Summing Up The Week

While there was some negative inflation news this week, the market’s moves weren’t about news – the reality of the situation finally hit the markets. And, when I say “markets,” I mean all of the markets as stocks, bonds, precious metals, and, yes, crypto, all collapsed to the downside with Bitcoin breaking all of its support with no end in sight.

Let’s take a look at the news that moved the markets (or didn’t) this week…

Market News

Consumers worried a tiny bit less about inflation in April

Consumer expectations for inflation dropped in April according to a Federal Reserve survey released on Monday, reported CNBC. Expectations for inflation over the next year dropped to 6.3%, a 0.3% decrease from March’s record high. On a 3-year outlook, inflation expectations rose 0.2% to 3.9%, off 0.3% from the record.

“We have our job to do and we have to bring inflation back down,” Minneapolis Fed President Neel Kashkari told CNBC’s “Squawk Box.” Of course, there are many analysts and stock market pundits who believe the rate of inflation is already out-of-control and that the Fed is acting too slowly to bring it back in line.

Despite a relatively positive survey outlook, the markets sold off precipitously on Monday following last week’s already-awful rout later in the week.

Inflation still red-hot: CPI shows 8.3% year-over-year

The Consumer Price Index (CPI) increased 8.3% in April, more than the 8.1% and the highest in more than 40 years, reported CNBC on Wednesday. As a reminder, the CPI collects prices from a variety of sectors affecting the average American consumer as a way of measuring inflation, and any increase is a sign of inflation.

Against the trend that “bad news is good news for the markets,” analysts were hoping for a lower number when it came to the CPI because a higher number indicates that the Federal Reserve Bank has a lot more work to do when it comes to battling inflation by reducing its balance sheet and increasing the benchmark interest rate.

And, yes, the Fed has a lot of work to do…

Powell: “About that ‘soft landing’…”

Federal Reserve Chairman Jerome Powell warned that a soft landing might not necessarily be in the cards in an interview on Thursday, reported CNBC. The Fed has been claiming for much of 2022 that the actions it intends to take would prevent too much of a hit to the economy, what’s referred to as a “soft landing.”

In an interview with Marketplace on Thursday, Powell dramatically reduced the chances that the sailing would be smooth for the economy (mixed metaphors intended).

“So a soft landing is, is really just getting back to 2% inflation while keeping the labor market strong. And it’s quite challenging to accomplish that right now, for a couple of reasons,” the central bank chief said in the Marketplace interview. “So it will be challenging, it won’t be easy. No one here thinks that it will be easy; nonetheless, we think there are pathways … for us to get there.”

Next Week’s Gameplan

Some analysts believe stocks have made a bottom, if only temporary, but you know my approach – don’t try to predict which way stocks are going to go, they only have two directions – up or down. Rather than try to predict the market’s next move, have a plan for both directions.

Every investor must find their own way in any market, but, for me, I have a few key rules that I follow:

- Always Buy in Stages… never buy an entire position all at once.

- Buy on RED days and sell on GREEN days. Do the opposite of the herd.

- If you don’t know what to do, do nothing at all. Doing nothing is a legitimate strategy.

As always, thanks for reading and I’ll see you next week!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

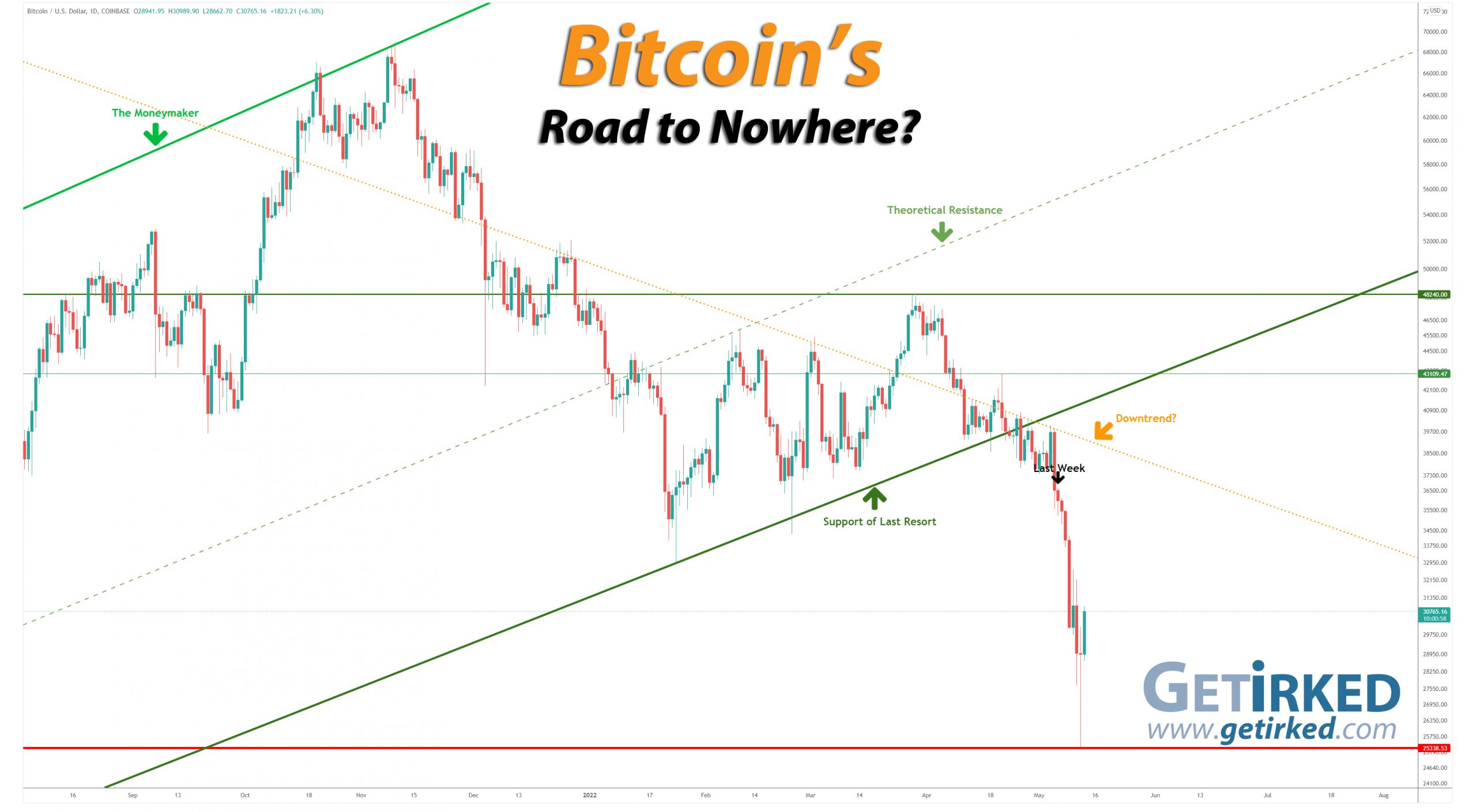

Bitcoin breaks down through $30K – loses ALL past support!

Everyone was waiting to see if Bitcoin would be able to continue to hold up through the epic market selloff we’ve been seeing over the past several months, and the world’s biggest crypto finally lost all of its support this week including its low from 2021, dropping through all previous support levels before finding a bottom at $25,338.53.

While many Bulls believe Bitcoin has found new support around $25K, the history of the crypto’s moves would indicate otherwise. Whenever Bitcoin has broken through a long-held level of support in the past, it breaks down further… much further.

The most recent example of this kind of support breaking was in 2018 where after breaking the $6,000 support mark, Bitcoin didn’t make a new bottom until $3128.89, nearly 50% lower. In other words, $14,000 is actually a “reasonable” low-end target for Bitcoin’s next key level of support if the selloff continues.

The Bullish Case

Bulls have been trying to keep it together but any arguments of “store-of-value” or “hedge against inflation” have long been defeated. At this point, no argument the Bulls make can be taken as legitimate – it’s obvious that Bitcoin has lost all previous support, and it’s up to the market to determine what its next move is.

The Bearish Case

Bears have ruled the roost, crowing about how Bitcoin would drop back down to $30,000 and below for months now. Well, their thesis has come true and many of them continue to claim that a drop to $20,000 in store. At this point, every argument is on the Bears’ side as Bitcoin trades in lockstep with the Nasdaq and high-growth stocks, and the trend is down for everything right now.

Bitcoin Trade Update

Current Allocation: 7.994% (+4.230% from last update)

Current Per-Coin Price: $30,683.55 (-21.635% from last update)

Current Profit/Loss Status: +0.266% (+8.413% from last update)

Bitcoin’s dramatic breakdown below $30K led to a series of my buy orders getting filled starting at $34,803.60 and all the way down to my lowest buy at $25,585.20. The combined buys gave me an average buy price of $27,566.97 after fees.

The buys substantially lowered my per-coin price -21.635% from $39,154.50 to $30,683.55, and raised my allocation +4.230% from 3.764% to 7.994%. My new per-coin price represents a -52.815% reduction from where this trade started in November 2021 way up at $65,027.96. This is why I always control my allocations, plan my trade, and buy in stages.

While Bitcoin has seen a bit of a bounce and relief rally off its $25K low and my trade is now profitable, it’s hard to get too excited about the move given the macro bearish sentiment we’re seeing in every market right now.

Yes, this trade is finally starting to get real as we all wait to see how low Bitcoin will go this time around.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

4.795% @ $23,412

12.57% @ $20,459

3.557% @ $18,257

3.557% @ $16,657

3.557% @ $13,766

3.557% @ $11,606

3.557% @ $10,309

3.557% @ $9,025

5.963% @ $7,611

17.38% @ $5,258

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

- In the first half of 2019, Bitcoin rallied +343% to $13,868.44.

- In December 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- In February 2020, Bitcoin rallied +64% to $10,522.51.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In April 2021, Bitcoin rallied +51% to a new all-time high of $64,896.75.

- In June 2021, Bitcoin crashed -56% to a low of $28,800.00.

- In November 2021, Bitcoin rallied +140% to a new all-time high of $69,000.00.

- In May 2022, Bitcoin crashed -63% to a low of $25,338.53.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero. I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto. I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space. On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.