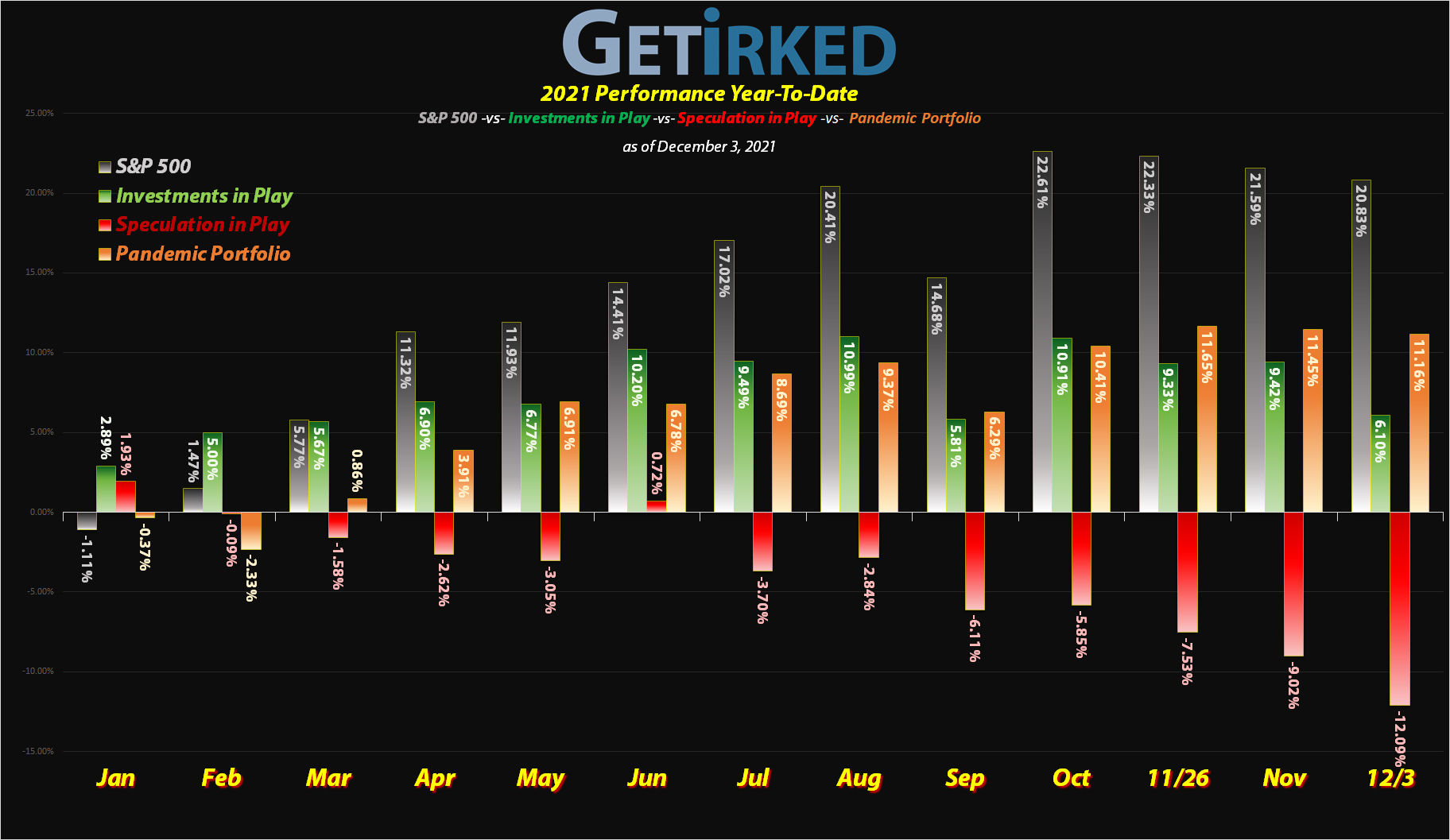

December 3, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

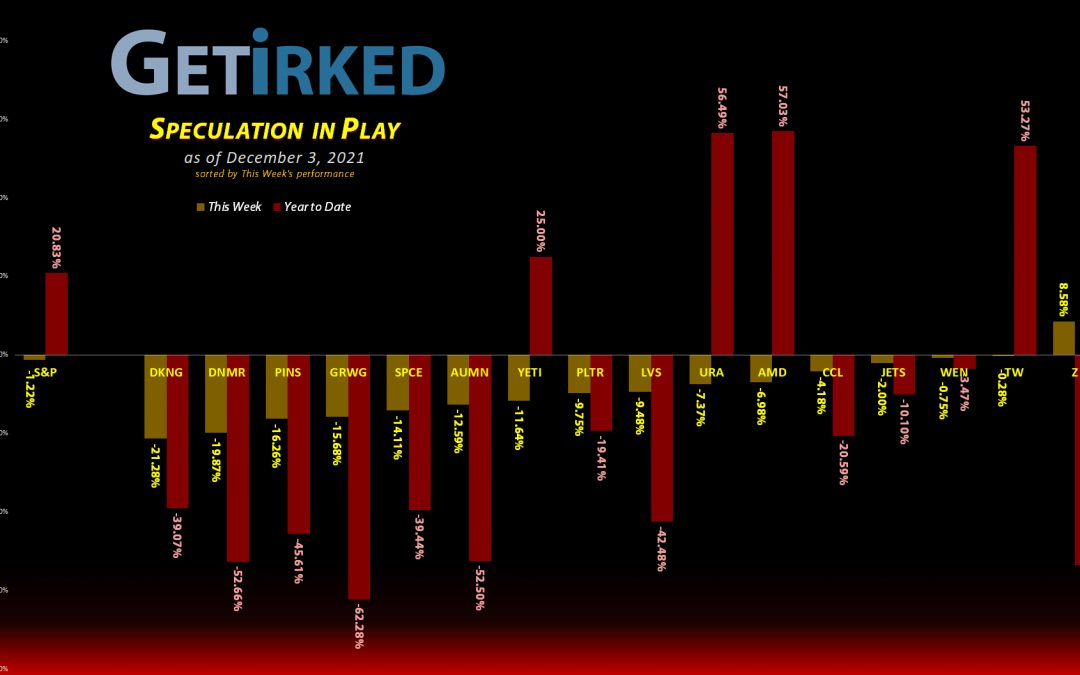

The Week’s Biggest Winner & Loser

Zillow (Z)

In a sea of red, how did super-stinker realty website Zillow (Z) pull off a win this week? By giving not-as-bad-as-expected news during a conference call, announcing that the spinoff of their terrible-terrible real estate flipping business was happening faster than expected. The resulting +8.58% pop occurred on Friday in the midst of the rest of the market’s selloff rout, definitely earning Zillow the spot of the Week’s Biggest Winner.

Draft Kings (DKNG)

It’s hard to lose on the week, but it’s even worse to be the Biggest Loser on a week of nothing but losers. Draft Kings (DKNG) and the rest of the Internet sports-gambling sector got positively slammed this week with DKNG finishing the week down -21.28%, locking in the spot as the Week’s Biggest Loser. Ouch!

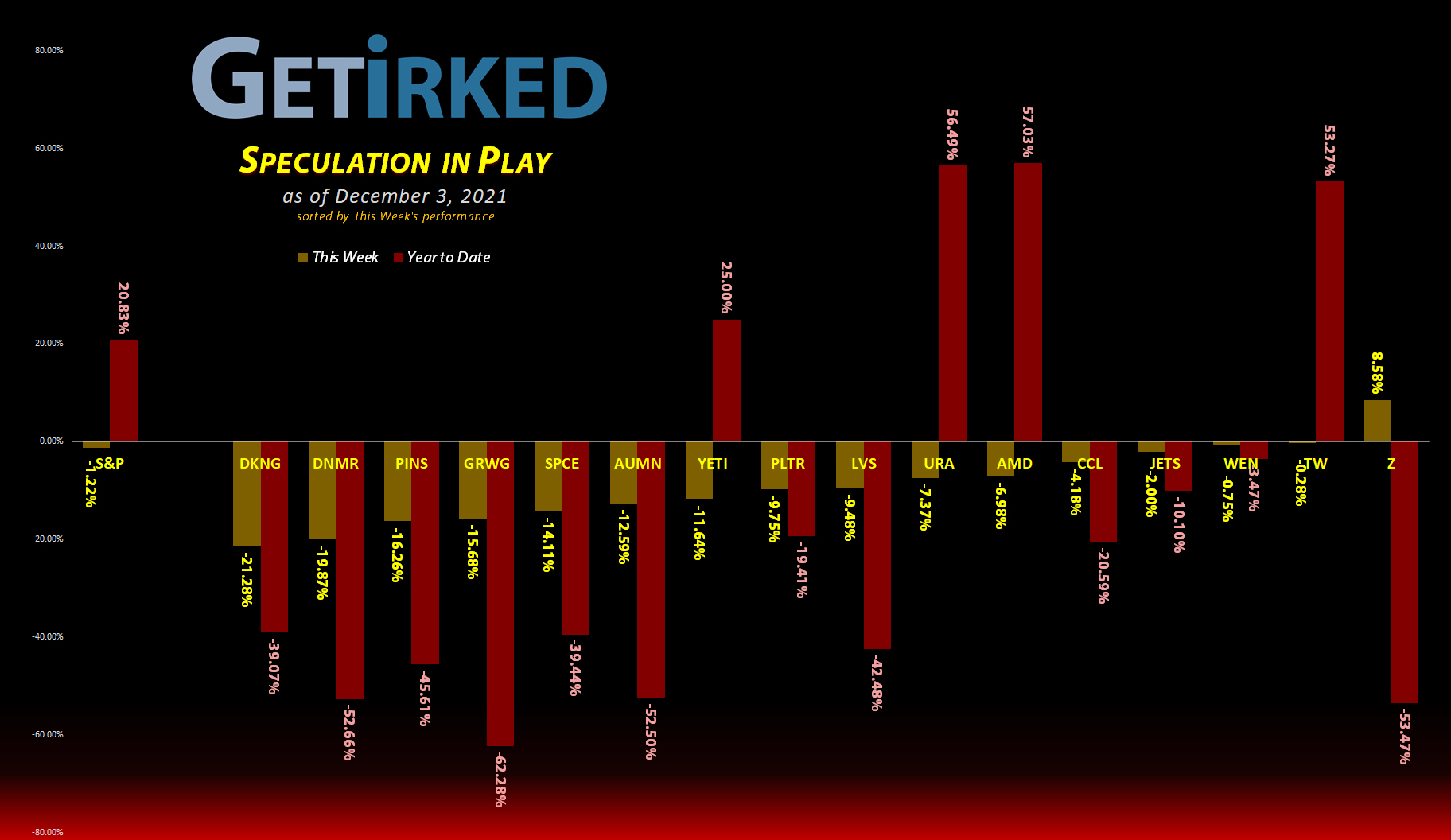

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

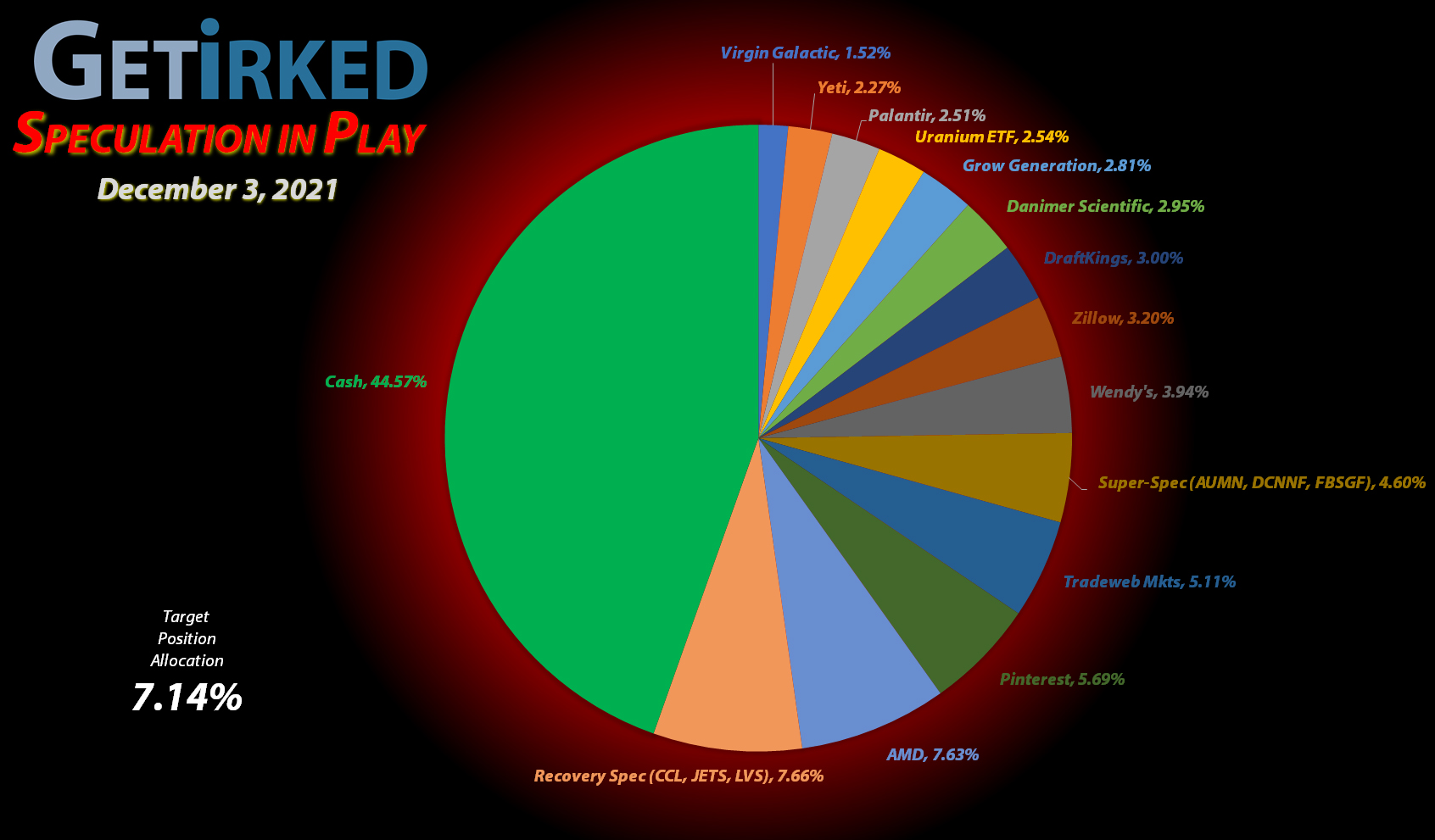

AMD (AMD)

+810.22%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+482.42%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Pinterest (PINS)

+451.02%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($20.65)*

Virgin Galactic (SPCE)

+244.65%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$19.60)*

Tradeweb Mkts (TW)

+203.10%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.60)*

Airlines ETF (JETS)

+169.11%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.90

Carnival Cruise (CCL)

+159.04%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $6.64

Uranium ETF (URA)

+21.50%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $19.75

Zillow (Z)

+5.71%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $57.13

Las Vegas Sands (LVS)

-4.51%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.90

Wendy’s (WEN)

-15.36%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $25.00

Fabled Co. (FBSGF)

-18.25%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.0827

Danimer Sci (DNMR)

-20.48%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $14.00

Palantir (PLTR)

-21.12%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

Golden Mine. (AUMN)

-22.77%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4675

Can. Palladium (DCNNF)

-26.63%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0692

DraftKings (DKNG)

-30.02%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $40.54

Grow Gen. (GRWG)

-40.51%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $25.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Super-Spec Basket Adjustment: *Market Rule Change*

This week, my primary broker announced that it would start charging commissions of $6.95/trade for OTC (Over-The-Counter) and Canadian stocks as of next Monday, December 6.

Since Canadian Palladium (DCNNF) is both OTC and Canadian, and Fabled Gold & Silver (FBSGF) is Canadian, any trades made in either of these super-speculative positions will have commissions applied to them.

While I did adjust my trading/investing strategies to accommodate commission costs prior to the elimination of trading commissions late in 2019, this change makes super-speculative penny stocks far riskier than their already incredibly high-risk status. Accordingly, I will no longer be adding to either Canadian Palladium or Fabled Gold & Silver, and neither will no longer be tracked in the Speculation in Play portfolio after this week’s update since they will no longer be actively managed in the same.

However, Golden Minerals (AUMN), the third in the super-speculative portfolio, is neither OTC nor Canadian, so I will continue to manage and report on this super-spec position. While DCNNF and FBSGF won’t be listed in the weekly price updates since I will no longer be adding to either position after this week, their value will be accounted for in the allocation pie chart where AUMN remains part of the Super-Spec Basket with DCNNF and FBSGF.

Canadian Palladium (DCNNF): Added to Position

After receiving the notification from my broker that I will no longer be able to trade Canadian Palladium (DCNNF) (or Fabled Gold & Silver Co (FBSGF)) without commissions starting next week, I decided to throw one last hurrah with attempted purchases in both positions.

I had a partial-fill in DCNNF on Monday at $0.0504 which lowered my per-share cost -8.31% from $0.0770 to $0.0706. On Tuesday, the remainder of the order filled at $0.0491, further lowering my per-share cost -1.98% from $0.0706 to $0.0692 to wrap up the position. In all, Buying in Stages lowered my per-share cost -30.80% from $0.1000 on July 19 to its final per-share price of $0.0692.

As mentioned above, there will be no additional buy orders in the position. Should it see a huge pop, I will be pulling all of the capital out at $0.1427 and letting the rest of the position ride.

DCNNF closed the week at $0.0507, up +1.20% from my $0.0501 average price.

Danimer Scientific (DNMR): Added to Position

Danimer Scientific (DNMR) sold off with the rest of the market this week, so I added to my position when it tested its Wednesday lows on Thursday with a buy order that filled at $11.87. On Friday, Danimer continued selling off, triggering a second order that filled at $10.89, giving me an average buying price of $11.38 and lowering my per-share cost -4.44% from $14.65 to $14.00.

From here, my next buy target is $9.65, just below a past point of support, and my next sell target is $20.30, near the high from DNMR’s last bull rally.

DNMR closed the week at $11.13, down -2.20% from my average buy price.

Draft Kings (DKNG): Added to Position

Draft Kings (DKNG) triggered a buy order on Thursday when it tested Wednesday’s low, with my order filling at $31.05. The buy lowered my per-share cost -7.23% from $43.70 to $40.54, a total -23.47% reduction from my first buy at $52.97 earlier this year on January 29.

From here, my next buy target is $25.35 and my next sell target is $63.90, near the high from its last bull rally.

DKNG closed the week at $28.37, down -8.63% from where I added Thursday.

Fabled Gold & Silver (FBSGF): Added to Position

Just like Canadian Palladium (DCNNF) above, I decided to put one last chunk into Fabled Gold & Silver (FBSGF) before my broker raised commissions this upcoming Monday. On Wednesday, a buy order of mine filled at $0.0707, reducing my per-share cost -6.66% from $0.0886 to $0.0827.

From here, I naturally have no additional buy orders, and my next sell target is $0.2643 where I will pull all of the capital out of my FBSGF position and let the rest ride to see where it may go from there.

FBSGF closed the week at $0.0676, down -4.38% from where I added Wednesday.

Las Vegas Sands (LVS): Added to Position

Las Vegas Sands (LVS) sold off with all of the travel & hospitality sector following the new of Omicron. On Tuesday, LVS triggered a buy order I had in place at $35.88 which lowered my per-share cost a whopping -$0.01 from $35.91 to $35.90.

More importantly, the buy also locked in an -18.71% discount replacing shares I sold for $44.14 back on September 2, 2021. From here, my buy target is $31.30, above a past point of support from the Great Recession, and my next sell target is $66.35, just under its recent high from its last bull run.

LVS closed the week at $34.28, down -4.46% from where I added Tuesday.

Virgin Galactic (SPCE): Added to Position

Virgin Galactic (SPCE) sold off with the rest of the market on Wednesday following news of the first COVID Omicron variant case in the U.S. and broke through the $15 mark, triggering a buy order I had in place at $14.90.

The buy locked in a -40.57% discount on shares I sold for $25.07 way back on February 14, 2020 and raised my per-share “cost” +11.50 from -$31.10 to -$19.60 (a negative per-share cost indicates all capital has been removed from the position and, instead, each share adds $19.60 to the portfolio in addition to the share’s current value).

From here, my next buy target is $9.20, above SPCE’s pandemic low at $9.00, and my next sell target is $52.70, slightly below significant resistance near SPCE’s all-time high made earlier in 2021.

SPCE closed the week at $14.37, down -3.56% from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.