August 18, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

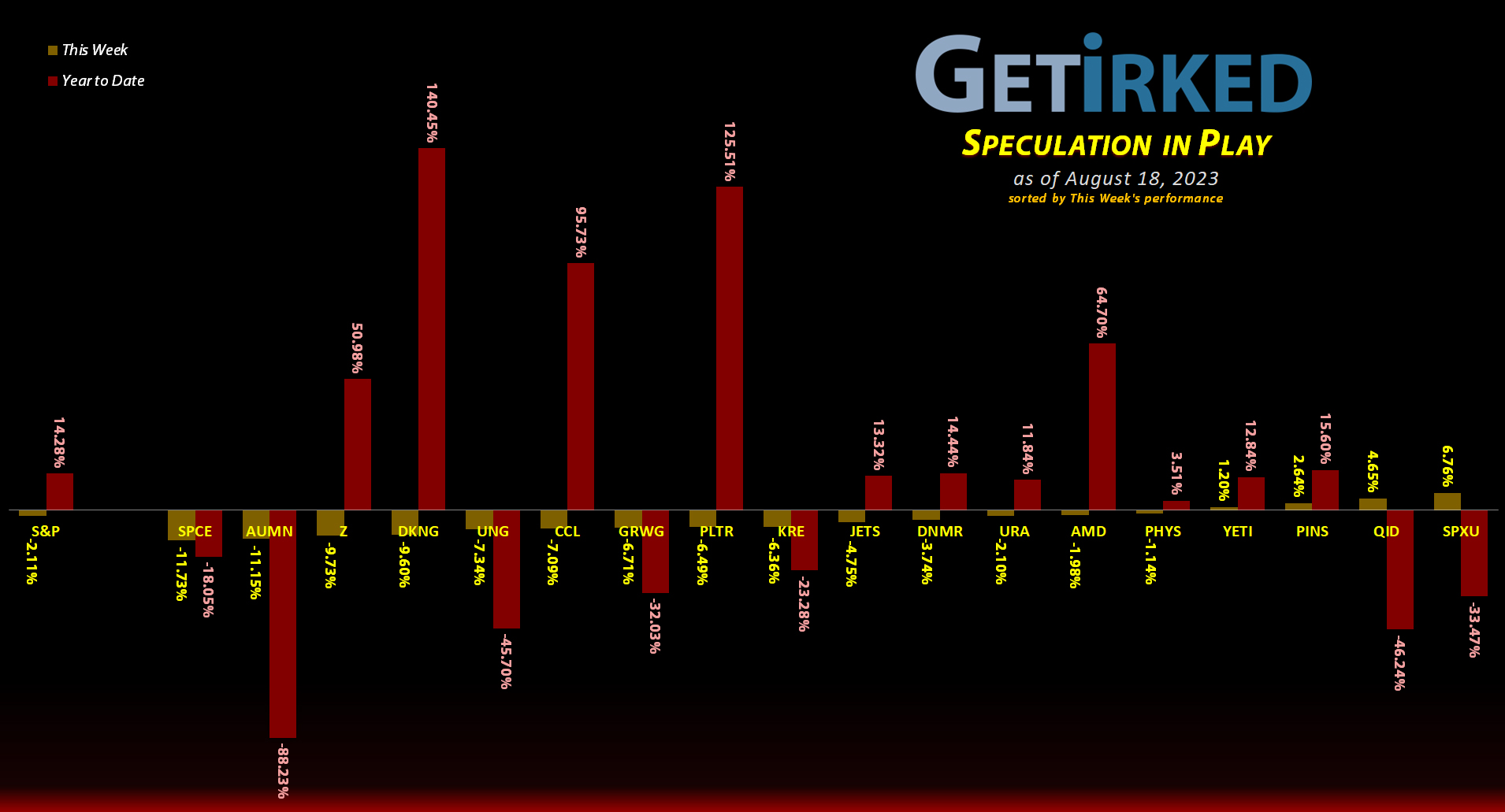

The Week’s Biggest Winner & Loser

Pinterest (PINS)

While, of course, my short positions on the S&P 500 and Nasdaq-100, SPXU and QID, respectively, were the biggest gainers this week as the indexes sold off, I prefer to look at the individual stock that outperformed in a down market.

This week, that outperformer was Pinterest (PINS). The social media network was identified by analysts as having an ever-improving advertising model and rumors also swirled that larger companies were eyeing PINS for either a partnership or even an outright takeover.

As a result, Pinterest rallied +2.64% in a downtrodden week, and that performance was enough to earn it the spot of the Week’s Biggest Winner.

Virgin Galactic (SPCE)

Despite finally starting commercial operations in the past few months, Virgin Galactic (SPCE) remains one of the most speculative investments out there since any accident, no matter how small, could render the company bankrupt.

Combine the speculative nature of SPCE with a market that’s starting to turn away from risk assets, and you get the situation we saw this week where Virgin Galactic was pushed to new all-time lows and finished the week down -11.73%, crashlanding into the Week’s Biggest Loser landing bay.

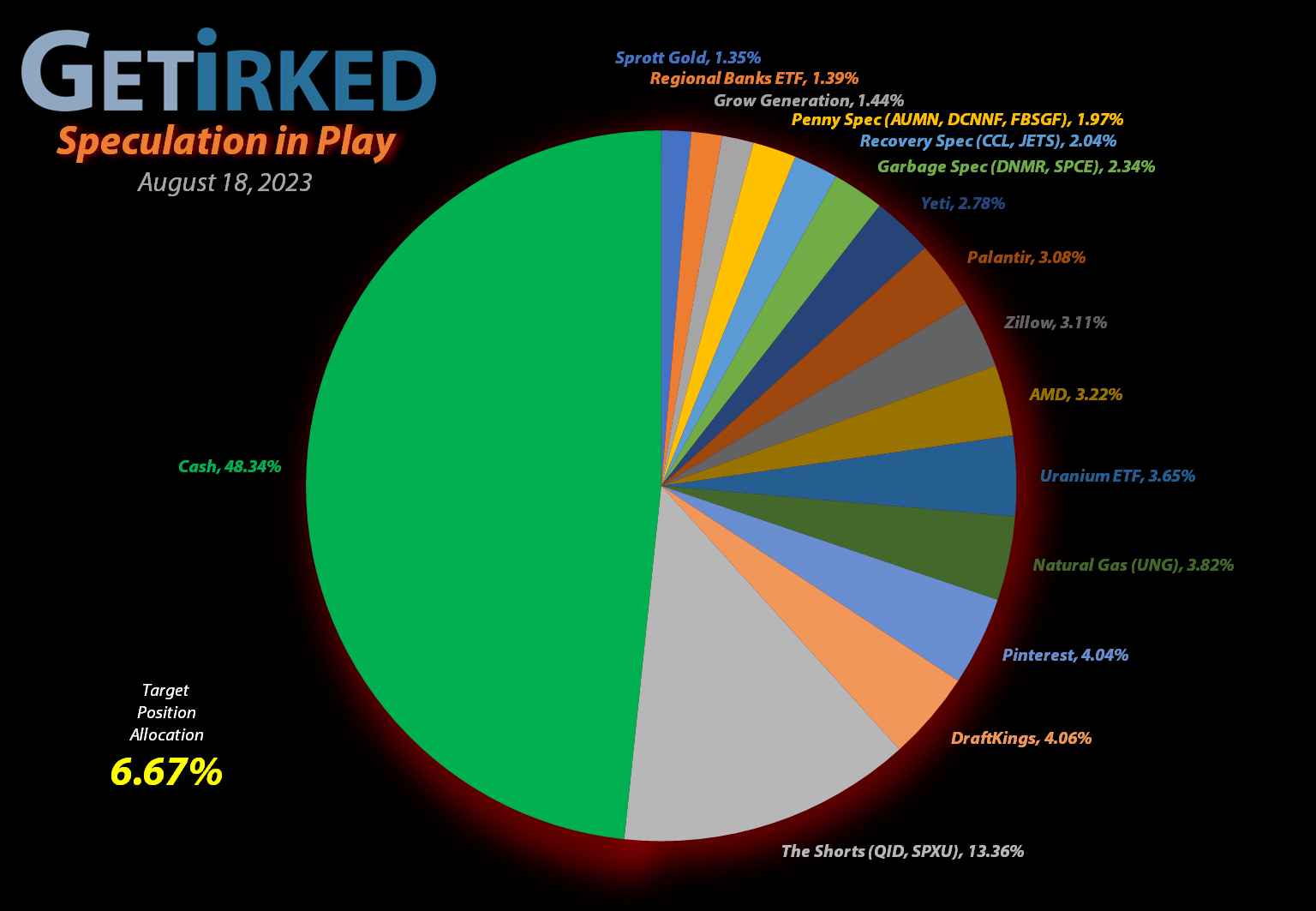

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+614.49%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+386.53%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+369.93%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+123.59%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+88.48%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+68.69%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+26.79%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+13.34%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+5.28%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

-0.92%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Short SPY (SPXU)

-7.94`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.35

Palantir (PLTR)

-10.50%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Short QQQ (QID)

-12.02%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $16.10

U.S. Natural Gas (UNG)

-15.88%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

DraftKings (DKNG)

-19.61%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Canadian Pal (DCNNF)

-51.52%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-75.96%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-81.34%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-86.21%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-97.12%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

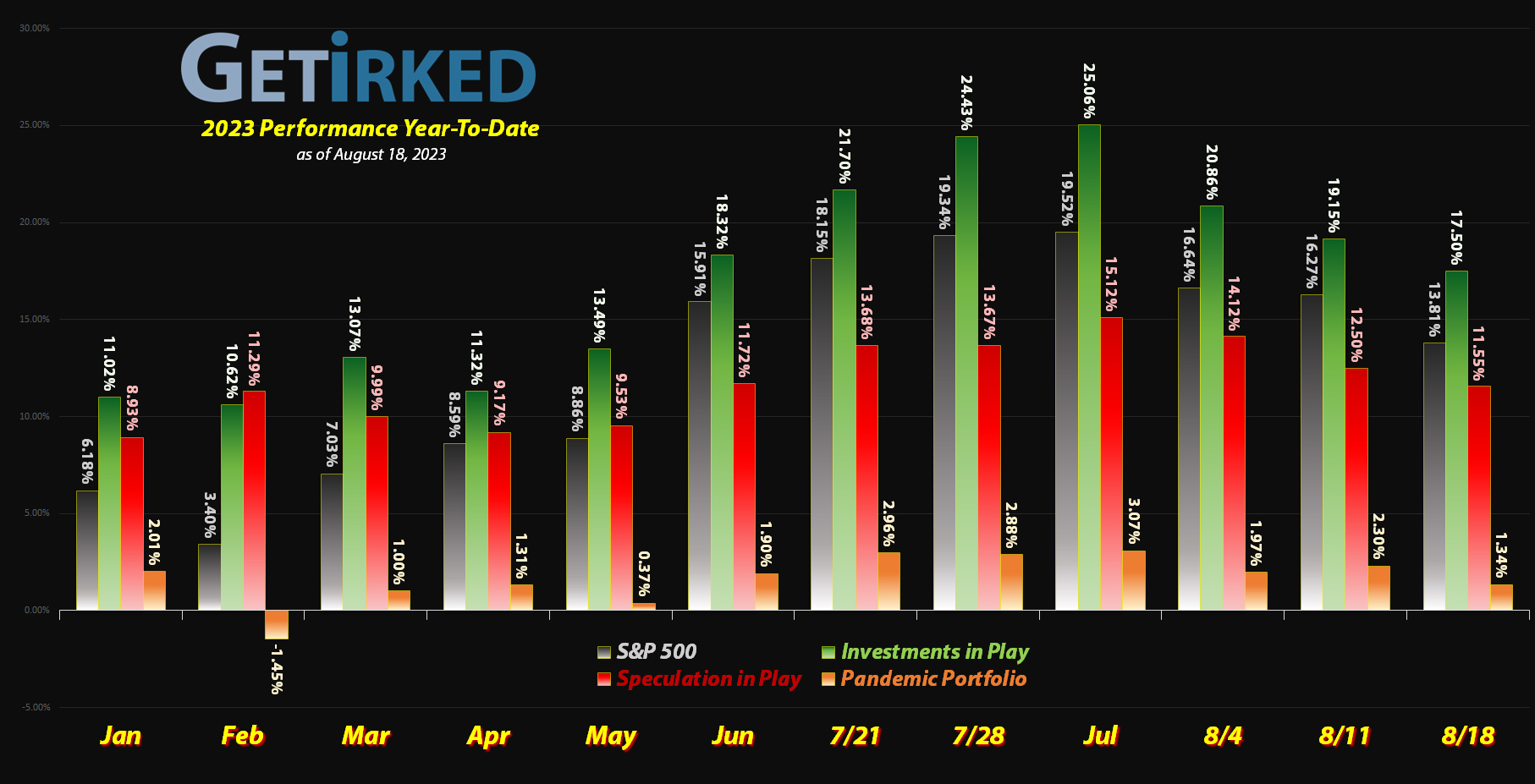

The Rotation of the Market Seasons

It’s now been four weeks and I’ve made no moves in the Speculation in Play portfolio. Over the past four weeks, I’ve addressed the dangers of forcing moves in a portfolio when there are no moves to make; sometimes, there’s nothing to do but wait until stocks sell off enough or rally enough – that’s it.

However, what the market appears to be doing right now is rotating from what I call seasons. For the majority of 2023 (barring March, of course) the market had been in Selling Season, where stocks rally so significantly that I’m not adding to any positions. Instead, I’m taking profits and trimming wherever possible as conditions become more and more overbought.

Over the past few weeks, the market has started to rotate into Buying Season. Just like our real-life winters and summers being broken up by springs and autumns, the market doesn’t just flip from one season into another.

This in-between time is where investing can become incredibly boring.

I don’t simply start adding to positions when the market begins to roll over. I wait for my positions to hit their buying targets. So, sometimes, it’s very possible that the market won’t sell off enough for me to add to anything before it rotates back to Selling Season and starts to rally. So be it.

In the meantime, it’s time for hand-sitting. I sit on my hands and do nothing – neither add to nor take profits in position. That’s it.

The key to disciplined long-term investing is patience, and while it’s very simple in theory, the practice is where the rubber meets the road.

… or the hands are sat on by my butt.