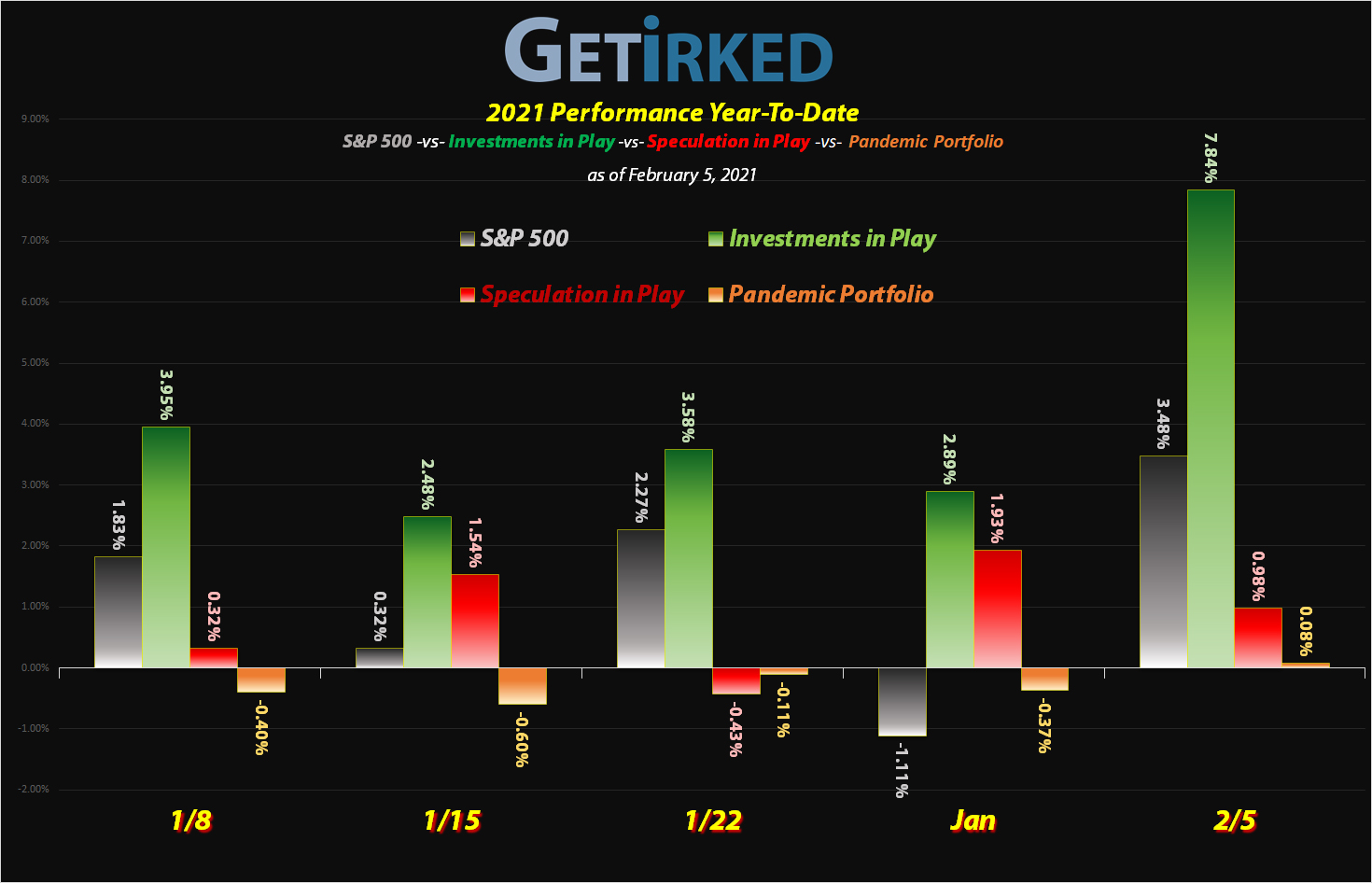

February 5, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

GrowGeneration (GRWG)

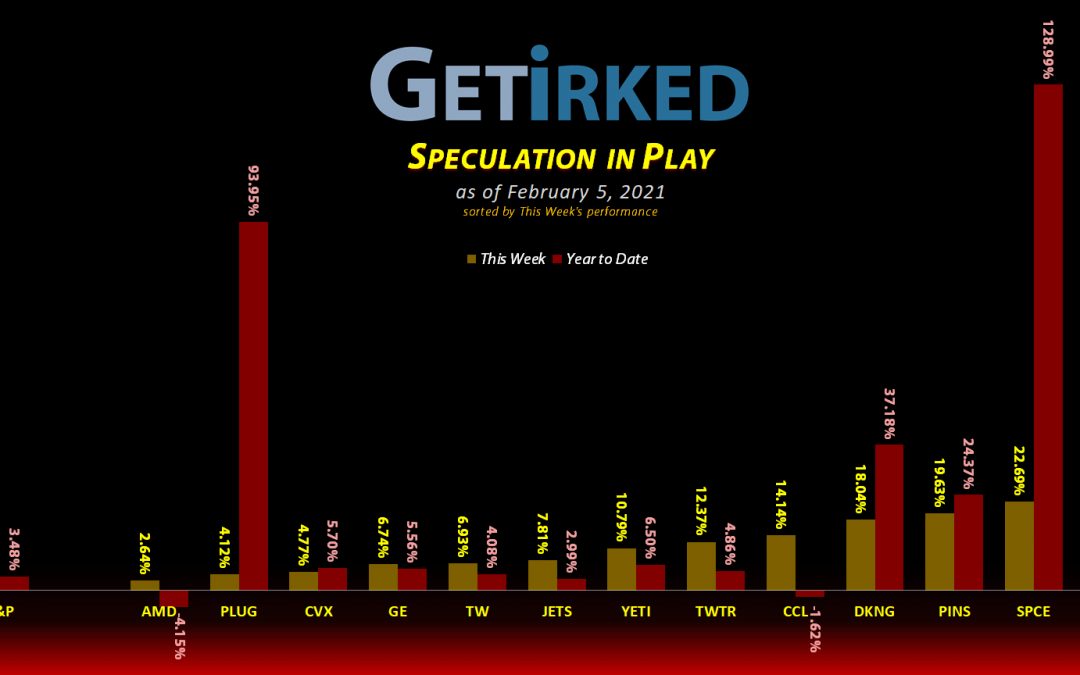

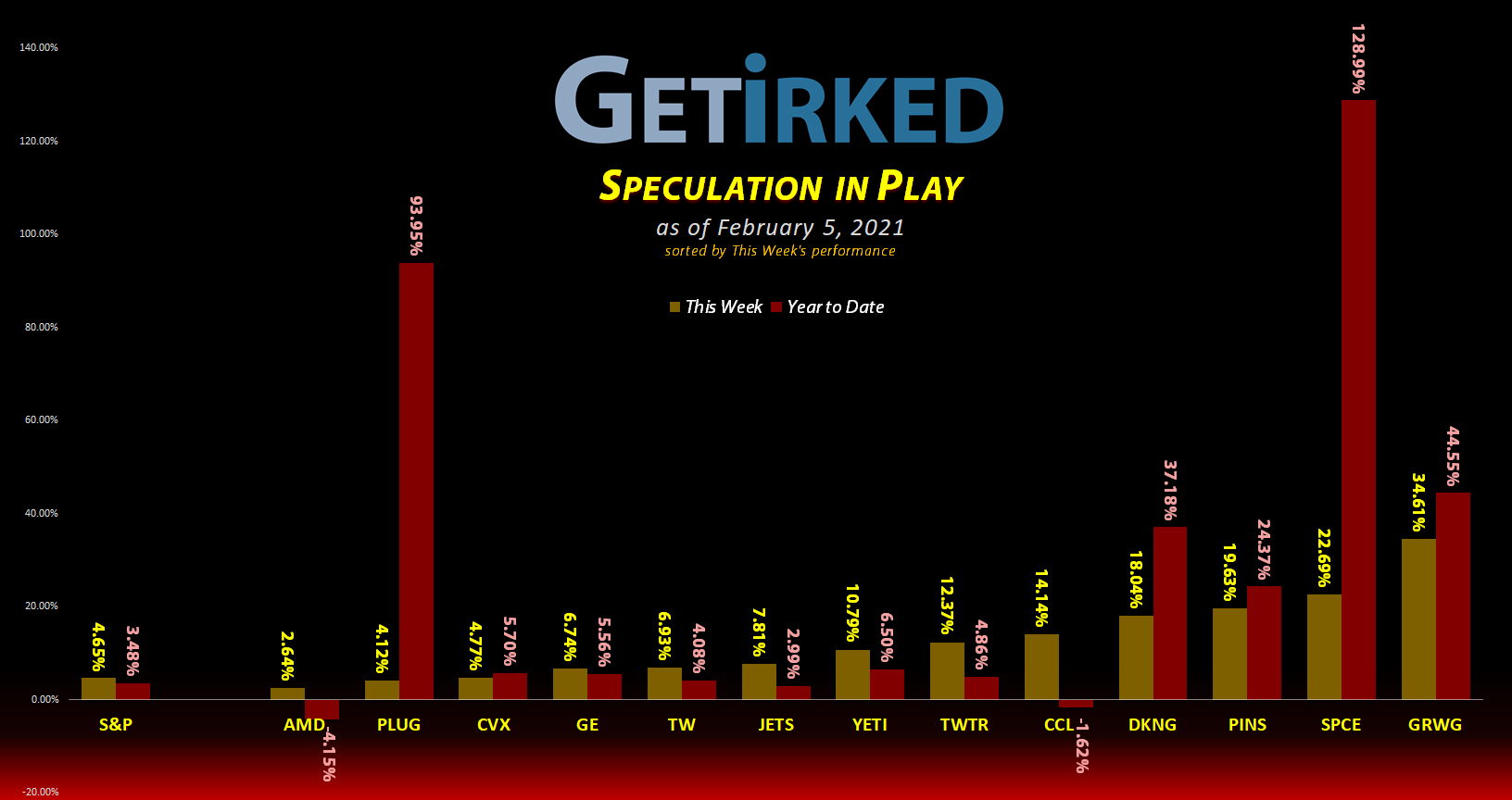

Picks-and-shovels cannabis play, GrowGeneration (GRWG), got some fertilizer this week, popping +34.61% to become the Week’s Biggest Winner.

AMD (AMD)

While a solid outperformer, AMD’s (AMD) recent announcement of its intention to acquire semiconductor Xilinx (XLNX) has led to mixed results with shareholders – and the stock price – as AMD became the Week’s Biggest Loser by gaining the least: +2.64%.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Tradeweb Mkts (TW)

+823.83%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $7.04

Pinterest (PINS)

+769.43%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

AMD (AMD)

+483.47%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$6.69)*

Airlines ETF (JETS)

+473.77%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $4.87

Yeti (YETI)

+455.58%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+395.87%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Virgin Galactic (SPCE)

+277.89%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$100.00)*

Twitter (TWTR)

+266.73%*

1st Buy: 10/30/2019 @ $29.79

Closed: February 2, 2021

Grow Gen. (GRWG)

+163.55%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $22.06

Chevron (CVX)

+128.15%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+125.33%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $5.06

Plug Power (PLUG)

+110.97%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $31.18

DraftKings (DKNG)

+20.58%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $52.97

2/19 SPY Put Spreads

-92.32%

Cost: $5.9914

Current Value: $0.46

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Recovery Speculation Basket

Airlines ETF

JETS

Carnival Cruise

CCL

What is the Recovery Speculation Basket?

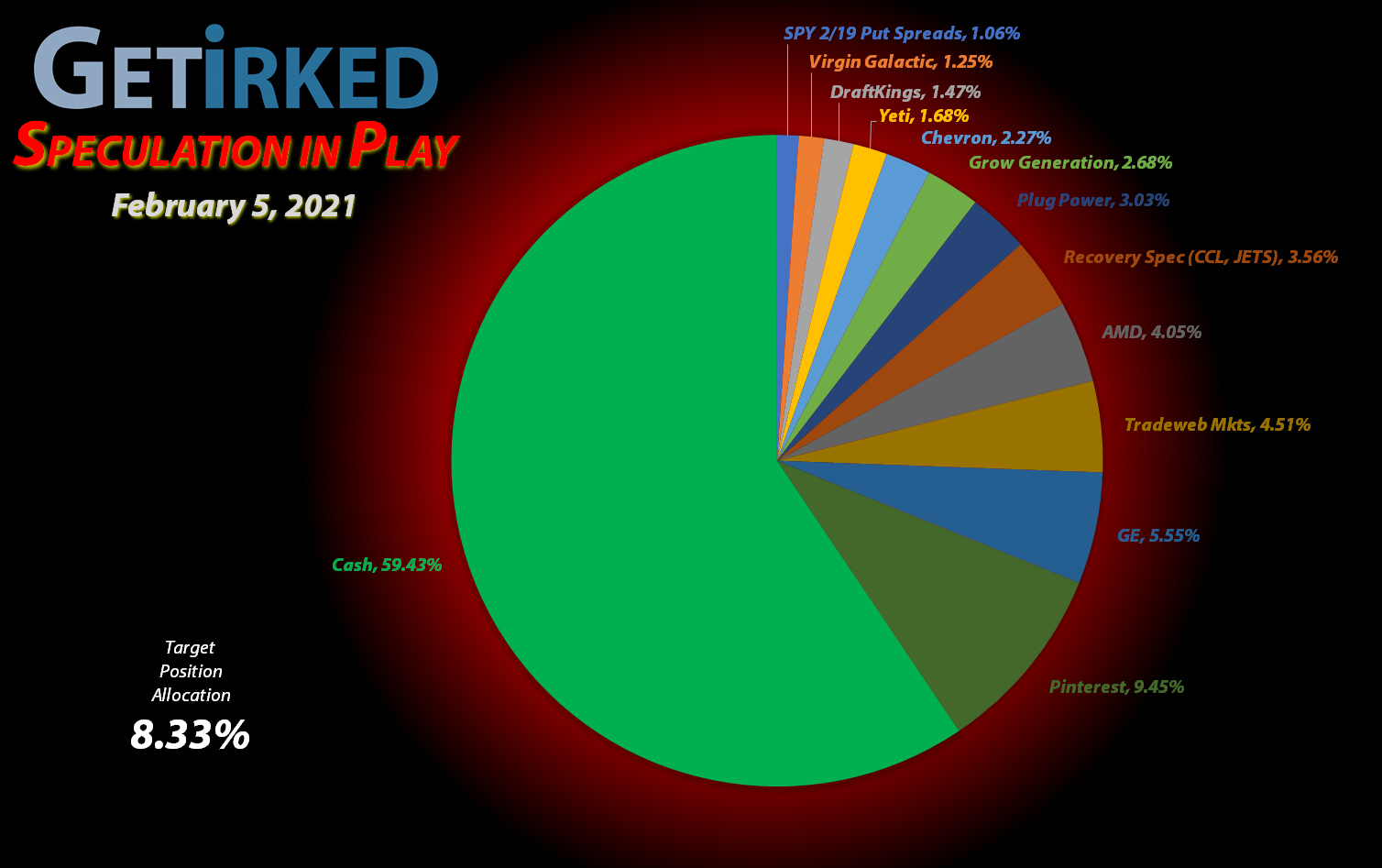

The Recovery Speculation Basket (“Recovery Spec”) represents stocks that will thrive if vaccines are released quickly and we return to normal but have the likelihood of collapsing if more lockdowns occur. These positions are too speculative to have their own allocation and share a single allocation.

Currently, my Recovery Spec stocks are as follows: the Airlines Exchange Traded Fund (JETS) and Carnival Cruise Lines (CCL). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Twitter (TWTR): *Closed Position: +266.73% Gain*

When Twitter (TWTR) bounced with the rest of the market on Tuesday, I decided it was time to remove it from the portfolio, closing it at $54.32 and capturing a lifetime gain of +266.73% on my starting capital with my first purchase made on October 30, 2019.

I decided to close Twitter because of the negative headwind risk stemming from government regulation and potential backlash from its customers over banning Donald Trump’s account. While I have ethical reasons for fully supporting Twitter’s decision to ban Trump, his popularity on the platform may result in a significant loss of users to Twitter which may negatively impact its business.

In addition, between Twitter and Pinterest (PINS), I have two social media plays in this portfolio, and with PINS reigning the portfolio as its all-time most successful play, I’m adhering to the strict rules of diversification and getting rid of TWTR.

Also, thanks to the addition of DraftKings (DKNG) to the portfolio last week, the removal of TWTR takes the target allocation for each position back up to 9.09% instead of 8.14%.

TWTR closed the week at $56.78, up +4.53% from where I closed it Tuesday.

Virgin Galactic (SPCE): Profit-Taking

Virgin Galactic (SPCE) continued to have a wild ride this week, skyrocketing through its all-time high once again to make a new top at $62.80. Not wanting to waste this volatility, I took profits at $59.20 using limit orders (I never use market orders and only use trailing stop orders on less volatile stocks) on Thursday, lowering my per-share cost to -$100.00 per share.

From here, I’ve been watching SPCE’s pattern and believe I will be able to replace a few of those shares at $40.20, a discount of more than -30% from where I sold. At this time, I have no additional sell targets as I believe we could see SPCE either go much higher or much lower from here.

SPCE closed the week at $54.34, down -8.21% from where I sold Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.