June 16, 2023

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

Even with a lot of the rest of the sectors catching up, Nvidia (NVDA) and the rest of the Artificial Intelligence (AI) cohort remain the place to be. NVDA closed the week rallying +10.09%, hitting all-time highs along the way, and realistically placed itself as the Week’s Biggest Winner.

Logitech (LOGI)

It’s never a good thing when a CEO leaves unexpectedly, particularly when that CEO was extremely successful. You can read more about what happened below, but when Logitech (LOGI) lost its CEO this week, it also lost -9.75% and became the Week’s Biggest Loser.

Portfolio Allocation

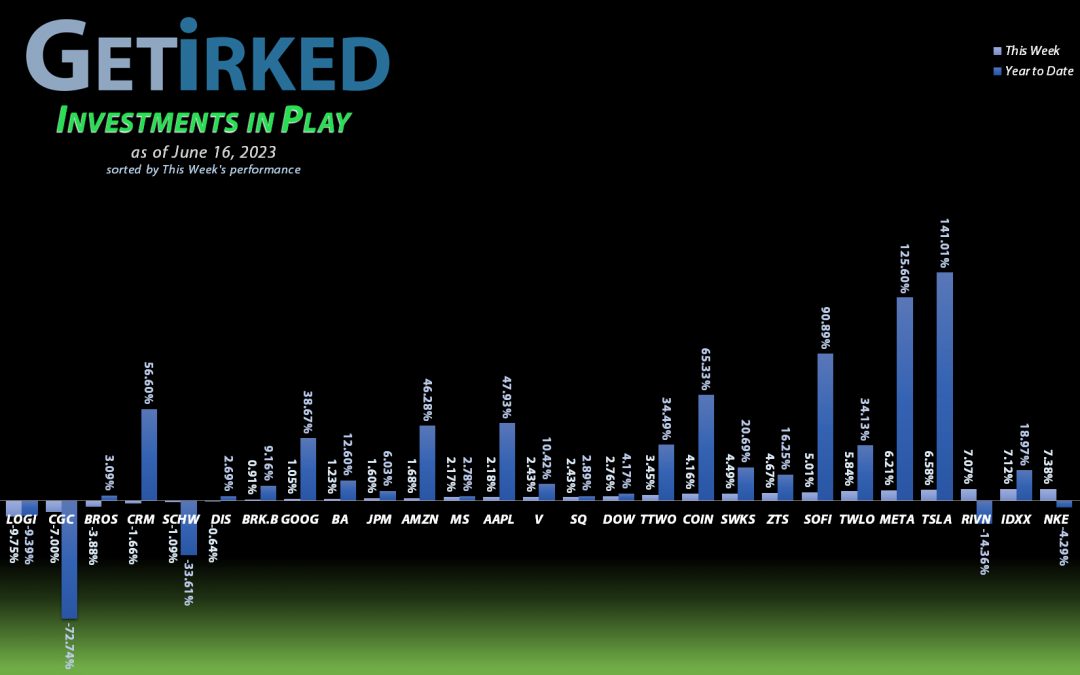

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1415.75%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$162.57)*

Apple (AAPL)

+958.14%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$68.60)*

Boeing (BA)

+700.42%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+666.88%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+523.11%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+490.34%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Logitech (LOGI)

+473.13%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: -($0.81)*

Nike (NKE)

+443.80%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.52)*

IDEXX Labs (IDXX)

+430.79%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+200.03%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

Salesforce (CRM)

+140.03%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $88.20

JP Morgan (JPM)

+117.32%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $65.92

Take Two (TTWO)

+107.13%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

SoFi (SOFI)

+104.53%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.20

Meta (META)

+93.43%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Amazon (AMZN)

+87.38%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $67.00

Dow (DOW)

+85.91%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $28.60

Berkshire (BRK.B)

+80.17%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Morgan Stan (MS)

+36.93%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.34

Visa (V)

+31.67%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $173.93

Alphabet (GOOGL)

+30.70%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $94.55

Zoetis (ZTS)

+19.83%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $142.46

Roblox (RLBX)

-6.88%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $44.90

Schwab (SCHW)

-14.93%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $63.95

Dutch Bros (BROS)

-19.31%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $34.70

Twilio (TWLO)

-25.19%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $90.40

Rivian (RIVN)

-50.16%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Coinbase (COIN)

-73.29%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

Canopy (CGC)

-84.26%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow, Inc. (DOW): Profit-Taking & Dividend Received

Dow, Inc. (DOW) paid out its ample dividend Friday evening, however, rather than reinvesting it, I have started taking the dividend as a cash payout. Why? Well, I’ve owned Dow for some time and while it’s been lucrative, it has regularly seen significant resistance from the $60-70 range. Additionally, since the economy is potentially entering a downturn for cyclical industrials, I would like to start aggressively taking my original investment capital out of this position rather than build it any further. The dividend lowered my per-share cost -2.36% from $29.66 to $28.96.

On Tuesday, Dow rallied through my next sell target which filled at $52.39. The sale locked in +28.69% on some of the shares I bought for $40.71 on February 27, 2020 and lowered my per-share cost an additional -1.24% from $28.96 to $28.60.

From here, I will continue aggressively taking profits in Dow with my next sell target at $57.84, slightly below a past point of resistance. My plan is to remove all capital from this position when/if it crosses over $60/shr. My next buy target is $41.99, below DOW’s 2022 low.

Given this position has the most investment capital out of any in the entire portfolio, I am in no hurry to add to it which will both increase the capital and raise my cost basis. I’m looking at turning this position capital-free in a very aggressive way.

DOW closed the week at $53.17, up +1.49% from where I took profits Tuesday.

Logitech (LOGI): Strategy Change: Sudden CEO Departure

On Wednesday, news broke that Logitech’s (LOGI) longtime CEO, Bracken Darrell, would be stepping down to “pursue another opportunity,” reported Barrons. Darrell has led Logitech through much of its rise to its current status as the leader in gaming and enterprise peripherals, and his unexpected departure could potentially leave a power vacuum and a lack of leadership at the company. The stock dropped more than -12% on the back of the news.

Fortunately, luck would have it that I had taken all of the remaining capital out of my Logitech position back on May 1, reducing my per-share cost to -$0.81 (with no capital, each share in the position adds $0.81 to the portfolio’s bottom line).

Discipline: “Never Turn a Winner into a Loser”

Sudden and unexpected news like this – especially the departure of an excellent CEO – requires a strategy change. Until we hear more clarification about what Logitech’s next moves are, I will no longer add to this position.

One of my key rules – reinforced by the complete collapse of Canopy Growth Corporation (CGC) – is to never turn a winner into a loser. In other words, now that I am only playing with the house’s money by having removed all of my original capital, my discipline will not permit me to add capital back into the position.

I have no intention of closing my current position entirely – just the usual profit-taking with my next sell target at $67.22 – but I will not add any capital back into this position.

We’ll see where things go from here…

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.