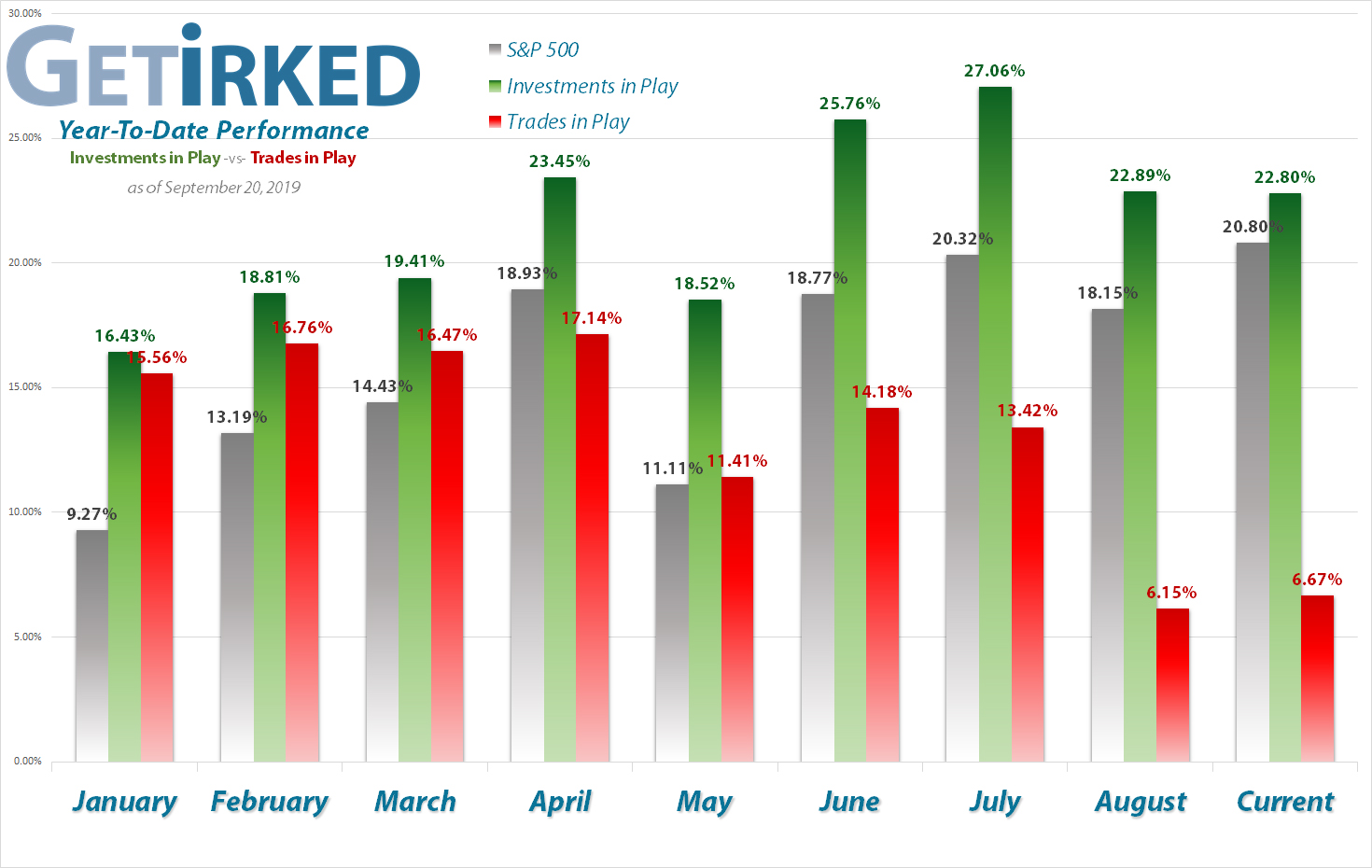

September 20, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

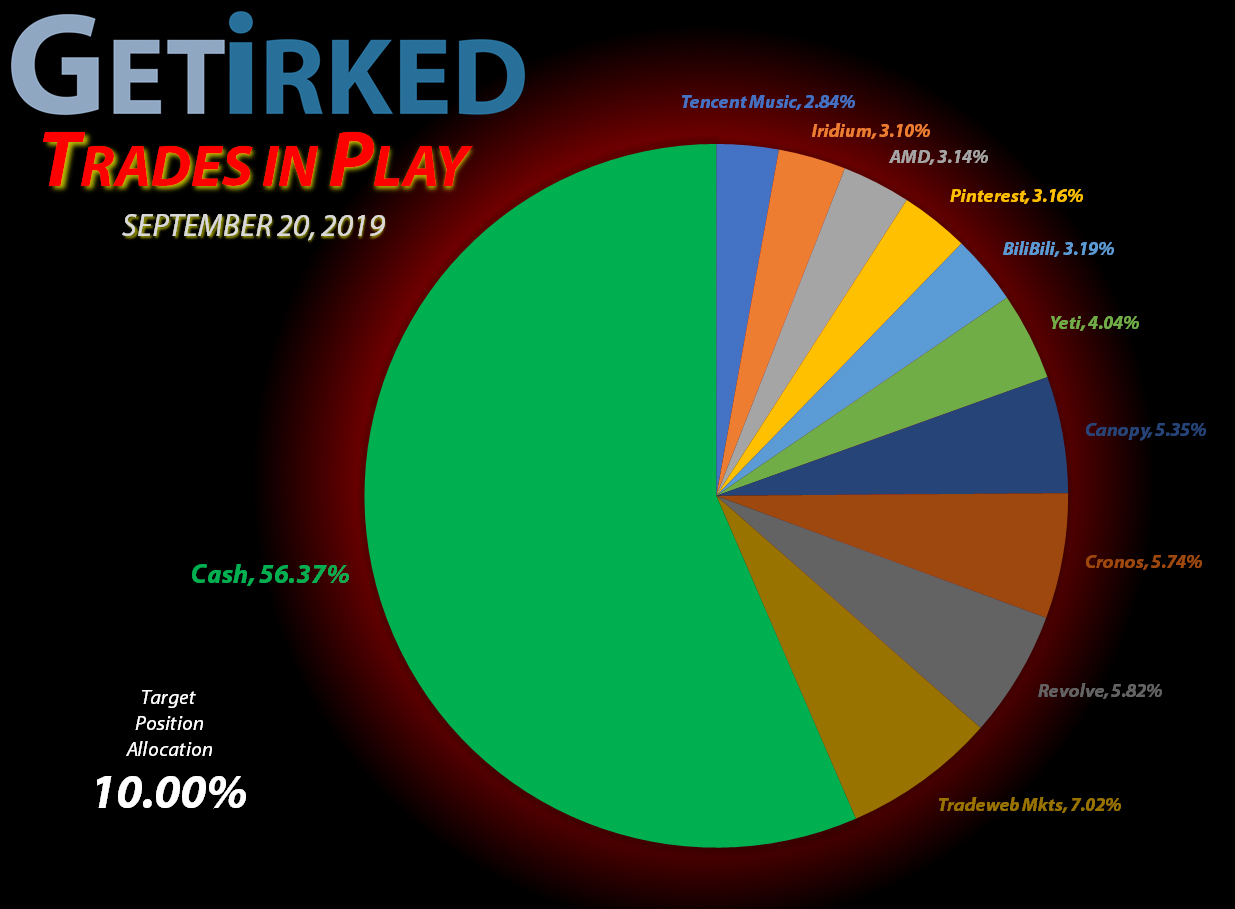

Portfolio Allocation

Positions

%

Target Position Size

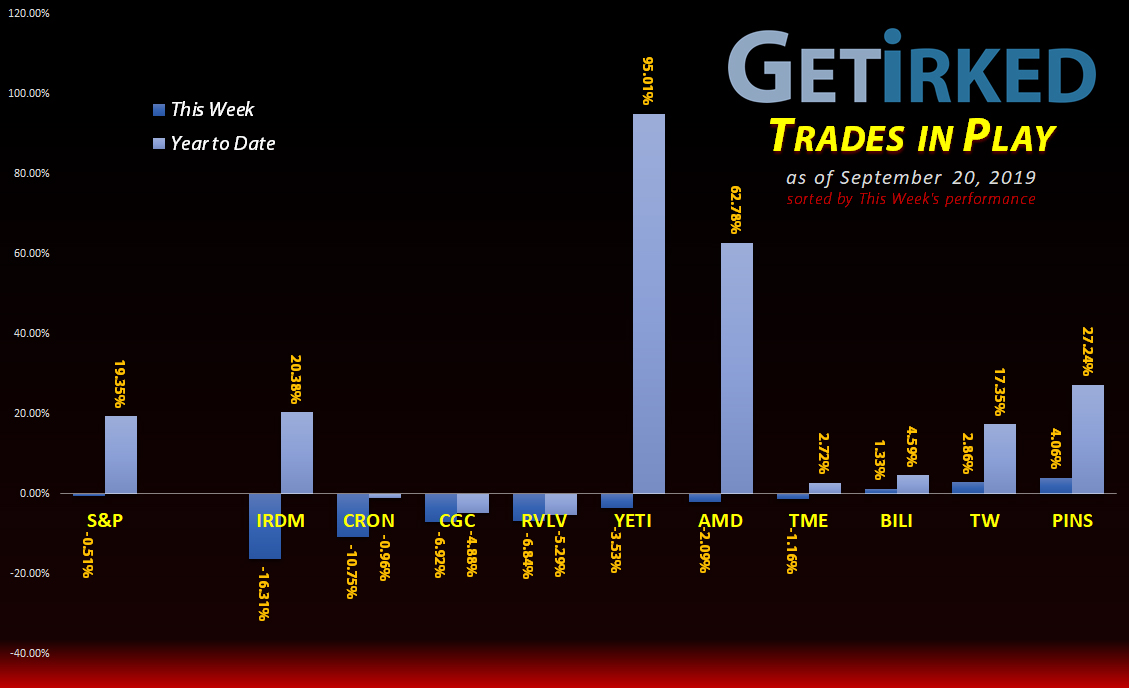

Current Position Performance

AMD (AMD)

+107.24%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $14.50

Yeti (YETI)

+71.14%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.91

Tencent Music (TME)

+29.99%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.45

Pinterest (PINS)

+25.92%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $24.00

Canopy Growth (CGC)

+24.39%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.55

Tradeweb Mkts (TW)

+7.24%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.53

BiliBili (BILI)

-0.51%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.34

Iridium Comm (IRDM)

-8.73%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $24.34

Cronos Group (CRON)

-17.08%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $12.41

Revolve Group (RVLV)

-27.25%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $32.76

Highlights from the Week

Biggest Winner: Pinterest (PINS)

It’s hard to keep a good IPO down and Pinterest (PINS) might be the only beloved IPO left, gaining +4.06% this week and earnings it spot as my Biggest Winner. Pinterest’s soft-spoken CEO undersells the company and tells it as it is, with the result being a company and a stock that consistently exceeds expectations. Amazing what simply telling the truth can do, right?

Biggest Loser: Iridium Communications (IRDM)

Without a doubt, this week’s Biggest Loser, Iridium Communications (IRDM) is one of the most volatile stocks I’ve ever traded as it collapsed -16.31% on almost no news. Given the drone attack in Saudi Arabia, you’d think that a company specializing in satellite technology would get some love from the defense sector, but, nope, nothing. After taking some profits last week (lucky move), I watched in horror as IRDM seemed to fall out of orbit and from grace this week.

This Week’s Trades

Cronos Group (CRON): Added to Position

Market weakness combined with additional news of potential deaths from vaping led cannabis stocks lower on Thursday including Cronos Group (CRON) which broke through its prior $10.58 low, triggering a buy order I had placed at $10.31.

The purchase lowered my per-share cost -2.36% from $12.71 to $12.41. I plan to add more to the position should CRON break through $10.00 and head down to $9.45.

CRON closed the week at $10.29, down -0.19% from where I added on Thursday.

Tradeweb Markets (TW): Added to Position

Tradeweb Markets (TW) continued to sell off at the beginning of the week, dropping through $39.00 where I used a trailing stop order to add to my position at $38.82 on Monday which raised my per-share cost 0.89% from $37.21 to $37.54.

My next buy target is slightly below my per-share cost at $37.30 should Tradeweb work its way that much lower during this decline.

TW closed the week at $40.25, up +3.68% from where I added on Monday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.