Summing Up The Week

Following a mid-week selloff that unnerved some investors, tame inflation data, good jobless claims numbers, and an outstanding March retail sales report sent the markets rocketing higher toward the end of the week.

Analysts pointed to algorithms and automated “bot” traders for the reason for Wednesday’s selloff which focused primarily on high-growth tech names. Thursday’s reports led to a broad-based recovery throughout the markets, however.

Let’s look at the news that moved the markets…

Market News

Tame inflation data stabilizes markets

On Tuesday, the Consumer Price Index (CPI) reported an increase of 0.6% versus an expected 0.5% increase, reported CNBC.

The increase was mainly a result of gasoline prices which increased a whopping 9.1% in March, representing about half of the overall CPI increase. The demand for gasoline was to be expected as more and more states reopened in March and allowed for travel during school spring breaks.

“[The report] is the clearest indication so far that the signs of mounting inflation evident in business surveys and producer prices are feeding through to stronger consumer prices,” wrote Michael Pearce, senior U.S. economist at Capital Economics. “For all the focus on supply disruptions pushing goods prices higher, the strongest upward pressure on prices is coming from the services sector.”

While the report was slightly worse than expected, the markets treated it as a generally-tame report given the small margin between expectations and reality.

FDA recommends pause for J&J Covid vaccine

On Tuesday, the Food and Drug Administration (FDA) recommended that the U.S. pause the use of the Johnson & Johnson (JNJ) Covid-19 vaccine following studies showing women developing rare blood clot disorders, reported CNBC.

The cases occurred in womens ages 18 to 48 with symptoms developing six to 13 days after they received the shot. “Right now, these adverse cases appear to be extremely rare,” the FDA said in a joint statement with the Centers for Disease Control and Prevention. “COVID-19 vaccine safety is a top priority for the federal government, and we take all reports of health problems following COVID-19 vaccination very seriously.”

J&J responded in a statement that “no clear causal relationship” has been identified ebtween the blood clots and the vaccine, adding that the company is working closely with regulators to assess the data.

Should the U.S. permanently stop the use of the J&J vaccine, the lack of it could create serious setbacks in the attempt to reach herd immunity. “This is a devastating blow to [the] vaccine effort in the United States,” said Dr. Kavita Patel, a former federal official, in a CNBC interview. Patel pointed out that the supply of the Pfizer and Moderna vaccines won’t be able to quickly make up the demand created by the J&J pause, and will delay U.S. vaccination efforts.

Mortgage demand hits lowest level in over a year

On Wednesday, the Mortgage Bankers Association (MBA) released a report showing mortgage refinance demand dropped 5% last week to 31% lower than 2020 and mortgage applications to purchase homes fell 1%, reported CNBC.

“Purchase and refinance applications declined, with most of the pullback coming earlier in the week when rates were higher,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Refinance activity has now decreased for nine of the past ten weeks, as rates have gone from 2.92% to 3.27% over the same period.”

The average interest rate for a 30-year fixed-rate mortgage decreased from 3.27% to 3.36%, but the combination of rates and an incredibly limited supply of homes both contributed to the decrease in demand.

“The third straight week of declining purchase activity is a sign that rising home prices and tight supply are constraining home sales – especially in the lower price tiers,” said Kan.

Retail sales explode 9.8% in March vs 6.1% expected

On Thursday, the Commerce Department released a report showing advance retail sales rose 9.8% in March compared to the Dow Jones estimate of 6.1%, reported CNBC. Thanks to stimulus checks, consumers rushed out to buy sporting goods, clothing, food, and beverage products.

The retail spending came as a relief to some economists who were concerned Americans might save this round of checks, invest in the stock market, or otherwise not put the money back into the economy. The goal of stimulus is to inject needed funds back into the economy to jumpstart business and regrow jobs.

The bar and restaurant industry saw a surge of 13.4% thanks to relaxing Covid restrictions due to the vaccine rollout while sporting goods was the highest percentage gainer at 23.5% followed by clothing and accessories at 18.3% and motor vehicle parts and dealers at 15.1%.

“Spending will almost certainly drop back in April as some of the stimulus boost wears off, but with the vaccinations rollout proceeding at a rapid pace and household finances in strong shape, we expect overall consumption growth to continue rebounding rapidly in the second quarter, too,” wrote Michael Pearce, senior U.S. economist at Capital Economics.

New jobless claims at 576K vs 710K expected

On Thursday, the Labor Department reported 576,000 new jobless claims in the past week versus the 710,000 expected by Dow Jones economists, reported CNBC. While still seeing jobless claims in the multi-hundred thousands is disconcerting, this week’s figure is easily the lowest since the Covid-19 pandemic began, potentially signifying further improvement in the economy.

While the media reports unemployment of 6%, that figure only includes unemployed Americans still looking for work and still receiving unemployment benefits. Economists estimate the real unemployment figure to be closer to 10-12%, an incredibly discouraging figure more akin to the unemployment seen during the Great Depression throughout the 1930s.

Covid approaching highest infection level ever

On Friday, the World Health Organization (WHO) warned that the rate of infection of the novel coronavirus Covid-19 was reaching its highest level ever, reported CNBC.

While many states in the U.S. are taking steps back from their reopening plans, the situation is just as dire or moreso globally. “Around the world, cases and deaths are continuing to increease at worrying rates,” said WHO Director-General Adhanom Ghebreyesus in a briefing. “Globally, the number of new cases per week has nearly doubled over the past two months; this is approaching the highest rate of infection that we have seen so far during the pandemic.”

To make matters worse, countries that had previously avoided transmission are now seeing increases in infections such as Papua New Gunea, added the Director-General.

The new and more powerful resurgence of the virus is discouraging as rollbacks and lockdowns could severely damage the progress of the global economy reopening.

Next Week’s Gameplan

With the markets continuing to make new all-time high after new all-time high, I continue to exercise conservative caution in adding to positions. With the amount of stimulus flowing into the markets and trillions of dollars in money market funds, the potential for any significant pullback has been diminished greatly.

Therefore, I am prepared to add to positions on dips as the adage “Buy the Dip” definitely applies, for the moment.

All that being said, it remains vital to account for the potential of a Black Swan Event (an event that was totally unexpected by analysts such as the 2020 pandemic) which could create the generational 90-year selloff some analysts predict will still happen at some point.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

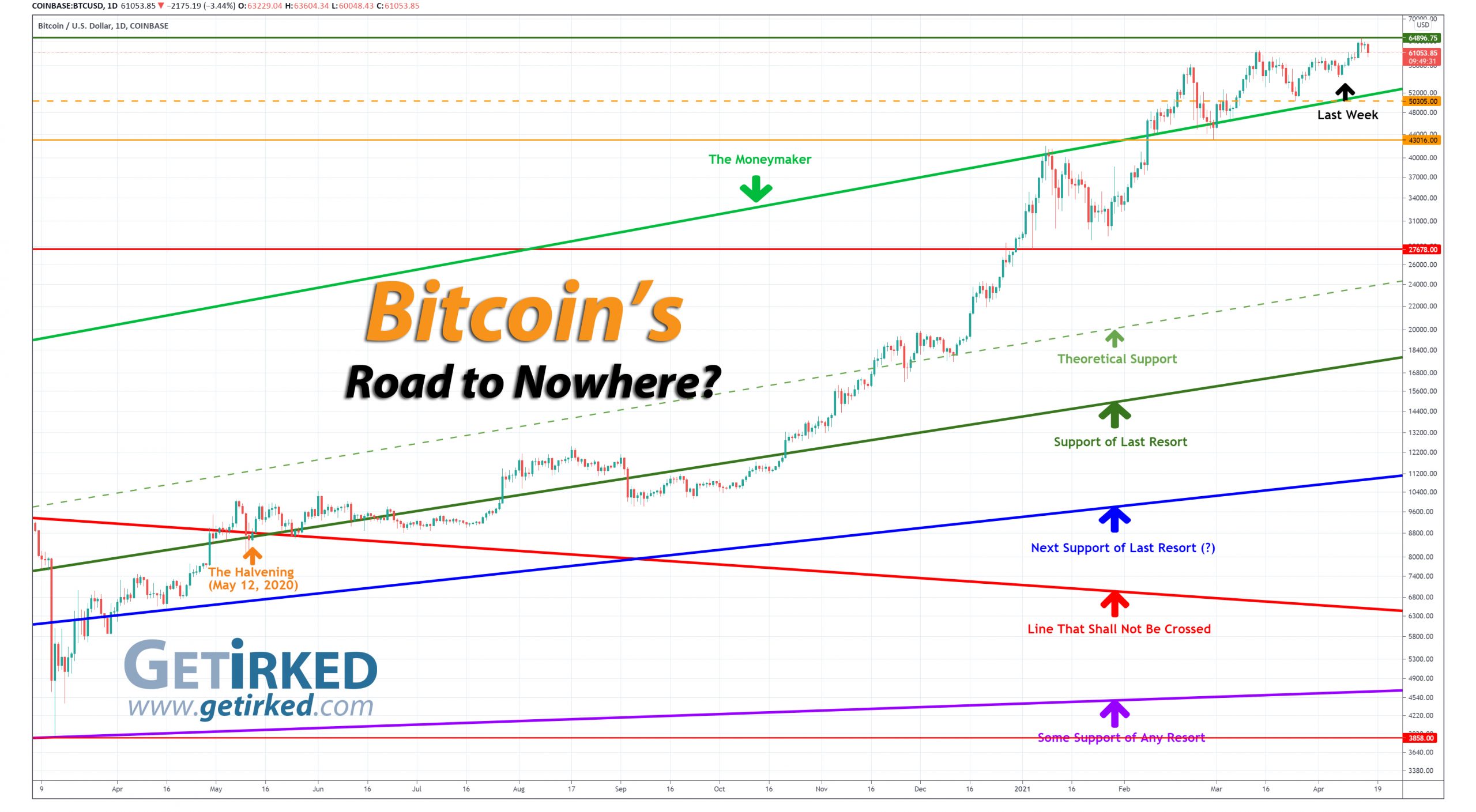

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Even more new all-time highs!

Bitcoin started its new rally by pulling off one of its “weekend miracles,” cracking through the $60K mark last Friday before dropping back below on Saturday. While many analysts suggest we ignore the moves that happen in cryptocurrencies on the weekend since trading volume is typically lower when the equity markets aren’t operating, they were definitely wrong in this case.

Early Tuesday morning, Bitcoin continued its rally and broke through its past all-time high, settling on a new one on Wednesday at $64,896.75. In what might be more correlative than coincidental, Bitcoin started to sell off nearly the very moment that the Coinbase (COIN) direct listing came public on the stock exchanges.

Coinbase (COIN) is one of the main exchanges that trades crypto, and some analysts were pointing to its public offering as the potential peak of the current bull rally. Since Wednesday, Bitcoin has pulled back nearly -7.5% before finding support at $60,048.43.

The Bullish Case

Bulls continue to defeat the Bears with their “this time is different” logic. While some analysts have sky-high forecasts for Bitcoin in the next five years (I’ve heard more than one give a $1,000,000 price target!), some are saying we’ll see an all-time high near $100,000 by the end of 2021.

The Bearish Case

Bears refuse to give up, arguing that the higher Bitcoin goes, the more likely governments around the world will regulate it and cause its value to fall precipitously. Despite Bitcoin’s amazing bull rally, the Bears believe that eventually we will see another “crypto winter” where Bitcoin will lose 85% of its value or more.

Bitcoin Gameplan

Current Allocation: None (*No Active Trade*)

Current Per-Coin Price: None (*No Active Trade*)

Current Profit/Loss Status: None (*No Active Trade*)

Ever feel like you caused the rally? Just me? Okay…

When Bitcoin cracked through $60K again, I chose to vote against the bullish “this time is different” crowd and used stop-loss limit orders to close my trade when Bitcoin looked like it might pull back below $60K.

Obviously, the “Crypto Gods that Be” saw what I was doing and triggered my sell order just in time for Bitcoin to make a new all-time high. LOL!

At any rate, this trade which was opened on March 21 @ $58,114.23 ended up earning a total profit of 3.52% when it closed early Tuesday morning at $60,525.48. Had I held on and sold at the new all-time high, I could have added another 8-10% on to my profits. Like they say, any trade you can walk away from with a profit is a good one… right? Maybe not…

As always, I keep all of my profits as the crypto

Here’s how the trade played out:

3/21: Opened @ $58,114.23

3/23: Buy @ $50,540.13

3/29: Sell @ $57,521.73

3/31: Sell @ $59,307.84

4/5: Sell @ $58,685.94

4/13: Closed @ $60,525.48

As for my next trade, I’m looking at entering around the 50-Day Moving Average, a key area of support for the entirety of the most recent bull run.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

1.849% @ $55,859

0.461% @ $52,011

0.461% @ $46,060

0.922% @ $41,659

0.922% @ $33,268

1.173% @ $28,387

3.335% @ $21,456

3.210% @ $18,655

7.336% @ $13,655

9.004% @ $11,007

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45.

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

- In April 2021, Bitcoin rallied +29% to a new all-time high of $64,896.75.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.