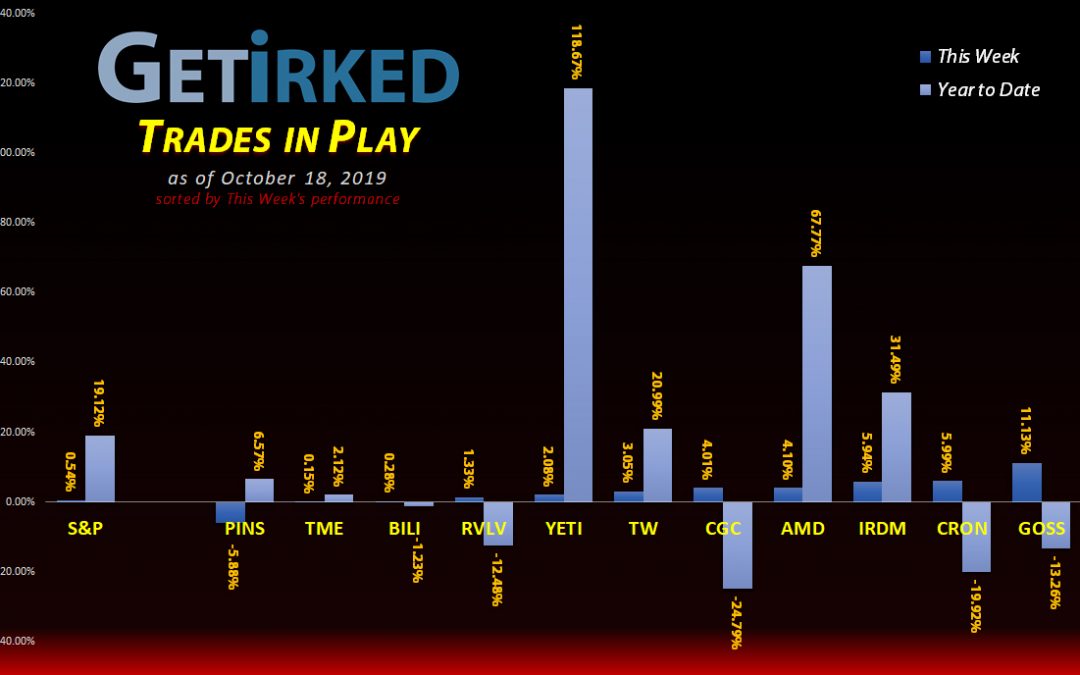

The Week’s Biggest Winner & Loser

Gossamer Bio (GOSS)

Following its sell-off reaching new all-time lows, Gossamer Bio (GOSS) bounced +11.13% this week to earn its spot as the Biggest Winner.

GOSS has been incredibly volatile ever since its IPO earlier in 2019 and given its new-found range, I fully expect to see this kind of up-and-down action continue well into the future.

Pinterest (PINS)

The lock-up on Pinterest (PINS) shareholders ended this week, meaning that early investors finally got their opportunity to sell, resulting in a -5.88% sell-off in the stock. A substantial drop is typical following an IPO’s lockup expiration, however, I must admit I was hoping this might be one of the rare occasions where early investors had enough faith to hang on to their investments. While this wasn’t the case, I do expect PINS to do well into the future given its prospects and profitability.

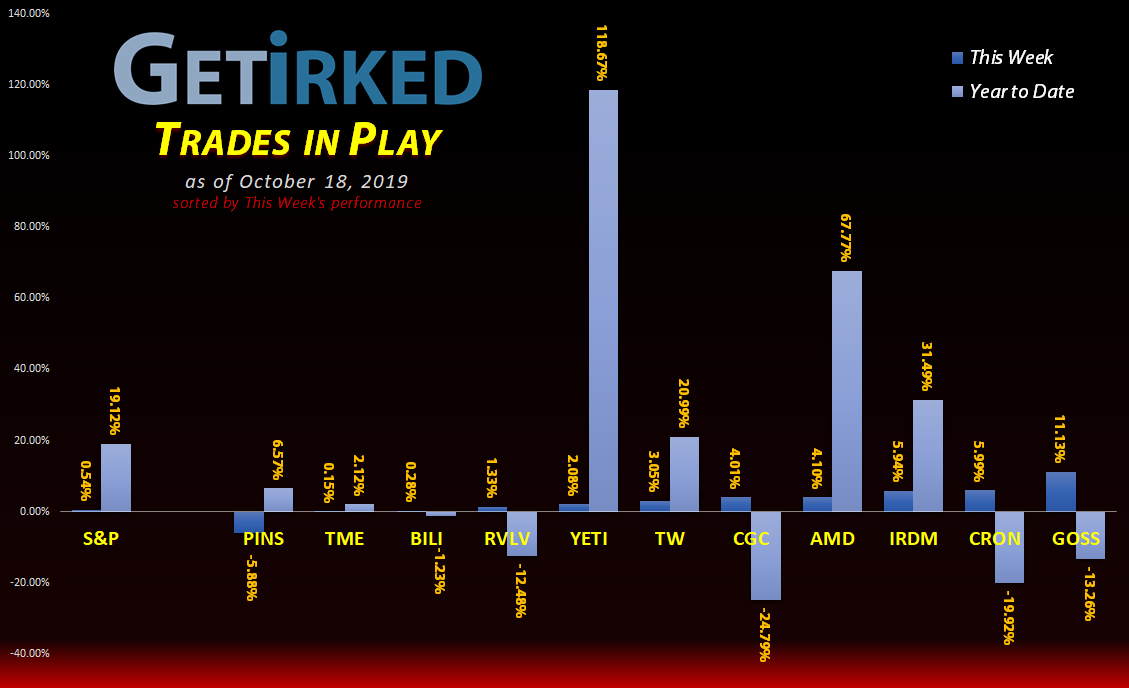

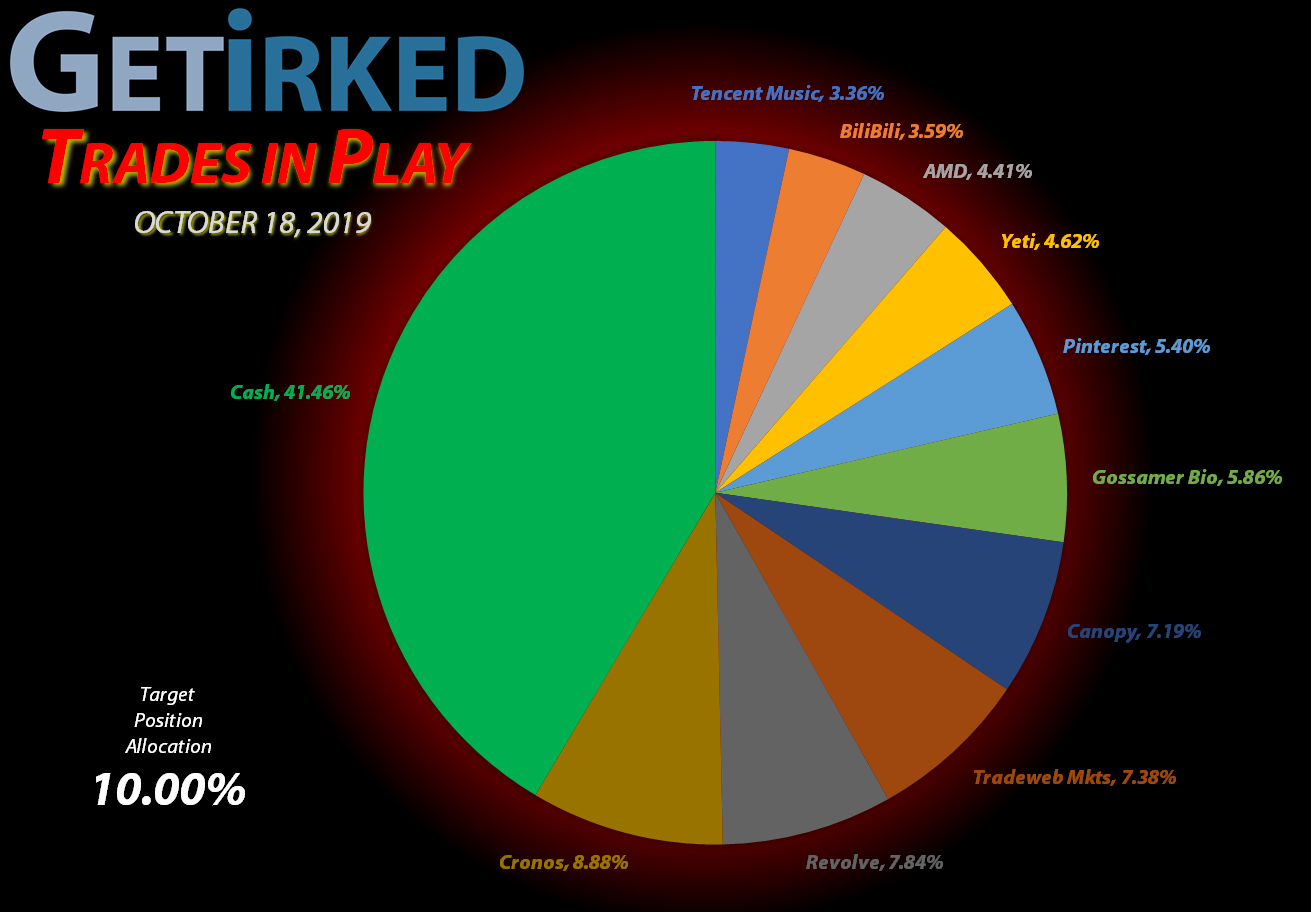

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+107.65%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.63

AMD (AMD)

+71.67%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $18.04

Tencent Music (TME)

+25.46%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.76

Tradeweb Mkts (TW)

+11.75%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.14

Gossamer Bio (GOSS)

+2.89%

1st Buy: 9/26/2019 @ $17.07

Current Per-Share: $16.02

Iridium Comm (IRDM)

+1.27%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $0.00

Pinterest (PINS)

+0.78%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $25.12

Canopy Growth (CGC)

-0.83%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.38

BiliBili (BILI)

-4.22%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.05

Cronos Group (CRON)

-21.47%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $10.60

Revolve Group (RVLV)

-25.76%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $29.67

Profit % for * positions = Current Gross Profit / Original Capital Investment

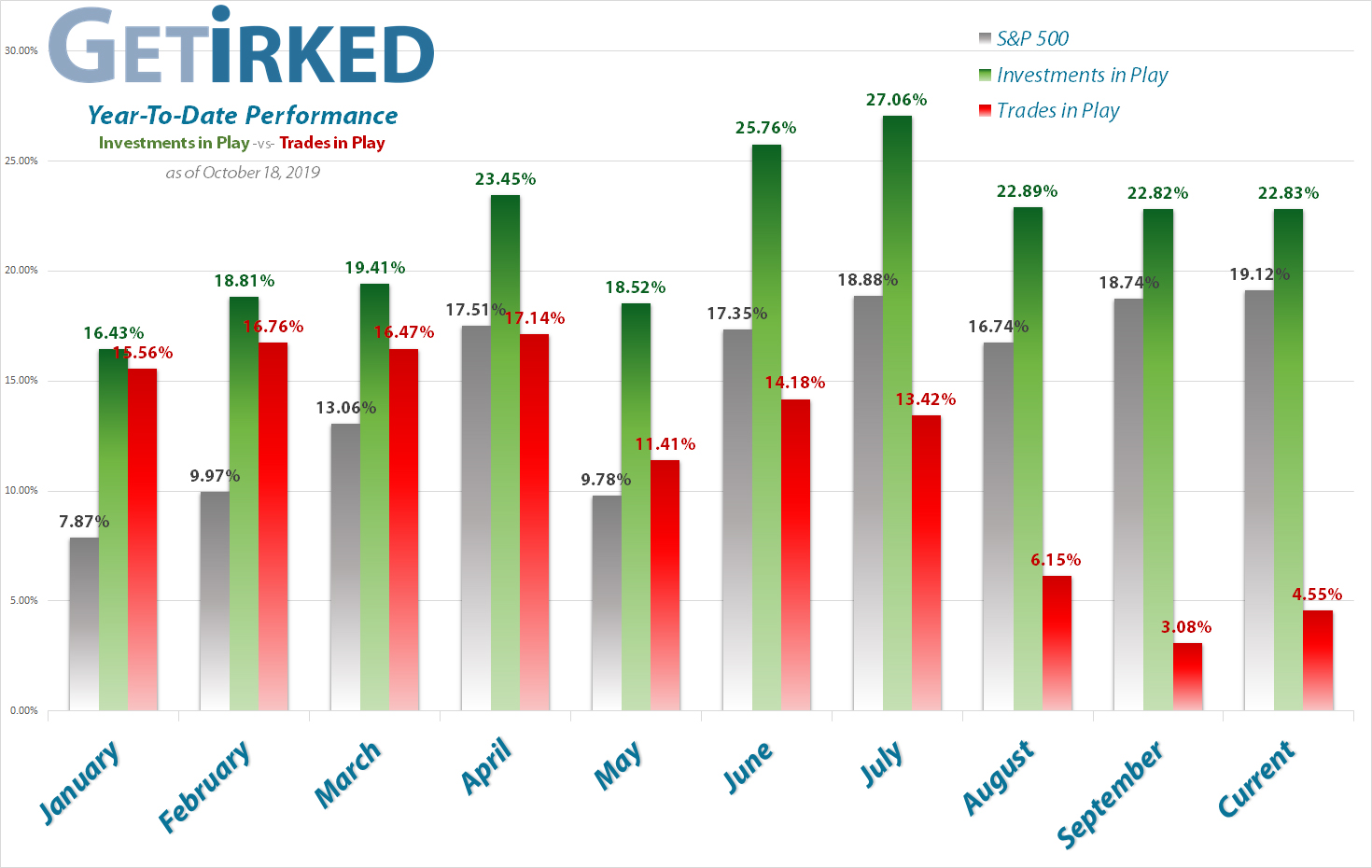

This Week’s Trades

Canopy Growth (CGC): Added to Position

Canopy Growth (CGC) and the rest of the cannabis sector continued to selloff substantially on Monday, triggering my trailing stop at $19.04 which filled at $19.1424 before reversing course to break straight through the $19.00 mark, making all-new lows (the lowest seen in the U.S. market, in fact). My next buy target for CGC is near $18.00.

CGC closed the week at $20.21, up +5.58% from where I added on Monday.

Gossamer Bio (GOSS): Flip-Flopping

Gossamer Bio (GOSS) continued to drop to new lows on Monday, triggering a trailing stop buy order I had in place at $14.71 which filled at $14.835. The buy lowered my per-share cost by a marginal -1.47% from $16.31 to $16.07.

Then, on Wednesday, GOSS flew back up to the upside, tearing through my per-share cost and allowing me to use a trailing stop to sell Monday’s shares at $16.303, snagging a 9.90% profit on those shares, reducing my per-share cost a whopping $0.05 (-0.31%) from $16.07 to $16.02, but, more importantly, freeing up that valuable investment capital.

My next buy target is back at GOSS’s new all-time low around $14.65 and my next sell order is around GOSS’s typical high range in its tidal wave pattern of $22.50.

GOSS closed the week at $16.48, up +1.09% from where I sold on Wednesday.

Iridium Communications (IRDM): *Closed Position*

When Iridium Communication (IRDM) started price-consolidation above my per-share cost on Wednesday, I decided to use a trailing stop to protect what little profits I had and closed the position at $23.86, locking in negligible profits of 1.27%.

I’ve held IRDM for about 7 months and although that’s not an exceptionally long time for one of my speculative Trades in Play, the stock just hasn’t performed the way I’d like for short- or even longer-term swing trades, particularly when it made a new low under $20 in the past few weeks.

While IRDM might make for an interesting speculative long-term investment, it was time for me to say goodbye to this position for the time being.

IRDM closed the week at $24.26, up +1.68% from where I closed the position Wednesday.

Tradeweb Markets (TW): Profit-Taking

After popping into the end of last week, I used a stop-limit sell order to protect my profits should Tradeweb Markets (TW) pull back, which it did early on Monday and triggered the sell order at $39.72.

The sale locked in a 5.25% gain on shares I bought back on 9/26 for $37.74, but, more importantly, freed up capital to reinvest should TW once again pull back to its lows. My next buy target for TW is $35.70.

TW closed the week at $41.50, up +4.48% from where I sold on Monday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.