December 8, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

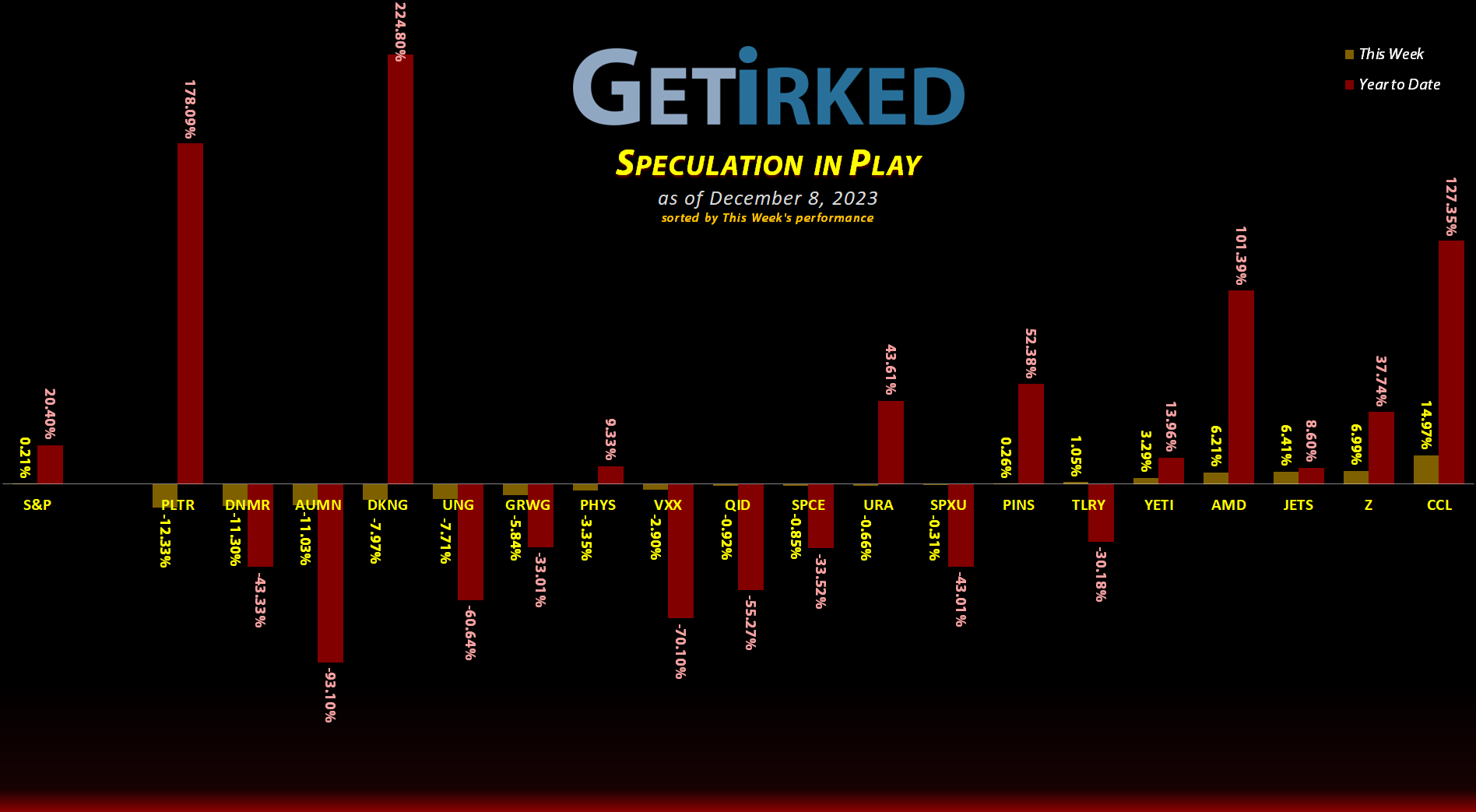

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

The entire travel and leisure sector saw a big rally this week, but Carnival Cruise Lines (CCL) cruised into victory with a +14.97% gain on the week – an incredible rally off its October lows and definitely the Biggest Winner of the Speculation in Play portfolio.

Palantir (PLTR)

A lot of the Artificial Intelligence (AI) stocks saw a pop this week, however Palantir Technologies (PLTR) wasn’t one of them. Oddly, I wasn’t able to find any fundamental reason for its substantial -12.33% pullback, although profit-taking could have been to the blame after its enormous year-to-date run. Regardless, Palantir swung in as the week’s Biggest Loser.

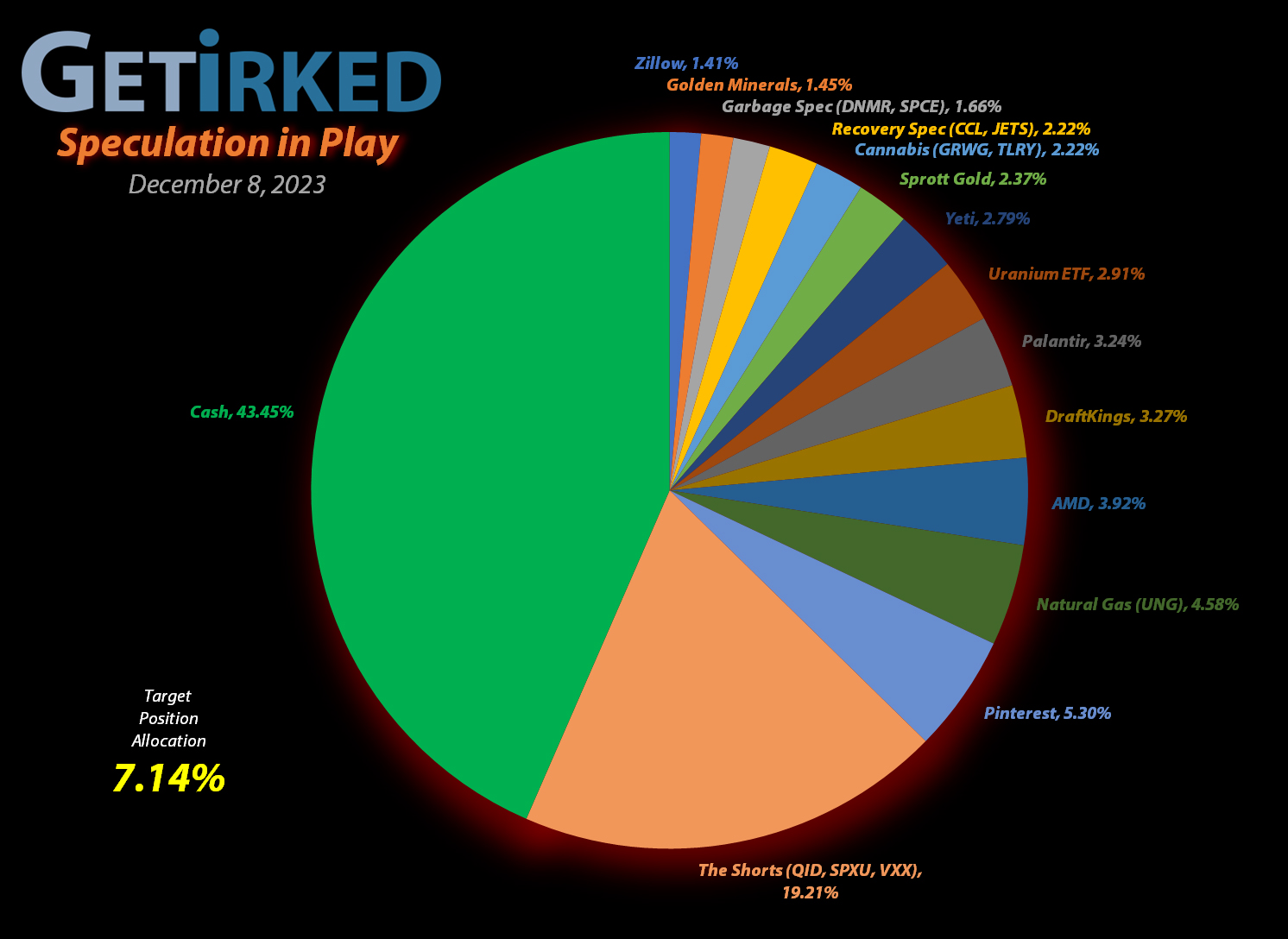

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+674.50%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+426.15%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$29.14)*

Yeti (YETI)

+388.43%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Uranium ETF (URA)

+142.62%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.85

Virgin Galactic (SPCE)

+106.03%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Airlines ETF (JETS)

+94.20%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$8.19)*

Carnival Cruise (CCL)

+78.60%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$9.00)*

Tilray Brands (TLRY)

+48.36%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

DraftKings (DKNG)

+16.75%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $30.75

Palantir (PLTR)

+13.20%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.69

Sprott Gold Trust (PHYS)

+6.68%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Zillow (Z)

-2.73%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Short SPY (SPXU)

-10.23`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.85

The “VIX” (VXX)

-13.98%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $19.45

Short QQQ (QID)

-21.46%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.00

U.S. Natural Gas (UNG)

-31.70%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.35

Grow Gen. (GRWG)

-79.78%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

Danimer Sci (DNMR)

-87.23%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $7.95

Golden Mine. (AUMN)

-92.15%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): Profit-Taking

The travel sector experienced an incredible rally this week, with the airlines really taking off. Given the incredible rally this sector has seen – airlines are up more than 25% off their lows at the beginning of November – I decided to trim my airlines position.

On Thursday, the Airlines ETF (JETS) triggered my next sell order which sold 34.08% of my position at $18.47, locking in +19.55% in gains on shares I bought just under two months ago for $15.45 on October 19.

The sale lowered my per-share cost -$9.09 from $0.90 to -$8.19 (a negative per-share cost indicates all capital has been removed in addition to $8.19 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $14.87, slightly above the lows JETS saw in November, and my next sell target is $21.13, below a point of resistance JETS has seen repeatedly in the past.

JETS closed the week at $18.43, down -0.22% from where I took profits Thursday.

Carnival Cruise Lines (CCL): Profit-Taking

Carnival Cruise Lines (CCL) rallied with the rest of the travel sector this week, particularly on Wednesday when it rallied nearly 6% and triggered my next sell order which sold 33.33% of my position at $17.40.

The sale locked in just +0.87% in gains on shares I bought for $17.25 when I initially opened the position during on March 12, 2020 in the midst of the pandemic selloff, and lowered my per-share cost -$8.79 from -$0.21 to -$9.00 (a negative per-share cost indicates all capital has been removed in addition to $9.00 per share added to the portfolio’s bottom line in addition to each share’s current value).

While it may seem odd for me to reduce my position despite already playing with the House’s Money, but Carnival has rallied an incredible +60.89% off its lows from less than two months ago at the beginning of October; that kind of move must be treated with kid gloves.

From here, my next sell target is $23.00, just under a past point of resistance, and my next buy target is $11.10, slightly above Carnival’s October low.

CCL closed the week at $18.11, up +4.08% from where I took profits Wednesday.

Natural Gas Fund (UNG): Added to Position

Energy stocks continued to slip at the start of the week sending natural gas lower and triggering my next buy order in the U.S. Natural Gas Fund on Monday which added 4.43% to my position at $5.25. The buy order lowered my per-share cost -2.00% from $7.50 to $7.35.

Yes, I am a glutton for punishment as I will continue adding to this position with my next buy target at $4.60. I will also start to substantially trim the position if it crosses above my cost basis with my next sell order at $7.55.

UNG closed the week at $5.02, down -4.38% from where I added Monday.