August 16, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+164.47%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$18.02)

Yeti (YETI)

+104.26%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $13.55

Pinterest (PINS)

+59.19%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $20.24

Canopy Growth (CGC)

+45.95%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $19.26

Tencent Music (TME)

+33.82%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.45

Tradeweb Mkts (TW)

+33.02%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $33.74

Build-A-Bear (BBW)

0.30%

1st Buy: 8/12/2019 @ $3.38

Current Per-Share: $3.38

BiliBili (BILI)

-7.41%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.68

Cronos Group (CRON)

-8.63%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $13.30

Iridium Comm (IRDM)

-9.78%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $24.75

Revolve Group (RVLV)

-28.41%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $33.09

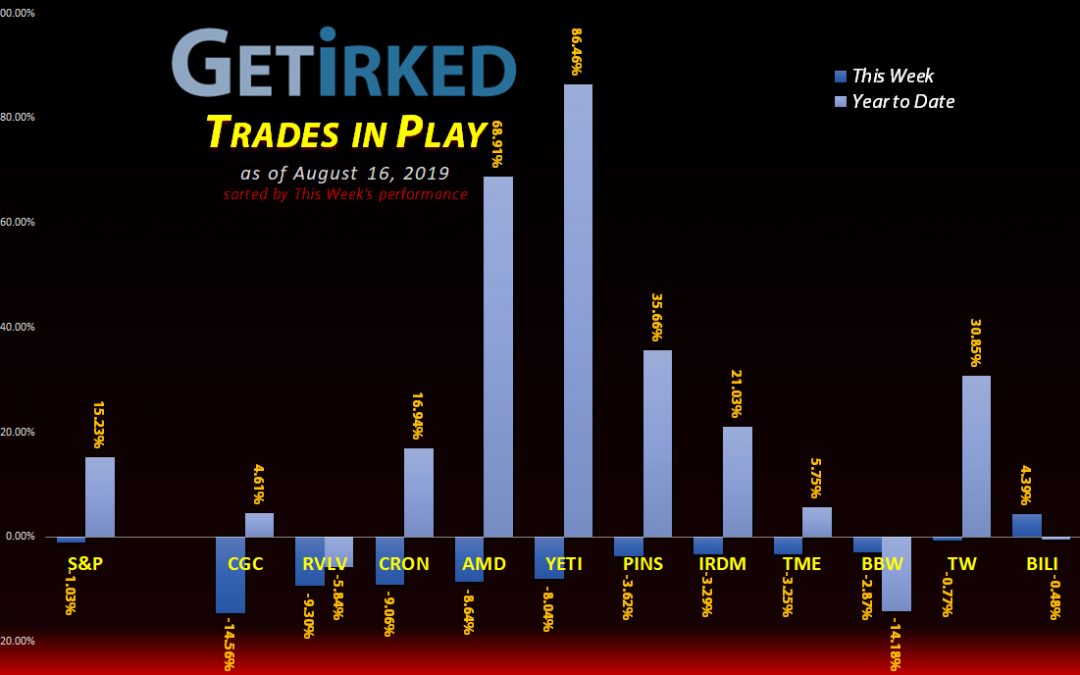

Highlights from the Week

Biggest Winner: BiliBili (BILI)

BiliBili (BILI), China’s YouTube competitor, came out of nowhere this week to lock in +4.39% gains in a week of death and destruction. Granted, BILI is still flat for the year, but given the market action combined with the U.S.-China Trade War sentiment, this is a pretty remarkable performance earning BILI the spot of this week’s Biggest Winner.

Biggest Loser: Canopy Growth Corporation (CGC)

If you follow my Investments in Play, too, you’ll know that Canopy Growth Corporation (CGC) is the only crossover target. This means good things when CGC has a good a week, but when CGC has a bad week like it did this week, losing -14.56% after reporting yet another horrendous quarter, it means I have to give it two Biggest Loser Awards.

Revolve Group (RVLV) took second place this week with a -9.30% loss, now down nearly -6% from where it opened in the public markets. While RVLV still has amazing long-term prospects, its deadly cocktail combination of being a hated Class of 2019 IPO combined with a disappointing quarter means it’s going to continue taking the pain for awhile.

This Week’s Trades

Build-A-Bear Workshop (BBW): *New Position*

Thesis: Turnaround Play

Catalyst: Earnings report on August 29, 2019

This is one of the moments where I really wish I could see the faces of my readers. “Build-A-Bear Workshop, really?!”

Yes, I opened a position in Build-A-Bear Workshop (BBW) on Monday at $3.38 when the stock pushed into oversold conditions on the Daily and Weekly time-frames of its Relative Strength Indicator (RSI).

I’ve been following Sharon Price John, Build-A-Bear CEO, for several years. She recently worked for Hasbro (HAS) and is responsible for the transformation of the Nerf line of toys from the ignored football and sports paraphernalia in the 1990s to the ultimate powerhouse of Nerf dart guns that has become one of Hasbro’s biggest earners.

Although relatively new in a CEO role (she did try to start her own toy company years ago which failed due to an economic crisis she could not have foreseen), John is a capable leader with the foresight to see that Build-A-Bear needs to emphasize its “experiential” qualities – a very appealing dynamic for millenials.

Build-A-Bear has actually been a very profitable, high-growth company in the past, but the Financial Crisis of 2009 combined with poor cost controls resulted in decreasing profits and a collapsing stock price.

Its most recent earnings history have been poor in both March and May, however I believe if anyone can turn around BBW, it’s Ms. John. Much of the issue has to do with where BBW does all of its sourcing – China. The tariffs could potentially seriously damage the profit margins of the stock.

Well, that changed a bit on Tuesday, when Trump announced a delay on tariffs that also includes much of BBW’s supplies causing the stock to pop above $3.75, more than 10% where I originally bought just a day earlier. Naturally, this went south in a hurry when Wednesday’s inverted yield curve smacked everyone upside the head.

Initially, I intended to add more to the position if BBW tried to test its $3.02 all-time low before earnings, however, given its recent price action, I’m going to hold the position as is and see what happens in earnings in a few weeks.

If BBW misses earnings again, I will take the loss and close the position. I’m using a relatively small position as I’m only willing to take on an entire allocation of about 41% of my typical target allocation.

This represents a true trade: If my thesis falls through and BBW misses on earnings again, I will not hold the position; I will use the Three Day Rule and close it at a loss.

BBW closed the week at $3.39, pretty much flat from where I opened it at $3.38.

Revolve Group (RVLV): Added to Position

Revolve Group (RVLV) sold off on Monday with the rest of the market, however, my Three Day Rule waiting period wasn’t up until Tuesday. On Tuesday morning, RVLV saw a pretty significant bounce as investors decided the earnings report may not have been as bad as expected.

Rather than buy RVLV up, I used the past three days’ worth of price action to determine some levels and added to my position when RVLV sold off, hitting my price target $25.63 (and lower – much, much lower nearly hitting $22.00 at one point).

I’m being patient with this one since I am so upside-down. I do have an open order in case RVLV pulls back to test its $22.00 low as well as lower still at $18.82, near a point of support from using Fibonacci Retracement analysis, however, I don’t believe we’ll see it get that low (famous last words).

RVLV closed the week at $23.69, down -7.57% from where I added on Tuesday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.