Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #48

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

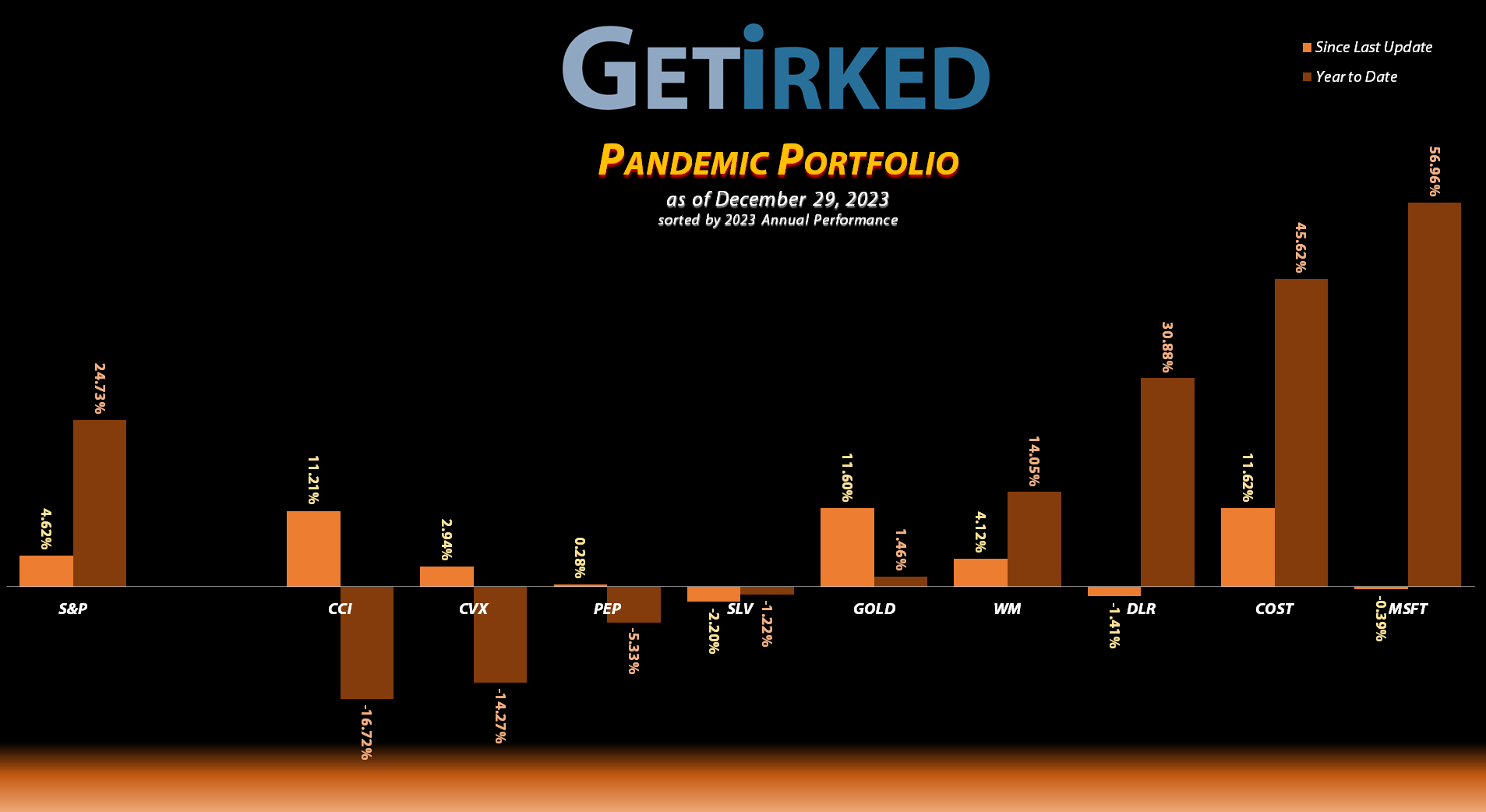

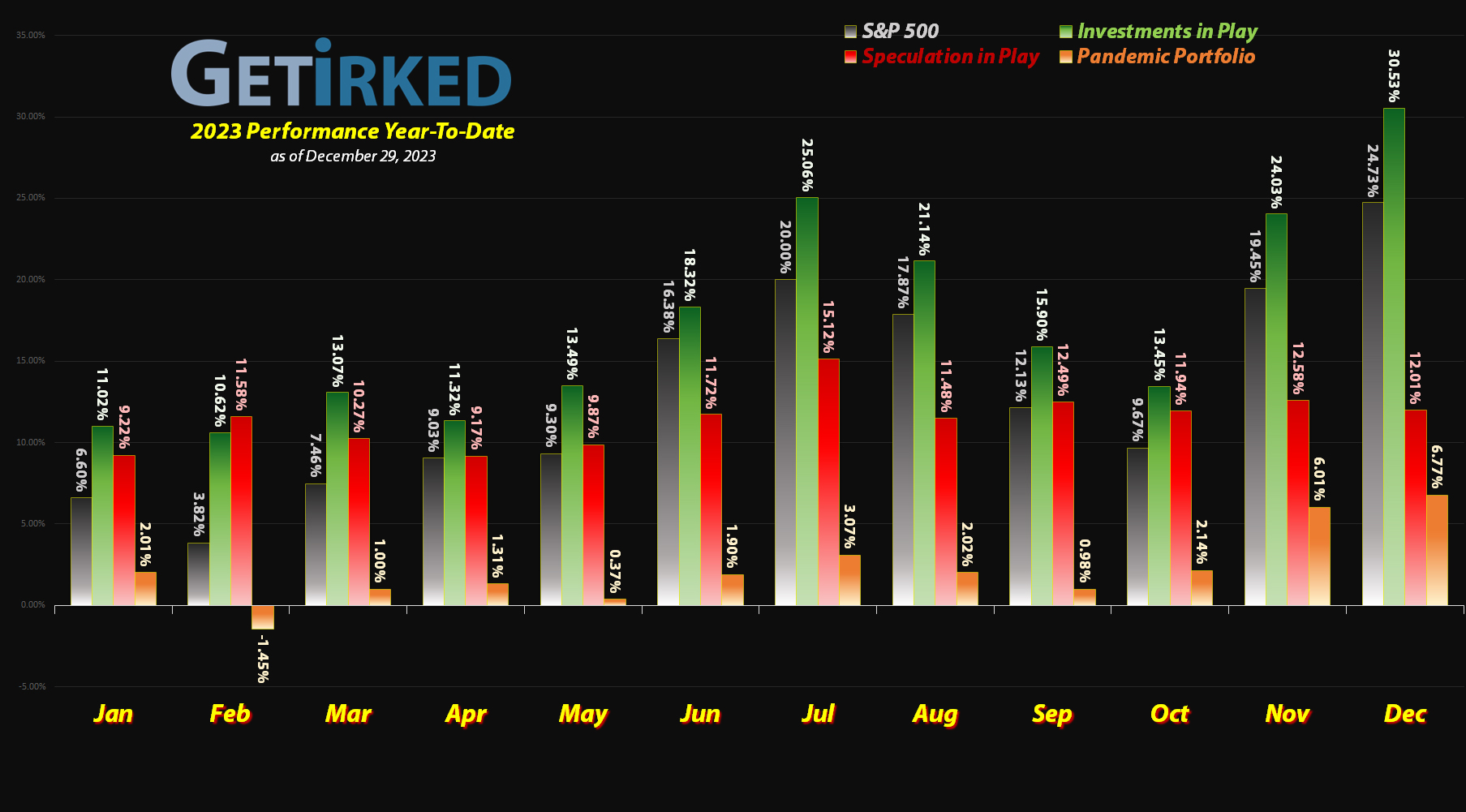

2023 was a Rough Year for the Portfolio

This year demonstrated the importance of diversification and the critical nature for investors to ensure their portfolios have exposure to a lot of the market. Unfortunately, 2023 demonstrated that the Pandemic Portfolio does not have proper diversification and exposure.

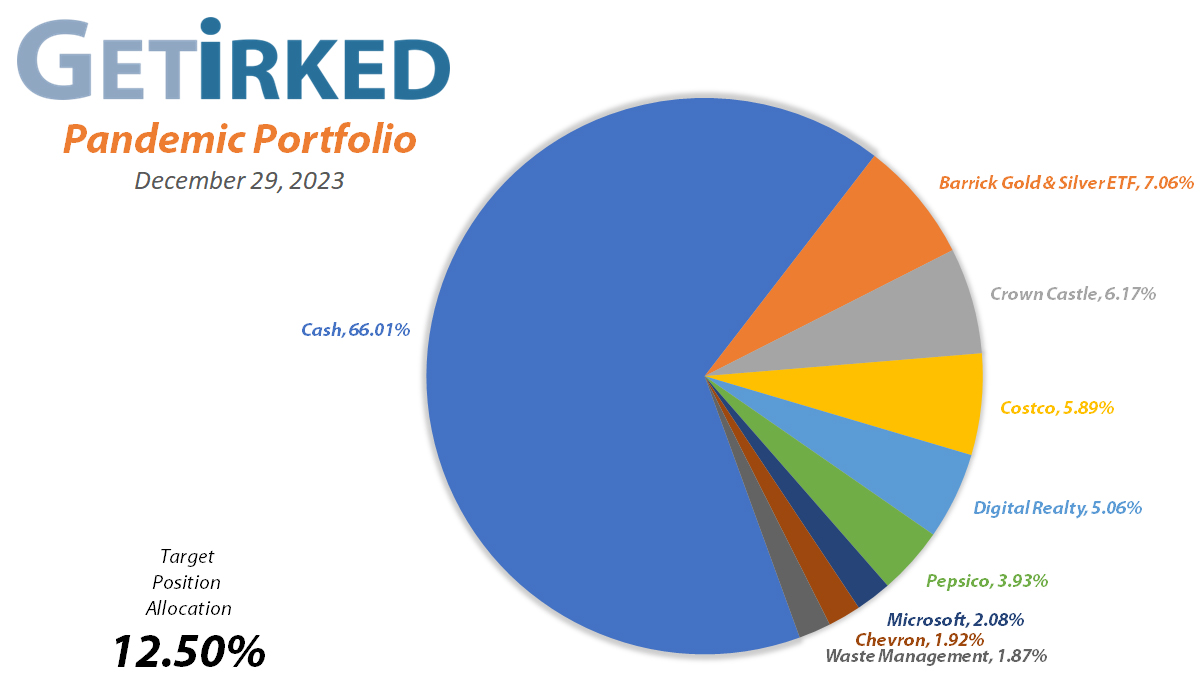

To exacerbate the situation of having extreme exposure to gold, Real Estate Investment Trusts (REITs), and other areas of the markets under selling pressure for much of the year, I also had far, far, far too much cash on the sidelines, with the portfolio finishing the year nearly 2/3 in cash!

All of this will change for next year as I get much more aggressive putting money to work in this portfolio, but, until then, let’s take a look at the moves I made since our last update…

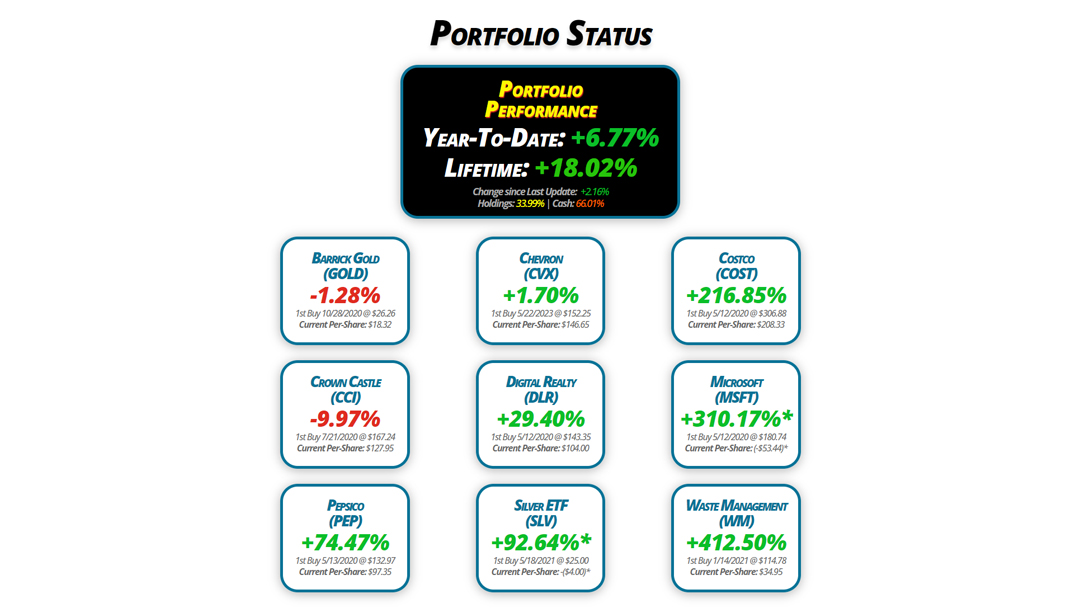

Portfolio Status

Portfolio

Performance

Year-To-Date: +6.77%

Lifetime: +18.02%

Change since Last Update: +2.16%

Holdings: 33.99% | Cash: 66.01%

Barrick Gold

(GOLD)

-1.28%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $18.32

Crown Castle

(CCI)

-9.97%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $127.95

Pepsico

(PEP)

+74.47%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $97.35

Chevron

(CVX)

+1.70%

1st Buy 5/22/2023 @ $152.25

Current Per-Share: $146.65

Digital Realty

(DLR)

+29.40%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $104.00

Silver ETF

(SLV)

+92.64%*

1st Buy 5/18/2021 @ $25.00

Current Per-Share: -($4.00)*

Costco

(COST)

+216.85%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $208.33

Microsoft

(MSFT)

+310.17%*

1st Buy 5/12/2020 @ $180.74

Current Per-Share: (-$53.44)*

Waste Management

(WM)

+412.50%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $34.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

Portfolio Breakdown

Positions*

%

Target Position Size

* The iShares Silver ETF (SLV) is combined with Barrick Gold (GOLD), and UnitedHealth (UNH) will be closed entirely as soon as it hits the sell price target.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Dividend Payout

Current Price: $18.08

Per-Share Cost: $18.32 (-0.43% since last update)

Profit/Loss: -1.28%

Allocation: 6.51%* (+0.55% since last update)

Next Buy Target: $14.07

Barrick Gold (GOLD) paid out its quarterly dividend on Friday, December 15. Due to Barrick’s headquarters being located in a foreign country (Canada, in this case), the stock is not eligible for Dividend Reinvestment Programs (DRiPs) in the United States, meaning I must accept the dividend as a cash payout and not shares of the stock.

Even still, this does reduce my cost basis, in this case -0.43% from $18.40 to $18.32. From here, my next buy target is $14.07, above GOLD’s low from October, and my next sell target is $19.58.

Chevron (CVX): Dividend Reinvestment

Current Price: $149.14

Per-Share Cost: $146.65 (-1.05% since last update)

Profit/Loss: +1.70%

Allocation: 1.92%* (+0.04% since last update)

Next Buy Target: $140.98

Chevron (CVX) paid out its ample quarterly dividend on Tuesday, December 12, which, after reinvestment, lowered my per-share cost -1.05% from $148.20 down to $146.65.

Chevron demonstrated significant support around the $140 level, so, despite my bearish outlook for energy next year, I will add to this underweight position if CVX tests $140.98, my next buying target.

Why am I bearish on energy in 2024?

The reason for this is there experts in the energy sector believe there’s a possibility that Saudi Arabia could flood the oil market. That sounds counterintuitive, doesn’t it? Why would a major oil-producing country flood a market that’s already at low prices and make less money as a result?

The reason is because Saudi Arabia wanted OPEC+ to cut production in order to raise prices. However, the countries couldn’t come to a consensus so no cuts were made. In order to lower production in the past, Saudi Arabia has raised its own production and flooded the markets.

The resulting crash in oil prices causes smaller producers – many of them located in the United States – to halt production as prices drop to a level where they cannot make a profit. As a result, flooding the market eventually causes a production cut and rebound in prices. However, this process can take more than six months to complete.

If Saudi Arabia floods the markets, even the major producers like Chevron and Exxon Mobil (XOM) will feel the pain, and I believe this could cause Chevron’s stock to collapse, potentially even lower than its 2022 lows. If this doesn’t come to pass, I will raise my next buy target to over $140, but I’m holding off for the meantime.

As for sell targets, I maintain a sell target just under Chevron’s all-time high where I will take profits at $189.62.

Costco (COST): Strategy Update

Current Price: $660.08

Per-Share Cost: $208.33 (Unchanged since last update)

Profit/Loss: +216.85%

Allocation: 5.89%* (+0.50% since last update)

Next Buy Target: $553.89

Costco (COST) had a stellar month, rallying more than +15% from our last update to its high earlier in December. Additionally, Costco management finally announced the next special dividend – the first in more than three years at $15/shr – which will be paid out on January 12, 2024 to all shareholders of record as of December 27.

Because of its outstanding performance, I’ve raised my next buy target to $553.89 where I will add more to this venerable performer.

Crown Castle (CCI): Strategy Update

Current Price: $115.19

Per-Share Cost: $127.95 (Unchanged since last update)

Profit/Loss: -9.97%

Allocation: 6.17%* (+0.51% since last update)

Next Buy Target: $85.00

After struggling for the majority of 2023, Crown Castle (CCI) finally got back off the mat after activist investors announced plans to transform the company. These plans included dumping not only the company’s current strategy, but also kicking its poor-performing CEO to the curb.

CCI’s rally continued since the last update, rallying more than an additional +15% from our last update to its high in early December. Despite its recent strength, Crown Castle’s weakness throughout 2022 and 2023 really surprised me, so I am not raising my buying price target from $85.00,. near its low in October.

Digital Realty Trust (DLR): Strategy Update

Current Price: $134.58

Per-Share Cost: $104.00 (Unchanged since last update)

Profit/Loss: +29.40%

Allocation: 5.06%* (-0.18% since last update)

Next Buy Target: $86.71

After a huge run off its lows back in May when Digital Realty Trust (DLR) was rolled into the artificial intelligence craze sweeping stocks, DLR ended up spending the last month meandering in a range, finishing the month basically flat from where it was in our last update.

Like Crown Castle (CCI), Digital Realty and the rest of the REITs really surprised me with their significant weakness over the past two years. Sure, they have exposure to the real estate sector, but with Digital Realty building data centers and Crown Castle building cell-phone towers, I expected them to be a bit more resilient.

Accordingly, just like CCI, I won’t be adding to my Digital Realty position until it makes an attempt for the lows it saw in May with my next buying price target at $86.71.

Microsoft (MSFT): Dividend Reinvestment

Current Price: $376.04

Per-Share Cost: -$53.44* (+0.21% since last update)

Profit/Loss: +310.17%

Allocation: 2.08%* (-0.05% since last update)

Next Buy Target: $330.89

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Microsoft (MSFT) paid out its quarterly dividend on Friday, December 15. While small, the dividend raises the cost basis of negative per-share cost positions by adding more shares to which the profit taken out of the position must be divided by. In this case, the dividend raised the per-share “cost” +0.21% from -$53.55 to -$53.44.

From here, I will add more to Microsoft at $330.89, but, given the extreme strength Microsoft has seen, I have no plans to take out additional profits at this time.

Pepsico (PEP): Strategy Update

Current Price: $169.84

Per-Share Cost: $97.35 (Unchanged since last update)

Profit/Loss: +74.47%

Allocation: 3.93%* (-0.07% since last update)

Next Buy Target: $156.15

Pepsico (PEP has done nothing for some time now following the scare that the GLP-1 weight loss drugs will eat into PEP’s profits (horrible pun intended, I’m afraid). For the past two months, Pepsico has been trading in a pretty strict range between $165 and $175, not seeming to want to make a breakout in either direction – bullish or bearish.

Given the potentially negative headwinds facing Pepsico, I will not be adding to my position until $156.15, slightly above the lows it saw when the GLP-1 news really smacked the stock in October.

iShares Silver ETF (SLV): Strategy Update

Current Price: $21.79

Per-Share Cost: -$4.00* (Unchanged since last update)

Profit/Loss: +92.64%*

Allocation: 0.55%* (-0.03% since last update)

Next Buy Target: $19.10

* A negative per-share cost indicates all capital has been removed from the position and each share remaining adds the amount to the portfolio’s bottom line.

Despite gold making a new intraday high, the pullback in the yellow precious metal also smacked Silver (represented here with the iShares Silver ETF (SLV)). In fact, silver has finished basically flat from where it was a month ago in our last update.

I do still plan to add to SLV if it pulls back to the lows it saw in October with my next buy target at $19.10, but I’m not in any hurry to add to this disappointing asset class until it does something to impress me.

Waste Management (WM): Dividend Reinvestment

Current Price: $179.10

Per-Share Cost: $34.95 (-0.37% since last update)

Profit/Loss: +412.50%

Allocation: 1.87%* (+0.04% since last update)

Next Buy Target: $150.46

Waste Management (WM) paid out its quarterly dividend on Monday, December 18, which, after reinvestment, lowered my per-share cost -0.37% from $35.08 to $34.95.

I remain undeterred regarding my next buying price target, down at $150.46 where Waste Management has tested support many times in the past. As for my next profit-taking target, I’m aiming for $199.52, just under the key $200.00 round-number psychological resistance.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.