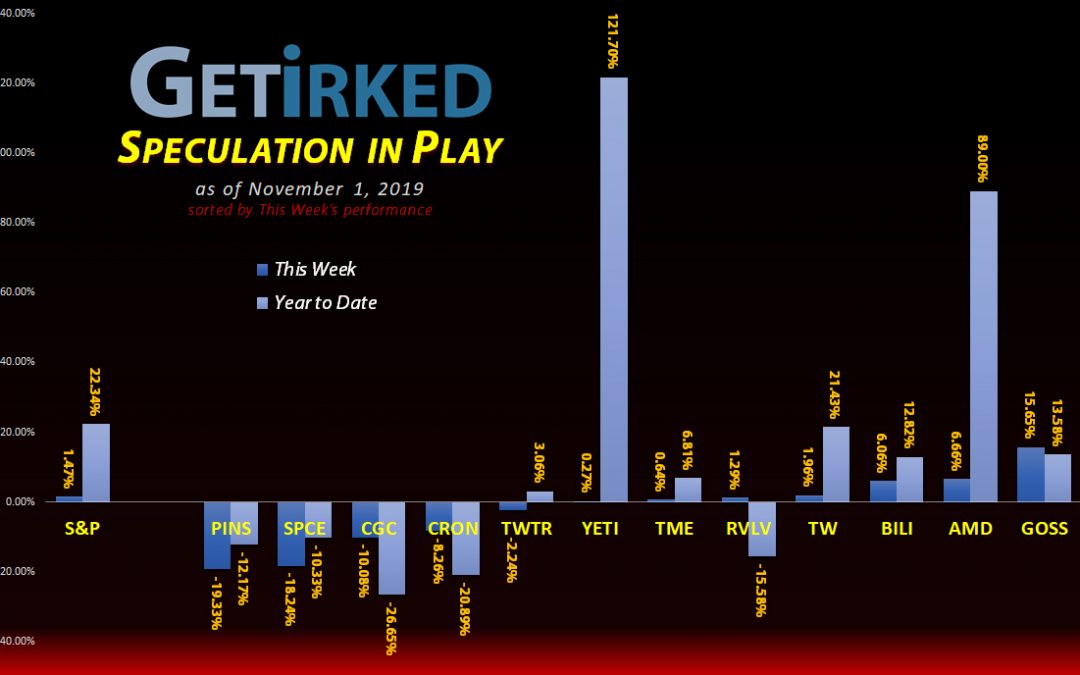

The Week’s Biggest Winner & Loser

Gossamer Bio (GOSS)

True to form, Gossamer Bio (GOSS) continues to be wildly volatile, gaining +15.65% and earning its place as this week’s Biggest Winner. Also, a gain this big means it’s time to close the position (read on to find the details).

Pinterest (PINS)

There were a lot of competitors for this week’s Biggest Loser, but Pinterest (PINS)’s -19.33% collapse beat out newcomer Virgin Galactic (SPCE) down -18.24% and record-holder Canopy Growth (CGC) down “just” -10%, following PINS’ terrible earnings report this week.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+163.52%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $13.24

Yeti (YETI)

+110.53%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.63

Gossamer Bio (GOSS)

+39.90%

1st Buy: 9/26/2019 @ $17.07

Current Per-Share: $0.00

Tencent Music (TME)

+31.23%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.76

Tradeweb Mkts (TW)

+12.16%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.14

BiliBili (BILI)

+10.87%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $14.85

Twitter (TWTR)

-0.57%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.79

Virgin Galactic (SPCE)

-2.30%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $9.87

Canopy Growth (CGC)

-3.28%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.38

Pinterest (PINS)

-16.94%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $25.12

Cronos Group (CRON)

-22.41%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $10.60

Revolve Group (RVLV)

-24.66%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $28.20

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

AMD (AMD): Profit-Taking

After reporting an in-line quarter to what analysts were expecting on Tuesday, AMD (AMD) traded slightly down on Wednesday, prompting me to set a stop-loss order to take profits in a 1/4 of my position, filling at $32.44.

The sale lowered my per-share cost -26.61% from $18.04 to $13.24 and locked in 13.19% of profits from shares I purchased on 9/27 this year.

Given recent negative activity in the semiconductor space, my next buy target is near the $24.00 level, a drop of more than -25% from Wednesday’s levels.

AMD closed the week at $34.89, up +7.55% from where I sold on Wednesday.

BiliBili (BILI): Profit-Taking

BiliBili (BILI) broke through resistance to reach higher-highs on Friday, triggering a limit sell order I had in place to take profits at $16.23. The sale lowered my per-share cost just -1.33% from $15.05 to $14.85 but permits additional purchases if BILI sees resistance and breaks down from these levels.

My next sell targets are at levels of past resistance: $19.10 and the all-time high of $22.50. My buy targets are $13.36, $12.59, $11.77, and $10.15.

BILI closed the week at $16.46, up +1.42% from where I sold on Friday.

Gossamer Bio (GOSS): *Closed Position*

Gossamer Bio (GOSS) gapped-up on the open on Friday, leading me to set trailing stop orders to protect profits in my position. While GOSS wasn’t as high as I was hoping (I was targeting $22+), my position ended up closing out at an average price of $21.53.

The total trade resulted in +39.9% gains from 9/26-11/1/2019, slightly over a month. I will eye re-entering GOSS for a future trade based on its Daily Relative Strength Index values, however, based on its setting of a new all-time low of $14.49 during this tidal wave, I’ll take extra care about my entry price.

GOSS closed the week at $21.58, up +0.02% from my average selling price.

Twitter (TWTR): *New Position*

As regular readers may know, I’ve been looking for a new position to replace Iridium Communication (IRDM) which I closed a few weeks ago. I wanted a speculation play with a great deal of volatility, and last week, Twitter (TWTR), the social network, gave me that play by reporting a disastrous quarter and promptly collapsing more than -20%.

While the quarter wasn’t great, this is a stock that has been positively slammed, down more than 35% from its September highs of $45.86 to $29.72 on Wednesday.

This kind of beat-down is actually unwarranted for a stock with good growth (just rough revenues and guidance). Plus, Twitter’s substantial trading range between $26-$46 over the past year offers the kind of volatility I was looking for my Speculation in Play portfolio so I opened a position on Wednesday at $29.79.

My next buy target for the stock is near its December 2018 lows around $26.26.

TWTR closed the week at $29.62, down -0.57% from where I opened Wednesday.

Virgin Galactic (SPCE): *New Position*

On Monday, Sir Richard Branson’s tourism space flight company Virgin Galactic (SPCE) listed in the U.S. markets for the first time (it’s been listed internationally since September 2017) and rocketed (pun intended) to an all-time high of $12.93 before pulling back substantially to the mid $10’s.

Virgin Galactic is a true speculative investment since commercial tourism space travel is way out there, and SPCE is a very interesting speculative play on the space (again, pun intended) so I decided to take a flyer (PUN!) out on the stock by putting in a trailing stop order to trigger if the stock dropped to its all-time low of $9.83.

Well, I had no expectation it would hit its all-time low just a few days later on Thursday when SPCE suddenly dropped nearly -15%, bouncing off its all-time low just enough to fill my trailing stop at $9.87 before crash-landing (yes, you guessed it… pun) to an all-new low of $8.96, -9.22% lower than where I opened my position.

My opening position was intentionally tiny at just 12.5% of my target allocation for the portfolio due to the unbelievably speculative nature of this stock. For the moment, the stock is weightless (PUN!) until we see how the price action stabilizes over the next few days.

My next buy target will add another 12.5% to my position, but that won’t be unless it drops to $6.84, -23.66% lower than Thursday’s low and a key level of support based on Fibonacci analysis.

SPCE closed the week at $9.64, down -2.33% from where I opened Thursday but up +7.59% off its all-new, all-time low of $8.96 made Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.