January 5, 2024

The Week’s Biggest Winner & Loser

Berkshire (BRK.B)

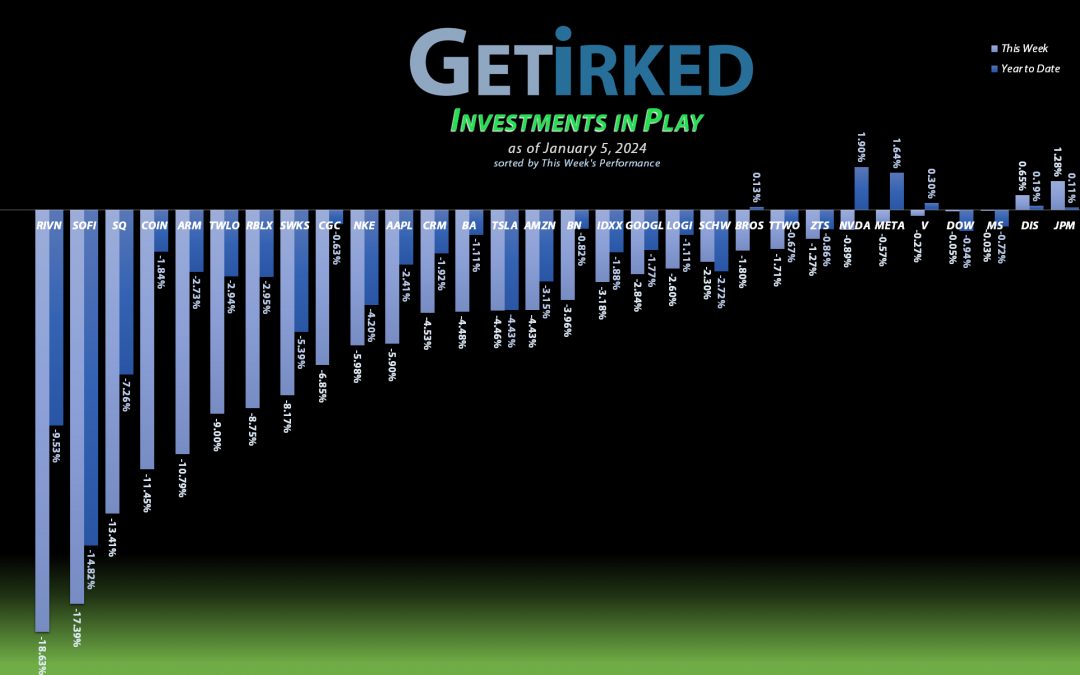

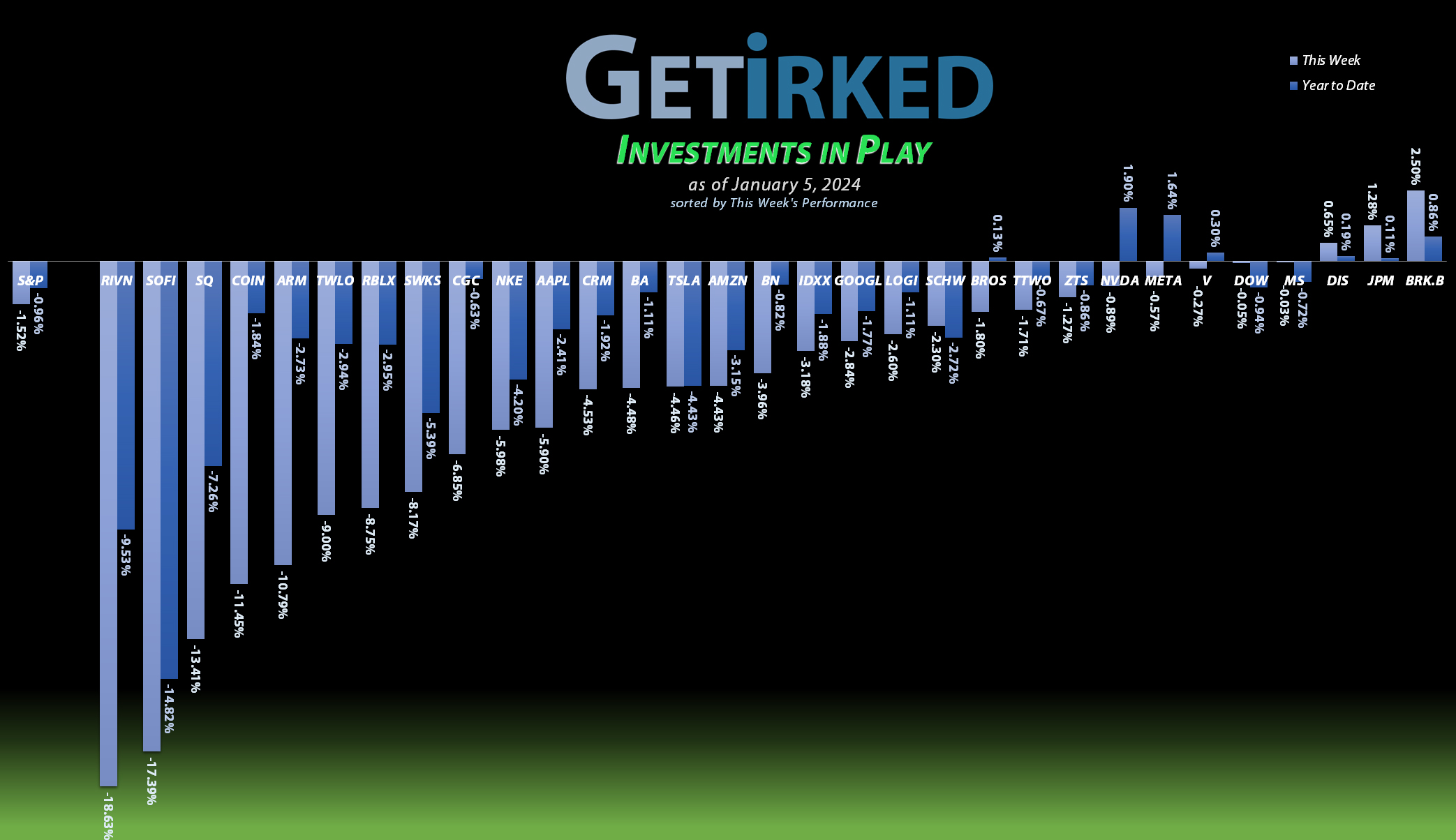

Only Warren Buffett’s venerable Berkshire Hathaway (BRK.B) could pull off a rally in a week that so many other companies’ stocks get positively destroyed. Granted, BRK only popped +2.50%, but in a week of death, that was enough to earn Berkshire the spot of the Week’s Biggest Winner.

Rivian (RIVN)

Rivian (RIVN) released its delivery numbers for the fourth quarter and while the company exceeded expectations, the stock had rallied so much going into year-end that investors were expecting a miracle that never came. As a result, Rivian positively collapsed this week, plummeting -18..63% and easily sneaking in as the spot of the Week’s Biggest Loser.

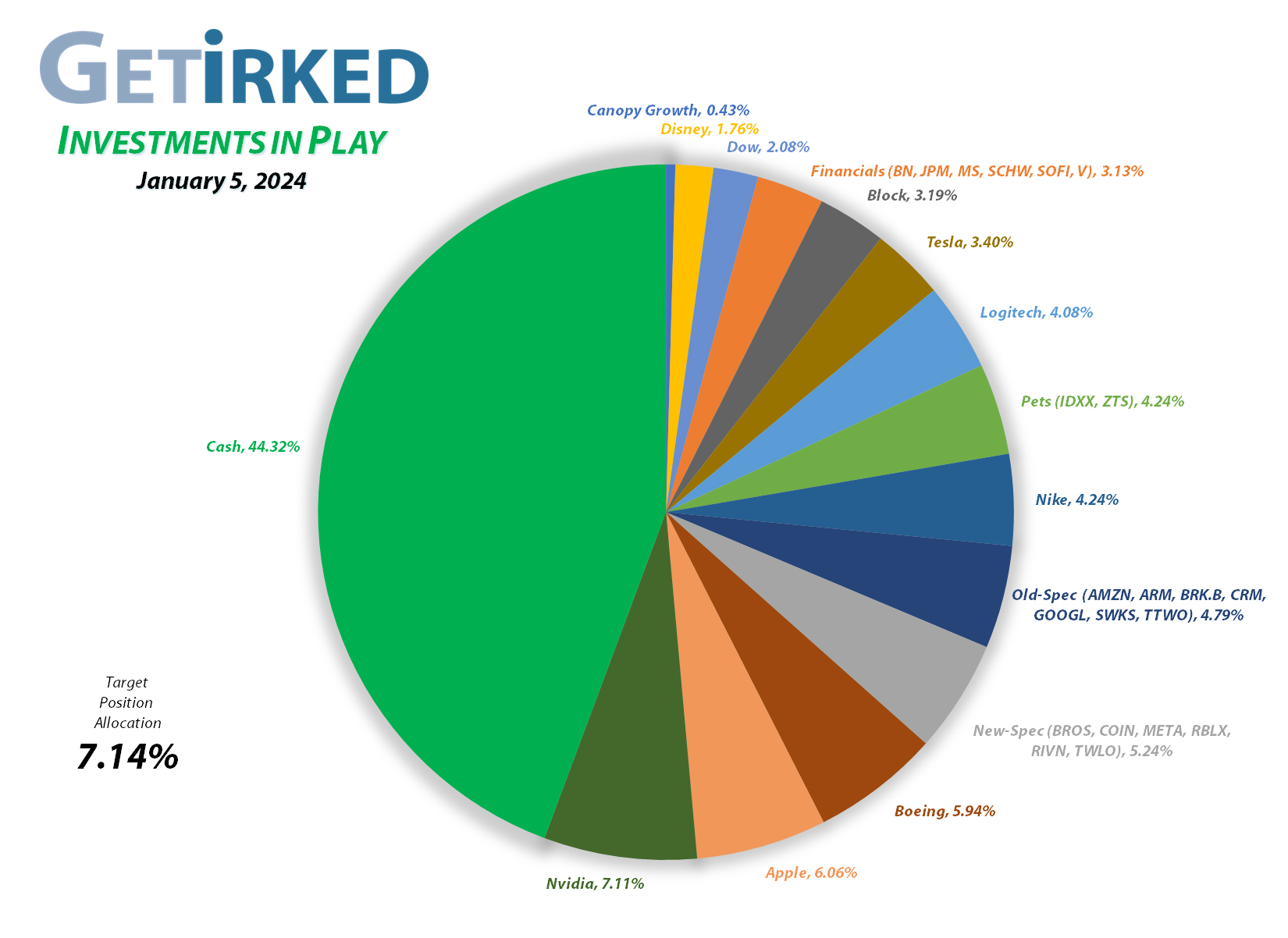

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1565.21%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$321.42)*

Apple (AAPL)

+948.52%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$87.10)*

Logitech (LOGI)

+765.06%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$8.30)*

Boeing (BA)

+750.33%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$200.25)*

Tesla (TSLA)

+617.11%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+533.81%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$66.90)*

Skyworks (SWKS)

+486.64%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.27*

IDEXX Labs (IDXX)

+464.04%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Nike (NKE)

+406.23%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.41)*

Dow (DOW)

+329.52%*

1st Buy 5/13/2019 @ $53.18

Current Per-Share: (-$0.32)*

Amazon (AMZN)

+196.34%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $49.00

Salesforce (CRM)

+184.82%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

Disney (DIS)

+157.17%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$2.23)*

Take Two (TTWO)

+136.29%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

JP Morgan (JPM)

+132.98%*

1st Buy 10/26/2017 @ $102.30

Current Per-Share: (-$39.70)*

SoFi (SOFI)

+116.33%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $3.80

Meta (META)

+104.34%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Berkshire (BRK.B)

+94.71%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Arm Hldgs (ARM)

+77.78%

1st Buy 9/14/2023 @ $57.28

Current Per-Share: $37.73

Alphabet (GOOGL)

+65.52%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $82.00

Morgan Stan (MS)

+62.83%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $57.25

Zoetis (ZTS)

+50.53%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $129.45

Visa (V)

+49.90%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.24

Brookfield (BN)

+27.96%

1st Buy 9/25/2023 @ $32.44

Current Per-Share: $30.11

Schwab (SCHW)

+8.42%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $62.00

Roblox (RLBX)

-1.84%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $42.50

Dutch Bros (BROS)

-6.18%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $33.15

Twilio (TWLO)

-23.63%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Coinbase (COIN)

-31.76%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $225.66

Rivian (RIVN)

-33.98%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $28.90

Canopy (CGC)

-87.93%

1st Buy 5/24/2018 @ $295.30

Current Per-Share: $39.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Brookfield (BN): Dividend Payout

Brookfield (BN) paid out its quarterly dividend last Friday evening (which is after the Investments in Play goes live on getirked.com). While meager, every little bit helps, and Brookfield’s dividend lowered my per-share cost -0.30% from $30.20 to $30.11. Unfortunately, because Brookfield is headquartered in Canada and not the U.S., my brokerage only allows me to accept the dividend as a payout and not reinvested shares, however it serves the same effect in lowering my cost basis.

From here, my next buy target is $29.07, a bit above the lows Brookfield saw in October 2023 and my next sell target is $43.97, just under a key point of resistance Brookfield has seen in the past.

JP Morgan (JPM): Profit-Taking

When JP Morgan (JPM) and the rest of the money-center banks continued their rally on Thursday, I decided it was time to take some more profits out of the position with a sell order which sold 13.44% of the position at $172.79, locking in +68.91% in gains on shares I bought when I initially opened the position at $102.30 back when I first opened the position on October 26, 2017.

The buy lowered my per-share cost -$28.55 from -$11.15 to -$39.70 (a negative per-share cost indicates all capital has been removed in addition to $39.70 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $199.79, just under the psychological round-number of resistance of $200.00, and my next buy target is $102.08, above the low JP Morgan saw at the depths of the 2022 selloff.

JPM closed the week at $172.27, down -0.30% from where I took profits Thursday.

Nike (NKE): Dividend Reinvestment

Nike paid out its quarterly dividend on Wednesday, which, after reinvesting, raising my per-share “cost” +0.76% from -$10.49 to -$10.41 (a negative per-share cost indicates all capital has been removed in addition to $10.41 per share added to the portfolio’s bottom line in addition to each share’s current value).

The reason reinvesting the dividend “raised” my per-share cost is since all of the capital and quite a bit of profit have been taken out of my Nike position, adding more shares means the same amount of profit is divided across more shares, thus making the amount of profit per-share “smaller.”

From here, my next buy target is $88.69, slightly above the last big low Nike saw in October 2023, and my next sell target isn’t until Nike approaches its all-time high with my target at $178.81 where Nike will have outgrown the target allocation size for the Investments in Play portfolio.

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.