Summing Up The Week

Volatility has returned to the markets in a big way as the indexes whipsawed wildly nearly every day this week with the S&P 500 regularly seeing day swings of more than 1.25% (just for a reference – the indexes typically move about 0.5% or less over the course a typical trading day).

By the end of the week, the S&P 500 had dropped to a low of -2.30% since last week and the NASDAQ collapsed, dropping more than -6% since last week!

How did this all happen? Well, let’s look at the news that moved the markets…

Market News

White House promises vaccinations for all by June

On Tuesday, President Joe Biden announced the U.S. will have enough supply of coronavirus vaccines to inoculate every adult by the end of May, reported CNBC. While this is excellent news for the health of the country in the ongoing fight against Covid-19, this news could counterintuitively spell the end of the Bull Market.

Um…. why could this news end the rally?

The stock market is a future discounting system which means stocks typically bake in good news well in advance. With the economy potentially recovering even faster than the stock market expected, fears that the Federal Reserve may start hiking interest rates could enter investors’ minds.

Additionally, a fourth stimulus injection in the form of an infrastructure bill was expected by many, however, if the virus is no longer an issue and people can go back to work, the infrastructure bill may be far more difficult to pass.

Finally, the rate on the 10-year treasury continues to be an issue. While the rate stayed flat during Monday’s trading, it stayed unusually flat, leading some pundits to question whether the Fed may have already pegged the interest rate, a disconcerting move for most as it could remove credibility in the U.S. dollar.

All this goes to say that the markets may continue to experience volatility as they continue pricing in the varying news events.

Private payroll February growth misses expectations

On Wednesday, ADP released a report showing private payrolls increased by 117,000 in February, far short of the 225,000 expected by Dow Jones economists, reported CNBC.

Paul Ashworth, chief U.S. economist at Capital Economics referred to the ADP report as “a disappointment given that the drop-off in coronavirus case numbers and the resulting lifting of containment measures should be giving the economy a bigger shot in the arm.”

The private payroll report is another indicator that rising interest rates may have more to do with inflation and less to do with the recovery of the U.S. economy as many had initially hoped.

Weekly jobless claims total 745K vs. 750K estimate

On Thursday, the Labor Department reported new weekly jobless claims of 745,000 versus the 750,000 expected by Dow Jones estimates, reported CNBC.

While some pundits suggested this slightly-less-than-bad number was good news, I disagree; these numbers are often revised up to a few weeks or even months after the fact, and 5,000 represents a -0.67% difference, well within any statistical margin of error.

And even if the number was “just” 745,000, that’s still nearly a million newly-unemployed Americans. Additionally, the Labor Department report showed more than 18 million Americans were receiving some form of unemployment compensation through February 13.

Yeah, the economy’s not red-hot, yet. Not by a long shot.

Tech stocks got slammed this week

While all three indexes (Dow Jones, S&P 500, and NASDAQ) saw significant volatility this week, the tech-laden NASDAQ saw more than most, with the index dropping more than 1% this week as higher rates spooked growth investors, reported CNBC on Thursday.

As I’ve mentioned the last few weeks, as treasury bond yields increase, the wealthiest investors retreat into bonds and dividend-yielding stocks. Others will swap out of secular (theme-based) growth stocks like technology into cyclical-based stocks that represent the state of the economy – such as infrastructure plays like Caterpillar (CAT), Deere (DE), and Boeing (BA).

The result can produce a flat S&P 500 or Dow Jones index combined with a negative NASDAQ. How to counter this to ensure your portfolio still gains? Better life through Diversification, my friends.

Powell warns of accelerated inflation

In statements made on Thursday, Federal Reserve Chairman Jerome Powell said that inflation is likely to rise as the economy recovers, however it will be temporary, reported CNBC.

In a perfect world, the Fed would like inflation to run around 2%, a rate it believes is a sign of a healthy economy while also providing room to cut interest rate. That being said, we haven’t seen an inflation rate that high in decades.

As I’ve said previously, the stock market is a future-discounting system, so shortly after Powell’s comments, stocks sold off in earnest as investors feared the rising yield of the ten-year treasury bond.

Job growth surges, Stock market craters…

On Friday, the Labor Department released a report showing nonfarm payrolls increased 379,000 in February versus estimates for 210,000, reported CNBC. Better still, the majority of the hiring came from the hospitality sector where the majority of jobs were lost due to the nationwide lockdown.

So, why did the stock market collapse?

While the hiring is excellent news for the overall health of the economy, the yield on the 10-year Treasury bond, a key indicator of inflation when it rises, jumped to 1.626%, higher than last week’s tick of 1.6%, reported CNBC.

As I discussed earlier in this week’s review, a rising bond yield indicates inflation, and causes investors to fear a potential rise of the Fed’s benchmark yield despite Powell’s comments on Thursday that such an action isn’t remotely in the cards from the Fed.

However, many analysts believe that the stimulus spending could result in runaway inflation, and that the Federal Reserve might not be able to control inflation like it thinks it can, resulting in a collapse of the economy as the U.S. dollar loses spending power and American companies are unable to compete on the international stage as a result.

Next Week’s Gameplan

Many analysts have been expecting a substantial pullback for quite some time (in fact, I’ve been talking about it for what feels like months), however, the question is – how much of a pullback do we have in store?

Some analysts suggest a garden-variety pullback of 5-10% on the S&P 500 while others think we could see 20%, 30%, or even more.

How do we counter these kinds of wild predictions? Buying in Stages, friends. Plan before the crash starts and take into consideration all possibilities. By doing so, you can take advantage of selloffs, yet don’t kick yourself for buying in all at once too early, or missing the drop entirely by waiting too long to buy.

Until next week, take care of yourselves and have a great weekend!

This Week in Play

Stay tuned for this week’s episodes of my two portfolios Investments in Play and Speculation in Play coming online later this weekend!

Crytpo Corner

Important Disclaimer

Get Irked contributors are not professional advisers. Discussions of positions should not be taken as recommendations to buy or sell. All investments carry risk and all readers must accept their own risks. Get Irked recommends anyone interested in investing or trading any asset class consult with a professional investment adviser to determine if an investment idea is suitable to them and their investment goals.

Click chart for enlarged version

Bitcoin Price (in USD)

%

Weekly Change

Bitcoin Price Action

Stocks aren’t the only ones having a wild ride…

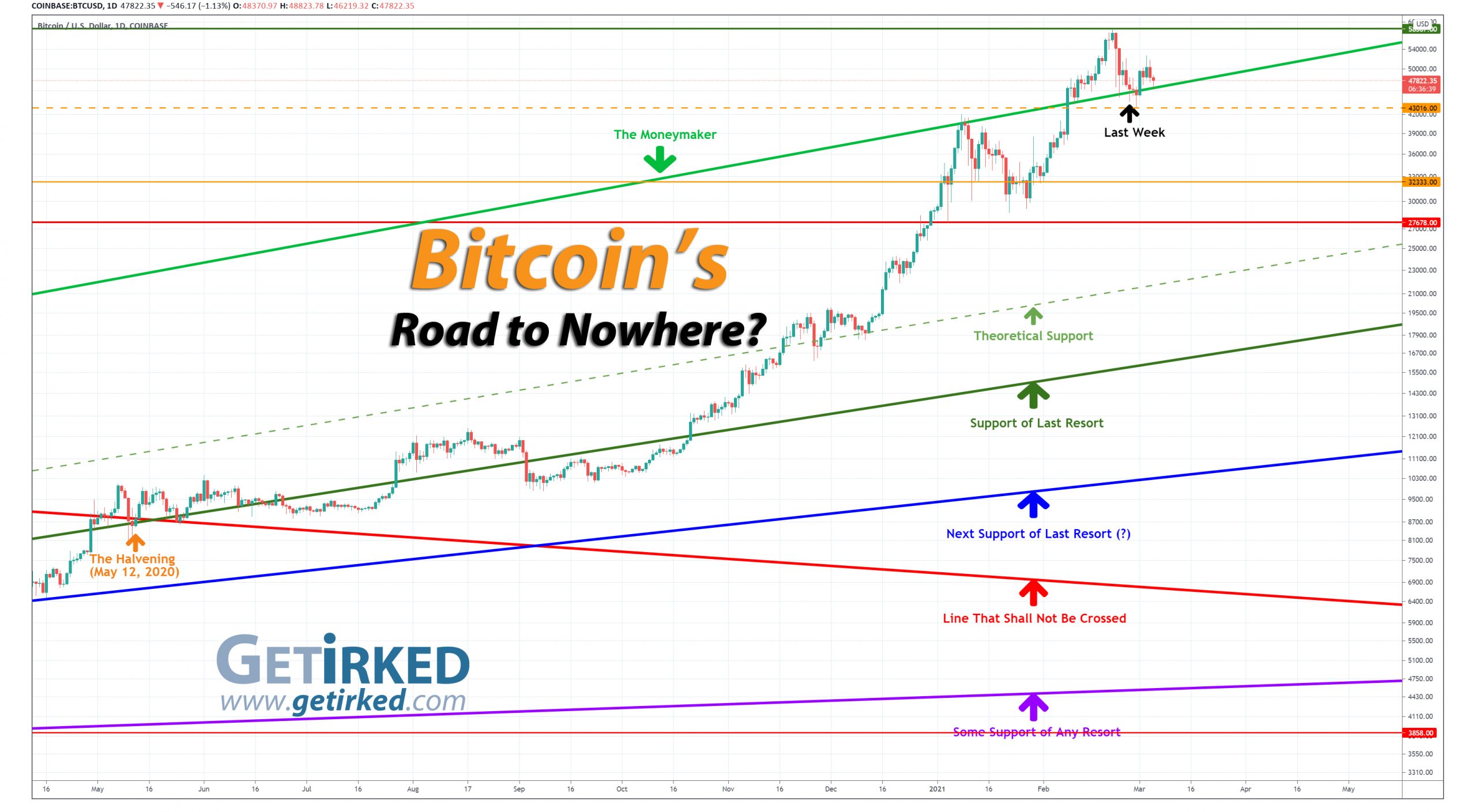

Bitcoin dropped to a new low of $43,016.00 this week before finding support basically right on The Moneymaker trendline. Man, if that isn’t a demonstration of how resistance becomes support, I don’t know what is!

That being said, between the volatility in the stock market and last week’s weakness in crypto, Bitcoin’s having a difficult time breaking $50K and staying there.

The Bullish Case

Bulls point to Bitcoin’s “only” -31% pullback from $42k to $28.7k in January and its recent -26.30% pullback from $58,387.00 to $43,016.00 in February as newfound strength in crypto never seen before. I’ve even heard some analysts say the most dangerous four words to anyone’s investment in any asset class: “This time is different.”

The Bearish Case

Bears believe they know better. Bitcoin and the entire cryptocurrency space is near all-time highs in terms of being overbought according to the Relative Strength Indicator (RSI). The last time Bitcoin was this overbought was back in 2017, and the space saw a pullback of nearly -85% from its then all-time high before finding support. If that happens again, Bears suggest we could see a low in the $9,000s.

Bitcoin Gameplan

Current Allocation: 4.493% (-0.063% since last week)

Current Per-Coin Price: $51,733.91 (-1.269% since last week)

Current Profit/Loss Status: -7.561% (+2.882% since last week)

Being Patient is Boring…

After adding a bit to my position last Saturday at $44,609.77 and reducing my per-coin cost by -1.269% from $52,398.72 to $51,733.91, it’s now time to sit on my hands and wait for Bitcoin’s next big move.

I’ve decided to trim small amounts of my allocation if Bitcoin rises to +5% and +10% above my per-coin cost ($54,510 and $57,100, respectively) just in case Bitcoin makes a try for its all-time high, fails, and potentially drops upwards of 80% as it did in 2018.

If Bitcoin does drop from here, I’ll use the buying targets I’ve set below to add more.

Bitcoin Buying Targets

Using Moving Averages and supporting trend-lines as guides, here is my plan for my next ten (10) buying quantities and prices:

0.453% @ $44,779

0.452% @ $41,849

0.452% @ $38,405

0.452% @ $34,475

0.452% @ $30,036

0.452% @ $27,790

0.452% @ $26,118

0.982% @ $22,440

1.290% @ $19,977

2.139% @ $16,860

No price target is unrealistic in the cryptocurrency space – Bullish or Bearish.

While traditional stock market investors and traders may think the price targets in the cryptocurrency space are outlandish due to the incredible spread (sometimes a drop of near -90% or a gain of up to +1000% or more), Bitcoin has demonstrated that, more than any speculative asset, its price is capable of doing anything.

Here are some of Bitcoin’s price movements over the past couple of years:

- In 2017, Bitcoin rose +2,707% from its January low of $734.64 to make an all-time high of $19,891.99 in December.

- Then, Bitcoin crashed nearly -85% from its high to a December 2018 low of $3128.89.

In the first half of 2019, Bitcoin rallied +343% to $13,868.44. - From June 2019, Bitcoin crashed -54% to a low of $6430.00 in December 2019.

- From December 2019’s low, Bitcoin rallied +64% to $10,522.51 in February 2020.

- In March 2020, Bitcoin crashed nearly -63% to a low of $3858.00, mostly in 24 hours.

- Then, Bitcoin rallied +988% to a new all-time high of $41,986.37 in January 2021.

- Later in January, Bitcoin dropped -32% to a low of $28,732.00.

- In February 2021, Bitcoin rallied +103% to a new all-time high of $58,367.00.

- Later in February, Bitcoin dropped -26% to a low of $43,016.00.

Where will Bitcoin go from here? Truly, anything is possible…

What if Bitcoin’s headed to zero?

The only reason I speculate in the cryptocurrency space is I truly believe Bitcoin isn’t headed to zero.

I am prepared for that possibility, however, by knowing I could potentially lose all of the capital I’ve allocated to this speculative investment. Professional advisers recommend speculating with no more than 5% of an investor’s overall assets. Personally, I’ve allocated less than that to speculating in crypto.

I feel that anyone who doesn’t fully believe in the long-term viability of cryptocurrency would be better served not speculating in the space.

On a good day, this asset class isn’t suitable for those with weak stomachs. On volatile days, the sector can induce nausea in the most iron-willed speculator. If a speculator isn’t confident in the space, the moves will cause mistakes to be made.

DISCLAIMER: Anyone considering speculating in the crypto sector should only do so with funds they are prepared to lose completely. All interested individuals should consult a professional financial adviser to see if speculation is right for them. No Get Irked contributor is a financial professional of any kind.

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Suicide Hotline – You Are Not Alone

Studies show that economic recessions cause an increase in suicide, especially when combined with thoughts of loneliness and anxiety.

If you or someone you know are having thoughts of suicide or self-harm, please contact the National Suicide Prevention Lifeline by visiting www.suicidepreventionlifeline.org or calling 1-800-273-TALK.

The hotline is open 24 hours a day, 7 days a week.