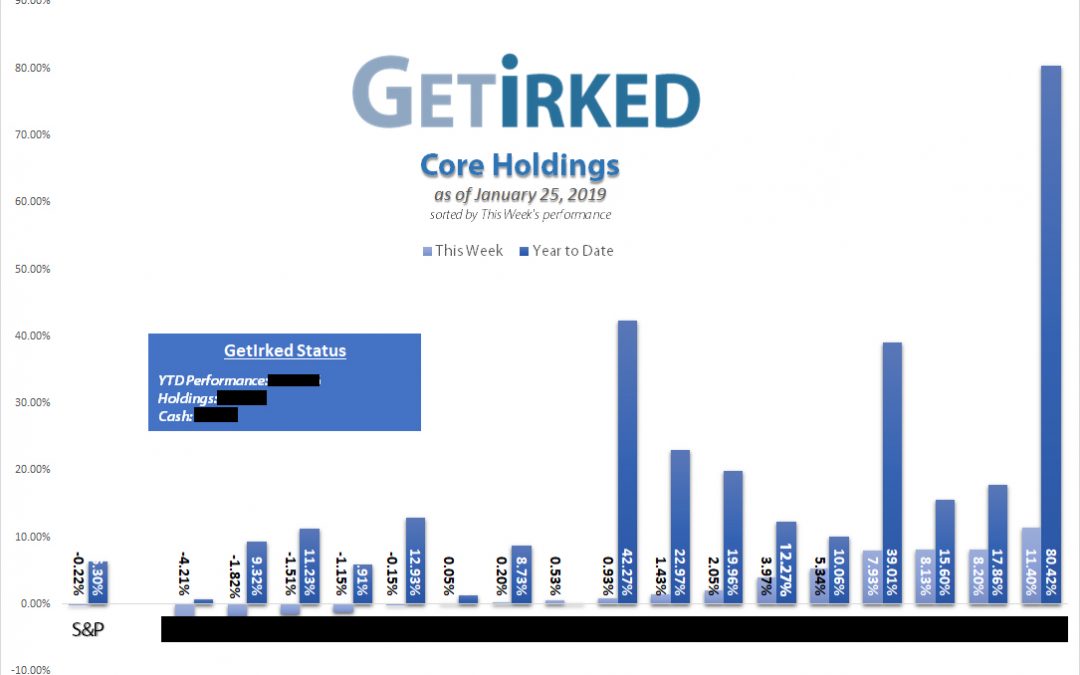

Core Holdings as of January 25, 2019

I’ll admit it – the 20% pullback “bear market” we saw from October to December caught me a bit off-guard. I always keep some funds on the sidelines to take advantage of pullbacks, but I wasn’t planning for the extent of this pullback – it was NUTS!

The market has recovered in spectacularly rapid fashion (some might say TOO rapid), so I spent this week taking profits so I can be better prepared if we see a retracement of December’s lows as many analysts expect. You’ll see the “taking profits” theme throughout the myriad of moves I made this week.

Highlights from the Week

• Are you getting tired of hearing about the pot stocks? Well, don’t bail too soon – they’re still going higher and higher. If you’re in any of these plays and have profits, you might consider setting some stop losses to protect some of your gains. This sector has more volatility than any of them right now – seeing huge gains followed by huge drops. Canopy Growth (CGC) is up a whopping 80.42% just this year!

• The semiconductor space is back despite Intel’s (INTC) disappointing earnings report. Cypress Semi (CY) gained 5.34% just this week and is already up 10% on the year!

• Apple (AAPL) and Disney (DIS) are both painfully lethargic with APPL just breaking even on the year (barely) this week and Disney lagging the S&P significantly, up only 1.31% on the year. We all know what happened to AAPL, but what’s going on at DIS?

• Take Two Interactive (TTWO) pulled back 6% on Thursday after the whisper on the street that Grand Theft Auto Online isn’t as popular as it used to be in light of the Fortnite phenomenon. TTWO is still best-of-breed in the video game software space, so we’ll have to wait for their earnings report to learn more.

Gameplan for Next Week

• Trump’s agreement to fund the government gives us three weeks, but then we’ll be right back at it. Although Friday’s news might move the markets higher, any bad news could send us down, too.

• Given the speed with which the market regained its footing, don’t be too sure of where we stand. Be prepared for any bad news next week – I have buy orders set close to December’s lows in case we see another drop that gives us the opportunity to pick up some of our favorite stocks at lower levels.

• I’m still eyeing my overweight positions – particularly Take Two (TTWO) and JP Morgan (JPM) – hoping that the upward movement continues and will let me lighten up to more acceptable sizes.

This Week’s Trades

• Canopy Growth (CGC) – I took profits WAY too early in CGC, choosing to sell some at its first pop to $37.72. Hey, who would have known it would fly so much higher? This is why I Sell In Stages just like I Buy in Stages. My per-share cost is now $11.62, a 314% gain from its $48.15 weekly close.

• Cypress Semiconductor (CY) started to pop when hedge fund investors flipped from safety plays back to the semis. I sold a small part of my position at $13.58 to get my per-share cost down to $3.68, a 269% gain from its $14.00 weekly close.

• GW Pharma (GWPH) took the selloff particularly rough, dropping from the low $170s all the way down to almost $90. When it crossed back over my per-share cost briefly this week, I took the opportunity to lighten up the entirety of my overbuy at $142.00. It closed the week lower at $138.56.

• IBM (IBM) popped after reporting spectacular earnings and I took some profits at $131.73, dropping my per-share cost to $107.94. I’m now up 22.67% on my position as it closed higher at $132.40 this week with aims to buy back in if we see a retrace of December’s lows.

• IDEXX Labs (IDXX) saw some great movement this week with me selling a bit right before $200 at $199.06, lowering my per-share cost to $132.40, a current gain of 57.74% off the $208.85 weekly close.

• Logitech (LOGI) reported some mighty nice earnings and started to regain its footings. I had gone overweight in my position during the December drop, so I lightened up at $36.14, lowering my per-share cost to $33.70, a gain of 7.30% off its $36.16 weekly close.

• Nike’s (NKE) been a big winner for me over the years, but when it showed relative strength crossing over $80 this week, I decided it was time to stop being greedy and snag some profits at $80.71, putting me up 322.57% over my initial investment at its $80.61 weekly close.

• Nvidia (NVDA) saw a bit of a pop this week. I had added to my position during the sell-off, so I took the opportunity to take my cost basis completely out of my position at $153.88. It closed the week even higher at $160.15, leaving me up 241% off my initial investment.

• Salesforce (CRM) shot past $150 this week and you don’t need to tell me twice about this high-flyer and its crazy volatility. I bailed on some of my position at $150.28 to lower my per-share cost to $120.10, up 24.68% from its $149.74 weekly close.

• Square (SQ) has bounced back in an insane way. I took some profits as it was struggling around the $70 mark at $70.12, taking out even more profits in the name and leaving me up 433.62% on my initial investment when it rocketed higher, closing the week at $78.10.

• Take Two Interactive’s (TTWO) rumor mill hit the market while I was watching, causing the stock to briefly dip just below $100. I added to my position at $100.11 to take advantage of the volatility, betting that their earnings report will blow away expectations. My per-share cost is now $109.52, 5.32% away from the $103.70 weekly close.

Core Holdings Status

- Year-To-Date Performance: +14.33%

- Cash: 27.74%

- Invested: 72.26%

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.