Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #5

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

Wait a little, Add a little…

The market hasn’t seen as much volatility over the past month (since my last update) as it did in September so there’s been a bit of sitting on my hands, collecting dividends, and revisiting strategies.

This week, a poor outlook for 5G rollouts led to my adding more to Crown Castle (CCI) so it was time for an update of where the Pandemic Portfolio stands and what adjustments I’ve made to my price targets to add more to the positions in this stalwart dividend-earning collection.

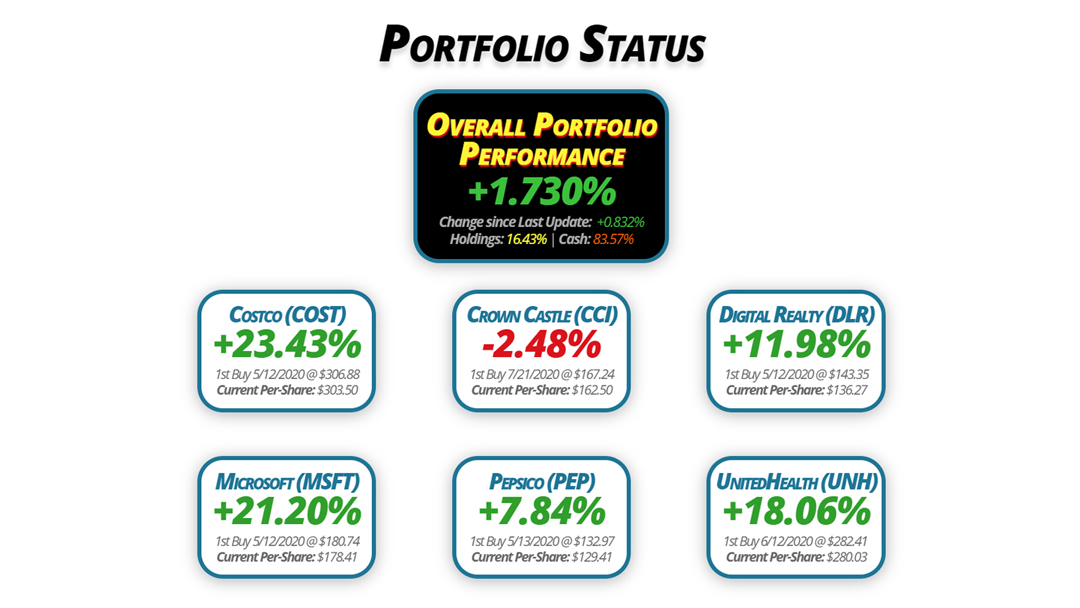

Portfolio Status

Overall Portfolio

Performance

+1.730%

Change since Last Update: +0.832%

Holdings: 16.43% | Cash: 83.57%

Costco (COST)

+23.43%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $303.50

Crown Castle (CCI)

-2.48%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $162.50

Digital Realty (DLR)

+11.98%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $136.27

Microsoft (MSFT)

+21.20%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $178.41

Pepsico (PEP)

+7.84%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.41

UnitedHealth (UNH)

+18.06%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $280.03

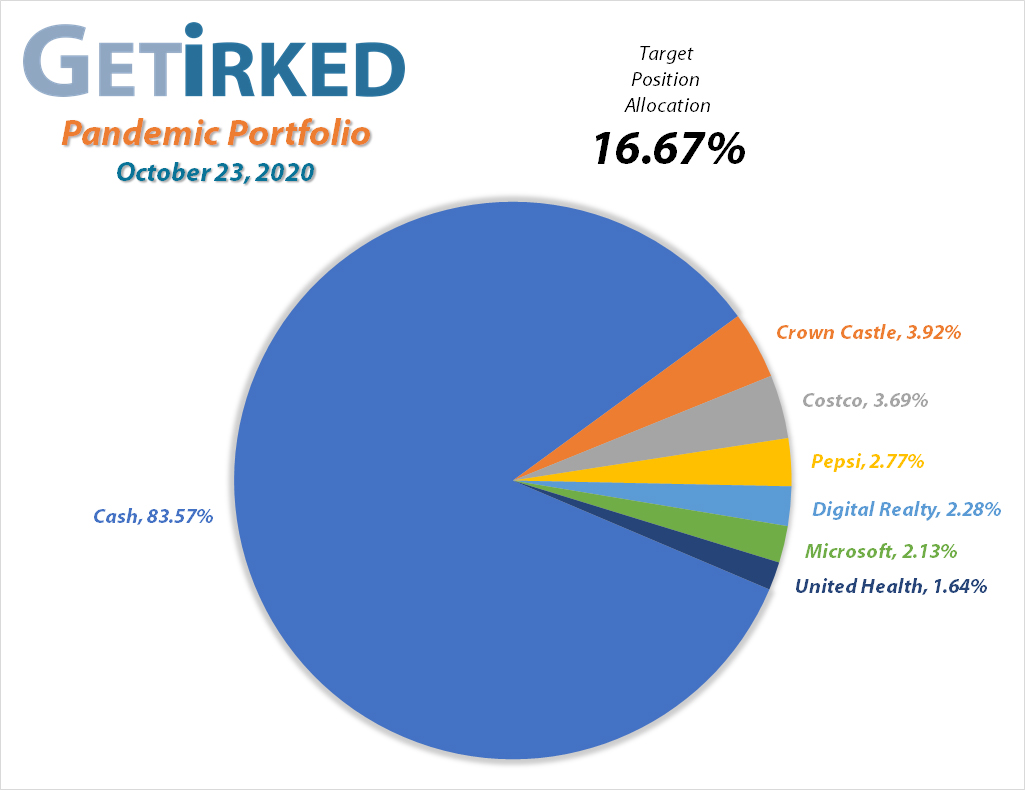

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Moves Since Last Update

Costco (COST): Strategy Update

Current Price: $374.60

Per-Share Cost: $303.50 (Unchanged from last update)

Profit/Loss: +23.43%

Allocation: 3.690%*

Next Buy Target: $338.90

Costco (COST) continues to dominate during the pandemic, rarely pulling back to offer a buying opportunity. While I typically abhor buying a stock at above my per-share cost, I’m having to make a lot of exceptions in this portfolio, a high-quality problem given how far a few of the positions have run.

Costco remains the Best-in-Breed retailer in or out of the pandemic, and, accordingly, I’m going to add more to this high-flyer if it pulls back.

Crown Castle (CCI): Added to Position

Current Price: $158.47

Per-Share Cost: $162.50 (-2.167% from last update)

Profit/Loss: -2.48%

Allocation: 3.917%*

Next Buy Target: $148.90

Crown Castle International (CCI) paid out its quarterly dividend of $1.20 per share on October 1, 2020 which gave it an annual yield of 2.89% as of its $166.10 closing price.

Since CCI is enrolled in the Dividend Reinvestment Program (DRiP) with my broker, I received shares instead of cash, lowering my per-share cost -0.72% from $165.23 to $164.04.

After reporting disappointing forecasts and a poor earnings report on October 21 reporting a loss of -$0.11 per share when the street expected a profit of $0.49 per share, Crown Castle (CCI) crashed through the 200-day Moving Average and triggered a buy order I had in place which filled at $156.29 on Thursday, October 22 when CCI was yielding an annual dividend slightly more than 3%.

Thursday’s buy lowered my per-share cost -0.94% from $164.04 to $162.50. By Buying in Stages, I have lowered my per-share cost a total of -2.83%, so far, from my initial $167.24. My next buy target is $148.90.

CCI closed the week at $158.47, up +1.39% from where I added.

Digital Realty Trust (DLR): Dividend Reinvestment

Current Price: $152.60

Per-Share Cost: $136.27 (-0.76% from last update)

Profit/Loss: +11.98%

Allocation: 2.285%*

Next Buy Target: $141.90

Digital Realty Trust (DLR) paid out its quarterly dividend of $1.12 per share on October 1, 2020 which gave it an annual yield of 3.05% as of its $146.74 closing price.

Since DLR is enrolled in the Dividend Reinvestment Program (DRiP) with my broker, I received shares instead of cash, lowering my per-share cost -0.76% from $137.31 to $136.27.

Like several of the other positions in this portfolio, Digital Realty Trust’s strength means I’m eyeing adding more to this position at a price point ($141.90) above my per-share cost.

Microsoft (MSFT): Strategy Update

Current Price: $216.23

Per-Share Cost: $178.41 (Unchanged from last update)

Profit/Loss: +21.20%

Allocation: 2.134%*

Next Buy Target: $200.30

Microsoft (MSFT) continues to hold up like a champ despite challenges coming to the tech sector from time to time. Accordingly, I’ve raised my price target to add to this position slightly above $200, 12.27% above my current per-share cost.

Hey, when you want the best, sometimes you have to pay up.

Pepsico (PEP): Dividend Reinvestment

Current Price: $139.56

Per-Share Cost: $129.41 (-0.55% from last update)

Profit/Loss: +7.84%

Allocation: 2.769%*

Next Buy Target: $130.90

Pepsico (PEP) paid out its quarterly dividend of $1.02 per share on October 1, 2020 which gave it an annual yield of 2.94% as of its $139.30 closing price.

Since PEP is enrolled in the Dividend Reinvestment Program (DRiP) with my broker, I received shares instead of cash, lowering my per-share cost -0.55% from $130.12 to $129.41.

Pepsico continues to demonstrate why it’s Best-of-Breed in the soda and snack sector, leading me to raise my buy target above my per-share cost once again to grab some more of this long-termer if it decides to sell off.

UnitedHealth (UNH): Strategy Update

Current Price: $330.60

Per-Share Cost: $280.03 (Unchanged from last update)

Profit/Loss: +18.06%

Allocation: 1.639%*

Next Buy Target: $280.90

UnitedHealth (UNH) has demonstrated some true strengths over the recent weeks and months, however, unlike some of the positions I’ve talked about above, UnitedHealth is notoriously volatile, selling off in excess of 30% seemingly on a whim.

Because of this and the potential volatility stemming from the presidential election, pandemic response, and myriad of negative catalysts on the horizon, I’m keeping my buy price target near my per-share cost for this monstrous mover.

* Target allocation for each position in the portfolio is 16.67% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.