Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #42

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

The Struggle Continues…

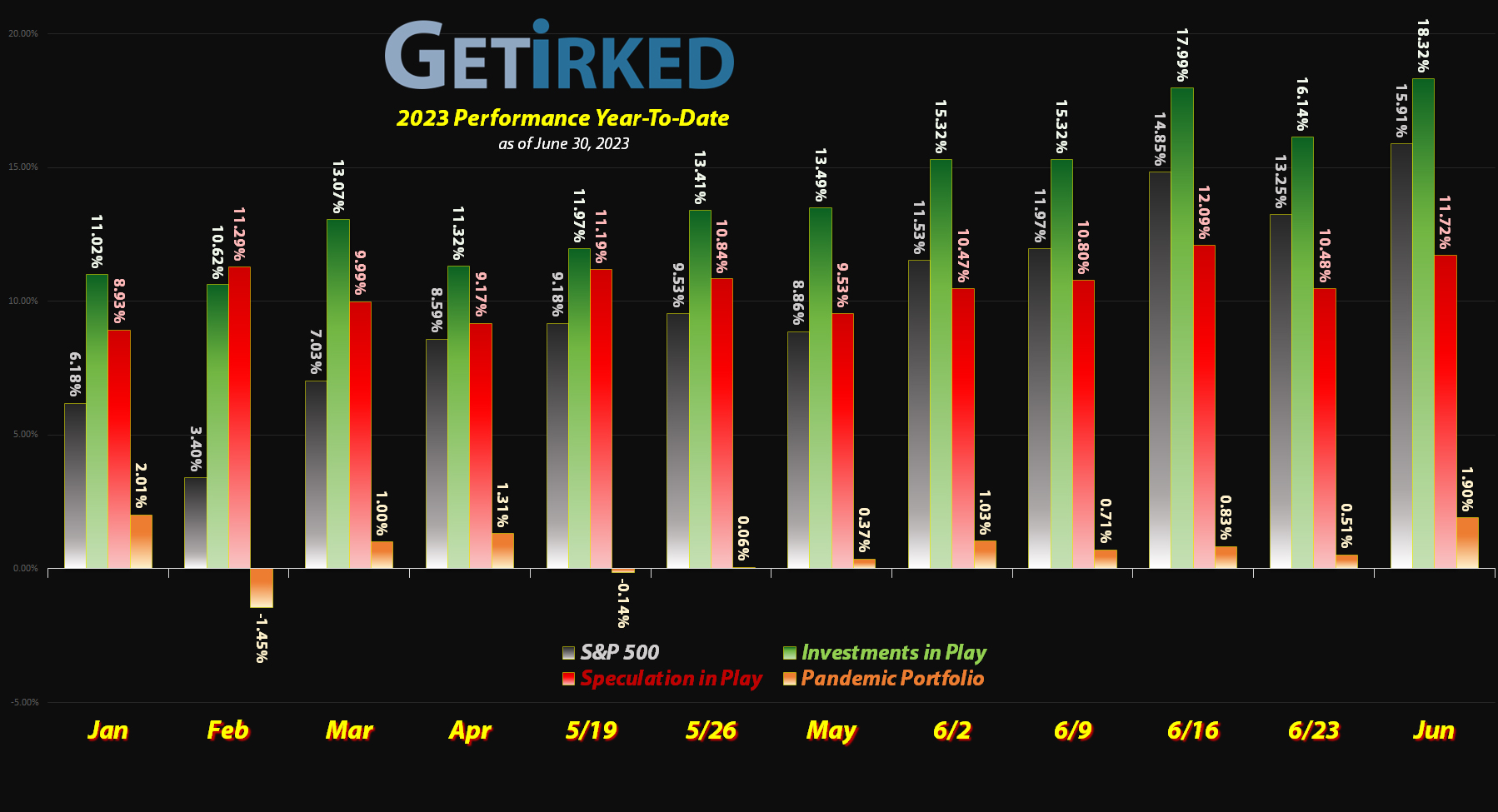

The makeup of the Pandemic Portfolio is such that its returns have been distinctly subpar when compared to Investments in Play, Speculation in Play, and even my other portfolios.

I attribute this underperformance to two significant factors:

1. A number of the portfolio’s largest positions are also in the weakest areas of the market – precious metals and real estate. As a result, the weakness in those areas has dramatically affected the overall returns.

2. Too much of the portfolio remains in cash. With more than 60% of the portfolio in cash, there simply isn’t enough money put to work. Getting the cash infused has been a struggle since I started the portfolio in May 2020. Throughout 2020 and 2021, the market rallied higher and faster than I expected, counter to my discipline of adding in stages over time.

So, what do I plan to do about it?

In order to see if I can’t revive this portfolio and get it to perform, I’m targeting additional new positions in sectors not fully represented in the Investments in Play portfolio. In addition to Chevron (CVX) added just last month, I am also eyeing positions in Caterpillar (CAT) for industrial exposure and Cameco (CCJ) for exposure to uranium and the revitalized nuclear energy space.

In the meantime, let’s look at the moves I’ve made since the last update…

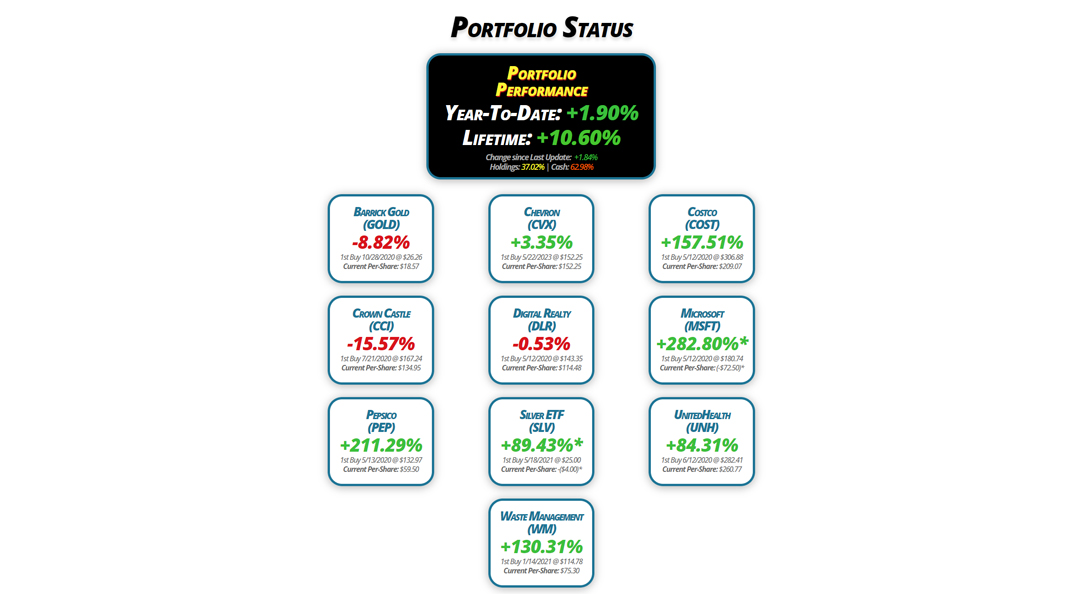

Portfolio Status

Portfolio

Performance

Year-To-Date: +1.90%

Lifetime: +10.60%

Change since Last Update: +1.84%

Holdings: 37.02% | Cash: 62.98%

Barrick Gold

(GOLD)

-8.82%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.57

Crown Castle

(CCI)

-15.57%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $134.95

Pepsico

(PEP)

+211.29%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $59.50

Chevron

(CVX)

+3.35%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $152.25

Digital Realty

(DLR)

-0.53%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $114.48

Silver ETF

(SLV)

+89.43%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Waste Management

(WM)

+130.31%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $75.30

Costco

(COST)

+157.51%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $209.07

Microsoft

(MSFT)

+282.80%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$72.50)*

UnitedHealth

(UNH)

+84.31%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $260.77

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $16.93

Per-Share Cost: $18.57 (-0.70% since last update)

Profit/Loss: -8.82%

Allocation: 6.24%* (+0.02% since last update)

Next Buy Target: $14.93

The precious yellow metal really rolled over in the past month and took the goldminers with it, of course. On Thursday, June 15, Barrick Gold (GOLD) fell through my next buy target which filled at $16.62, locking in a -15.85% discount replacing some of the shares I sold for $19.75 a little over a month ago on May 3. Since gold has a tendency to really sell off when it starts going, I made a very small quantity buy which only lowered my per-share cost -0.27% from $18.70 down to $18.65.

Later on Thursday, GOLD paid out its quarterly dividend, which although not reinvested due to Barrick being based in a foreign country (Canada), it still lowered my per-share cost another -0.43% from $18.65 to $18.57.

From here, my next buy target is $14.93, right around a past point of support, and my next sell target is $19.97, just under key resistance where GOLD has found significant resistance repeatedly in the past.

GOLD is $16.93 as of this update, up +1.87% from where I added at $16.62.

Chevron (CVX): Strategy Update

Current Price: $157.35

Per-Share Cost: $152.25 (Unchanged since last update)

Profit/Loss: +3.35%

Allocation: 0.70%* (Unchanged since last update)

Next Buy Target: $150.15

Despite oil continuing to experience significant selling pressure since last month, Chevron (CVX) and most of the rest of the energy sector has held up shockingly well. Annoyingly well, in fact, as I intentionally initiated this position with a very small allocation and have been unable to add to it.

I remain undeterred, however, with my next buy target at $150.15, slightly above the point of support Chevron saw in its last “significant” selloff.

Costco (COST): Strategy Update

Current Price: $538.38

Per-Share Cost: $209.07 (Unchanged since last update)

Profit/Loss: +157.51%

Allocation: 5.02%* (+0.20% since last update)

Next Buy Target: $477.89

Costco (COST) rallied extremely well off its lows in May, motivating me to raise my buy target to $477.89, a bit above May’s low, to add to the position should COST pull back to that point of support.

In the meantime, all of Costco’s investors, including me, are anxiously awaiting an announcement of a special dividend which Costco is still expected to do any day now (although analysts have been saying a special dividend is coming for more than a year and Costco’s been radio-silent so who really knows?)

Crown Castle (CCI): Strategy Update

Current Price: $113.94

Per-Share Cost: $134.95 (Unchanged since last update)

Profit/Loss: -15.57%

Allocation: 5.71%* (+0.01% since last update)

Next Buy Target: $103.61

Crown Castle (CCI) continues to remain under pressure, trading just above its 2023 lows which are quite a bit below its pandemic bottom and prices the stock hasn’t seen since January 2019.

Since CCI is one of the largest positions in the portfolio and may continue to see selling pressure since it crosses over with the real estate sector, I am keeping my buy target at $103.61 for the meantime.

Digital Realty Trust (DLR): Strategy Update

Current Price: $113.87

Per-Share Cost: $114.48 (Unchanged since last update)

Profit/Loss: -0.53%

Allocation: 6.89%* (+0.80% since last update)

Next Buy Target: $86.96

Digital Realty Trust (DLR) recovered spectacularly over the last month, potentially on the back of the Artificial Intelligence (AI) craze as all of this AI computing will require more data centers to process.

DLR rallied so far and so fast, that I’ve raised my next buy target to $86.96, quite a bit above DLR’s lows from May and much higher than its 2022 bottom.

Microsoft (MSFT): Dividend & Profit-Taking

Current Price: $340.54

Per-Share Cost: -$72.50* (-$187.60 since last update)

Profit/Loss: +282.70%

Allocation: 1.87%* (-1.49% since last update)

Next Buy Target: $323.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Microsoft (MSFT) paid out its quarterly dividend on Friday, June 9, and, while nothing to write home about, the reinvested dividend still lowered my per-share cost -0.21% from $115.10 to $114.86.

On Thursday, June 15, Microsoft rallied so close to its all-time high that I decided it was time to take the remaining capital out of the position with a sale that went through at $346.72.

The sale locked in +95.40% in gains on shares I bought for $177.44 way back on May 27, 2020 and lowered my per-share cost -$292.30 from $114.86 to -$72.50 (a negative per-share cost indicates all capital has been removed in addition to $72.50 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, I have no additional sell targets as I want to wait to see where the price action is going to take us. My next buy target is $323.89, above a past level of support where I will add a small quantity of the shares I sold back into this high-flying position.

MSFT is $340.54 as of this update, down -1.78% from where I took profits.

Pepsico (PEP): Strategy Update

Current Price: $185.22

Per-Share Cost: $59.50 (Unchanged since last update)

Profit/Loss: +211.29%

Allocation: 2.81%* (-0.02% since last update)

Next Buy Target: $169.12

Pepsico (PEP) bounced a bit from its selloff heading into June but remains under selling pressure. That being said, PEP holds up incredibly well and is still significantly above my new buying price target at $169.12. After seeing PEP’s strength in action, I chose to raise my target slightly, even though I believe when/if Pepsico and the rest of the consumer staples sector sells off, it could potentially be a big one and PEP could drop below my buy target.

On the flip side, I will remove all remaining capital from this position if Pepsico rallies above its current $196.88 all-time high and breaks through the $200 barrier, but I am in no hurry to take additional profits.

In the meantime, if Pepsico continues to trade rangebound as it has for several months, I’ll just sit back and collect the dividend.

iShares Silver ETF (SLV): Strategy Update

Current Price: $20.89

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +89.43%

Allocation: 0.56%* (-0.02% since last update)

Next Buy Target: $18.75

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

The precious metals continued to sell off throughout the remainder of May and most of June with SLV finding lower lows throughout the month. Despite its significant selloff, I’m in no hurry to add to this position since I have no capital in it and I’m playing with the House’s Money. My next buy price target is $18.75, above SLV’s lows it saw in March.

UnitedHealth (UNH): Dividend Payout

Current Price: $173.42

Per-Share Cost: $260.77 (-0.72% since last update)

Profit/Loss: +84.31%

Allocation: 4.59%* (-0.09% since last update)

Next Buy Target: -NO BUY TARGET-

UnitedHealth (UNH) came under enormous selling pressure in June when it announced that more customers were having elective surgery than analysts had expected. UNH actually sold through its 2023 lows, not finding support until $445.68. Even though that level would have potentially been a good place to add to UNH, I remain steadfast in my desire to exit this position due to evidence of its poor business practices shared with me by colleagues of mine.

On Tuesday, June 27, UnitedHealth (UNH) paid out its quarterly dividend. Since I am trying to close the position, I have set my broker to not reinvest the dividend, taking it as cash instead. Regardless, the dividend still lowers the per-share cost, -0.72% from $262.65 to $260.77, in this case.

My sell target to close my position is $527.57, below its high from April and under a key downtrend line.

Waste Management (WM): Dividend & Profits

Current Price: $173.42

Per-Share Cost: $75.30 (-22.57% since last update)

Profit/Loss: +130.31%

Allocation: 2.65%* (-0.57% since last update)

Next Buy Target: $149.43

Waste Management (WM) paid out its quarterly dividend on Tuesday, June 20, which, after reinvesting, lowered my per-share cost -0.42% from $97.25 to $96.84, not a bad reduction for what is nearly a utility company.

On Friday, Waste Management made a run over $170, a key area of resistance, so I took profits with a sell order that filled at $170.91, locking in +15.13% in gains on shares I bought for $148.45 on 10/1/2021 and lowering my per-share cost -22.24% from $96.84 to $75.30.

From here, my next buy target is $149.43, above a repeated area of support WM found through the end of 2022, and my next sell target is $199.90, just under the key $200 psychological resistance.

WM is $173.42 as of this update, up +1.47% from where I took profits.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.