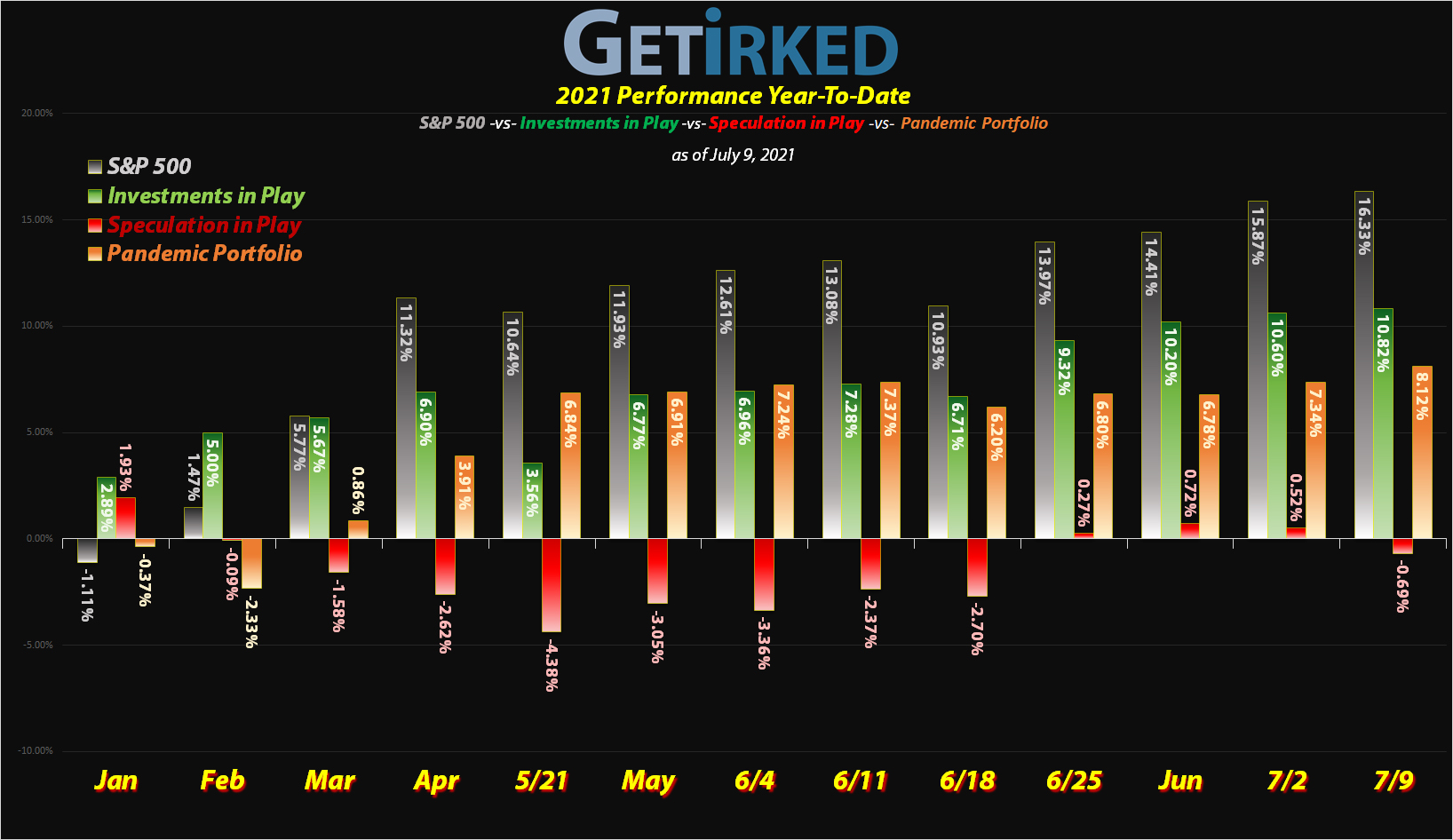

July 9, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

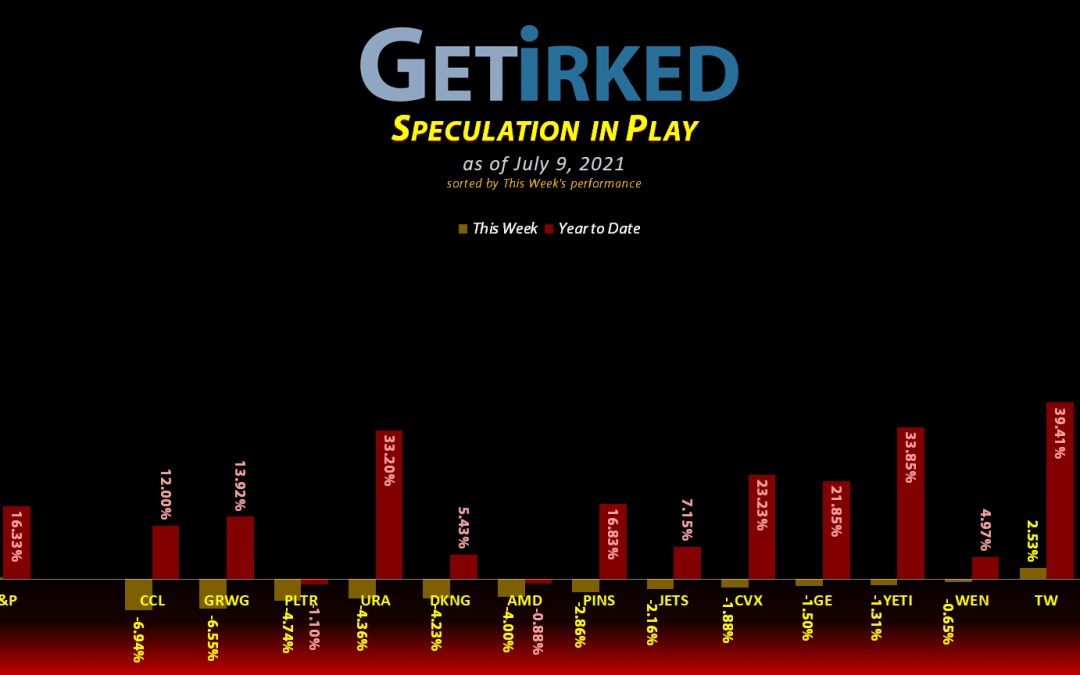

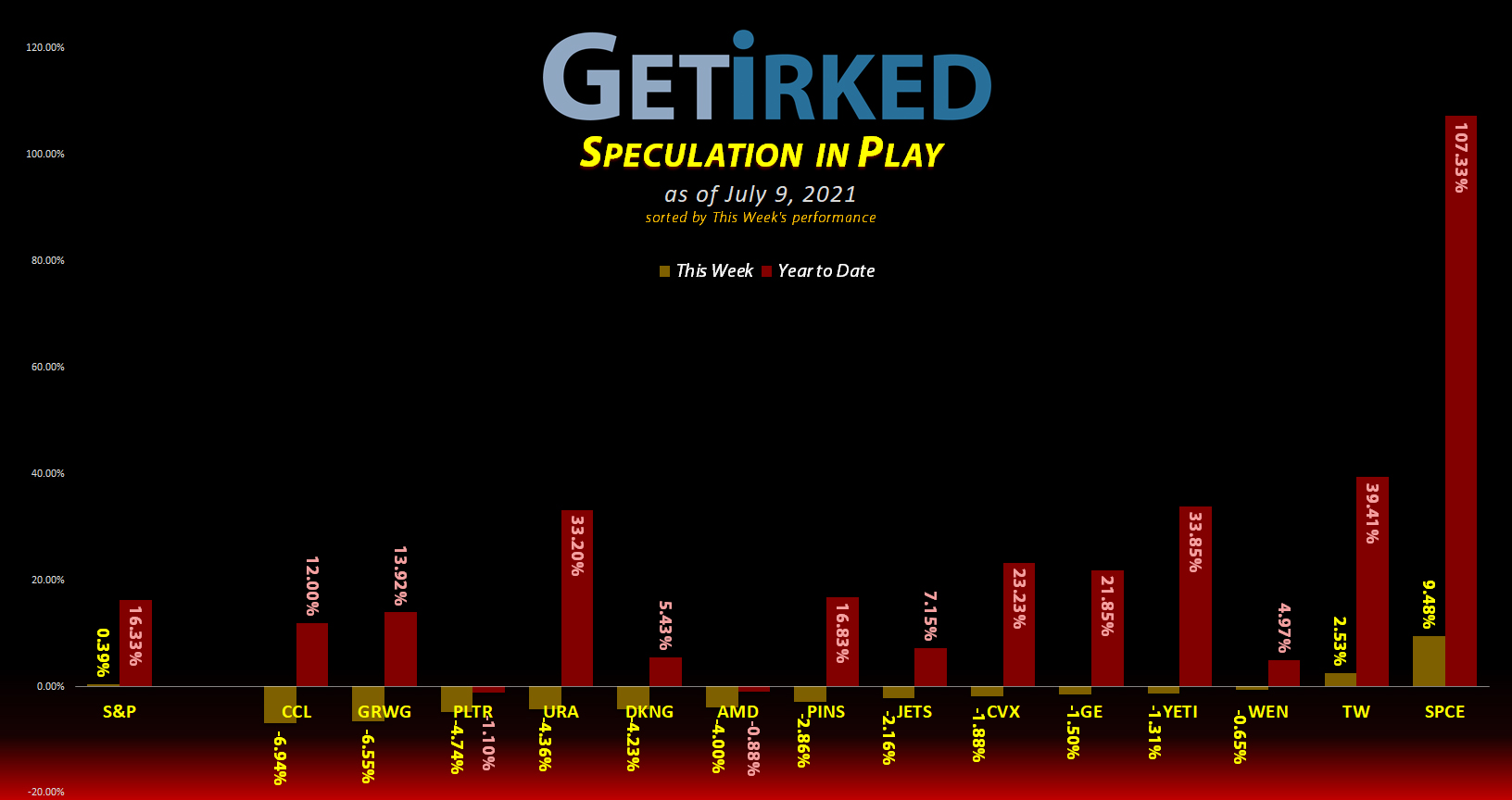

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

After crashing down a bit last week, Virgin Galactic (SPCE) once again pulls up, locking in +9.48% in weekly gains and earning itself the Week’s Biggest Loser as the date of its first civilian launch with Richard Branson aboard rapidly approaches later in July.

Carnival Cruise Lines (CCL)

Carnival Cruise Lines (CCL) along with the rest of the tourism and hospitality sector sank this week as the Covid Delta variant rear its ugly head internationally. Both domestic and international tourism is expected to get pounded as the more-contagious variant takes root everywhere.

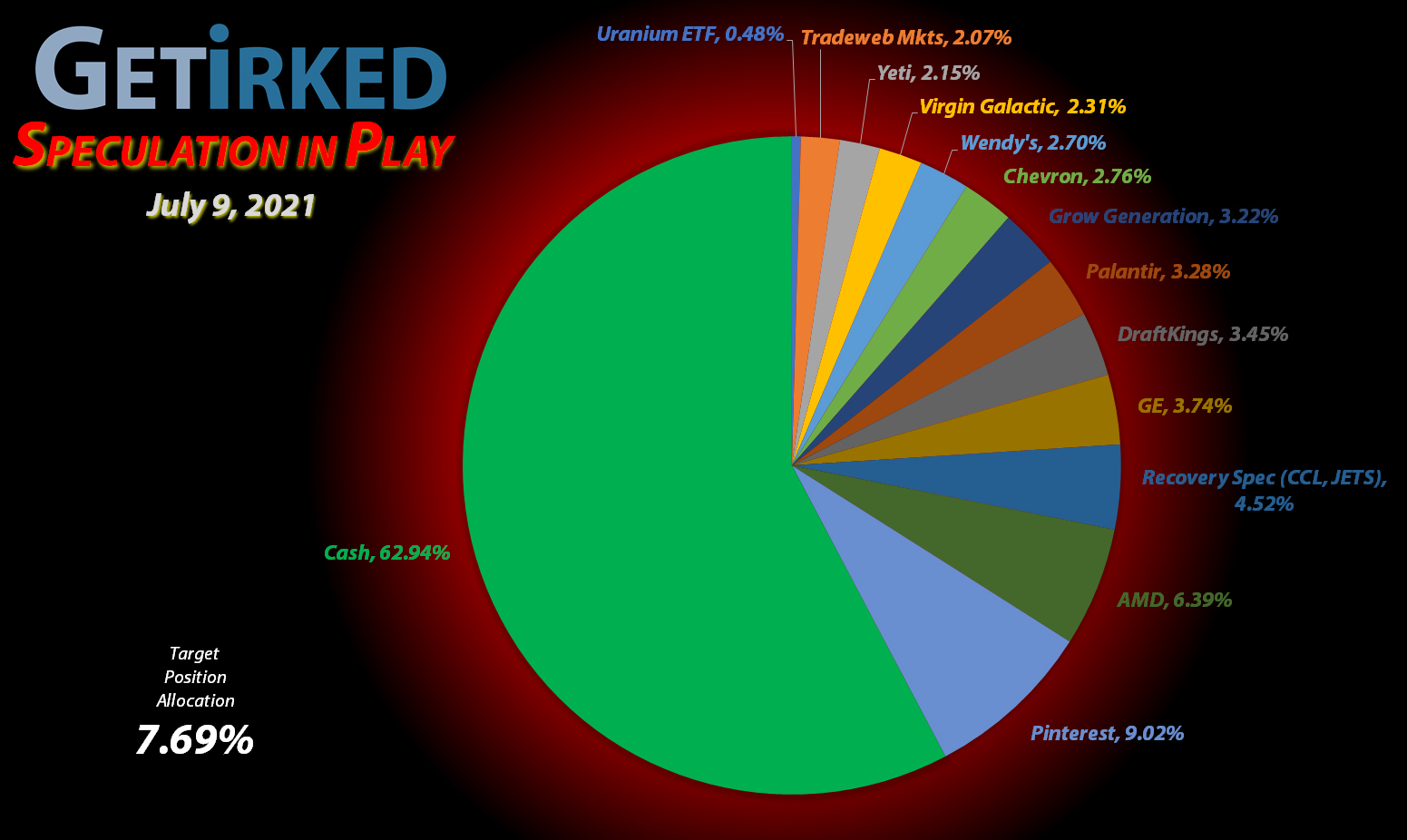

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+736.37%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Yeti (YETI)

+495.26%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+464.51%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Virgin Galactic (SPCE)

+379.44%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$56.17)*

AMD (AMD)

+313.18%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $22.00

Airlines ETF (JETS)

+242.89%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+184.47%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($128.08)*

Chevron (CVX)

+152.96%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+83.89%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($1.00)*

Grow Gen. (GRWG)

+68.95%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $27.12

Uranium ETF (URA)

+54.35%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $13.23

Palantir (PLTR)

-4.61%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.42

DraftKings (DKNG)

-4.68%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $51.50

Wendy’s (WEN)

-13.50%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $26.60

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

No Moves… Patiently Waiting…

As we head through summer, volatility looks like it may be back in the markets so things could get exciting very quickly. With a few positions like Pinterest (PINS) reaching for profit-taking targets and others reaching buying targets, the summer might pick up for the Speculation in Play portfolio.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.