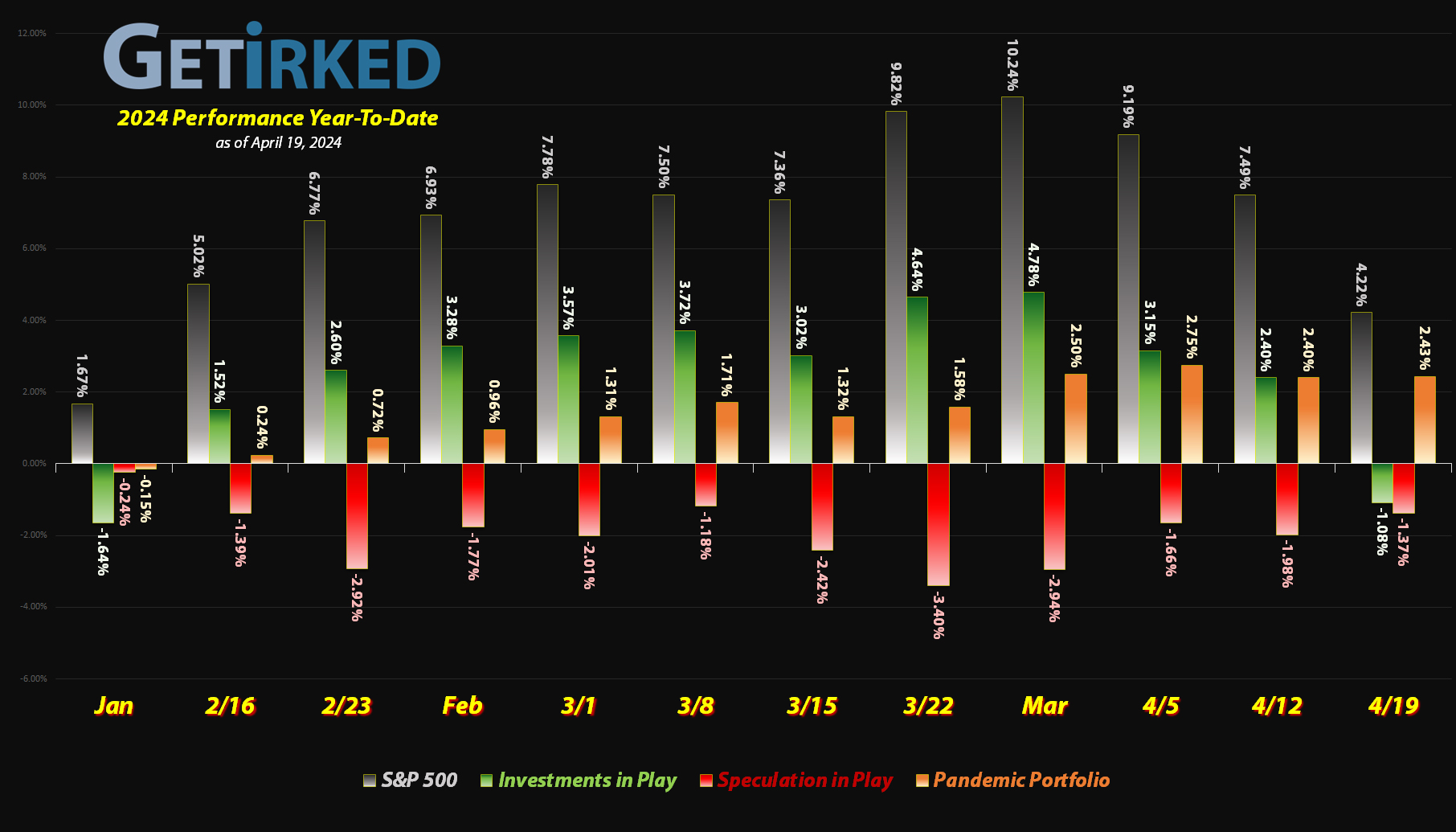

April 19, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

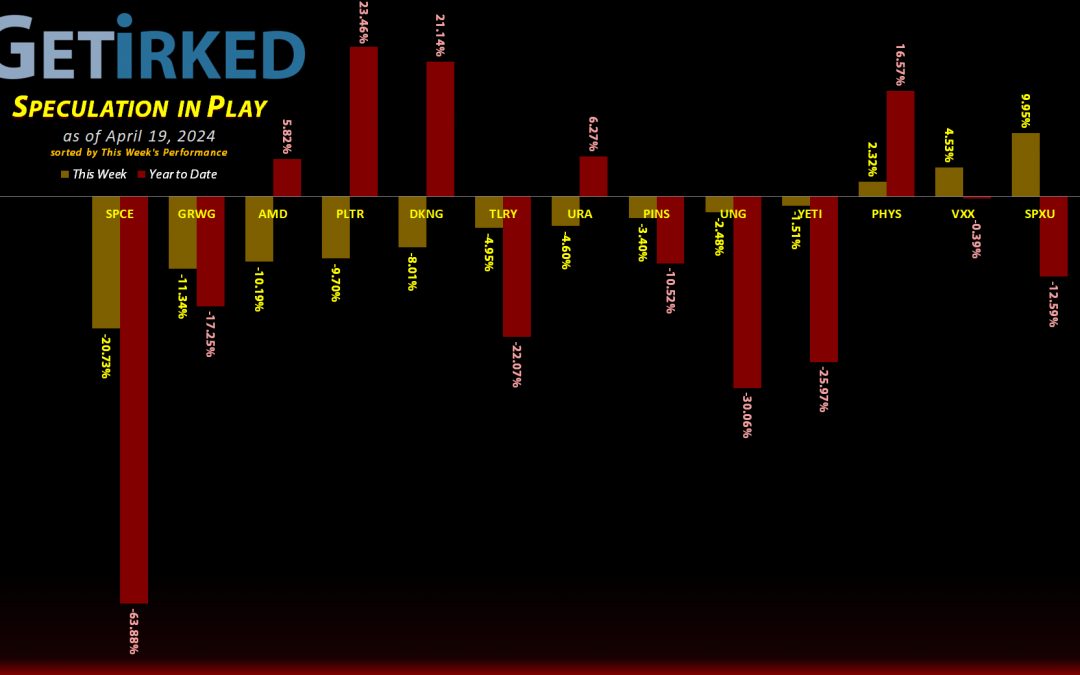

The Week’s Biggest Winner & Loser

Sprott Gold Trust (PHYS)

As always, ignore the shorts. This Week’s Biggest Winner was the Sprott Physical Gold Trust (PHYS) for the second week running. When fear’s driving investors to escape their positions, they often escape into gold. PHYS rallied just +2.32% this week, but in a week this bad, that was enough to cause gold to shine!

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) remains in a tailspin. Concerns about funding and lack of revenue plague the company. To make matters worse, now that the stock has collapsed below $1.00, it’s just a matter of time before they have to execute a reverse-split to stay listed! YIKES! Virgin Galactic dropped another -20.73% this week, making the Biggest Loser in the portfolio for two weeks in a row. Ouch!

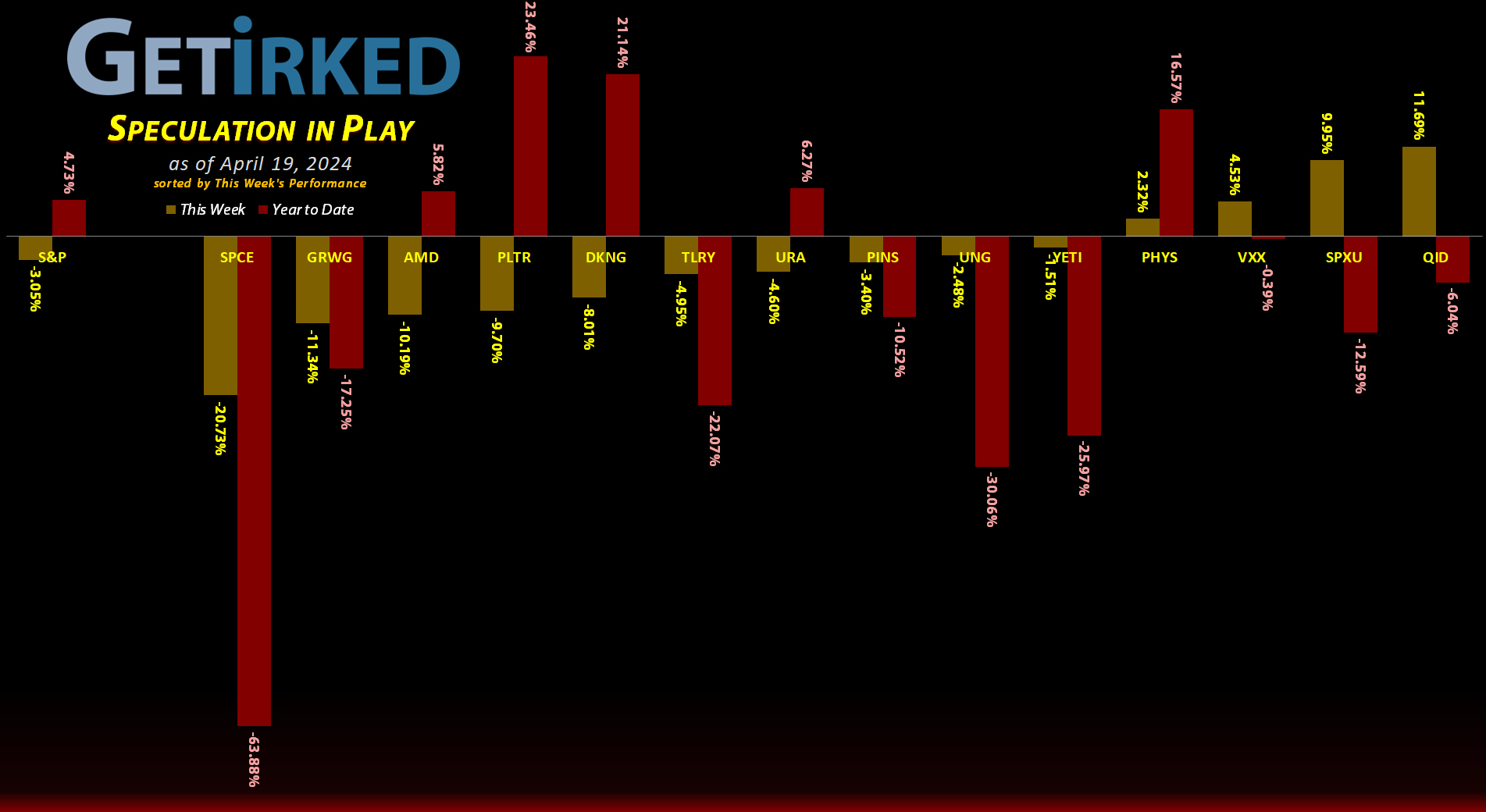

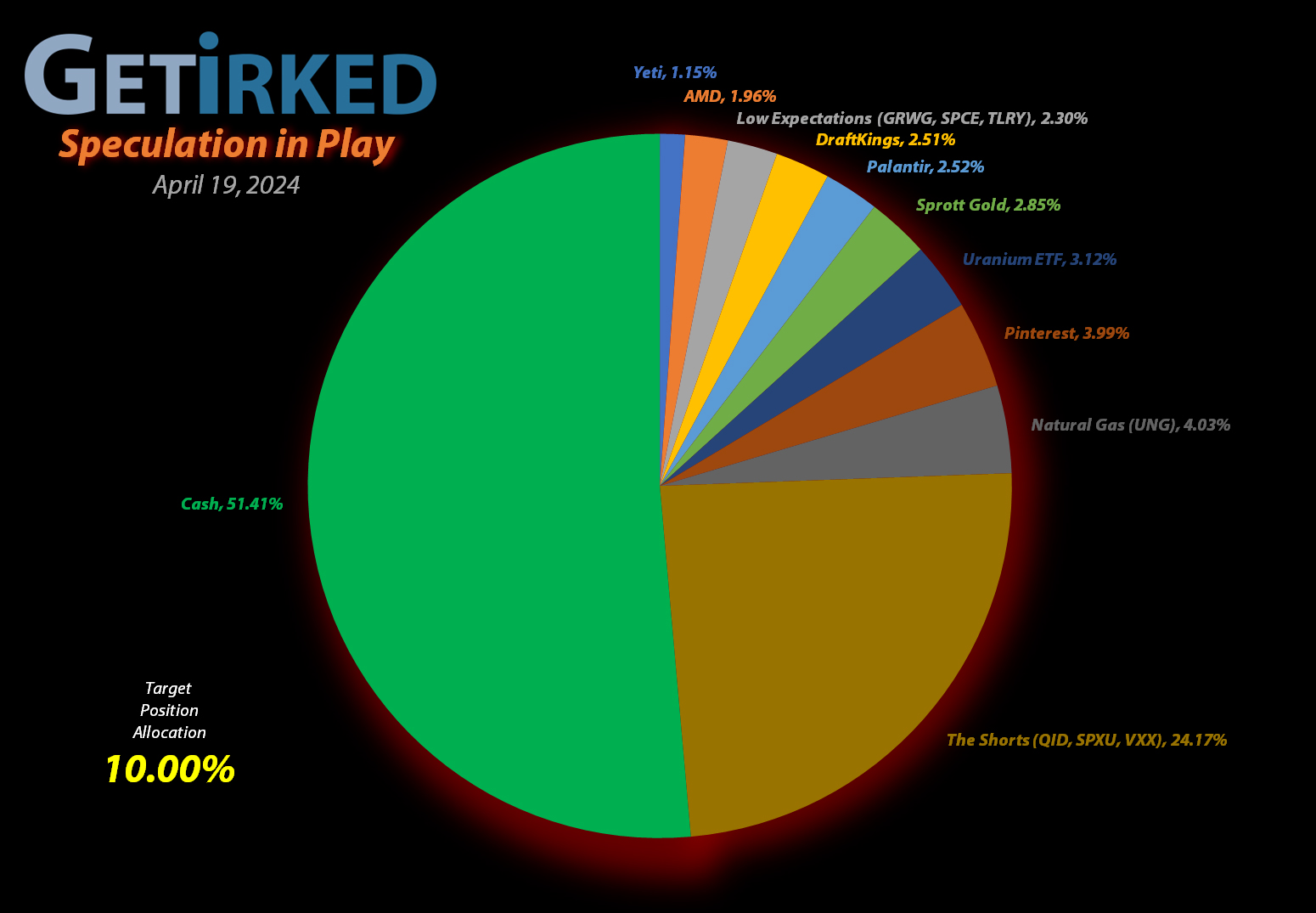

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+777.54%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$556.01)*

Pinterest (PINS)

+413.96%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+386.15%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+157.26%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.20

Virgin Galactic (SPCE)

+70.76%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$1.60)*

Tilray Brands (TLRY)

+46.80%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Palantir (PLTR)

+45.08%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+42.71%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Sprott Gold Trust (PHYS)

+26.71%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-11.85%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $17.55

Short SPY (SPXU)

-20.16%

1st Buy: 3/9/2023 @ $73.75

Current Per-Share: $48.04

Short QQQ (QID)

-23.51%

1st Buy: 3/7/2023 @ $101.00

Current Per-Share: $67.33

U.S. Natural Gas (UNG)

-46.63%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-84.43%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Advanced Micro Devices (AMD): Added to Position

Advanced Micro Devices (AMD) sold off with the rest of tech on Friday, filling my next buy order at $146.11 and added 3.08% to my position, locking in a -19.15% discount replacing some of the shares I sold for $180.75 back January 25.

The buy order raised my per-share “cost” +$131.72 from -$687.73 to -$556.01 (a negative per-share cost indicates all capital has been removed in addition to $556.01 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $133.89, above a key level of support, and I have no plans to take any additional profits as AMD is a relatively small part of the portfolio and nowhere near its allocation target size.

AMD closed the week at $146.64, up +0.36% from where I added Friday.

Virgin Galactic (SPCE): Added to Position

Virgin Galactic (SPCE) imploded this week, crashing below the key psychological support of $1.00 and crashing through my next buy target which added 0.80% to my position at $0.86, locking in a -97.87% discount replacing some of the shares I sold for $40.36 back on January 26, 2021.

The buy raised my per-share “cost” +$0.36 from -$1.96 to -$1.60 (a negative per-share cost indicates all capital has been removed in addition to $1.60 per share added to the portfolio’s bottom line in addition to each share’s current value).

I feel compelled to remind readers every time I add to Virgin Galactic that I am only adding profits I had taken out previously. This position may be the most speculative of the more than 100 I hold, I am fully prepared to lose all the funds in it. However, I have also locked in my risk. I will add two more times lower from here, but, even if Virgin Galactic goes bankrupt, I will have still made +86.49% from this investment – planning the entire trade in advance is key to my risk management.

From here, my next buy target is $0.40, a price calculated using the Fibonacci Method, and, as preposterous as it sounds, my next sell target is $40.40, just below Virgin Galactic’s first all-time high in February 2020.

SPCE closed the week at $0.8561, down -0.45% from where I added Friday.