

From here, my next buy target is $130.55, slightly above a key point of support from the pandemic selloff in March 2020, and my next sell target is around $278.50, just under BA’s 2021 high during its last bull rally where it will outgrow the allocation size for the Investments in Play portfolio.

BA closed the week at $148.84, down -3.07% from where I added Wednesday.

IDEXX Laboratories (IDXX): Added to Position

IDEXX Laboratories (IDXX) sold off with the rest of the high-growth stocks early in the week, triggering a buy order which filled at $469.01 on Monday. The order locked in a -32.14% discount replacing some of the shares I sold for $691.11 on July 28, 2021. The order increased my per-share “cost” +$4.75 from -$52.18 to -$47.43 (a negative per-share cost indicates all capital has been removed from the position in addition to $47.43 per share which adds to the portfolio’s bottom line).

From here, my next buy target for IDXX is $423.90, above a past point of support, and my next sell target is around $1,100 when the position will have outgrown the allocation size for the portfolio.

IDXX closed the week at $430.48, down -8.22% from where I added on Monday.

Morgan Stanley (MS): *New Position Opened*

As I mentioned a few weeks ago when I opened in a position in brokerage Schwab (SCHW), I wanted to increase my exposure to the financial sector by creating the Financials Basket, allowing me to add several positions in order to get exposure to different elements of the sector without allocating more than a single allocation to the sector as a whole.

This week, I was able to add the third contender, Morgan Stanley (MS), an investment bank with great prospects and an excellent dividend paying more than 3% when it pulled back and triggered my first buy order at $83.50 on Monday.

From here, my next buy target is $78.50, above a past point of support, and I do have a sell target at $109.60 just in case, for some freak phenomenon of the market, MS tries to make a stab at its all-time high.

MS closed the week at $80.59, down -3.49% from where I opened my position.

Roblox (RBLX): Added to Position

The market continues to hate anything that’s not making money, and Roblox (RBLX), a long-term play on metaverse, certainly fit the bill this week. On Wednesday, RBLX got slammed to a new all-time low where a buy order of mine filled at $29.90. The buy lowered my per-share cost -5.61% from $51.65 to $48.75, a total reduction of -36.69% from my first buy at $77.00 on September 29, 2021.

IMPORTANT: While it seems like I keep putting good money after bad in this position, it’s important to remember that Roblox is part of my Speculative Baskets and represents an incredibly small portion of my portfolio, accordingly. In fact, after this buy, RBLX is just 0.601% of the entire portfolio whereas the biggest position, Apple (AAPL), is 7.295%. It’s vital to use Risk Management strategies to limit exposure to potential downside risk – speculation is fine, just manage the risk.

From here, my next buy target is $25.40, a price calculated using Fibonacci Retracement method, and my next sell target is $102.65, near a point of resistance from RBLX’s run to its $141.60 all-time high.

RBLX closed the week at $30.65, up +2.51% from where I added on Wednesday.

Schwab (SCHW): Added to Position

Schwab (SCHW) continued to lose ground this week after Robinhood (HOOD) reported it would be laying off a significant amount of its staff due to lack of retail trading volume. On Thursday, SCHW triggered my next buy order at $67.60 which lowered my per-share cost -1.90% from $76.30 to $74.85.

From here, my next buy target is $63.65, above a past point of support, and my next sell target is $92.85, below the high of its last bull rally.

SCHW closed the week at $66.33, down -1.88% from where I added on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.