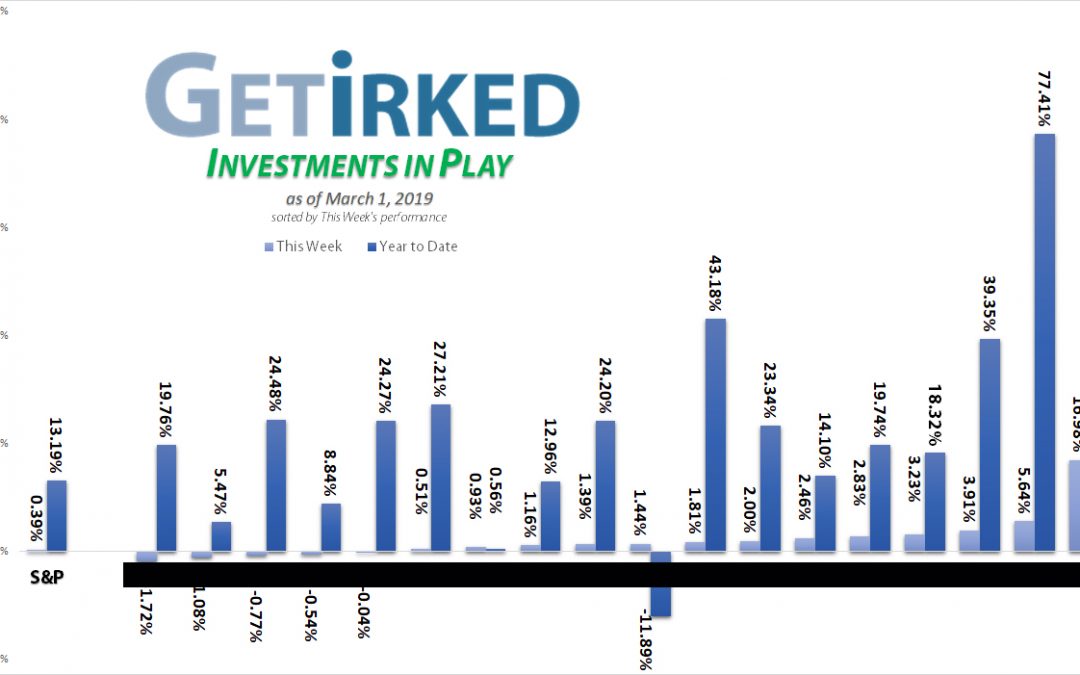

Highlights from the Week

Biggest Winner: GW Pharmaceuticals (GWPH)

GW Pharmaceuticals (GWPH), the cannabis prescription drug play, blew the roof off the joint with an excellent earnings report thanks to increased sales from their epilepsy drug closing the week up an outstanding 16.98% with the entirety of the gain coming the day after earnings.

Biggest Loser: Nvidia (NVDA)

Nvidia (NVDA) continues to pull back following its terrible earnings report, only softened by the preannouncement in January. We don’t expect to see anything amazing from NVDA for some time as there’s nothing that’s going to pull them out of this funk until they can improve earnings.

This Week’s Moves

Boeing (BA)

Boeing refuses to stop rocketing into the stratosphere, even with analysts and professional screaming that it’s time to sell. Good news event after good news event continues pushing BA up. Boeing received yet another plane order in excess of $12 billion on Tuesday, so our trading discipline required us to take even more profits as Boeing regained its spot as our largest position. Our stop-limit sell order was filled at $429.72. BA closed the week higher still at $440.62, with our position +563.11%.

GW Pharmaceuticals (GWPH)

Remember how we talked about GWPH being a huge mover in last week’s Investments in Play? We weren’t kidding! After blowing out their earnings report to the upside on Tuesday, GWPH rocketed more than 17.50% Wednesday morning, nearly pegging its previous all-time high of $179.72 (it hit $179.62). We placed a stop-limit sell-order which was filled at $170.63 to take some serious gains off the table and lower our per-share cost. GWPH closed the week at $177.34, with our position +43.02%.

Take Two Interactive (TTWO)

Take Two has suffered greatly from the depression in the video game sector thanks to free-to-play battle royale shooter, Fortnite. After dropping more than 20% in just three weeks, we placed a trailing stop-buy order when TTWO dropped to $84.41 on Wendesday. The opposite of a stop-loss, a stop-buy triggers when a stock dropping in value reverses direction and heads upward. TTWO reversed on Thursday to head higher and filled our order at $84.95, adding to our position and lowering our per-share cost to $106.13. TTWO closed the week at $88.32 with our position down painfully at -16.78%.

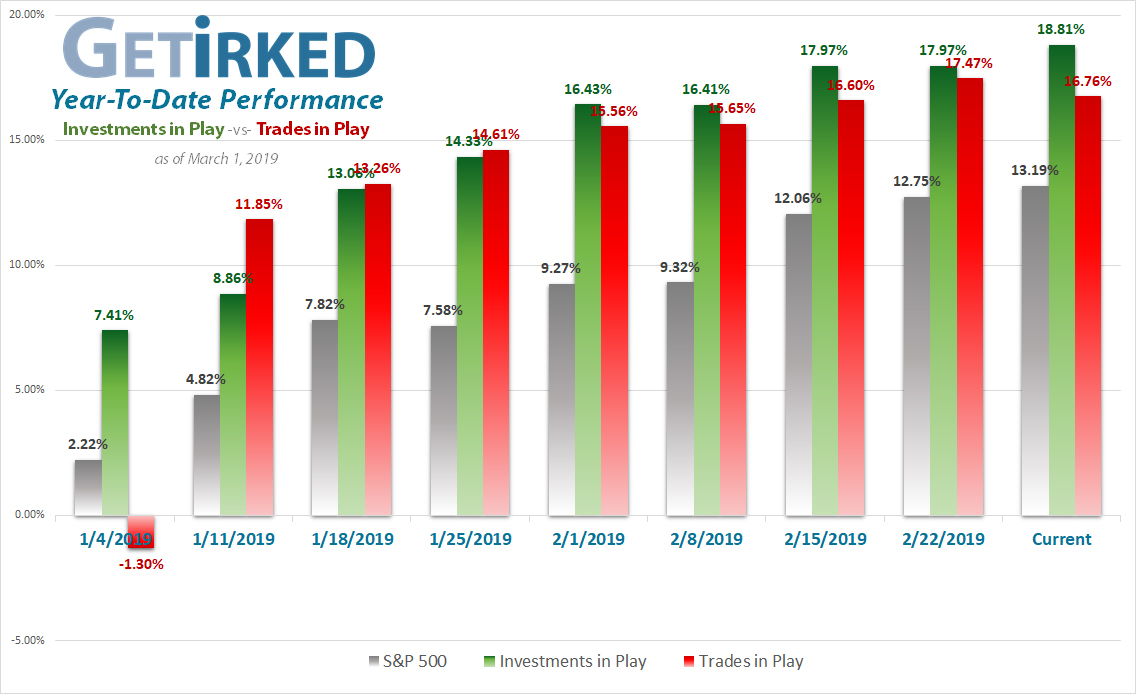

In Summary

Keeping Our Head Down

The market’s topped out another outstanding week, but this is 10 up weeks in a row now! We’ve taken all the necessary precautions – drying up powder in preparation for a pullback – but with this kind of upward momentum, it’s hard to know how big a pullback we’re going to see. For the moment, we’ve got 61% of our portfolio invested and have no interest in reducing our exposure unless we see serious upside.

Want further clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!