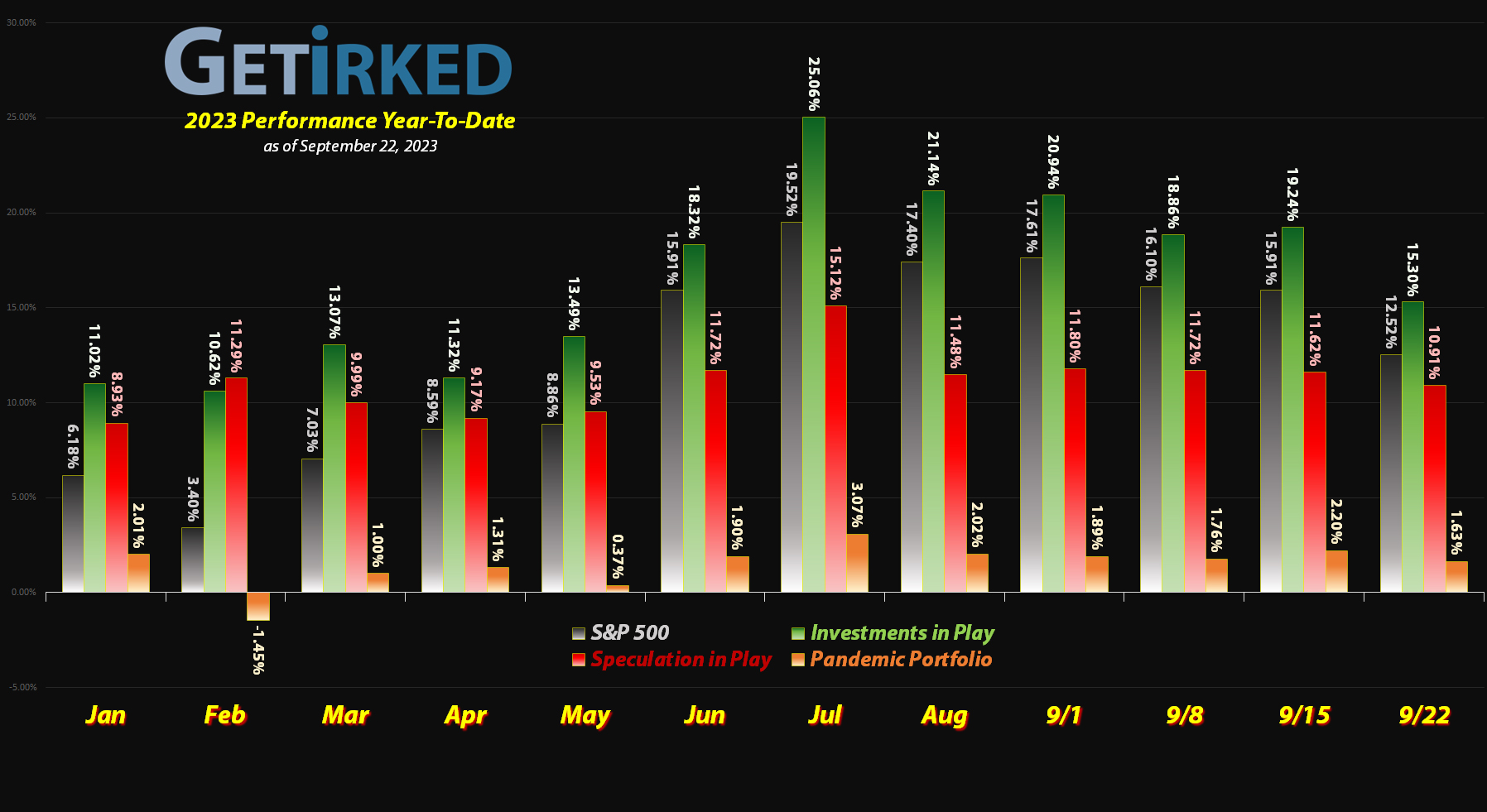

September 22, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

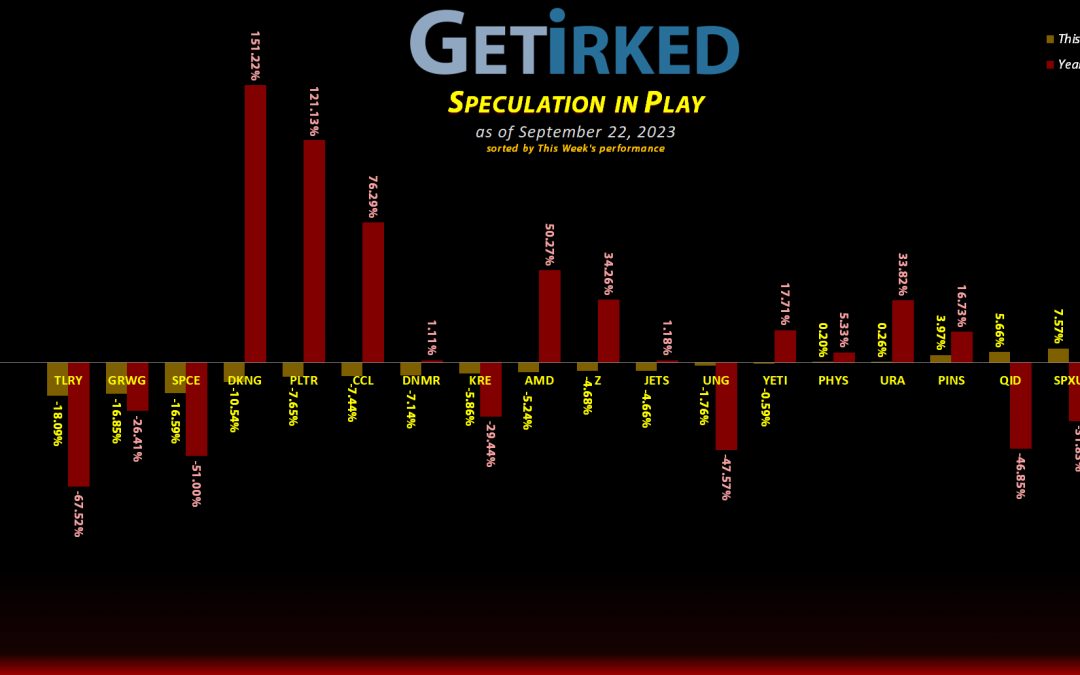

The Week’s Biggest Winner & Loser

Golden Minerals (AUMN)

While a +9.12% gain in a very, very bad week is usually something commendable in a stock, I’m chalking Golden Minerals’ (AUMN) win this week up to the sheer luck of a “dead cat bounce.”

A dead cat bounce occurs when a stock becomes so oversold that it makes a move higher. This is not necessarily indicative that the stock has bottomed, rather that the short-sellers are buying the stock price up to take profits and cover their shorts.

In other words, I fully believe AUMN is still dull to the touch and this week’s move was just a matter of trading price action.

Tilray Brands (TLRY)

When the market rolls over and investors get nervous, the first sectors they sell are their most speculative ones. After the spectacular run cannabis stocks have seen over the past month, it’s no wonder that the rats fled from Good Ship Tilray (TLRY), sending the stock crashing -18.09% and letting it slide in the spot of the Week’s Biggest Loser.

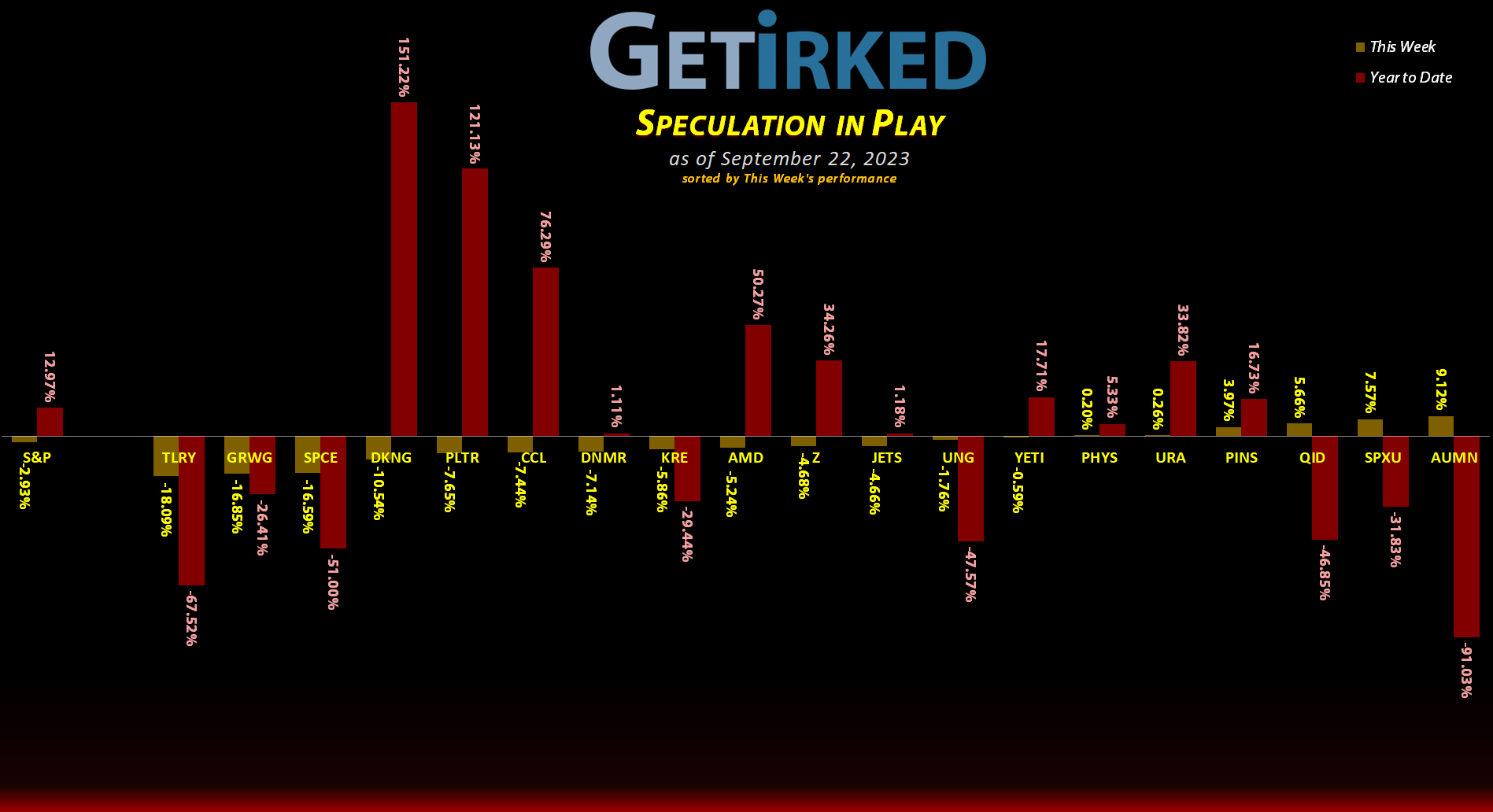

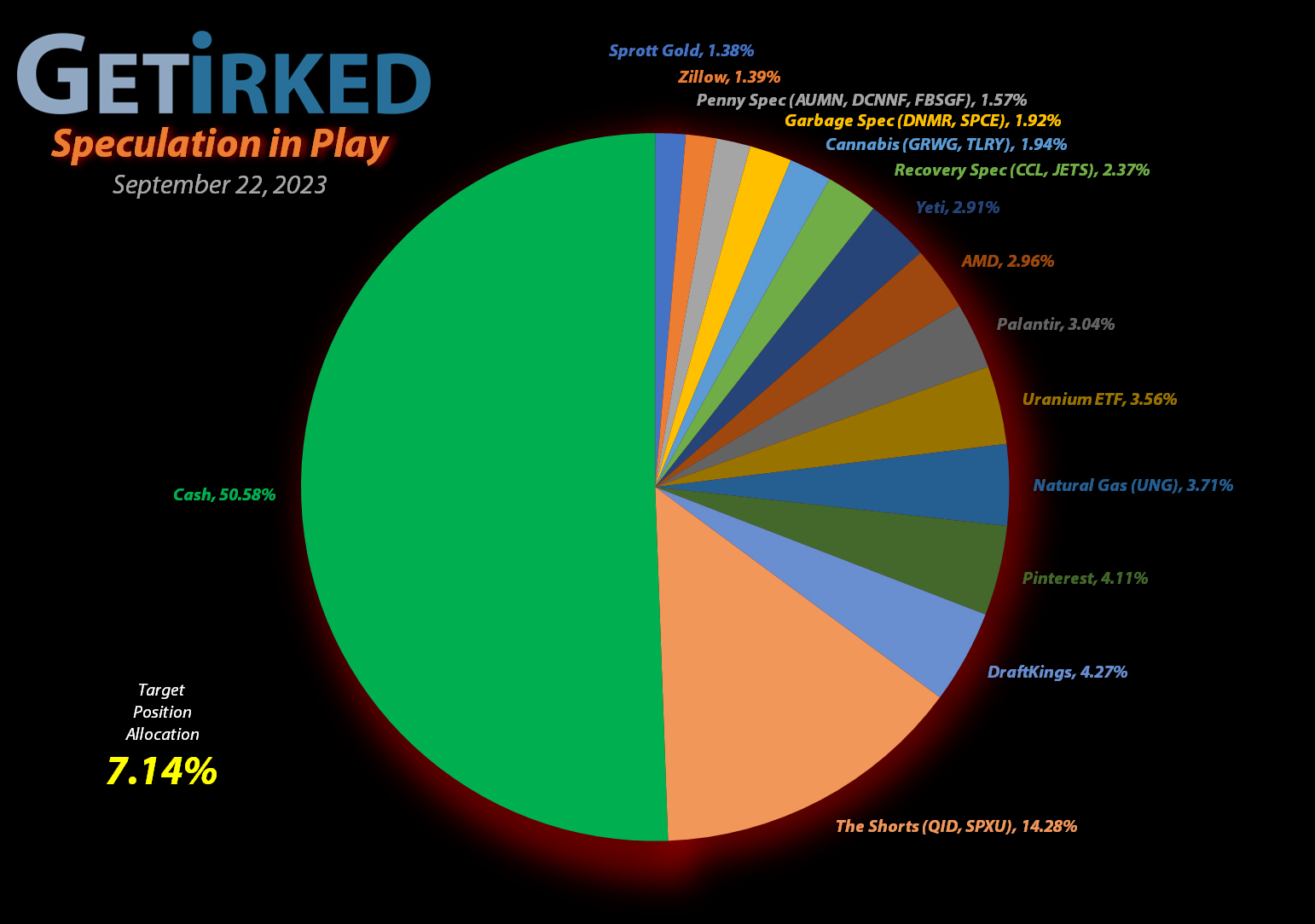

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+590.88%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+394.83%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+371.66%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+91.64%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Airlines ETF (JETS)

+84.32%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$6.26)*

Uranium ETF (URA)

+69.45%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+61.95%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+51.01%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($10.76)*

Regional Banks ETF (KRE)

+8.60%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: -Closed 9/18/23-

Sprott Gold Trust (PHYS)

+0.83%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Short SPY (SPXU)

-4.73`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.25

Zillow (Z)

-5.18%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Short QQQ (QID)

-12.16%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.95

Palantir (PLTR)

-12.24%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

DraftKings (DKNG)

-16.01%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-18.85%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-60.76%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-78.65%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-79.80%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-89.80%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-96.69%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): Added to Position

The airlines sector has been getting hit pretty hard ever since oil prices shot through the roof. Naturally, this means the Airlines ETF (JETS) has also been selling off.

On Thursday, JETS was finally pushed far enough to trigger my next buy order which added 14.96% to my position at $17.39 and raised my per-share “cost” up $22.86 from -$29.12 to -$6.26 (a negative per-share cost indicates all capital has been removed in addition to $.26 per share added to the portfolio’s bottom line in addition to each share’s current value).

This buy locked in a -19.64% discount replacing shares I sold for $21.64 back on July 20. From here, my next buy target is $14.84, above JETS’ 2022 low, and my next sell target is $22.45, just under its 2023 high.

JETS closed the week at $17.17, down -1.27% from where I added Thursday,

Regional Banks ETF (KRE): CLOSED +8.60% Gain

Some of the analysts I follow have been tracking potential liquidity issues in the regional banks, suggesting that the beleaguered sector could get hit with another epic selloff.

Since I was only holding on to my position in hopes the regionals would make a more robust recovery, I decided to get out when the getting was good on Monday, closing the position at $42.84, locking in a small +8.60% lifetime gain on the position over six months, originally opened on March 13, 2023.

While an annualized +17.2% gain isn’t too shabby, given the S&P 500 is still up over 16% currently, hanging on to a riskier position any longer certainly would not have been the prudent move.

KRE closed the week at $41.16, down -3.92% from where I closed it Monday.