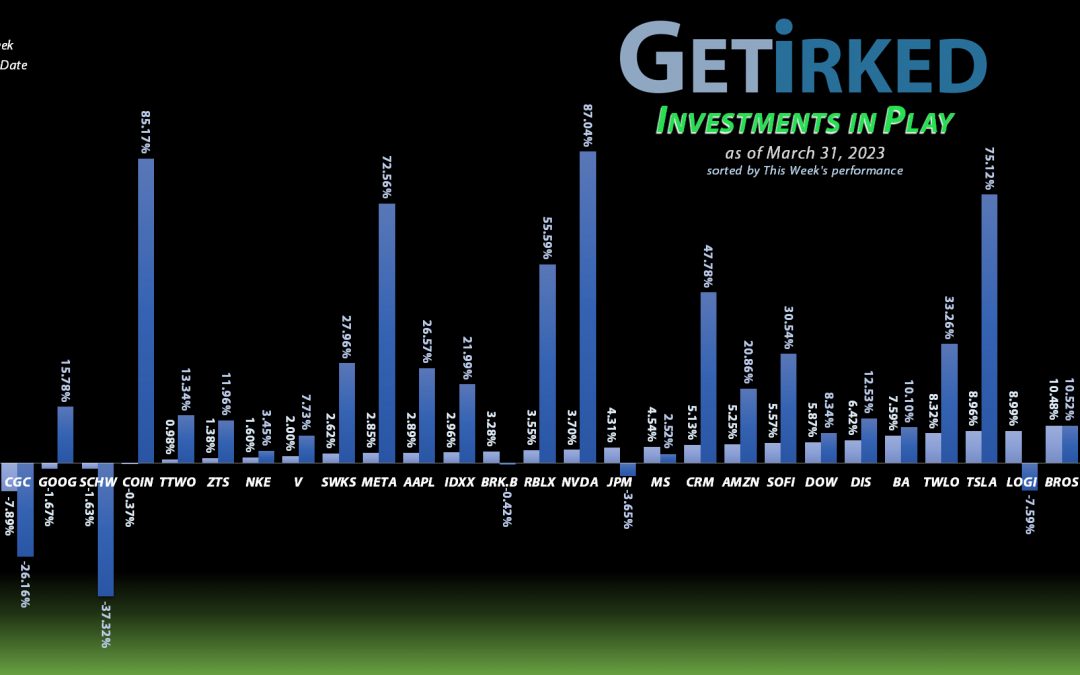

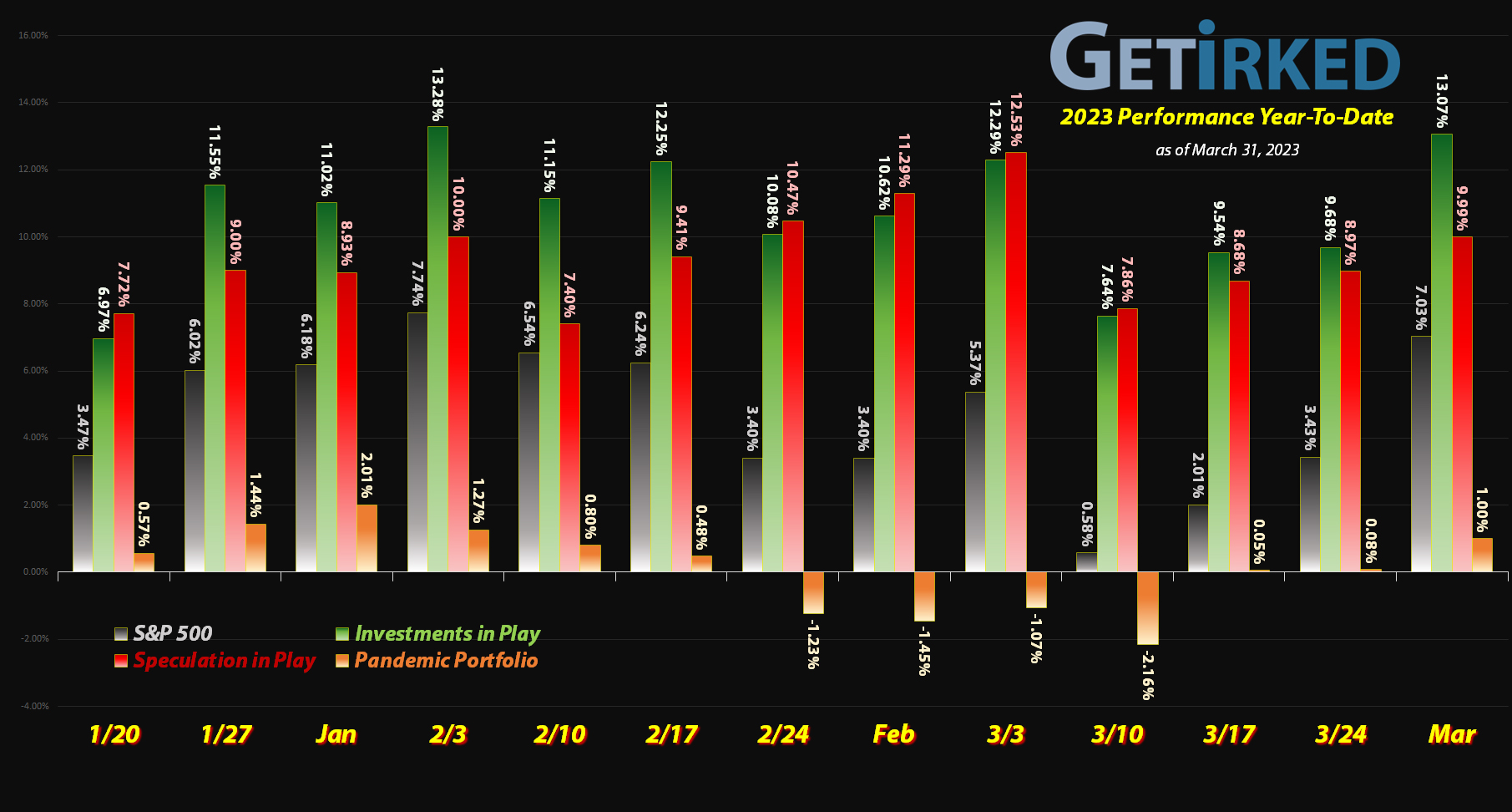

March 31, 2023

The Week’s Biggest Winner & Loser

Rivian (RIVN)

After weeks having the snot beaten out of it, Rivian (RIVN) finally caught a break this week when an analyst released a positive report about the EV company’s future prospects. As a result, RIVN popped +13.74%, making it the Biggest Winner.

Canopy Growth (CGC)

The cannabis sector is seeing absolutely no signs of legislative relief and all of the pot stocks are just withering on the vine. Canopy Growth Corporation (CGC) broke through to new lower-lows this week as it works its way down $1.50/shr. CGC dropped another -7.89% in a week where almost every stock saw a rally, certainly earning it the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Nvidia (NVDA)

+1012.21%*

1st Buy 9/6/2016 @ $15.67

Current Per-Share: (-$55.69)*

Apple (AAPL)

+879.63%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$60.72)*

Boeing (BA)

+687.15%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$179.40)*

Tesla (TSLA)

+552.26%*

1st Buy 3/12/2020 @ $37.10

Current Per-Share: (-$48.28)*

Block (SQ)

+531.00%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$75.30)*

Skyworks (SWKS)

+520.14%*

1st Buy 1/31/2020 @ $113.60

Current Per-Share: (-$34.93)*

Nike (NKE)

+474.73%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$10.55)*

Logitech (LOGI)

+445.87%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $10.64

IDEXX Labs (IDXX)

+441.22%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$220.95)*

Disney (DIS)

+228.84%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $30.45

JP Morgan (JPM)

+96.26%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $66.40

Dow (DOW)

+84.86%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $29.66

Meta (META)

+82.69%*

1st Buy 9/16/2017 @ $128.58

Current Per-Share: -($323.00)*

Take Two (TTWO)

+78.20%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $66.95

Salesforce (CRM)

+74.10%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $114.75

Berkshire (BRK.B)

+64.44%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $187.77

Amazon (AMZN)

+39.40%

1st Buy 2/6/2018 @ $69.15

Current Per-Share: $74.10

SoFi (SOFI)

+37.95%

1st Buy 11/22/2022 @ $4.80

Current Per-Share: $4.40

Morgan Stan (MS)

+35.19%

1st Buy 4/25/2022 @ $83.50

Current Per-Share: $64.94

Visa (V)

+29.37%

1st Buy 5/9/2022 @ $194.00

Current Per-Share: $174.27

Zoetis (ZTS)

+12.14%

1st Buy 6/13/2022 @ $157.55

Current Per-Share: $148.42

Alphabet (GOOGL)

+6.99%

1st Buy 9/16/2022 @ $101.93

Current Per-Share: $96.95

Roblox (RLBX)

-0.16%

1st Buy 9/29/2021 @ $77.00

Current Per-Share: $45.05

Dutch Bros (BROS)

-10.90%

1st Buy 9/20/2021 @ $42.25

Current Per-Share: $35.50

Schwab (SCHW)

-18.47%

1st Buy 4/18/2022 @ $76.30

Current Per-Share: $64.25

Twilio (TWLO)

-30.12%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $95.35

Rivian (RIVN)

-48.05%

1st Buy 11/12/2021 @ $127.00

Current Per-Share: $29.80

Canopy (CGC)

-61.11%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $4.50

Coinbase (COIN)

-67.51%

1st Buy 4/14/2021 @ $412.47

Current Per-Share: $208.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Don’t just stand there… DO NOTHING!

This was one of those week’s where none of the positions in the portfolio hit buy targets or sell targets. Whenever that happens, it can be tempting to force a move – either add to a position to soon or take profits too early.

In the 25 years I’ve been at this, I’ve learned that the best thing to do is nothing at all. I need to trust the work I’ve put in, trust my price levels, and just sit back, eat popcorn and wait for the next move.

From here, it’s time to wait and see what April brings.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.