Risk Disclaimer

No one at Get Irked is a professional financial adviser. All information provided on this website is for entertainment and educational purposes only. All investments involve risk, all equities could lose value, and investors are responsible for their own choices. Consult with your own financial adviser to see if any of these positions and strategies fit your risk profile and long-term financial goals.

Pandemic Portfolio: Update #14

This is an update to a series. See Starting a Portfolio from Scratch to learn how it started.

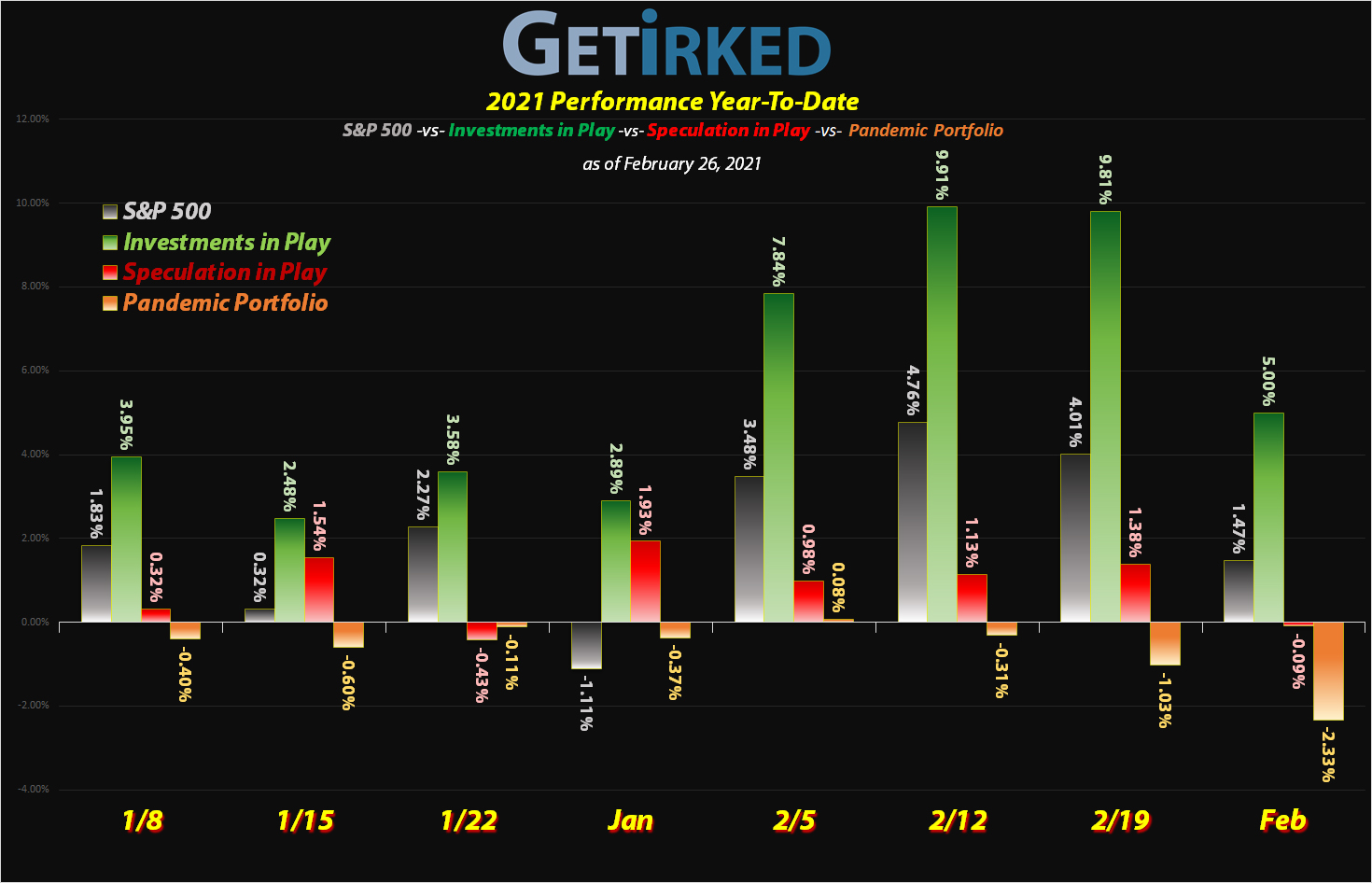

Another bad month for the portfolio…

Whew… the positions in the Pandemic Portfolio just aren’t seeing the bright side of the market so far this week with only one position, Microsoft (MSFT) having any kind of gain for the year.

However, this is a long-term portfolio, so instead of feeling defeated, the approach is to Buy in Stages and add to positions when they reach key levels, and, in this update, add to positions I certainly did…

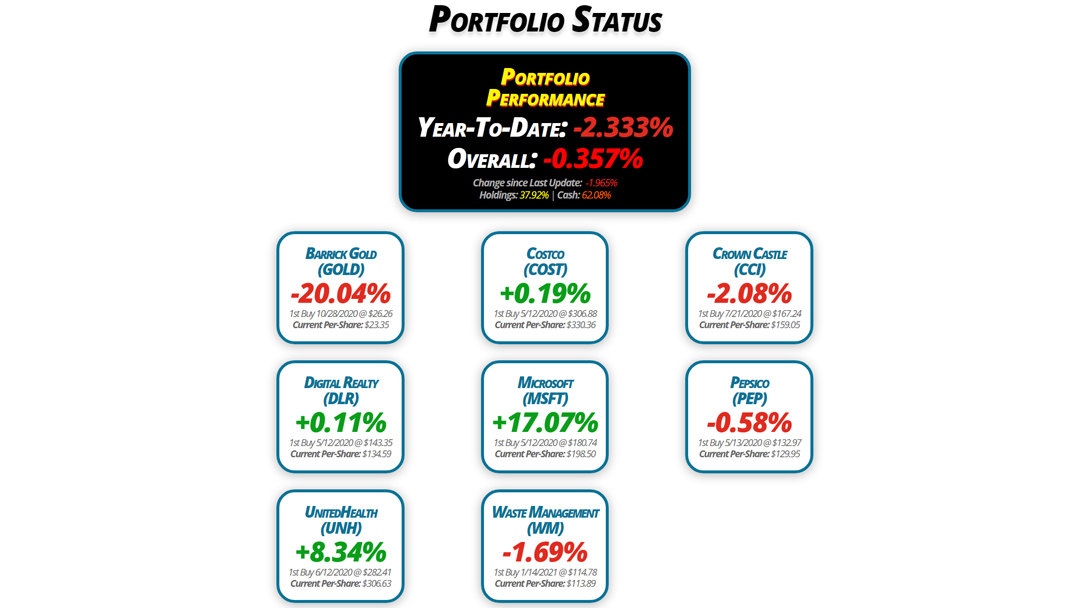

Portfolio Status

Portfolio

Performance

Year-To-Date: -2.333%

Overall: -0.357%

Change since Last Update: -1.965%

Holdings: 37.92% | Cash: 62.08%

Barrick Gold

(GOLD)

-20.04%

1st Buy 10/28/2020 @ $26.26

Current Per-Share: $23.35

Digital Realty

(DLR)

+0.11%

1st Buy 5/12/2020 @ $143.35

Current Per-Share: $134.59

UnitedHealth

(UNH)

+8.34%

1st Buy 6/12/2020 @ $282.41

Current Per-Share: $306.63

Costco

(COST)

+0.19%

1st Buy 5/12/2020 @ $306.88

Current Per-Share: $330.36

Microsoft

(MSFT)

+17.07%

1st Buy 5/12/2020 @ $180.74

Current Per-Share: $198.50

Waste Management

(WM)

-1.69%

1st Buy 1/14/2021 @ $114.78

Current Per-Share: $113.89

Crown Castle

(CCI)

-2.08%

1st Buy 7/21/2020 @ $167.24

Current Per-Share: $159.05

Pepsico

(PEP)

-0.58%

1st Buy 5/13/2020 @ $132.97

Current Per-Share: $129.95

Portfolio Breakdown

Positions

%

Target Position Size

Click image for an enlarged version.

Click image for an enlarged version.

Click image for an enlarged version.

Moves Since Last Update

Barrick Gold (GOLD): Added to Position

Current Price: $18.67

Per-Share Cost: $23.35 (-4.420% from last update)

Profit/Loss: -20.04%

Allocation: 4.684%* (+0.723% from last update)

Next Buy Target: $18.40

Despite the rest of the markets rallying early in February, the “Powers That Be” (see: big financial banks and the CFTC) sought out quelling the attempted Reddit Rebellion in silver by stamping down the prices of all of the precious metals, which, naturally, includes gold.

Barrick Gold (GOLD) dropped in price in response, triggering a buy order which filled on Thursday, February 4 at $21.71. Gold didn’t stop dropping there, triggering a buy order on Wednesday, February 17 which filled at $21.11, an order on Thursday, February 18 at $20.25, and yet another order on Wednesday, February 24 at $19.75. The combined orders gave me a $20.25 average buying price and lowered my per-share cost -4.42% from $24.43 to $23.35.

As of this update, GOLD is $18.67, down -7.80% from my average buy price.

Costco (COST): Dividend Reinvestment

Current Price: $331.00

Per-Share Cost: $330.36 (-0.199% from last update)

Profit/Loss: +0.19%

Allocation: 6.670%* (-0.278% from last update)

Next Buy Target: $297.95

Costco (COST) paid out its dividend on February 22, a relatively meager 0.8% yield at the $350.86 payout price. As always, I reinvest dividends whenever possible both reducing my per-share cost (in this case -0.199% from $331.02 to $330.36) and also increasing my allocation.

Costco’s annual dividend isn’t the truly exciting thing about the stock. In addition to substantial growth, COST has developed a track record for paying special dividends, such as the $10 per share dividend last December which worked out to a one-time yield of 2.58% when it was paid on December 12.

Given Costco’s current size in my portfolio (and the pressure seen on the stock), I don’t plan to add to this position until it drops below my per-share cost by a decent margin.

Crown Castle (CCI): Strategy Update

Current Price: $155.75

Per-Share Cost: $159.05 (Unchanged from last update)

Profit/Loss: -2.08%

Allocation: 5.527%* (-0.013% from last update)

Next Buy Target: $149.35

Crown Castle (CCI) sold off with the rest of the markets toward the end of February, and while it has dipped below my per-share cost and I do think the demand for cellular towers will be huge during the 5G rollout, I think we might be in store for even more selling pressure in the coming weeks.

Accordingly, my next buying price target of $149.35 is slightly above the last selloff’s support.

Digital Realty Trust (DLR): Strategy Update

Current Price: $134.73

Per-Share Cost: $134.59 (Unchanged from last update)

Profit/Loss: +0.11%

Allocation: 6.842%* (-0.324% from last update)

Next Buy Target: $127.50

Digital Realty Trust (DLR) continues to fluctuate dramatically as treasury bond yields cause investors to consider fleeing from dividend-paying stocks to the relative “safety” of bonds.

Given that DLR already has more than a 50% allocation in the portfolio, I’m comfortable waiting for deeper selloffs to $127.50 (and lower) before adding to the position, even with its fantastic 3.325% yield at these prices.

Microsoft (MSFT): Added to Position

Current Price: $232.38

Per-Share Cost: $198.50 (+6.127% from last update)

Profit/Loss: +17.07%

Allocation: 4.682%* (+1.241% from last update)

Next Buy Target: $203.30

Microsoft (MSFT) came under pressure with the rest of the technology sector toward the end of February, triggering a buy order I had in place which filled on Monday, February 22 at $233.06.

After Microsoft’s relentless outstanding performance, I decided I once again do that which I hate to do – buy up my cost basis – and the order raised my per-share cost +6.127% from $187.04 to $198.50.

As of this update, MSFT is $232.38, down -0.29% from where I added.

Pepsico (PEP): Added to Position

Current Price: $129.19

Per-Share Cost: $129.95 (-$0.05 from last update)

Profit/Loss: -0.58%

Allocation: 3.933%* (+0.529% from last update)

Next Buy Target: $127.85

Pepsico (PEP) sold off with the rest of the market during the last week of February, briefly dipping below $130 on Friday, February 26 where I couldn’t resist adding to my position with an order that filled at $129.71.

The order lowered my per-share cost a measly -$0.05, but, more importantly, increased my allocation in a stock with a bountiful 3.3% dividend yield at these levels.

As of this update, PEP is $129.19, down -0.40% from where I added.

UnitedHealth (UNH): Strategy Update

Current Price: $332.22

Per-Share Cost: $306.63 (Unchanged from last update)

Profit/Loss: +8.34%

Allocation: 3.302%* (+0.052% from last update)

Next Buy Target: $281.40

Even though UnitedHealth (UNH) has held up remarkably well during the selling pressure seen market-wide through February, I’m in absolutely no hurry to add to my position.

UnitedHealth tends to be an incredibly volatile stock when it starts moving for the downside, so I’m completely comfortable holding my $281.40 price target, a pretty substantial, but not unrealistic, -15.30% lower from these levels.

Waste Management (WM): Added to Position

Current Price: $110.89

Per-Share Cost: $112.80 (-9.571% from last update)

Profit/Loss: -1.69%

Allocation: 2.226%* (+0.583% from last update)

Next Buy Target: $109.30

Waste Management (WM) came under weakness with the rest of the market later in February, dropping below its 200-Day Moving Average (MA) and triggering a buy order I had in place which filled at $109.53 on Monday, February 22.

The order lowered my per-share cost -9.571% from $113.89 to $112.80. While I do like the long-term prospects for WM, I am still building this position slowly as volatility continues to dramatically affect the name.

Given how well WM held up during the selloff and how small my current allocation is, I’ve decided to re-up and add additional shares if WM re-tests the lows of the recent selloff with my first buy target at $109.30.

As of this update, WM is $110.83, up +1.19% from where I added.

* Target allocation for each position in the portfolio is 12.50% of the overall portfolio.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.