August 23, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+103.72%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $14.50

Pinterest (PINS)

+70.45%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $20.24

Yeti (YETI)

+54.52%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.91

Tradeweb Mkts (TW)

+31.03%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $33.74

Tencent Music (TME)

+29.13%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.45

Canopy Growth (CGC)

+21.13%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.55

BiliBili (BILI)

-6.26%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.68

Build-A-Bear (BBW)

-6.80%

1st Buy: 8/12/2019 @ $3.38

Current Per-Share: $3.38

Iridium Comm (IRDM)

-8.08%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $24.75

Cronos Group (CRON)

-12.59%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $13.04

Revolve Group (RVLV)

-30.46%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $33.09

Profit % for * positions = Current Gross Profit / Original Capital Investment

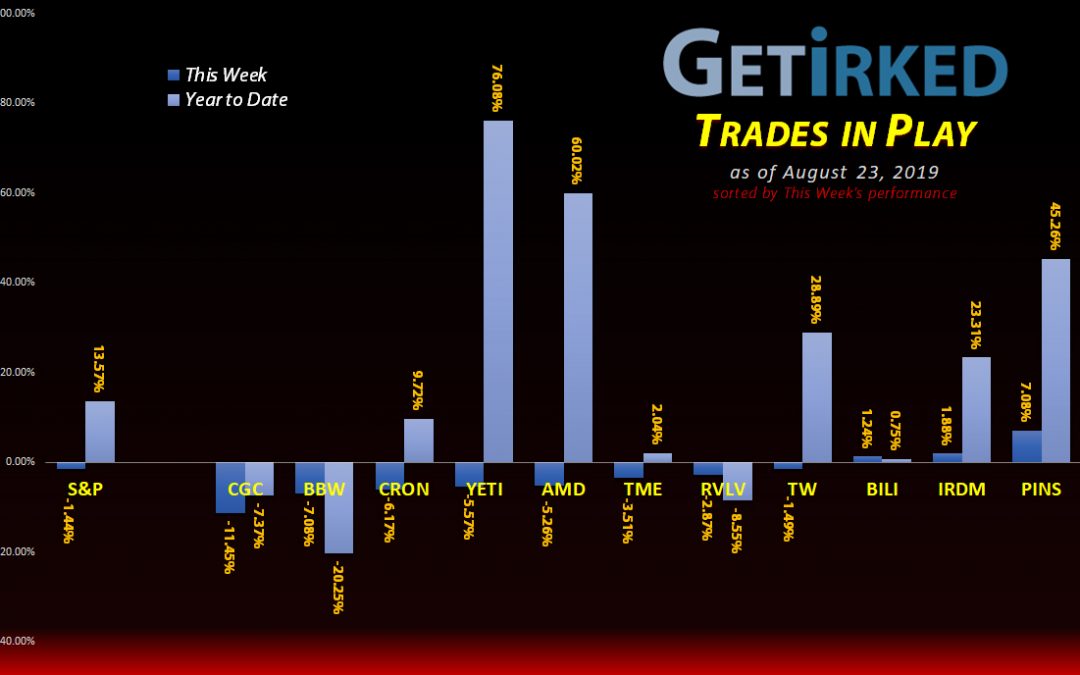

Highlights from the Week

Biggest Winner: Pinterest (PINS)

Even during the heat of the selloff Pinterest (PINS) held strong, earning itself +7.08% for the week as well as the title of this week’s Biggest Winner. It seems the market has figured out that Pinterest isn’t messing around when it comes to growth potential.

Biggest Loser: Canopy Growth Corporation (CGC)

The selloff doesn’t end for Canopy Growth Corporation (CGC) as it lost another -11.45% this week to earn itself the title of Biggest Loser for two weeks running. Given the company’s not-so-hot balance sheet combined with a valuation that is still rich even at these levels, CGC goes on the “no-touch” list for awhile as I wait for it to cross below my newly-acquired $20.55 per-share cost basis (see this week’s buy… way too high… below).

This Week’s Trades

AMD (AMD): Added to Position

AMD (AMD) showed remarkable resilience during last week’s selloff, so when it pulled back a bit on Monday, I replaced some of the shares I sold at $33.92 at $31.62, a reduction of -6.78%.

Then, on Friday, the entire market took it hard and AMD crossed through the $30.00 mark where I added at $29.90. This buy replaced the remainder of the $33.92 sale, representing a reduction of -11.85% for those shares or an total reduction of -9.32% for all shares sold at $33.92. The two buys also raised my per-share position cost to $14.50. My next buy target is $28.10.

AMD closed the week at $29.54, down -3.97% from my $30.76 average buy price.

Cronos Group (CRON): Added to Position

Canopy Growth Corp’s (CGC) terrible earnings report last week continued to slaughter the cannabis space going into this week. Even though Monday was an up day for the markets, Cronos Group (CRON) continued to sell-off, triggering a buy order I placed at a key level of support at $11.77. CRON continued slightly lower following my order, finding full support at $11.70 and bouncing back to the $11.90s.

Next key levels of support are near: $10.63, $8.71, and $7.57 where I will add to my position at each level.

CRON closed the week at $11.40, down -3.14% from where I added on Monday.

Canopy Growth Corporation (CGC): Added to Position

Canopy Growth (CGC) sold off in excess of an additional -4% on Monday, cooking its Daily and Weekly Relative Strength Indicator (RSI) levels to such an oversold level that I decided to raise the price target of my next purchase.

After the price action settled in mid-day, I added some of the position I had sold off at much higher levels when the price pulled back below $27 (adding at $26.99). This order replaces some of the shares I sold at $39.60, a cost reduction of -34.17%.

Although the buy raises my per-share cost to $20.55 and increases my allocation, my per-share cost is still more than 20% lower from this level. Given the amount of trouble this company is having, however, I’m holding off adding more shares unless CGC crashes through the $20.00 mark, below my current $20.55 per-share cost.

CGC closed the week at $24.89, down -7.78% from where I added on Monday (ouch).

Yeti (YETI): Added to Position

Outdoor products manufacturer, Yeti (YETI), got slammed particularly hard on Friday following Trump’s tweets, dropping nearly -7% to $26.97 where my buy order filled at $27.00, replacing some of the shares I sold at $35.21, +23.32% higher than here.

My next buy target for Yeti is at a key level of support at $25.36 followed by much lower levels of $23.10, $19.03 and $16.81.

YETI closed the week at $26.13, down -3.11% from where I added on Friday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.