Investments in Play – February 1, 2019

Earnings Season is upon us which means it’s time to analyze where we stand and where we’re going.

Highlights from the Week

Amazon (AMZN) reported good earnings but guided down so badly that the stock slid 2.65% by the week’s end.

Apple (AAPL) brought its A-Game and flipped a bird at the haters with an outstanding earnings report, jumping 5.55% by the end of the week.

Boeing (BA) came out of the gate with a spectacular earnings report, causing the stock to jump 6.38% with highs in the $390s. Analysts say this is just the beginning with even higher highs expected.

Cypress Semiconductor (CY), one of our favorite sneak attack plays with a 3% dividend and fingers in every mobile space, proved not all semiconductor stocks are created equal after NVDA bombed with a pre-earnings warning. Cypress reported spectacular earnings leaving CY to close up 5.64% on the week!

Nvidia (NVDA) still can’t get its act together, pre-announcing a terrible earnings report. Bizarrely, investors snapped up the stock after a horrendous drop causing it to close the week only down 9.63% after being much lower following earnings. Analysts say this is NOT a buying opportunity, though – watch for NVDA to test its December lows.

Gameplan for Next Week

- GW Pharma (GWPH) is on deck for earnings next Wednesday (2/6). Jim Cramer (CNBC’s Mad Money) has noticed that this earnings season, stocks moving higher into earnings have been dropping after earnings and stocks dropping into earnings have moved higher after earnings. GWPH was up 5.64% this week – should we be concerned?

- Take Two (TTWO) got beaten up a bit after reports that gaming is on the outs with gamers not buying as much as they have. TTWO will report earnings next Wednesday (2/6) and although Red Dead Redemption 2 has been an indisputable success, will their earnings forecast cause the stock to plummet? We have our fingers crossed we’ll see an upside surprise of some sort rather than more downside.

This Week’s Trades

*NEW POSITION* Pfizer (PFE), the fabled pharmaceutical company, dropped so low on Monday that we couldn’t pass on the opportunity to open a position, buying 1/5 of our position before they reported earnings at $40.50 with a mouth-watering dividend in excess of 3.5%. When PFE missed on its earnings report, we thought we’d surely be picking up more at lower levels which never happened as the stock rocketed higher. This is the downside of Buying in Stages – the stock we bought is what we have unless PFE drops to our cost basis or below. This is a high-quality problem, though, as we’re up 4.85% after PFE closed the week at $42.88.

Boeing (BA) gained into earnings and we reluctantly stuck to our discipline, pulling a little more profits out at $364.91 before BA reported. BA’s excellent earnings report caused them to close at $387.43 for the week, with us up 437.24% on our remaining position.

Canopy Growth Corp (CGC) continued its rise to dominance. Such incredible highs (pun intended) made us pull a little bit more of our profits off the table, selling some at $48.13. CGC closed the week at $48.94, leaving us up 2,743.06% (yes, that’s not a typo, that’s a 2,743.06% gain) on our remaining position.

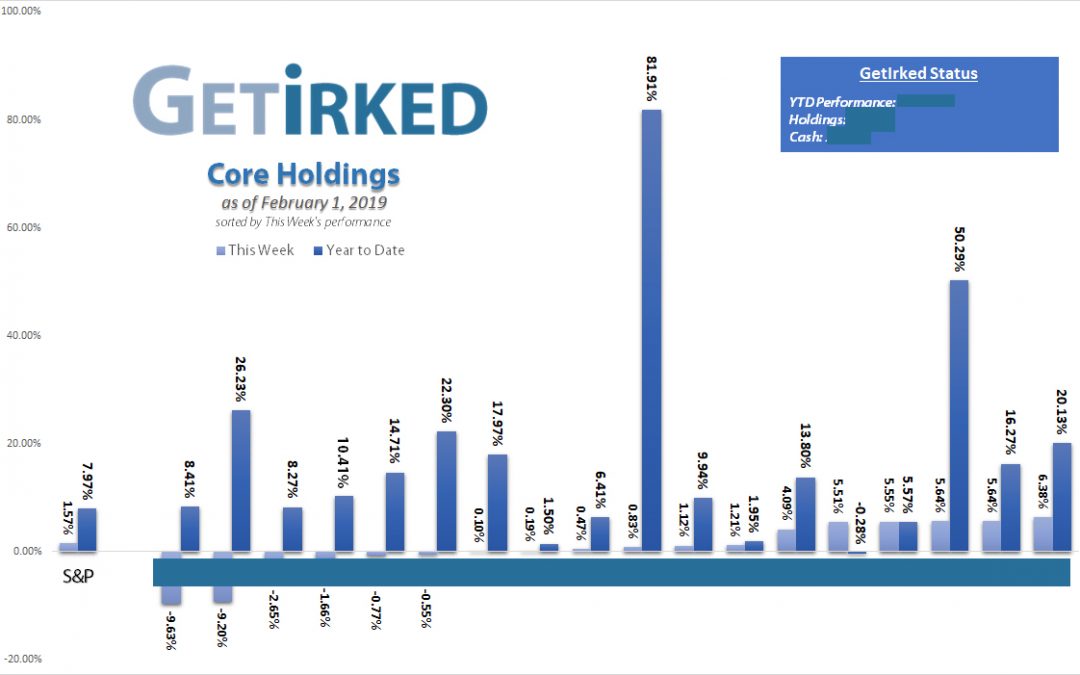

Core Holdings Status

- Year-To-Date Performance: +16.43%

- Cash: 21.59%

- Invested: 78.41%

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.