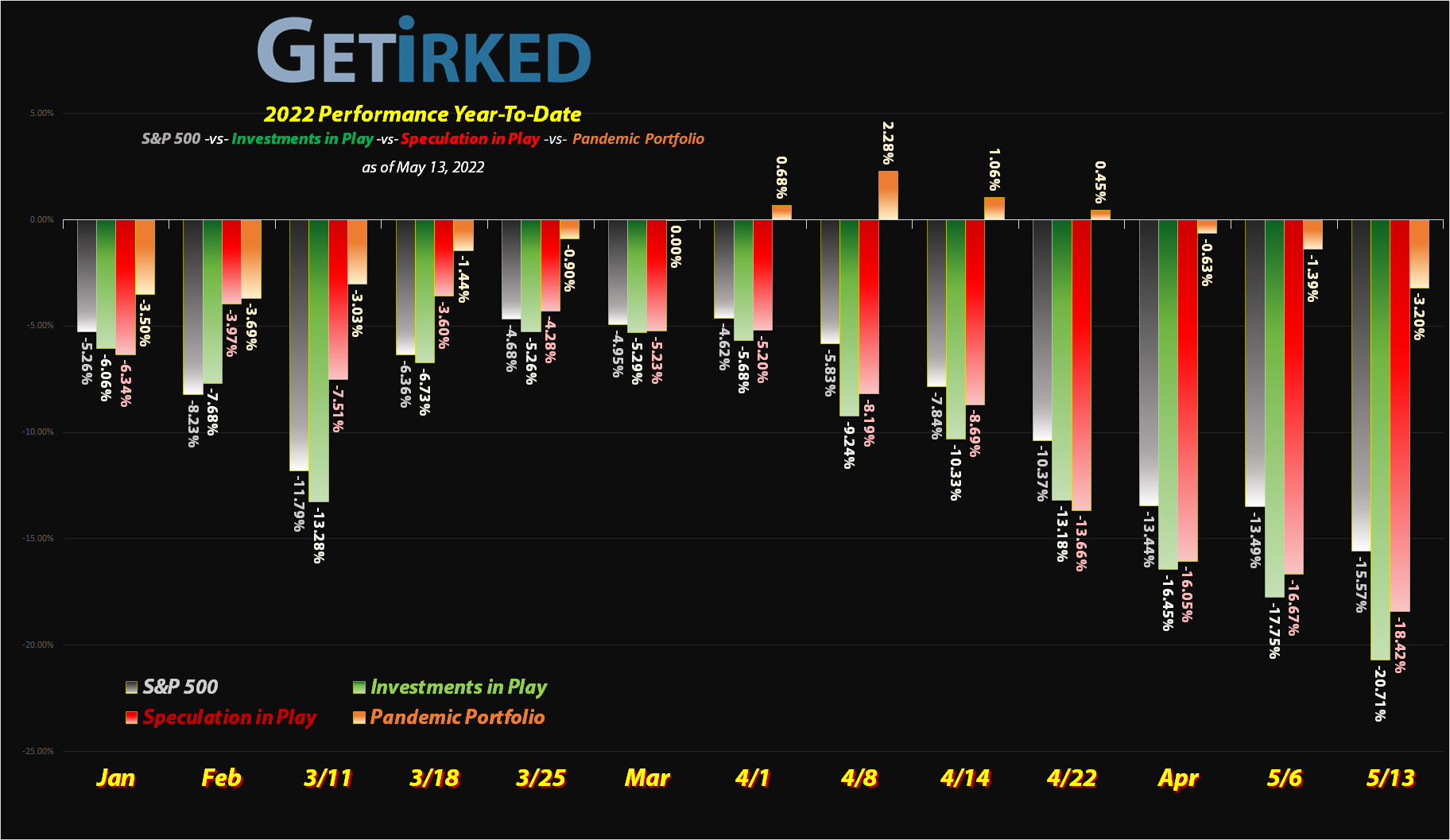

May 13, 2022

The Week’s Biggest Winner & Loser

Roblox (RBLX)

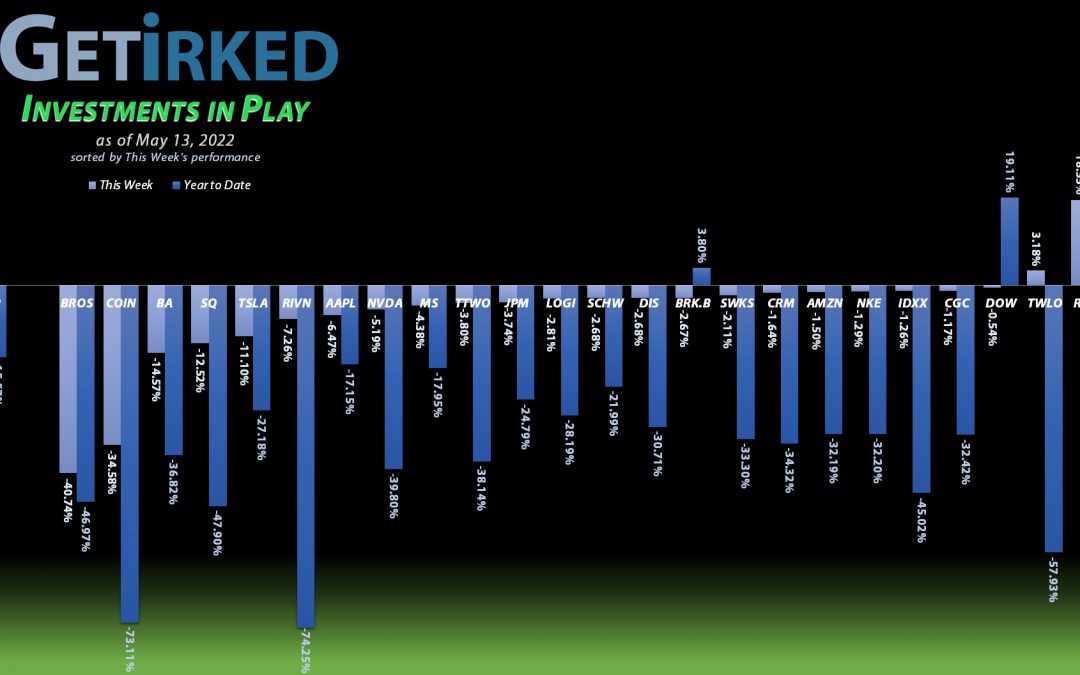

Despite reporting disappointing quarterly earnings, Roblox (RBLX) recovered spectacularly, finishing the week – a week of red – up an astounding +18.55% from where it closed last week. Obviously, investors had become way too depressed about the stock, causing RBLX to pop *huge* and earning the stock the top spot of the Week’s Biggest Winner.

Dutch Bros (BROS)

When you’re a high-growth restaurant/hospitality play, you absolutely, positively cannot disappoint, and Dutch Bros (BROS) let out a stinker of a quarterly report this week. The resulting backlash decimated the stock, down -40.74% for the week and easily earning the stock the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

The “Baskets”

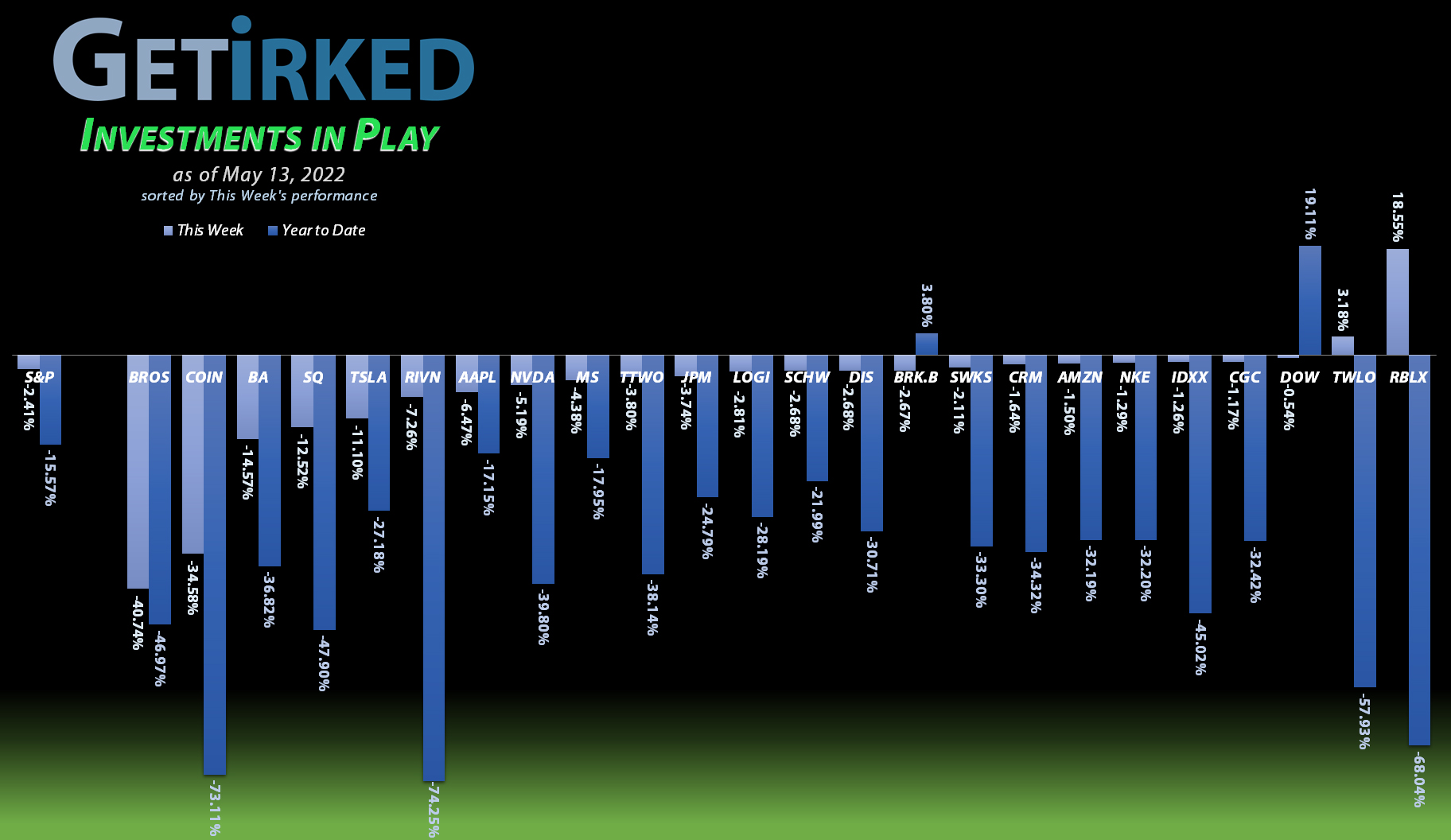

The Investments in Play portfolio contains a number of groups of stocks called “baskets.” I use baskets when I want exposure to a certain sector, but I want to use more than one stock to get that exposure without giving each individual stock an allocation.

In this portfolio, there is the Financials Basket which includes stocks that provide the portfolio with exposure to the financial sector which includes money-center banks, credit card companies, and investment management firms.

Additionally, there are two speculative baskets in the portfolio: Old-Spec and New-Spec.

Companies in the Old-Spec basket are ones with long track records where I want to have some exposure in the portfolio but I’m not confident enough to give each a full allocation.

New-Spec companies are typically stocks either new on the scene or representing a fairly new approach or sector, where, like Old-Spec, I want exposure but I don’t want a full allocation of any individual company.

Current Position Performance

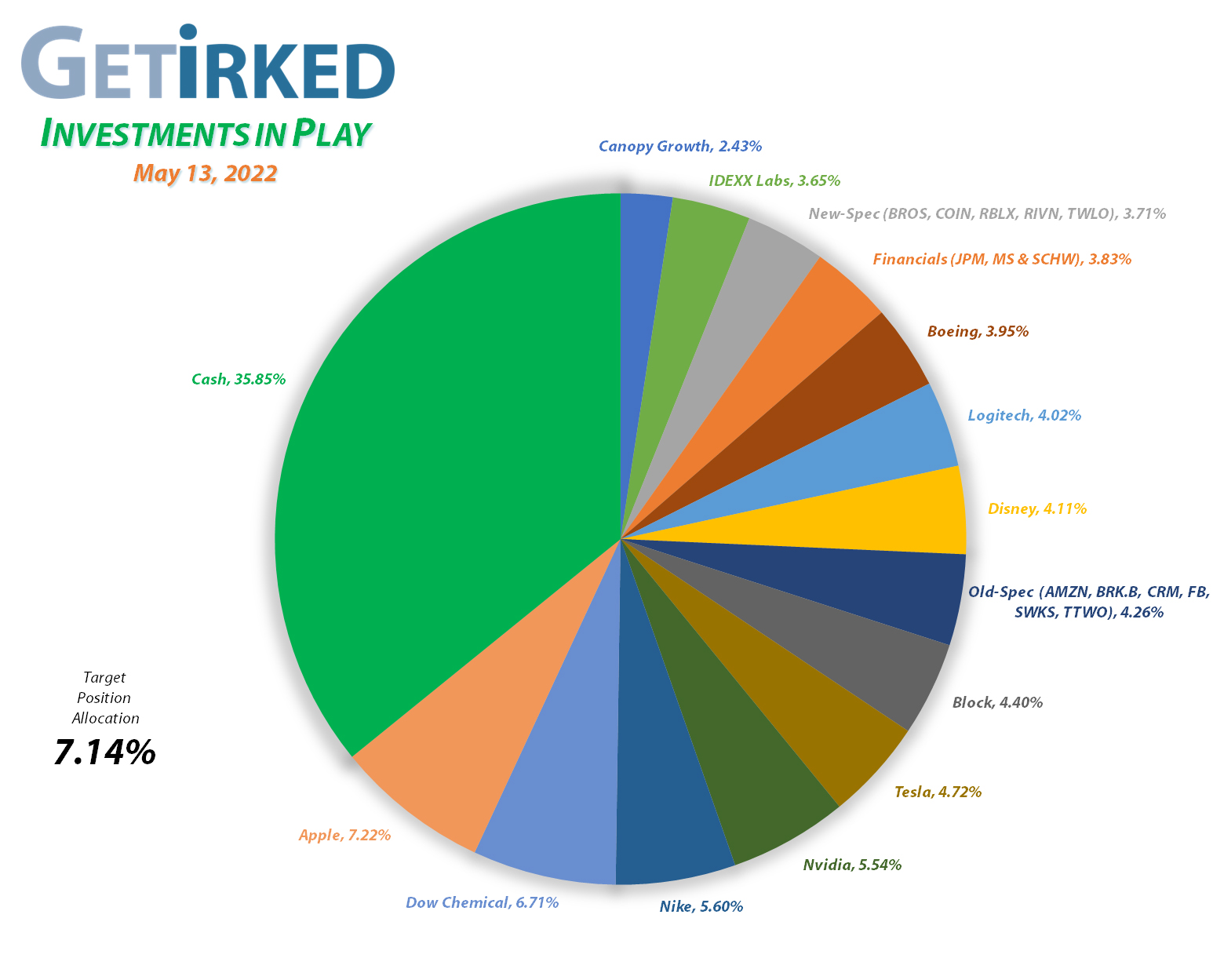

Apple (AAPL)

+798.30%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$35.21)*

Nvidia (NVDA)

+665.19%*

1st Buy 9/6/2016 @ $15.77

Current Per-Share: (-$12.60)*

Tesla (TSLA)

+661.21%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$78.43)*

Block (SQ)

+587.25%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.05)*

Boeing (BA)

+528.46%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$160.45)*

Logitech (LOGI)

+474.93%**

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.95

Nike (NKE)

+432.82%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$6.10)*

Skyworks (SWKS)

+355.84%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$33.85)*

IDEXX Labs (IDXX)

+341.31%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$39.57)*

Disney (DIS)

+190.47%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $36.95

Take Two (TTWO)

+145.41%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $75.60

Dow (DOW)

+100.18%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $33.75

Amazon (AMZN)

+90.82%

1st Buy 2/6/2018 @ $1,382.96

Current Per-Share: $1,184.96

Meta (FB)

+76.34%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($295.25)*

Berkshire (BRK.B)

+69.71%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $182.87

JP Morgan (JPM)

+56.49%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $76.10

Salesforce (CRM)

+45.46%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Visa (V)

+2.70%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $194.00

Morgan Stan (MS)

-1.73%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $81.95

Twilio (TWLO)

-5.06%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $116.70

Canopy (CGC)

-10.29%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $6.60

Schwab (SCHW)

-10.43%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $73.25

Dutch Bros (BROS)

-28.37%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $37.70

Roblox (RLBX)

-28.48%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $46.10

Rivian (RIVN)

-55.05%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $59.40

Coinbase (COIN)

-68.04%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $212.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

** Indicates a position calculated based on initial investment due to extremely low per-share price (causes ridiculous and inaccurate “gains”)

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Apple (AAPL): Added to Position

Apple (AAPL) finally lost support this week in a big way and dropped through $150, triggering my next buy order on Thursday which filled at $142.27. The buy locked in a -12.79% discount replacing shares I sold a few weeks ago at $163.14 on April 28, 2022.

The buy also raised my per-share “cost” +$5.26 from -$40.47 to -$35.21 (a negative per-share cost indicates all capital has been taken out of the position in addition to $35.21 of profit per-share which is added to the portfolio’s bottom line).

From here, my next buy target is $124.05, above a past point of support, and my next sell target is $177.10, below the high of AAPL’s last real bull rally and a point where the position will have exceeded the target allocation size for the portfolio.

AAPL closed the week at $147.11, up +3.40% from where I added on Thursday.

Block (SQ): Added to Position x 2

Block (SQ) collapsed with all of the rest of the stocks that had exposure to Bitcoin when the crypto market fell on Monday, dropping through my next buy target which filled at $83.50. On Wednesday, SQ continued to selloff when Bitcoin collapsed, dropping through my next buy target which filled at $70.75 and gave me a $77.13 average buy price.

The first buy locked in a -38.74% discount replacing shares I sold at $136.30 on August 4, 2020 and the second buy locked in a -45.44% discount replacing shares I sold for $130.40 on July 8, 2020. The combined buys raised my per-share “cost” +$8.70 from -$83.75 to -$75.05 (a negative per-share cost indicates all capital has been taken out of the position in addition to $75.05 of profit per-share which is added to the portfolio’s bottom line).

From here, my next buy target is $65.55, above SQ’s low from this week, and my next sell target is $146.35, under the high of Block’s last bull rally and beyond the point where SQ will have outgrown the allocation size for the portfolio.

SQ closed the week at $84.13, up +9.08% from my $77.13 average buy price.

Coinbase (COIN): Added to Position x 3

Coinbase (COIN) suffered the double-whammy of a stock market selloff and a crypto selloff, causing the stock to collapse under the pressure, triggering my next buy order which filled on Monday at $93.75. However, COIN wasn’t done selling off, and, on Tuesday, triggered my next buy order at $78.25, and, following and absolutely disastrous earnings report Tuesday evening, COIN filled at a third buy on Wednesday at $54.72 giving me an average buy price of $75.57.

The combined buys lowered my per-share cost -21.63% from $270.95 to $212.34. From here, my next buy target is $41.45, above COIN’s new all-time low set this week, and my next sell target is $241.05, just below the key 50% retracement level of COIN’s fall from its all-time high.

COIN closed the week at $67.87, down -10.19% from my $75.57 average buy price.

Disney (DIS): Added to Position

Despite reporting a surprise upside earnings report Wednesday evening, Disney (DIS) continued to sell off with the rest of the market on fears that streaming services are lagging when it comes to growth. On Thursday, DIS triggered my next buy order which filled at $99.66 and raised my per-share cost +6.95% from $34.55 to $36.95 (still a -11.75% from my initial opening buy at $41.87 on February 14, 2012).

From here, my next buy target is $80.55, right above DIS’ pandemic low, and my next sell target is $174.15, below a key level of resistance.

DIS closed the week at $107.33, up +7.70% from where I added Thursday.

Dutch Bros (BROS): Added to Position x 2

Investors panicked out of Dutch Bros (BROS) ahead of its quarterly report on Wednesday, triggering a selloff that tested BROS’ lowest-low since it IPO’ed, a low around $38.00, and triggering my next buy order which filled at $38.40.

Buying ahead of its quarterly report turned out to be a huge mistake as BROS disappointed with subpar future guidance, causing the stock to collapse on Thursday where it triggered my next buy that filled at $22.97, giving me a $30.69 average buy price.

The combined buys lowered my per-share cost -6.91% from $40.50 to $37.70. From here, my next buy target is $20.15, above BROS’ all-time low set this week, and my next sell target is $62.00, slightly below the highs from its last bull rally.

BROS closed the week at $27.00, down -12.02% from my $30.69 average buy price.

JP Morgan (JPM): Added to Position

It was time to add to JP Morgan (JPM) when it plumbed new depths on Thursday, triggering a buy order I had in place which filled at $115.51. The buy locked in a -28.33% discount replacing shares I sold for $161.17 on March 18, 2021 and raised my per-share cost +3.89% from $73.25 to $76.10 (still a -25.90% reduction from my initial buy at $102.30 back on October 26, 2017).

From here, my next buy target is $100.65, above a past point of support, and my next sell target is $166.75, below a past point of resistance.

JPM closed the week at $119.09, up +3.10% from where I added Thursday.

Logitech (LOGI): Added to Position

Logitech (LOGI) broke through the $60.00 psychological support mark on Monday, falling through my buy order which filled at $58.01. The buy locked in a -38.22% discount replacing some of the shares I sold for $93.90 on October 20, 2020, and raised my per-share cost +$1.00 from $9.95 to $10.95.

From here, my next buy target is $55.05, above a past point of support, and my next sell target is $109.65 where LOGI will have outgrown the allocation size for the portfolio.

LOGI closed the week at $59.23, up +2.10% from where I added on Monday.

Morgan Stanley (MS): Added to Position x 2

I continued to ever-so-slowly add to my Morgan Stanley (MS) position when it sold off Monday and triggered a buy order at $80.75. On Thursday, MS continued to push further down, triggering my next buy at $76.95 and gave me an average buy price of $78.85.

The combined buys lowered my per-share cost -1.86% from $83.50 to $81.95. From here, my next buy target is $72.85, above a past point of support, and I do still plan to take profits around MS’ all-time high of $109.73 if it gets that high.

MS closed the week at $80.54, up +2.14% from my $78.85 average buy price.

Roblox (RBLX): Added to Position

Roblox (RBLX) broke down ahead of earnings as investors panic-sold out of all speculative positions early in the week, triggering a buy order of mine which filled at $26.23 on Monday.

The buy lowered my per-share cost -5.44% from $48.75 to $46.10. From here, my next buy target is $22.10, above RBLX’s recent low, and my next sell target is $83.70, right around the 50% retracement level for RBLX’s selloff from its all-time high.

RBLX closed the week at $32.97, up +25.70% from where I added on Monday.

Rivian (RIVN): Added to Position x 2

Rivian (RIVN) broke down before it even had a chance to report earnings this week after Ford (F) announced it would be selling its multi-billion dollar stake in RIVN, triggering a buy order of mine which filled on Monday at $25.00. Rivian’s selloff didn’t stop there, falling below $20.00 on Wednesday and triggering my next buy at $19.85 which gave me an average buy price of $21.57.

The combined buys lowered my per-share cost -16.04% from $70.75 to $59.40. From here, my next buy target is $18.15, calculated using the Fibonacci Method, and my next sell target is $71.40, below a key level of resistance developed on RIVN’s way down using the Fibonacci Method.

RIVN closed the week at $26.70, up +23.78% from my $21.57 average buy price.

Schwab (SCHW): Added to Position

Schwab (SCHW) and the rest of the financial sector certainly weren’t exempt from this week’s selloff with SCHW triggering my next buy order on Tuesday at $63.65. The buy lowered my per-share cost -2.14% from $74.85 to $73.25.

From here, my next buy target is $58.05, above a past point of support, and my next sell target is $92.75, below the high of SCHW’s last bull rally.

SCHW closed the week at $65.61, up +3.08% from where I added on Tuesday.

Twilio (TWLO): Added to Position

One of the older speculative plays in the portfolio, big cloud data play Twilio (TWLO) broke its $100 psychological support this week and careened through my next buy target which filled at $90.06 on Thursday.

The buy locked in a -24.52% discount replacing some of the shares I sold at $119.32 back on January 21, 2020 and lowered my per-share cost -4.37% from $122.03 to $116.70. From here, my next buy target is $69.80, slightly above TWLO’s pandemic low, and my next sell target is $338.20, below a key level of resistance and far below TWLO’s all-time high around $455.

TWLO closed the week at $110.79, up +23.02% from where I added on Thursday.

Visa (V): *New Position Opened*

As I mentioned several weeks ago, I’ve been increasing my exposure to the financial sector and created a basket to provide a variety of different ways to participate with major credit card payment processor, Visa (V), being the fourth and final component of the basket (which also includes JP Morgan (JPM), Morgan Stanley (MS), and Schwab (SCHW)).

I chose Visa over competitors MasterCard (MA) and American Express (AXP) for a few reasons. First, American Express (AXP) manages its own debt. In other words, while AXP makes a lot of money off of its consumer debt, if there is a debt crisis as some analysts expect, AXP will get hit hard. As for why Visa over MasterCard? Well, that’s just personal preference. My primary personal credit cards are actually Visas and since the two companies are so similar, I figured I’d dance with the girl who brought me.

I dipped my toe into Visa (V) very slowly with an incredibly small buy on Monday during the market-wide selloff which filled at $194.00. From here, my next target is $187.00, above Visa’s 2022 low.

V closed the week at $199.23, up +2.70% from where I opened it on Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.