Summing Up The Week

With the Trade War in full effect showing absolutely no signs of stopping, volatility will be the name of the game for the coming weeks and months.

This week was intense with powerful selloffs on multiple days. Opportunities abound, however this is the time to refer to your Trading Plan and, if you do decide to make a move, add or open positions using small quantities and wide trading levels.

With that, let’s see what news moved the markets this week…

Market News

Hedge Funds say the Markets are in the Clear

Based on the call-to-put ratio in the VIX – the Volatility Index fund that tracks the amount of extreme movement in the markets, hedge funds are betting the sell-off is over, reported CNBC on Monday.

A quantitative strategist at Nomura Capital – an investment firm – said hedge funds taking off their bets that the markets would see choppy trading over the coming days signals the end of the market selloff from the past few weeks.

If the markets returned to their bull run, we’d be happy, but, as always, prudent investors plan for both outcomes. One errant tweet can send the market reeling once again!

Game of Thrones causes 27.2 million to call in sick

Did you watch the Game of Thrones series finale on Sunday? Don’t worry – we won’t spoil it for you if you didn’t. However, it seems many U.S. workers decided the last episode was so traumatic that they needed a day to mourn – to the tune of an estimated 27.2 million workers calling in sick on Sunday (to watch it live) and Monday (to get over the hangover?), according to a poll by the Workforce Institute at Kranos reported CNBC.

As a point of reference, Kronos estimates that 17.2 million people called in sick the Monday after the Patriots beat the Rams in the Super Bowl. We feel their pain – those Pats have got to lose sometime, right?

Huawei Receives a Reprieve

Just like that, the U.S. Commerce Department eased restrictions against Huawei after the bell on Monday, reported CNBC. The easing of bad news amounted to good news for the semiconductor sector, which bounced from its recent lows during Tuesday trading.

The seemingly erratic and bipolar behavior of the news flow results in extremely volatile market conditions. Because of this, we hold to the Buying in Stages strategy; rather than buying all in or waiting for the absolute lowest levels, a prudent strategy seems to be to buy small amounts at lower and lower stages in order to capitalize on sudden bounces.

Amazon’s Next Target? Electric Cars!

Jeff Bezos, CEO and Founder of Amazon (AMZN), told employees at an all-hands meeting that he’s “very excited” about the auto industry, reported CNBC on Tuesday.

In February, Amazon invested $700 million in Rivian, an electric vehicle (EV) start-up, and Bezos told employees his excitement is why he made the investment.

In an odd twist of fate, Amazon’s investment makes them “partners” with Ford (F), which invested $500 million in Rivian in April, likely as a result of Ford having fallen behind to its competitors in the EV space according to auto industry experts.

And Speaking of Electric Cars…

In the meantime, Tesla (TSLA), the claimed leader in the EV space, is watching its stock collapse to $200 a share as reports of waning Model 3 sales have spread like wildfire. This is the first time Tesla’s stock has been at these price levels since 2016, and analysts say the shrinking demand combined with poor financial fundamentals does not look good.

In fact, Morgan Stanley analysts warned that a worst-case scenario event for Tesla could result in its stock dropping to $10 a share. The bad news continued for Tesla on Wednesday, when Citi got into the action with a slightly more “optimistic” price target for Tesla – $36 a share.

And we thought ride-sharing companies Lyft (LYFT) and Uber (UBER) had it bad…

Brexit’s Next Casualty? Prime Minister Theresa May

British Prime Minister Theresa May announced her resignation following her failure to negotiate an agreement for Britain to exit the European Union, reported CNBC.

Since the start o f her tenure, May has stated she would resign if she couldn’t fulfill her campaign promise of finding a way out of the European Union for Britain, and she proved that she is a woman of her word.

With all the trade war schenanigans, many traders and investors have forgotten all about the potential Brexit crisis, but Friday’s news serves as a reminder that it’s a potential market-moving event that still lies very much on the horizon.

Next Week’s Gameplan

The volatility might be unpredictable, but our approach hasn’t changed in weeks – stick to your trading plan and add where appropriate. As always, if you feel overwhelmed during a selloff, take a break and stop checking your positions for awhile to let your mind cool off so you don’t make rash decisions.

With the entire market selling off, take heart in knowing it’s likely not company-specific news that’s causing your stocks to drop.

Oh, and don’t forget next week is a four-day trading week! Happy Memorial Day, everyone!

This Week in Play

Stay tuned for this week’s episodes of our Investments in Play and Trades in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

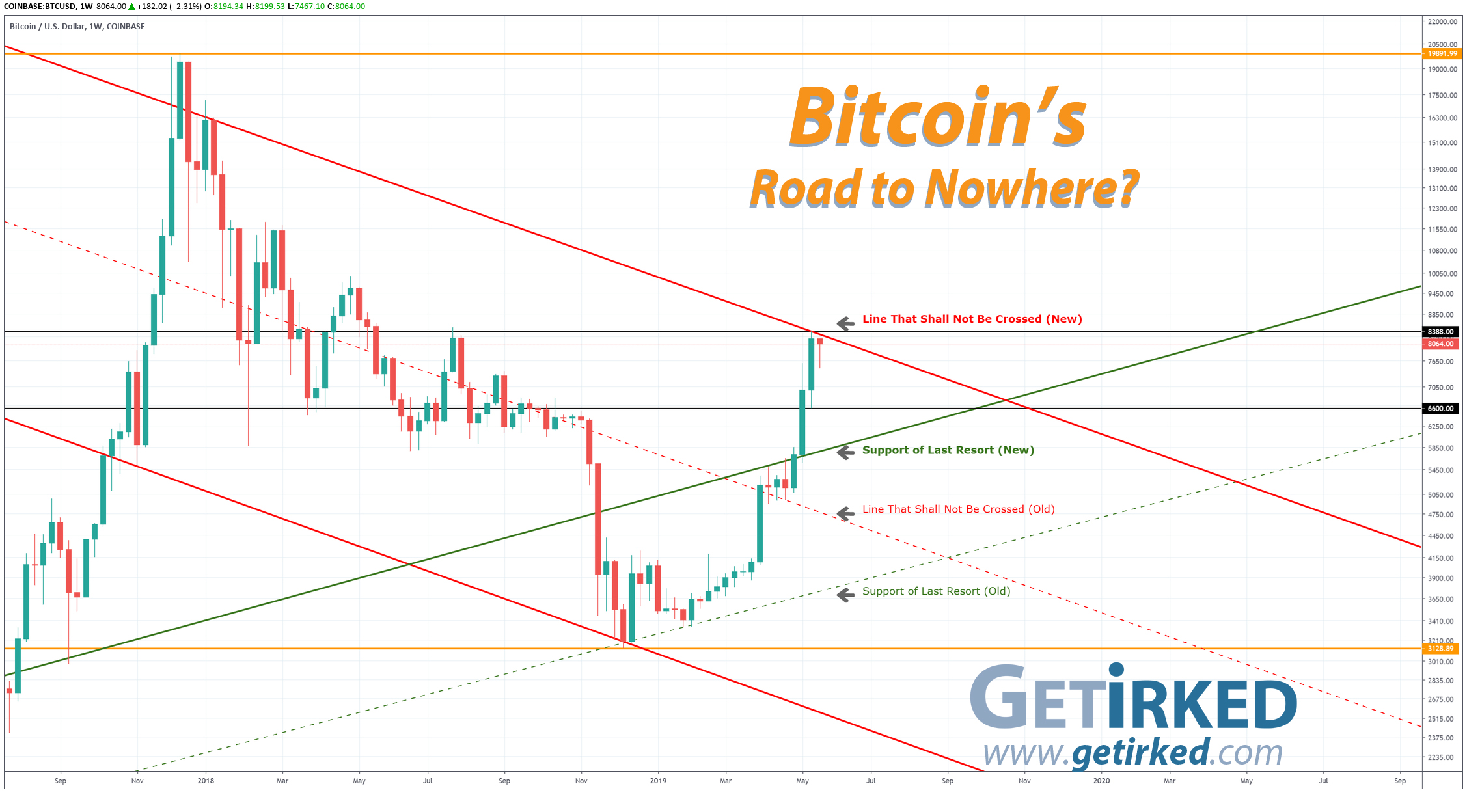

This week, Bitcoin once again shrugged off bad news – another delay for the SEC’s decision on a Bitcoin – maintaining the same levels it held last week with a weekly high of $8388.00 and a low of $6600.00.

Accordingly, we’ve revisited our basic trend-line analysis, adding new versions of both the Line That Shall Not Be Crossed (in solid red) and the Support of Last Resort (in solid green).

We’ve left the old versions as dashed lines of respective colors. Also, orange lines indicate the 2017 high and 2018 low of Bitcoin. The solid black lines indicate the weekly high and low.

For the moment, neither the bulls nor the bears seem able to move Bitcoin’s price. This is a holding pattern as both sides wait to see what will happen next.

Crypto in the News

Bitcoin ETF Delayed… Again

Bitcoin bulls and HODLers have promised that the ever-coming Exchange Traded Fund (ETF) will allow normal retail investors and institutions to safely trade crypto without having to hold the actual coins.

Unfortunately, Bitcoin can’t catch a break with the U.S. Securities and Exchange Commission (SEC) postponing the decision for years now. Although a decision was due this week, the SEC announced that it would once again delay their decision, putting Bitcoin price action in limbo, just under the $8,000 mark.

Bitcoin Gameplan

Bitcoin seems to have stablized… for the moment. We’re treading very carefully in the space with trading plans in place prepared for a potential pullback as far as December 2018’s $3,128.89 low.

If you’re considering the space, exercise extreme caution.

Get Irked in your Email?

We’re making a list and checking it twice! If there’s enough interest, we’ll start sending the Week in Review straight to your inbox!

Interested? Click here to sign up!