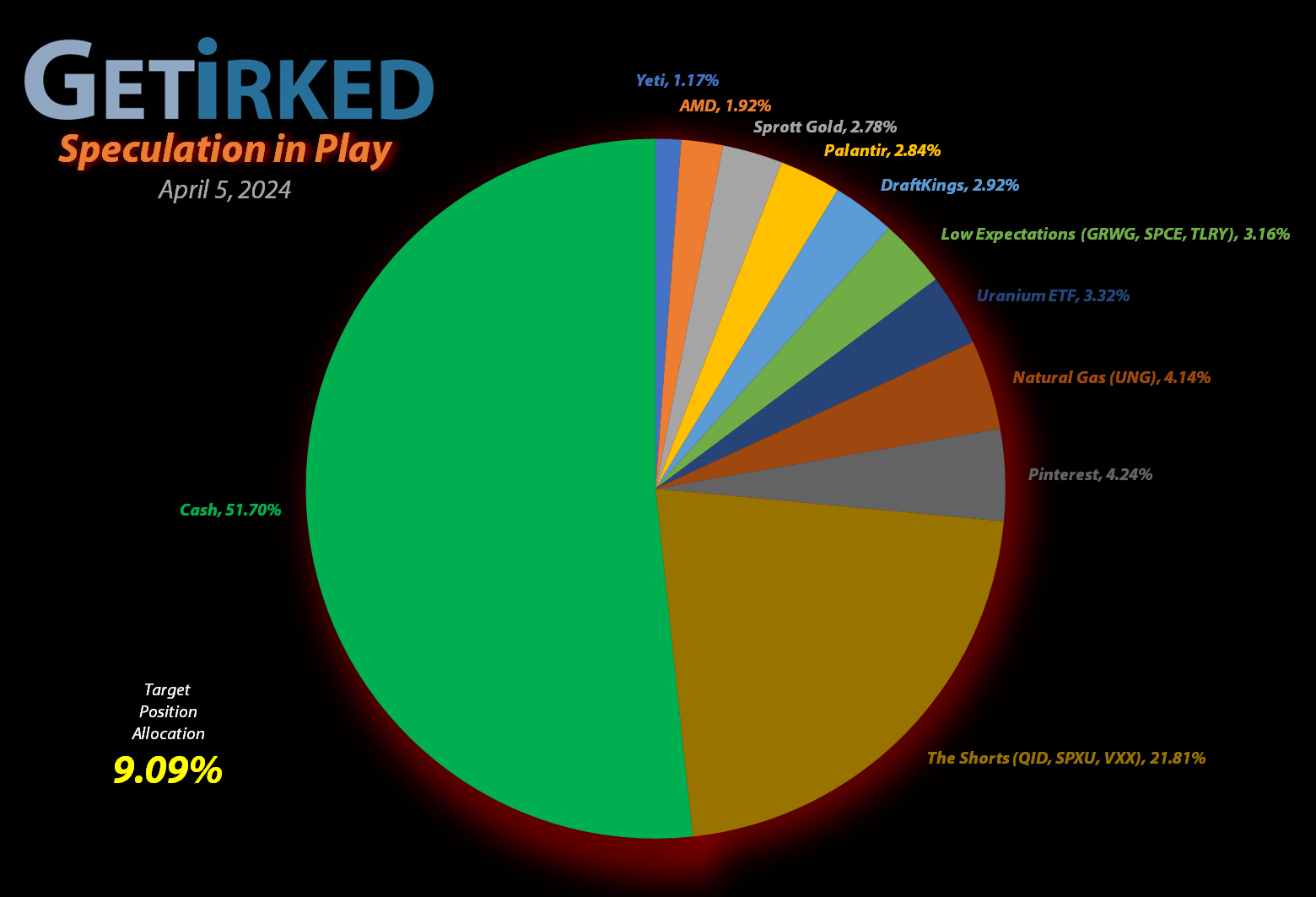

April 5, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

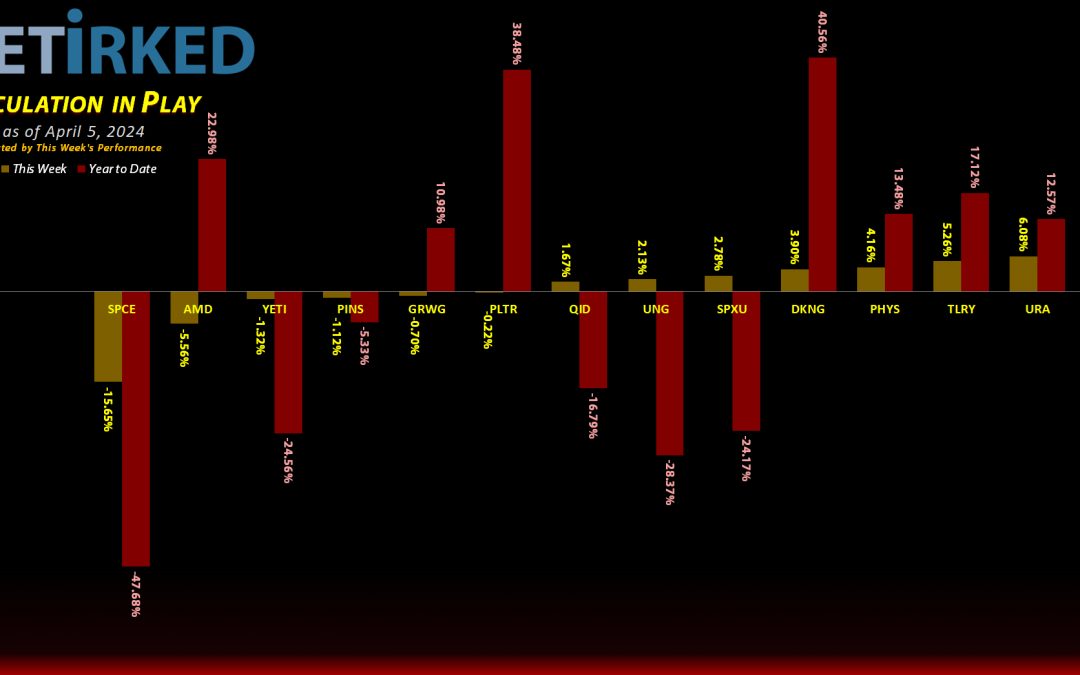

The Week’s Biggest Winner & Loser

Uranium ETF (URA)

As always, the short positions don’t qualify to be the Week’s Biggest Winner or Biggest Loser, so this time it’s the GlobalX Uranium ETF (URA) which rallied +6.08% this week on the back of geopolitical concerns, making URA the Week’s Biggest Loser.

Virgin Galactic (SPCE)

The outlook is beginning to look pretty grim for Virgin Galactic (SPCE). The development of space travel isn’t cheap, and the company just isn’t generating the revenue it needs, not by a long shot. Virgin Galactic crashed -15.65% this week, earning it the spot of the Week’s Biggest Loser.

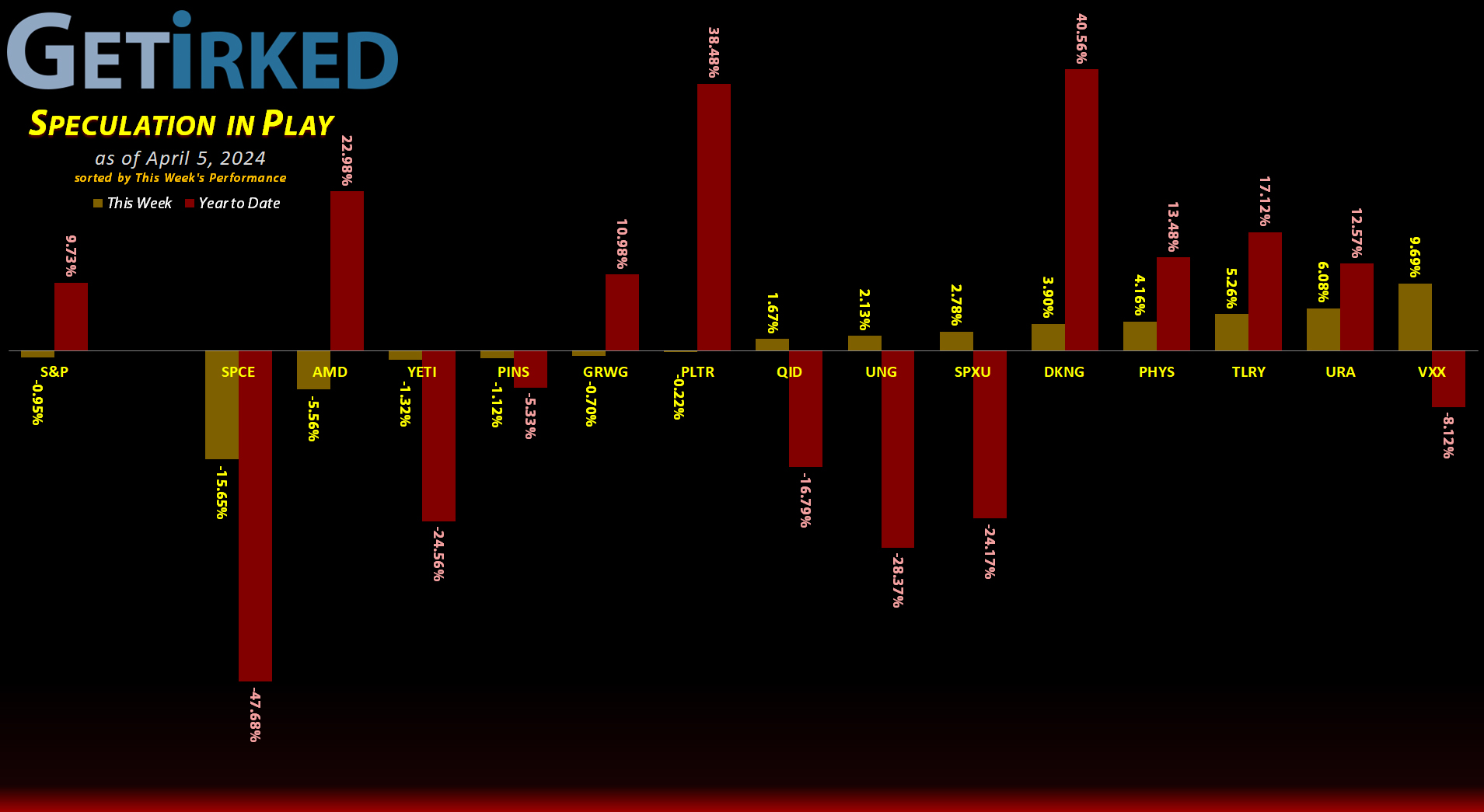

Portfolio Allocation

Positions

%

Target Position Size

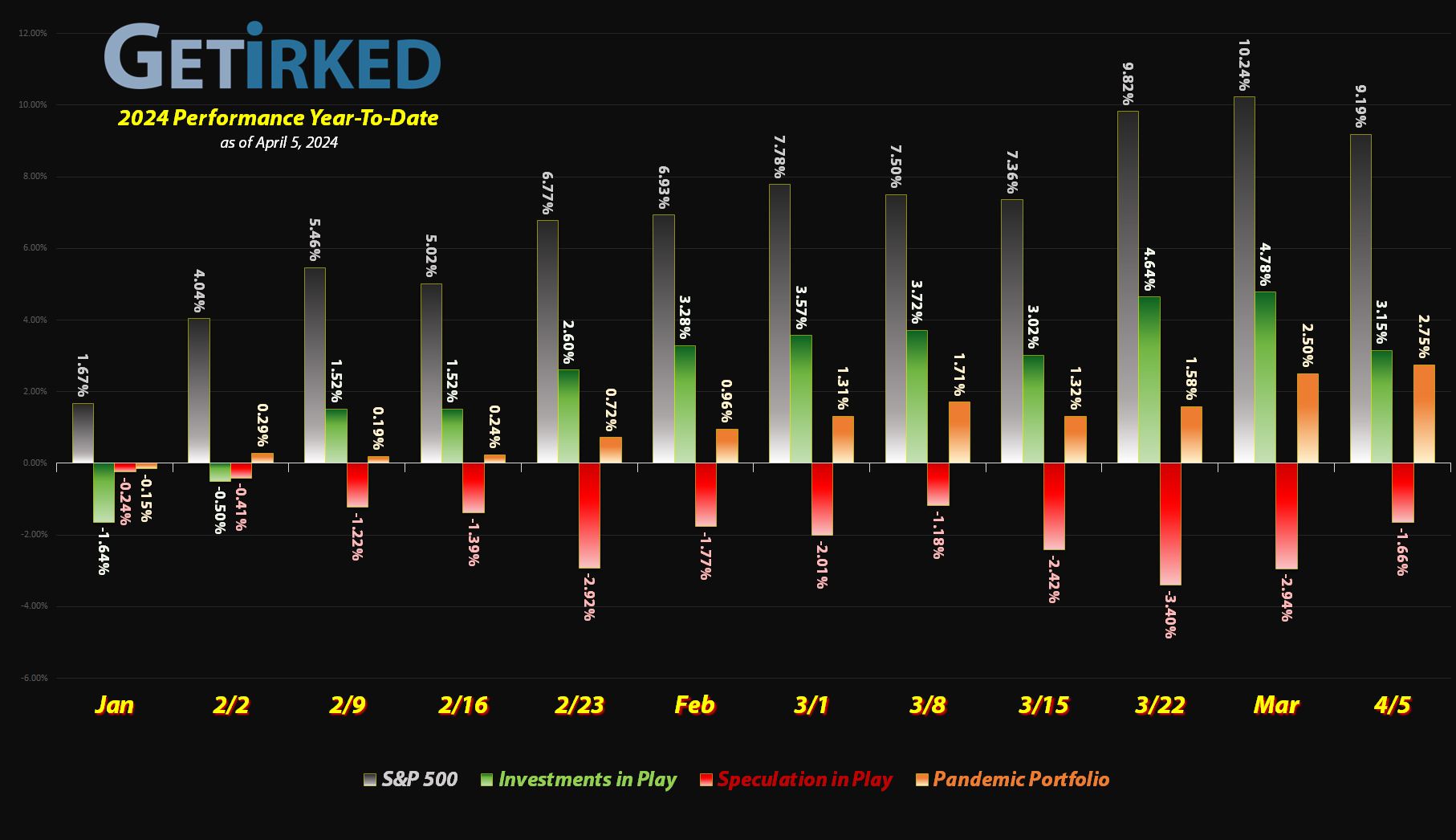

Current Position Performance

AMD (AMD)

+799.59%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$687.73)*

Pinterest (PINS)

+423.91%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+387.65%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+172.70%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.20

Virgin Galactic (SPCE)

+80.57%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$1.96)*

Palantir (PLTR)

+62.64%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+65.58%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+54.85%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Sprott Gold Trust (PHYS)

+23.32%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-18.75%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $17.55

Short SPY (SPXU)

-31.80%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $9.76

Short QQQ (QID)

-32.31%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.47

U.S. Natural Gas (UNG)

-45.31%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-79.11%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Advanced Micro Devices (AMD): Added to Position

Advanced Micro Devices (AMD) really lost support on Thursday, careening through my next buy target which filled at $171.44, adding 3.11% to the position, locking in a -5.14% discount replacing a few of the shares I sold for $180.72 earlier this year on January 25.

The buy raised my per-share “cost” +$163.53 from -$851.26 to -$687.73 (a negative per-share cost indicates all capital has been removed in addition to $687.73 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $150.89, above a past level of support, and I have no sell targets as I’m intending to rebuild this position a bit as the AI play of the Speculation in Play portfolio.

AMD closed the week at $170.42, down -0.59% from where I added Thursday.

Virgin Galactic (SPCE): Added to Position

Virgin Galactic (SPCE) crashed to new all-time lows on Wednesday, triggering my next buy order which added 1.19% at $1.28.

The buy locked in a -96.83% discount replacing some of the shares I sold at $40.36 back on January 26, 2021 and raised my per-share “cost” +$0.24 from -$2.20 to -$1.96 (a negative per-share cost indicates all capital has been removed in addition to $1.96 per share added to the portfolio’s bottom line in addition to each share’s current value).

CRUCIAL TO REMEMBER: One of my key rules is that I can never turn a winner into a loser. In other words, with extraordinarily speculative positions like Virgin Galactic, I can only add profits back into this position, I will never add investment capital back into any position where all the original capital has been taken out.

Virgin Galactic is basically on the verge of bankruptcy at any given moment, so I’m using this position as a virtual lottery ticket on the future of space travel.

From here, my next buy target is $1.07, just a bit above the critical $1.00 psychological support level, and my next sell target is $40.93, ridiculously higher from here, I know, but slightly below Virgin Galactic’s first all time high that it saw in early 2020.

SPCE closed the week at $1.25, down -2.34% from where I added Wednesday.

The Volatility “Fear” Index (VXX): Added to Position

With the volatility index (VIX), also known as the “fear gauge,” remaining at unbelievably, near-historic levels, I decided it was time to once again pile more money on the fire with a buy order in my iPath S&P 500 VIX Short-Term Futures ETN (VXX) that filled at $13.09 on Thursday, adding 4.05% to my position.

The buy lowered my per-share cost -1.79% down from $17.87 to $17.55. From here, I will continue adding good money after bad with another buy at $12.75, slightly above VXX’s all-time low, because surely… surely… there will be a VIX spike at some point, right? Right???

Don’t worry… I haven’t lost my mind and become a gambling addict. The VIX trade in my super-speculative Speculation in Play account is an experiment and I am fully prepared to lose all the money I put into this trade.

Should we see an eventual spike that pushes VXX past my cost basis, I will be trimming the position dramatically with a sell target at $17.59 below a high the VXX saw in December 2023.

VXX closed the week at $14.26, up +8.94% from where I added Thursday.