Summing Up The Week

The stock market has become unimpressed with comments from the Fed and the Treasury, selling off despite repeated positive commentary and potential positive indications that the economy is recovering.

Investors continue to rotate out of growth stocks in cyclical value stocks, putting extreme selling pressure on technology and any stock with a high valuation such as newly-released IPOs and Special Purpose Acquisition Companies (SPACs).

Let’s take a look at the news that moved (or didn’t) the markets this week…

Market News

Existing Home Sales Drop, but is a Housing Crash Coming?

The housing market continues to rage on as the National Association of Realtors released a report showing sales of existing homes in February dropped a larger-than-expected 6.6% compared with January, reported CNBC on Monday.

While economists continue to point to the housing market as a point of economic rebound, they regularly forget a few key factors – between the mortgage and eviction moratoriums and the low interest rates, existing homeowners either don’t want to sell because they’re comfortable with their current mortgage, or existing homeowners aren’t paying their mortgages and therefore have no motivation to sell – why move where you’ll need to pay rent when sitting pat is free?

Worse still, real estate professionals whose advice has been proven in the past believe the housing market will crash dramatically in the last-half of 2021 or the first-half of 2022.

Why?

Once the moratoriums expire, there are millions of homes currently in forebearance either due to homeowners not paying mortgages or renters not paying rent leading to the landlords not paying the mortgage.

While some may be able to make deals with lenders to prevent foreclosure, forecasts reveal that the current 2-month supply may balloon. Whereas a healthy real estate market has 6 months of homes on the market, more than that causes price depreciation.

During the Great Recession, the last time we saw huge housing market price declines, a one-year supply led to significant price depreciation. Current predictions for the upcoming crash suggest we may end up with a one- or even two-year supply.

Should that come to pass, the upcoming crash will be more severe than any seen in the real estate market up to this point. Buyers entering the housing market now may be sorely disappointed with their near-term results.

Powell, Yellen see high valuations, not worried about stability

On Tuesday, Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell testified before Congress, acknowledging that while they see prices in some areas of the market that look expensive, they remain unconcerned about market stability, reported CNBC.

“I’d say taht while assset valuations are elevated by historical metrics, there’s also belief that with vaccinations proceeding at a rapid pace, that the economy will be able to get back on track,” said Yellen.

“We look carefully at financial stability on an ongoing basis, we have a framework with four pillars,” explained Powell. “If you look at those, the evidence is kind of mixed; you can say that some asset prices are a bit high, but the bank system is highly capitalized.”

Despite the duo’s relatively benign testimony, the stock markets sold off following the Congressional session, leading to some analysts to believe that the markets feel the Treasury and Federal Reserve may be out-of-touch.

Why did the markets sell off if the comments were relatively positive?

While in times of extreme crisis, the comments from the Treasury Secretary and the Federal Reserve may calm markets, we’re not in a time of crisis. In fact, many investors believe we may see “hyper-inflation” (a condition where the prices of food, goods, and services rises incredibly fast).

In times like these, the markets will often sell off following benign testimony, fearing that the Federal Government simply isn’t seeing the signs and that the conditions could get much worse before any action is taken to temper potential inflation risk.

New Jobless Claims at 684K vs 781K Expected

On Thursday, the Labor Department released the past week’s new jobless claims coming in at 684,000 versus the 781,000 expected by Dow Jones economists, reported CNBC.

While this was the first time since the beginning of the pandemic for jobless claims to drop below 700,000 and continuing claims declined to 3.87 million (down 264,000), there is still a lot of work to be done to restart the economy.

The stock market was unimpressed and continued its week-long selloff with a particular focus on growth stocks with high valuations such as those in the technology sector along with high-flying SPACs (Special Purpose Acquisition Companies) which had become popular in recent months.

Next Week’s Gameplan

It should come as no surprise that predicting exactly how much longer this selloff will continue is virtually impossible, however, I believe we’ve started to enter Buying Season, so I’ve been adding to long-term, trusted positions… slowly.

As always, make a trading plan in advance so you will know when the stocks of companies you want to buy are at good valuations and Buy in Stages, always keeping some of your powder dry in case we see further weakness.

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

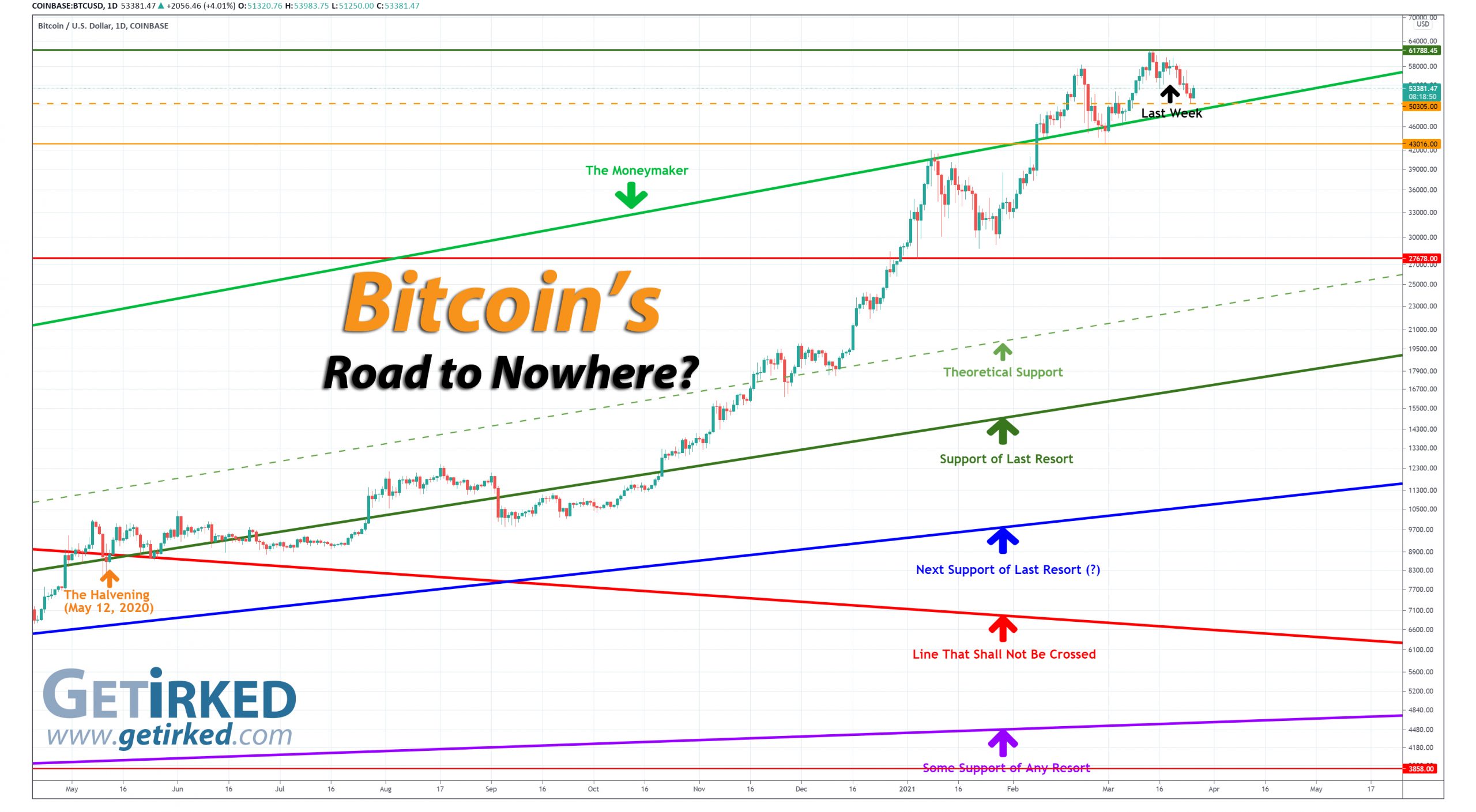

Bitcoin retreats but finds support above $50K

Bitcoin sold off after last week’s update, dropping to a low of $50,305.00 (-18.59% off its all-time high) before finding support and bouncing as of this writing.

The Bullish Case

Bulls continue to extol the virtues of ongoing institutional interest and announcements of Tesla (TSLA) officially accepting Bitcoin as payment for vehicles. Additionally, holding the psychological $50,000 level is significant for the bullish thesis and they believe Bitcoin will see further upside from here.

The Bearish Case

Bears argue that this pullback is just the beginning. Looking at the Relative Strength Indicator (RSI) of Bitcoin on the Monthly timeframe shows Bitcoin remarkably overbought, similar to levels last seen at 2017’s all-time high. Based on its current levels, Bears believe April could be a very rough month for the crypto.

If Bitcoin breaks through its new weekly low of $50,305.00, the next point of support is the monthly low of $43,016.00.

For more details, check out my YouTube video on Technical Analysis where I analyze Bitcoin’s current chart and potential downside risks.

Bitcoin Gameplan

*Closed trade with 11.628% profit, Opened new trade at $58,114.23*

Current Allocation: 2.827% (+0.108% from 2.719% start)

Current Per-Coin Price: $57,792.41 (-0.554% from $58,114.47 start)

Current Profit/Loss Status: -7.632% (New Trade)

Meet the New Trade, Same as the Old Trade?

On Sunday, I decided to lock in +11.628% in gains at $58,114.23, closing out the trade that I bought for an average price of $51,933.10 after fees and sold for an average price of $57,971.78 (also, after fees). As always, I never take my profits as USD, instead transferring any crypto gains onto cold wallets.

Feeling like Bitcoin could go either direction from there, I decided to open a new trade with a smaller 2.719% allocation at $58,114.23 to see where Bitcoin might head next (although it felt like lower was more likely… and it was).

On Thursday, Bitcoin broke down and triggered a small buy order I had in place which filled at $50,540.13 and reduced my per-coin cost by -0.554% to $57.792.41. I only purchased a small quantity as I fully expect Bitcoin to test its low of $43,033.66 (on Gemini) and potentially head much lower to cool off extreme overbought conditions on the monthly Relative Strength Index (RSI).

After bouncing so convincingly off its low, I’ve raised my next buy target to add more should Bitcoin retest its low before heading higher.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.183% @ $50,639

0.183% @ $47,958

0.456% @ $46,469

0.456% @ $43,453

0.456% @ $38,356

0.456% @ $33,209

1.727% @ $26,086

2.445% @ $21,044

3.654% @ $16,583

4.345% @ $13,593

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

- In March 2021, Bitcoin rallied +44% to a new all-time high of $61,788.45

- Later in March, Bitcoin dropped -19% to a low of $50,305.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.