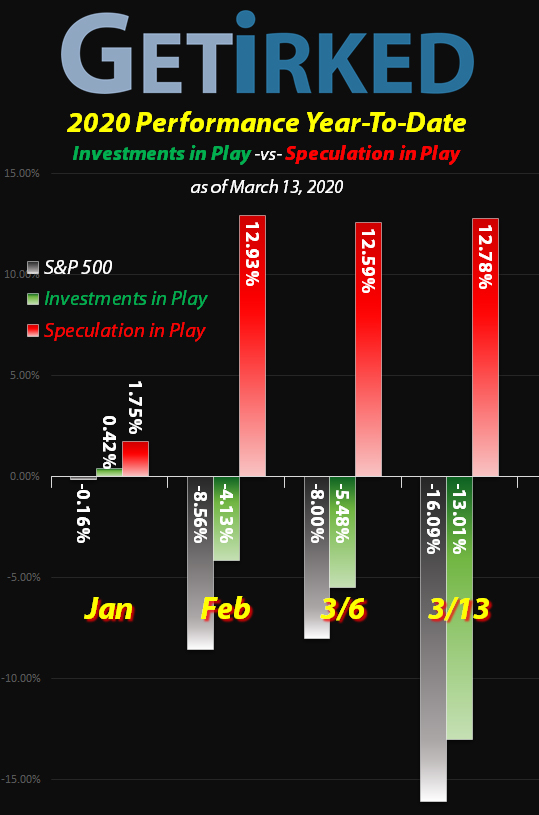

March 13, 2020

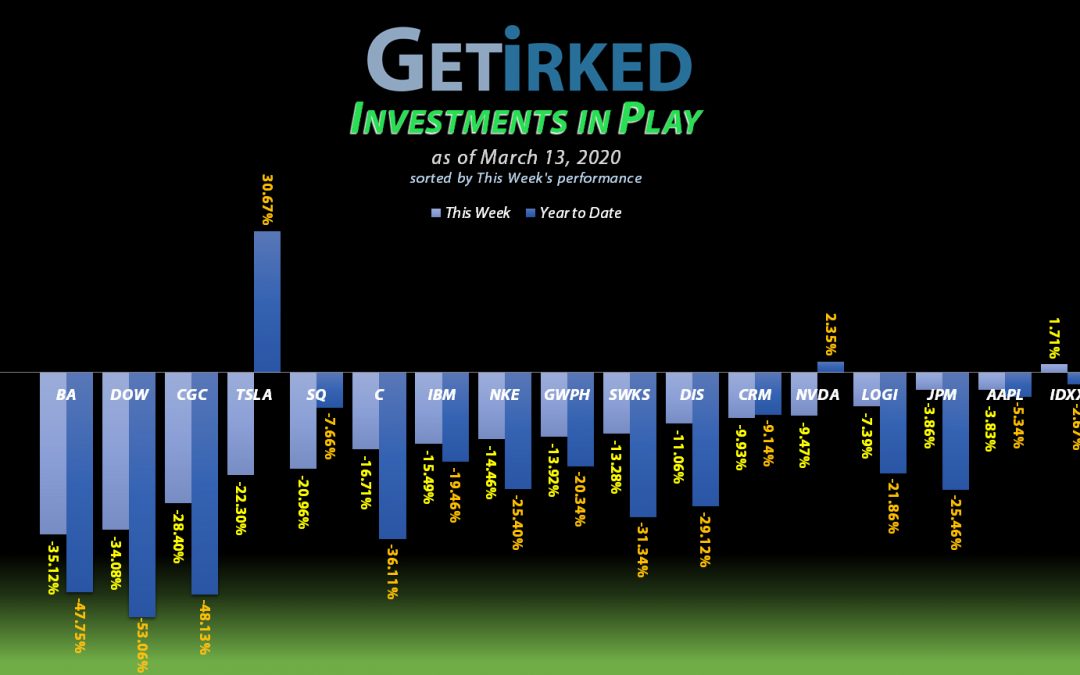

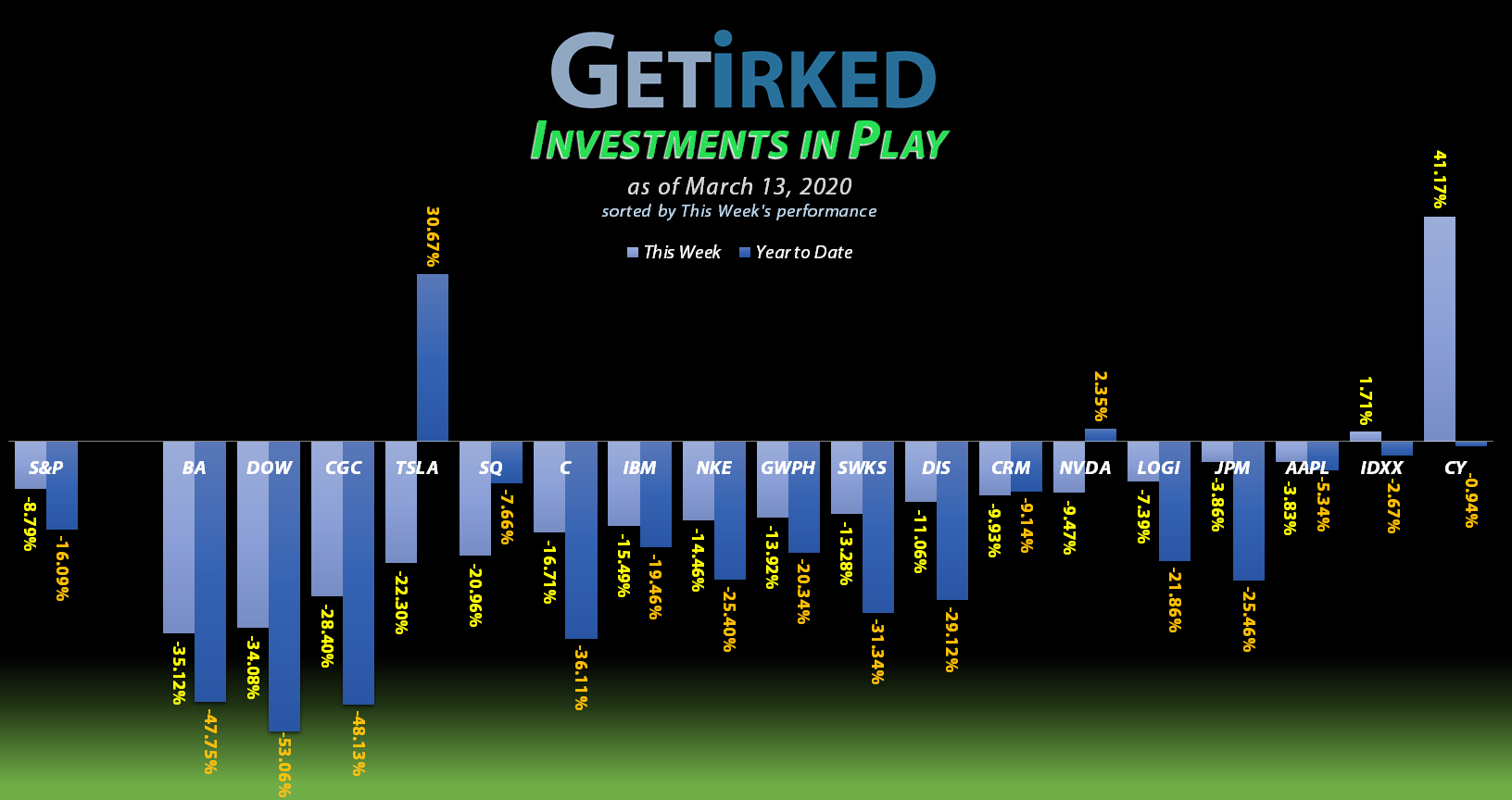

The Week’s Biggest Winner & Loser

Cypress Semi (CY)

Returning champion Cypress Semiconductor (CY) wins the week with a remarkable +41.17% gain within just a few hours of where I re-opened the position to earn itself the Biggest Winner of the Week (and, truthfully, Biggest Winner… ever)

Boeing (BA

Boeing (BA)?! What’s become of you?!!! Even Dow Chemical (DOW) – the ultimate stinker – couldn’t compete with Boeing’s *epic* -35.12% loss this week.

Boeing, I still love you, but, man, that’s not just bad, that’s horrendous.

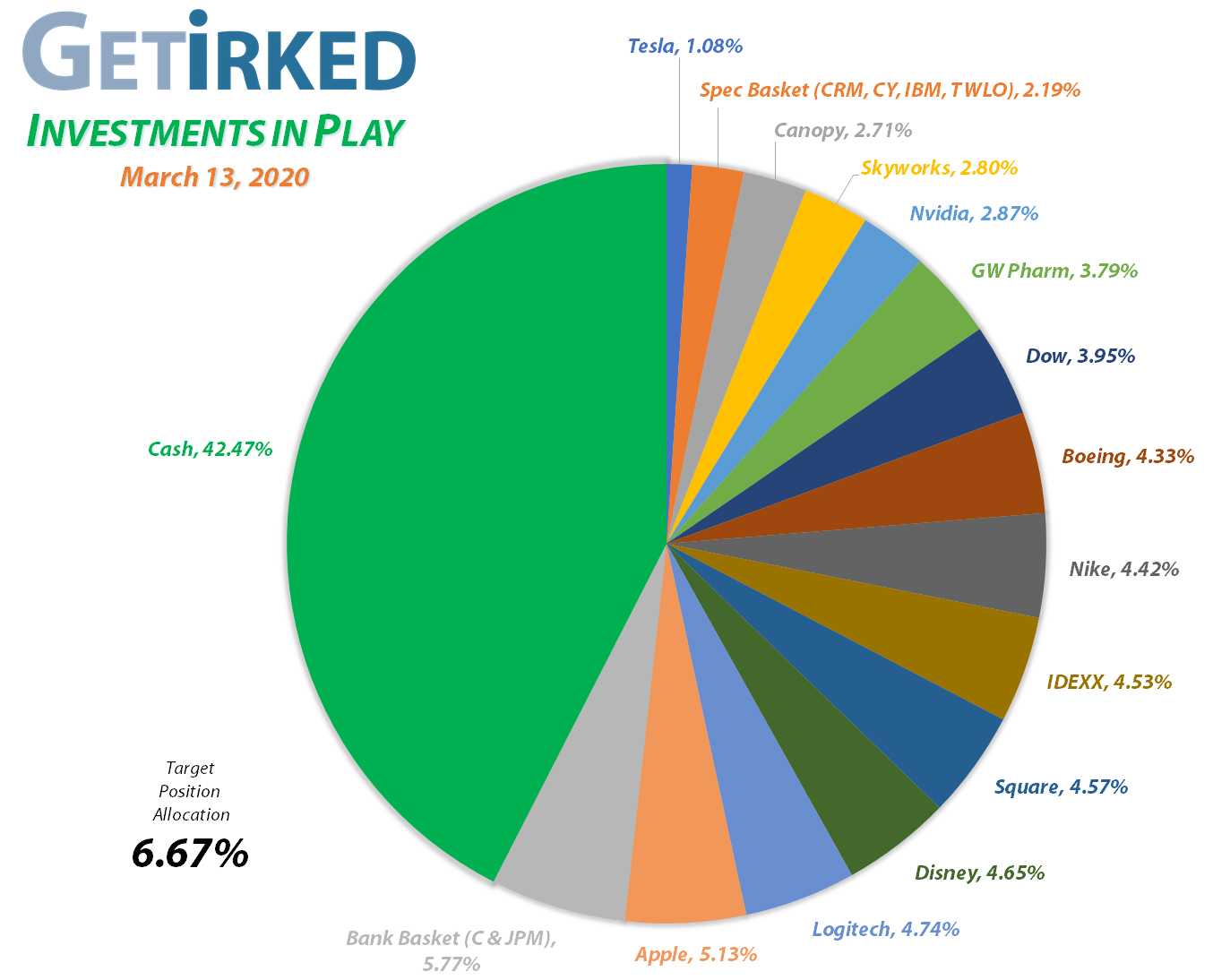

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+623.19%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$411.21)*

Apple (AAPL)

+459.73%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$113.27)*

Square (SQ)

+373.62%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$35.92)*

Nike (NKE)

+314.00%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$27.13)*

Disney (DIS)

+244.04%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $19.49**

Nvidia (NVDA)

+230.72%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$1.07)*

Cypress Semi (CY)

+168.88%*

1st Buy 4/6/2016 @ $8.20

Current Per-Share: (-$324.43)*

Salesforce (CRM)

+166.49%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $55.45

IDEXX Lab (IDXX)

+117.50%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

Twilio (TWLO)

+88.82%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $42.36

IBM (IBM)

+46.80%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

JP Morgan (JPM)

+12.33%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $92.50

Logitech (LOGI)

+11.67%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $33.00

Tesla (TSLA)

-1.77%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $556.49

Citigroup (C)

-10.13%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $56.79

Skyworks (SWKS)

-11.42%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $93.70

GW Pharm (GWPH)

-24.87%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Canopy (CGC)

-31.56%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $15.98

Dow (DOW)

-37.78%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $41.29

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

Risk Management – Baskets

Changes to Risk Management

I regularly review my portfolio, and I finally decided to make some changes to limit the amount of risk exposure I’m taking on in different sectors.

For the most part, these changes have no real effect on what readers will see, but I still wanted to fill everyone in so they can think about risk management in their own portfolios.

Underwater Banking Basket Weaving?

Although I hold both JP Morgan (JPM) and Citibank (C) for different reasons – JPM is best-of-breed in the banking sector and C has long-term international growth potential – both trade pretty similarly since they’re in the same sector.

This kind of overlap is higher-risk because it reduces the amount of diversification in the portfolio with potentially too much exposure to one sector.

In order to combat this, I’m going to split one allocation size between the two of them. In other words, the maximum I will hold of both of them combined will be equivalent to one allocation (now 6.67% of the portfolio thanks to this week’s changes to risk management).

Long-Term Speculative Basket

While I do have a portfolio dedicated to speculation (not-very-creatively named “Speculation in Play”), there are companies whose long-term prospects are strong enough that I’d like to have more exposure than my comparatively small speculation portfolio can manage.

To accommodate this, I’ve decided to allocate one full position size (6.67%) in my Investments in Play portfolio that will be divided among a number of different long-term speculative plays.

By splitting one position size across a number of plays, I’m increasing my exposure beyond my Specs in Play portfolio while limiting my longer-term portfolio’s overall downside risk rather than letting each highly-speculative play potentially grow to a full allocation size.

What are the members of this basket?

My first position for this basket was IBM (IBM) which I added two weeks ago when it dropped below my price target.

This week, you’ll discover I’ve also added my second, third, and fourth speculative plays – ones that long-time readers may recognize – Cypress Semiconductor (CY), Salesforce (CRM), and Twilio (TWLO).

This Week’s Moves

Boeing (BA): Added to Position

While it’s true the entire market got positively slammed on Monday, Boeing (BA) continues to get hit harder than virtually any other stock in the S&P and Dow due to its exposure to the airline space and the bad news in the stock with the 737-Max crisis.

I started buying on Monday at $232.35, but adjusted my price targets after news came out on Tuesday that Boeing was already using its billions of debt, a particularly bad news item.

Boeing plummeted later in the week, and, during Thursday’s panic sell, triggered a buy order which filled at $160.32, giving me an average buying price of $196.34 for the week.

That’s a -46.89% discount replacing the shares I sold early in 2019 at an average price of $369.67 and a -55.98% drop from 2019’s $446.01 high.

After Boeing made a low of $155.00 Thursday following my buy, I decided to lighten up during Friday’s bounce, selling what I bought on Thursday for $163.60. The 2.5% gain in a day was nice, but wasn’t as important as reducing the amount of capital allocated to this position which is obviously much weaker than I expected.

My next buy target for Boeing is much lower at $126.60.

BA closed the week at $170.20, up +4.03% from my average buy price.

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) was destroyed at the open on Monday, collapsing through $13.00 where a buy order of mine filled at $12.94, adding to my position.

On Thursday, Canopy lost all support with the rest of the market and tagged another buy order I had in place at $11.22, giving me an average buying price of $12.08. The buys lowered my per-share cost -14.04% from $18.59 to $15.98. My next buy target for CGC is $9.40.

CGC closed the week at $10.94 down -9.44% from my average buy price.

Citigroup (C): Added to Position

While Citigroup (C) has more exposure to oil debt than many of the other banks, at 3% of its balance sheet, that’s not enough to destroy the bank – even if C has to take a loss on all of it.

So, when Citi tested its lows on Tuesday, I decided to stat adding a little at $51.66 given it was so far below my per-share cost. On Thursday, I added even more when I had orders fill at $45.29, giving me an average buying price of $48.47. The orders lowered my per-share cost -2.37% from $58.17 to $56.79. My next buy target is around $42.00.

C closed the week at $51.04, up +5.30% from my average buy price.

Cypress Semiconductor (CY): *Reopened Position*

Long-time Get Irked readers may recognize Cypress Semiconductor (CY), manufacturer of a wide variety of excellent processors that are used in automotive, industrial, home automation, consumer electronics, and medical products.

I first opened a position in this company in April 2016 at a stock price of $8.20. In June 2019, German semiconductor, Infineon, announced plans to buy the company and sent the stock to the low $20s where I closed the position for a 258.22% gain (2.5+ times my investment in 3 years) at $22.37.

One of my trading rules is always sell when a company gets a buyout offer. There’s too much that can go wrong to hold a stock from a buyout announcement through to the buyout and not much gain.

Last week was an epic example of why to follow that rule with Cypress Semi.

While its stock did work its way 5%+ higher to a high of $23.50 from its June 2019 buyout announcement to early last week, CY collapsed a whopping -30% after news reports came out mid-week that President Trump may stop the buyout deal in order to prevent foreign companies like Infineon (headquartered in Germany) from buying up any potentially-proprietary American technologies.

While bad news for Cypress, the situation presents an intriguing opportunity.

Cypress continues to be a leader in its field and carries a nearly 3% dividend at its current prices. That makes it an excellent long-term investment.

The kicker is Trump might not block the deal. If the deal goes through, there’s potentially 40% upside between its current price and its $22-24 buyout price.

However, if the deal does not go through, Cypress will surely go lower (potentially much lower) than where I reopened this position during the death-drop on Monday at a fill price of $15.50 and a small quantity since the price action is still undefined. This gives my position a starting price of -39.15 per share after rolling in the profits from the first round of investing.

Because of this potential downside risk, sizing will be key to this investment’s success or failure in my portfolio. To limit my risk, I’m taking several steps:

First, the position will be part of my speculative basket which will help limit risk exposure by splitting a single allocation size across a group of riskier stocks (see “Risk Management – Baskets” above).

Second, the maximum amount I will allocate to my CY position will be equal to the profits I made previously (i.e. if CY’s stock drops to zero, I won’t lose any of the initial capital I spent in 2016).

Finally, I will only buy more if the buyout deal falls through, my allocation will remain unchanged until final news about the deal. To accommodate what will likely be a significant price drop if Trump blocks the buyout, my next price target is at $15.25, a past point of support, with additional price targets significantly lower than that.

And later that night…

While it’s hard to determine if there was solid news the deal would go through, rumors swirled on Monday night suggesting that Infineon would still be able to buy CY which caused the stock to jump to $22.60 in overnight trading, nearly a 50% pop from where it closed that afternoon.

As much as I wanted (and still want) to hold this position for the long term, my trading discipline required me to take gains on Tuesday, selling 2/3 of what I was picked up for $15.50 the day before at a sale price of $22.66.

That’s a gain of +46.19% in less than 24 hours and more proof of the old stock adage: “Better lucky than good!”

CY closed the week at $23.11, up +1.99% from where I sold on Tuesday.

Disney (DIS): Added to Position

Disney (DIS)’s stock was hit along with the rest of the market during Monday’s death-drop, hitting a price target of mine with an order filling at $108.05. The order raised my position’s per-share price modestly from $11.55 to $15.95.

On Thursday, I picked up some more when Disney broke the $100 barrier (something it hasn’t done in many years) with an order filling at $97.00, giving me an average buy price of $102.53 on this week’s orders. My next price target is $90.20.

DIS closed the week at $102.52, down $0.01 from my average buy price.

Dow Chemical (DOW): Added to Position

Dow Chemical (DOW) gets hit incredibly hard during these sell-offs since the chemical space is on the outs with the ESG (Environmental-Social-Governance) investing trend.

I continued to add throughout the week, and while I swore off adding more after Wednesday, Thursday’s freefall was too much of an opportunity, so through several orders, I got an average buying price of $28.49.

When under $30 a share, Dow’s dividend yield in excess of 10% may seem incredibly tempting, however, I don’t believe the dividend is safe from cuts at that high amount. In order to be fiscally responsible, I believe management will likely reduce the dividend (if not eliminate it entirely).

The week’s orders lowered my per-share cost -10.88% from $46.33 to $41.29, but I’m miles from that per-share cost at this point. I’m a glutton for punishment, though, as I do have another price target: $15.10. Ugh.

DOW closed the week at $25.69 down -9.82% from my average buy price.

GW Pharmaceuticals (GWPH): Added to Position

I added a small amount to GW Pharmaceuticals (GWPH) during Monday’s death-drop from the open with an order that filled at $89.64. The relatively small order still lowered my per-share cost a substantial -2.25% from $118.92 to $116.00.

On Thursday, I made a larger buy during the freefall, picking up more GWPH at $76.68 which gave me an average buying price of $81.86 and lowered my per-share cost an additional -4.42% to $110.87.

GWPH closed the week at $83.29, up +1.75% from my average buy price.

IBM (IBM): Added to Position

After IBM (IBM) didn’t drop low enough on Monday to hit my price target, I raised it slightly with an order which filled on Tuesday at $118.17.

On Thursday, I picked up some more when IBM dropped to its December 2018 lows with orders filling at $106.07, giving me an average $112.12 buying price.

As I mentioned above, I’m also using additional risk management by including IBM in my Long Term Speculative Basket rather than allocating an entire position size to it.

IBM closed the week at $107.95, down -3.72% from my average buying price.

JP Morgan (JPM): Added to Position

After JP Morgan (JPM) retreated this week and set some support levels, I added a bit to my position when it tested (and broke) support on Wednesday with a buy order that filled at $96.30.

On Thursday, I was able to snag some more during the freefall at $89.00 for an average price of $92.65 on those shares.

The orders replace shares I sold in November 2019 at $129.12, a -28.25% discount on their replacement. My next buy target is $81.70.

JPM closed the week at $103.91, up +12.15% from my average buy price.

Logitech (LOGI): Added to Position

Logitech (LOGI) has shown remarkable strength throughout the entire COVID sell-off, prompting to raise my price target to pick up some shares on Wednesday at $37.45.

On Thursday, trailing-stop orders failed me. Despite LOGI dropping as low as $31.50 during the freefall, my orders filled at $34.47, giving me an average buy price of $34.97 for the week.

I capitalized on Friday’s bounce, lightening up on some of the extra shares I bought thanks to the failed trailing-stop. My sell order went through at $36.63 giving me a quick +4.75% gain on the shares I bought throughout the week, but, more importantly reducing my allocation size to prepare for further selloffs.

My next buy target for LOGI is around $29.20, and, from now on, I will only be using limit orders with this position due to the high-frequency traders obviously targeting it.

The combination of buys and sells gave me an average buy price of $33.04.

LOGI closed the week at $36.85, up +10.34% from my average buy price.

Nike (NKE): Added to Position

Nike’s (NKE) significant Chinese exposure combined with its dependence on consumer spending caused it to fall straight through $82 on Monday where I had orders fill at $81.73.

On Thursday, Nike really fell through the floor with an order filling at $77.50 to give me an average buy price of $79.62.

The orders filled some of the shares I sold back in September 2019 at $87.67, a discount of -9.18% on their replacement. My next buy target for Nike is $72.50.

NKE closed the week at $75.58, down -5.07% from my average buy price.

Nvidia (NVDA): Added to Position

When I saw we were going to open trading on Thursday “limit-down,” I checked Nvidia’s (NVDA) after-hours pricing and placed a limit order to simply replace a share I had sold way too early in December at $225.61. I got lucky and my bid was filled at $225.00.

I’m still playing entirely with the house’s money in Nvidia with no capital invested at this time, although I do have a buy target to add more if we see the $200 level in the stock.

NVDA closed the week at $240.84, up +7.04% from where I bought Thursday.

Salesforce (CRM): *Back in Play*

From time-to-time, when I close a position I keep some of the profits as shares of the stock but I remove the company from coverage in Investments in Play as I no longer intend to add to the position.

Salesforce (CRM) was one of these companies.

I closed out my Salesforce position at the end of 2019 in November and December, getting an average selling price of $160.19 for my shares as I perceived an ongoing inability for the stock to break through its previous mid-$160s all-time-high.

I was dead wrong.

From December until February, CRM rocketed to a new all-time high of $195.72 in February before collapsing -23.03% from its highs to a low of $150.64 during Monday’s selloff.

Once I had seen the levels of support established by Salesforce during the sell-off, I placed a buy order which filled on Tuesday at $151.19, giving my new position in CRM a $55.45 per share cost when the profits were rolled in. My next buy target for the stock is $138.00.

CRM closed the week at $147.78, down -2.26% from Tuesday’s buy.

Skyworks Solutions (SWKS): Added to Position

Skyworks Solutions (SWKS) is a very fast-moving stock with huge falls down followed by incredible bounces from the bottom. Because of its volatility, I don’t use trailing-stop orders, only limit orders, and I placed one for the open on Monday which filled at $86.62 (SWKS ended up bouncing into the $90s after dropping).

On Thursday SWKS collapsed more, hitting a buy order I had in place at $80.50. The combined orders gave me an average buying price of $83.22 and lowered my per-share cost -11.16% from $105.47 to $93.70 per share. My next buy target is $67.10.

SWKS closed the week at $83.00, down -0.27% from my average price.

Square (SQ): Added to Position

While Square (SQ) held up remarkably well during the first round of coronavirus selloffs two weeks ago, it lost all support last week. Monday further exacerbated its downward move, causing SQ to fall through one of my price targets with an order filling at $64.02.

On Thursday, I snagged even more shares during the freefall at $55.87 giving me an average buying price of $58.58. The orders replace shares I sold at $69.49 in November 2019, a discount of -15.7% on their replacement. My next buy target is $49.85.

SQ closed the week at $57.77, down -1.38% from my average buy price.

Tesla (TSLA): *New Position*

Many long-time readers are really going to give me crap for this one as I used to be quite the bear on Tesla (TSLA). However, both Elon Musk, the company’s outspoken CEO, and Tesla as a company have really turned it around in the past six months to a year.

So, when Tesla got slammed during the selloff, I decided to start a position by buying a few shares at $556.49. Given the sheer volatility in this name (this stock was nearly $1,000 a month ago), my next price target is much lower than here at $422.00.

TSLA closed the week at $546.62, down -1.77% from my opening.

Twilio (TWLO): *Back in Play*

Like Salesforce (CRM) above, I kept some of my profit as shares in the notoriously volatile Twilio (TWLO).

Unlike Salesforce, my decision to close my position in TWLO at an average price of $119.32 back in January proved to be very much the right decision.

TWLO was positively destroyed this week with my first buy at $91.00 on Monday and my second buy at $77.00 on Thursday, an average buying price of $84.00 on those orders and an epic -29.60% discount on replacing some of the shares I had sold.

Like Cypress Semiconductor (CY), IBM (IBM), and Salesforce (CRM), Twilio will share a single allocation as part of my Long-Term Speculative Basket in order to reduce risk and exposure to its volatility.

The orders give my position a per-share cost of $42.36. My next buy target is at the next level of support around $63.00.

TWLO closed the week at $79.99, down -4.77% from my average buy price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.