January 5, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

Is it ever O.K. to break your own rules?

I had an astute follower of Get Irked ask me why I was selling on a red day last Friday. As many of you have likely heard me say, one of my tenets is “Only Sell on Green Days, Only Buy on Red Days.” That rule is still very much true and I follow it very closely in all of my portfolios except for one – the Speculation in Play.

Not only is this portfolio speculative, it’s also imperative for me to manage risk. Going into 2024, I decided to do some housekeeping in the Speculation in Play portfolio, trimming positions here and there, and eliminating others entirely.

This week, you’ll see additional trades where I “Sell on Red.” Remember that, as long term investors, we want to buy weakness and sell strength. However, in speculative portfolios, I allow myself the freedom to mess around, experiment with other strategies, and see what happens.

99.99% of the time, any deviation from my disciplines help me cement those disciplines. In other words, whenever I break my rules, it’s usually a mistake.

With that, let’s get to the first Speculation in Play update of 2024…

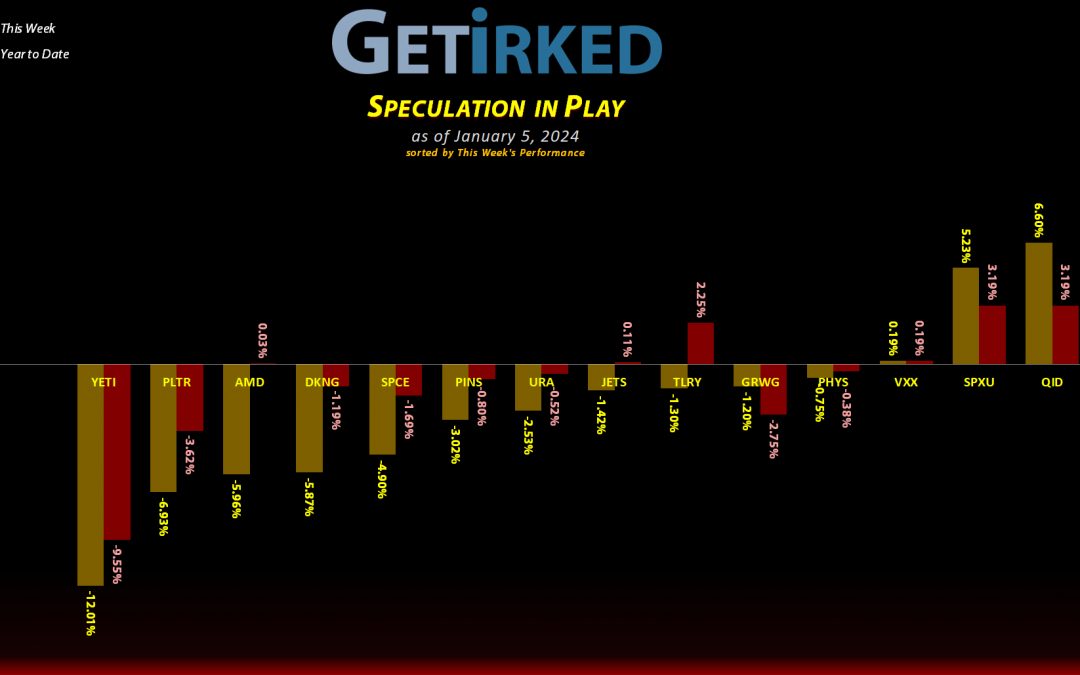

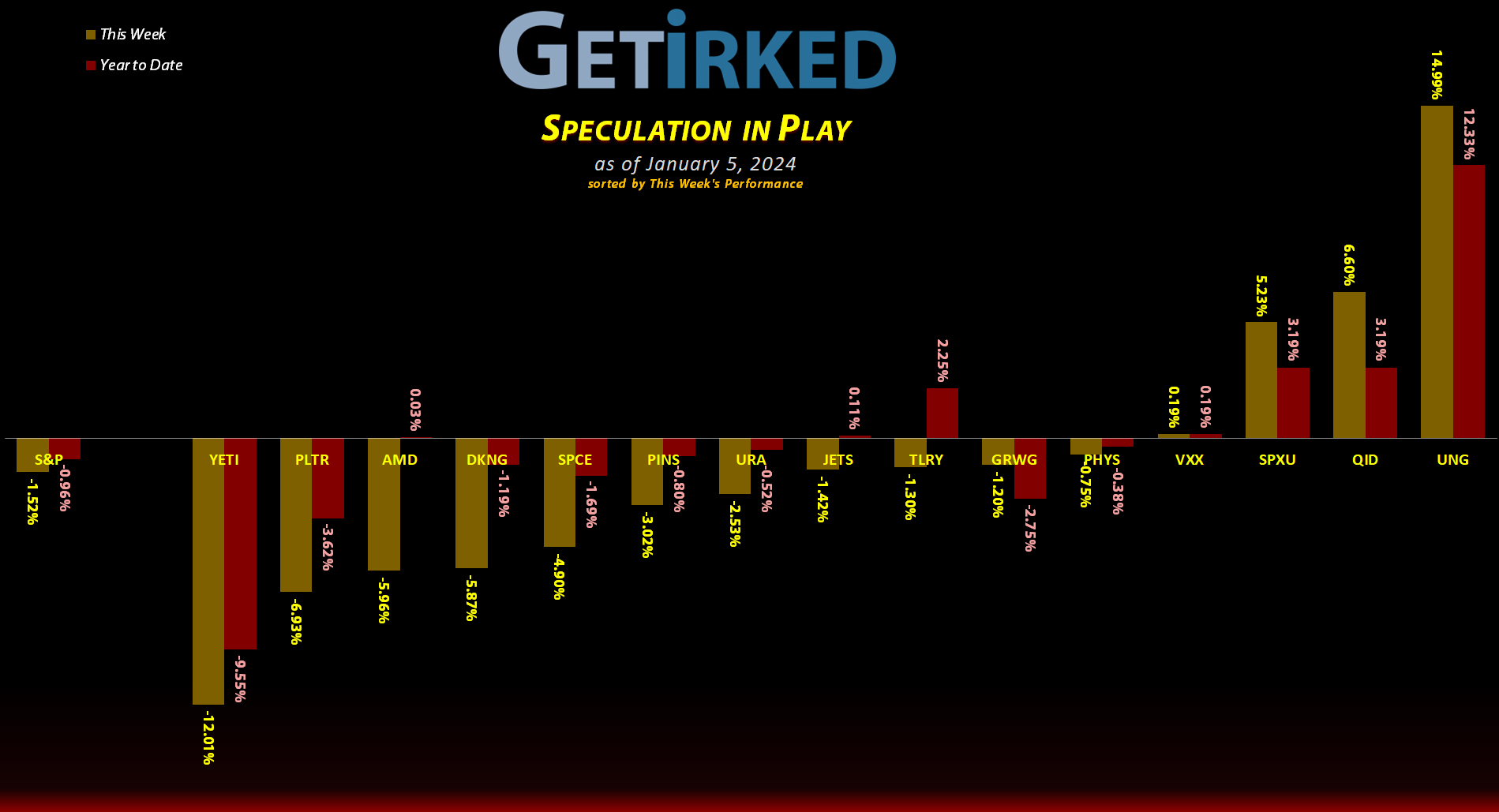

The Week’s Biggest Winner & Loser

U.S. Natural Gas (UNG)

With winter storms rolling in, natural gas finally caught a bid this week, causing the U.S. Natural Gas Fund (UNG) to rally +14.99%. In a week where everything that wasn’t a short position sold off, that certainly earns UNG the spot of the Week’s Biggest Winner.

Yeti (YETI)

A series of analyst downgrades on the thesis that the consumer would soon be cutting back on spending sent insulated drink tumbler maker, Yeti (YETI), tumbling last week. YETI finished the week down -12.01% which was enough to earn the drinkmaker the chilliest last place of the Week’s Biggest Loser.

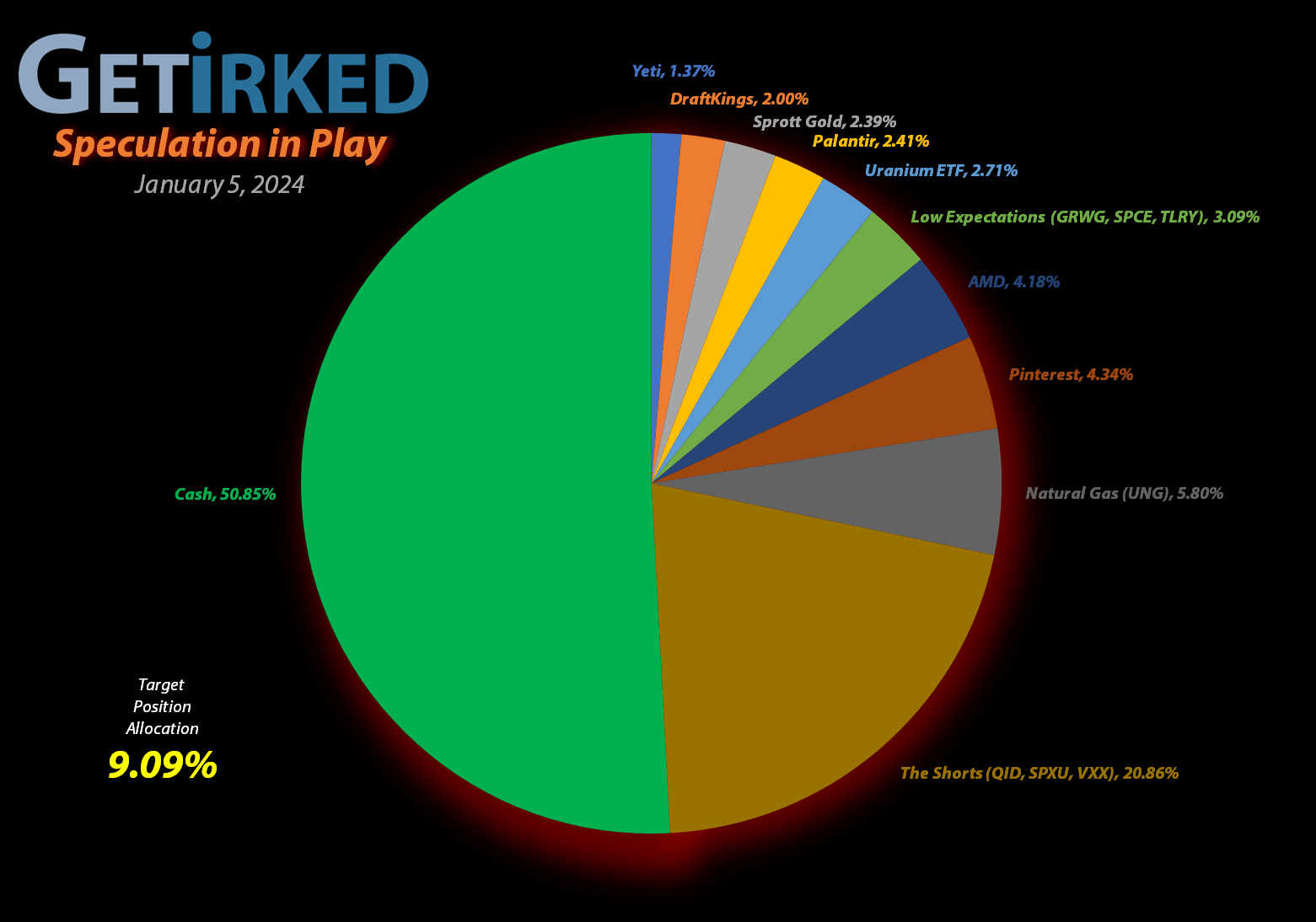

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+699.28%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+432.75%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+403.66%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+127.77%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.85

Virgin Galactic (SPCE)

+105.91%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Airlines ETF (JETS)

+95.66%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: -CLOSED-

Tilray Brands (TLRY)

+51.35%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

DraftKings (DKNG)

+16.40%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Sprott Gold Trust (PHYS)

+8.29%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Palantir (PLTR)

+3.97%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.37

Short SPY (SPXU)

-13.96%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.52

The “VIX” (VXX)

-17.51%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.85

U.S. Natural Gas (UNG)

-17.87%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.15

Short QQQ (QID)

-20.88%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.30

Grow Gen (GRWG)

-81.70%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): *Closed: +95.66%*

The Airlines ETF (JETS) came under selling pressure with the rest of the market when the year kicked off on Tuesday. Just like Carnival Cruise Lines (CCL) which I closed last week, the Airlines ETF (JETS) was part of the “Recovery Basket.” Since I believe we’ll see a downturn in 2024 and the airlines had rallied huge into the end of 2023, I decided to use stop-loss limit orders to close my position in JETS.

The stop was triggered on Tuesday, closing the entire position at $18.69 and locking in lifetime gains of +95.66% on the trade (annualized to +26.09%/yr). The airlines are great trading vehicles, so it’s entirely possible that I may return to re-open this trade in the future, but, for now, I’m cleaning house.

JETS closed the week at $18.76, up +0.37% from where I closed it Tuesday.

Pinterest (PINS): Profit-Taking

Pinterest (PINS) has been a fantastic position for me and is one of the oldest remaining in the Speculation in Play portfolio, first opened on May 16, 2019 at $25.72. Since then, it’s been a wild ride, with PINS selling off to a low of $10.10 during the March 2020 Pandemic Selloff, rocketing +790% from those lows to hit a high of $89.90 in 2021, only to reverse course and sell off -82.05% in 2022 to hit a low of $16.14.

However, PINS has made a pretty remarkable recovery, rallying +62.08% in a little more than three months, from its low in October 2023 to hit its recent high at $38.23 just a few weeks ago. Between that move and the fact that Pinterest was one of the largest positions in the portfolio, I decided to use stop-loss limit orders to lock in gains in case it sold off, which it did when the market opened on Tuesday.

After my stop was triggered, my sell order was filled at $35.83, selling 20.00% of the position and locking in +41.40% in gains on shares I bought for $25.34 on September 30, 2019, and lowering my per-share “cost” -$16.25 from -$29.14 to -$45.39 (a negative per-share cost indicates all capital has been removed in addition to $45.39 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $23.78, just above the lows Pinterest saw in October 2023, and my next sell target is $65.97, just above point of resistance that PINS has tested many times in the past.

PINS closed the week at $35.92, up +0.25% from where I took profits Tuesday.