Originally posted March 11, 2019. Last Updated February 23, 2023.

What is an Exchange Traded Fund?

An Exchange Traded Fund (ETF) or Index Fund is a portfolio of stocks managed by a firm to achieve certain goals. When buying a share in an ETF, investors are actually buying small portions of each stock in the ETF.

Firms manage ETFs based on different investing theses. For example, Vanguard’s VTI fund is a Total Market Index Fund, meaning managers ensure the ETF represents the entire stock market with equal percentages of each stock in the market balanced so the performance of VTI is roughly equivalent to the performance of the entire market. The ETF’s managers regularly buy and sell the stocks of the different companies in the ETF to ensure it closely mirrors the sector or market it’s designed to represent.

Vanguard, one of the more popular ETF providers, offers a wide variety of ETFs including market- and sector-specific funds such as VGT which focuses on Technology or VHT which focuses on healthcare with other funds such as VWO focusing on Emerging Markets or BND which represents the Total Bond Market.

To see all the ETF’s that Vanguard Funds offer, click here.

By using ETFs, investors can invest with exposure to a specific sector or market without having to worry about the risk of a single company having a negative news event destroying the stock. For example, if an investor believes healthcare will increase in value in the future, but wants to avoid the downside risk of a specific company (or would prefer not to do the research on individual companies), the investor could buy VHT, Vanguard’s Healthcare ETF, and get exposure to the entire healthcare space and the companies involved.

What’s the Downside to ETFs?

Buying an entire sector or market limits an investor when a specific company has a good news event resulting in huge gains for that one company’s stock. Although the company’s upside performance will likely be at least partially reflected in the ETF, the fact that the company is only a part of the ETF limits the amount of upside the ETF will see to the percentage that the specific stock represents in the entire ETF.

The Power of Diversification

On Sunday, March 10, 2019, a crash of a Boeing (BA) 737 MAX-8 plane took the lives of more than 150 people. Although the loss of life is a tragedy, the company-specific event provides a valuable investing lesson – the power of diversification.

If you owned shares of Boeing on Monday, March 11, the stock dropped 5.33% from Friday’s close of $422.54 to Monday’s close of $400.01. Boeing continued to plummet throughout the week, dropping more than 15% from the previous Friday’s close.

Although index funds tracking the entire stock market get a lot of attention, fund providers like Vanguard also offer sector-specific Exchange Traded Funds (ETFs). For example, Vanguard’s Industrials ETF (VIS) includes Boeing (BA), Caterpillar (CAT) and the many other companies that make up the sector.

On Monday, Boeing’s collapse didn’t push VIS down, in fact, VIS closed higher at $139.78 with a gain of more than 1% from Friday’s $138.38 close. On Tuesday, Boeing’s worsening news caused the VIS to pull back to close at $138.71, still higher than the previous Friday’s close.

The moral of diversification? If an investor wants to have exposure to a specific sector without the risk of company-specific news, consider using sector-tracking ETFs.

Diversification may slightly limit the upside in investing, but it definitely protects against the downside.

Building an ETF Portfolio

When investing in Exchange Traded Funds (ETFs), the diversification offers a degree of safety not available in purchasing individual stocks – investors don’t have to worry about a specific company’s performance.

However, not all ETFs are created equal. The more diversified the ETF, the less risk but also less reward. For example, the Total Market Index (VTI) provides equal exposure to the entire market, reducing risk, but VTI won’t see the same gains if only the technology sector explodes to the upside. To receive exposure specifically to the technology sector, investors could choose VGT – Vanguard’s technology-specific ETF, however that would mean a selloff in just the technology sector would impact an investor holding VGT more than one holding VTI.

Investors can vary the amount of exposure to a sector or space by building a portfolio from a variety of different ETFs (read more about Vanguard Funds, our preferred ETF provider, in our feature about why investors should use ETFs instead of roboadvisers).

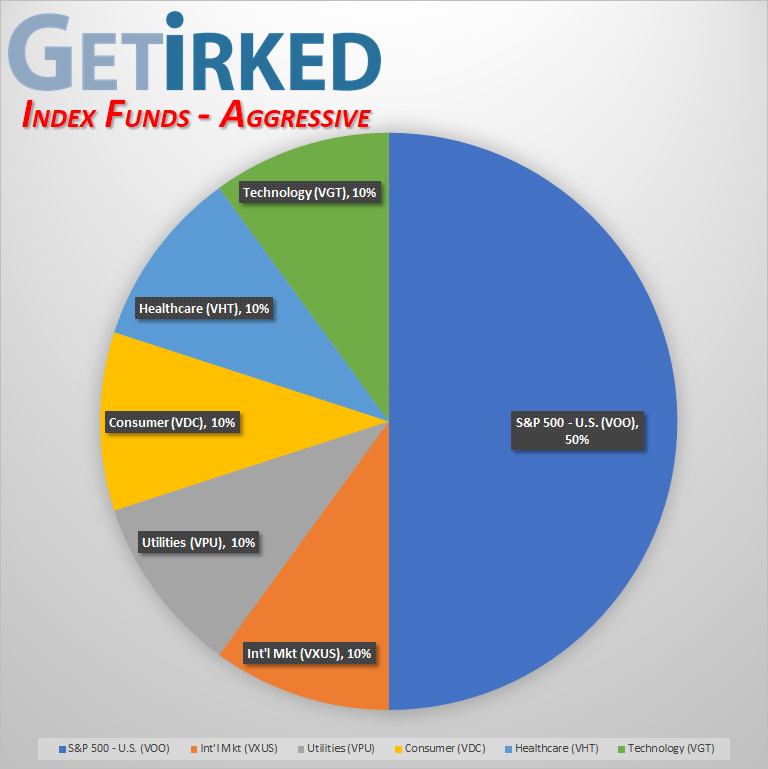

Get Irked recommends choosing percentage targets for each of the sectors in your portfolio. A well-balanced portfolio will have exposure to the entire market, the international market, downturn plays and perhaps a few targeted sectors (although it’s not necessary to pick specific sectors if the investor prefers less risk).

- S&P 500 (VOO) – 50% – As a more aggressive portfolio, we are using the S&P 500 ETF (VOO) instead of Vanguard’s Total Market Index ETF (VTI) so we can more specifically target the historically faster-growing companies represented by the S&P 500 index.

- International Markets (VXUS) – 10% – For broad exposure to the international markets where we can capitalize on global growth, we use VXUS, the International Stock Market ETF. The VXUS does not include any companies based in the United States, so it’s a strictly international play.

- Utilities (VPU) – 10% – The Utilities ETF takes the place of a bond issue in this portfolio as many analysts consider the Utilities sector a good alternative to bonds. Although the sector carries higher-risk than bonds, it historically offers higher returns than bonds.

- Consumer Staples (VDC) – 10% – In addition to the Utilities ETF, this portfolio uses the Consumer Staples (VDC) sector to protect our portfolio in downturns. Professional investors put money into Consumer Staples during market downturns as consumers won’t stop buying staples like shampoo or food, even in downturns. The Consumer Staples space may still decline in downturns, but historically not as much as the other sectors in the market.

- Targeted Sectors: Healthcare (VHT) and Technology (VGT) – 20% total – We believe that healthcare will continue to be a growth area as baby boomers retire and begin to age. We also believe that Technology will continue to be a growth sector as technological advances seem to affect the entire market. This portfolio targets 10% for each sector.

Build Your Own Portfolio!

Some of the biggest benefits to investing in ETFs are choosing your own portfolio and eliminating exposure to a single company’s risk. When selecting ETFs, investors must keep in mind their own time horizon and risk appetite to ensure their selections fit their investing goals.

Don’t just take our word for it, explore Vanguard’s ETFs (and other firms) to see what’s out there and create your own portfolio. To see all the ETF’s that Vanguard Funds offer, click here.

Why do we keep talking about Vanguard Funds?

At Get Irked, we’re big fans of Vanguard Funds. Not only are they one of the oldest players in the space with some of the most successful ETFs, Vanguard allows investors to buy and sell their funds for free with no commission costs.

In addition, uninvested funds are placed in Vanguard’s Money Market account which earns a very competitive interest rate to some of the best savings accounts on the market.

You can learn more about Vanguard Funds at their website: www.vanguard.com

Disclosure

Get Irked receives no referral bonus from Vanguard for the above links and we are not receiving any sponsorship from Vanguard for this feature. We are simply impressed with Vanguard’s services and offerings for passive investors as an alternative to roboadvisers or traditional brokerages.