November 17, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

GrowGeneration (GRWG)

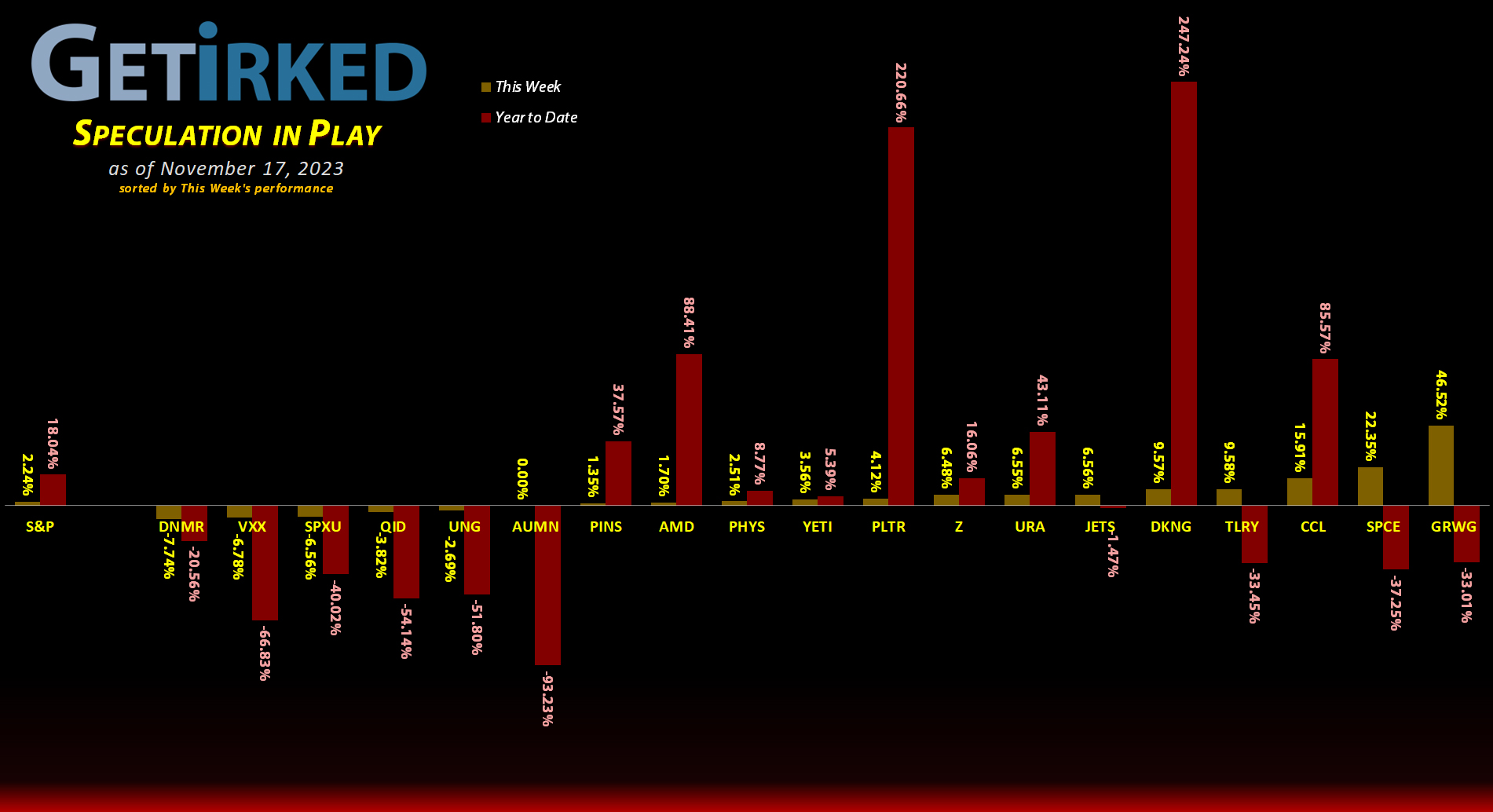

While the entire cannabis sector rallied with the rest of the markets this week, GrowGeneration (GRWG) saw a significant pop following news that an insider bought nearly $1 million worth of shares in the company. The news caused GRWG to leap +46.52% in the week, easily securing its spot as the Week’s Biggest Winner.

Danimer Scientific (DNMR)

How big of a stinker must your company be to sell off during an epic week-long rally? Well, Danimer Scientific (DNMR) knows the feeling, dropping -7.74% on the week where every equity rallied. Man, this is a terrible, terrible stock.

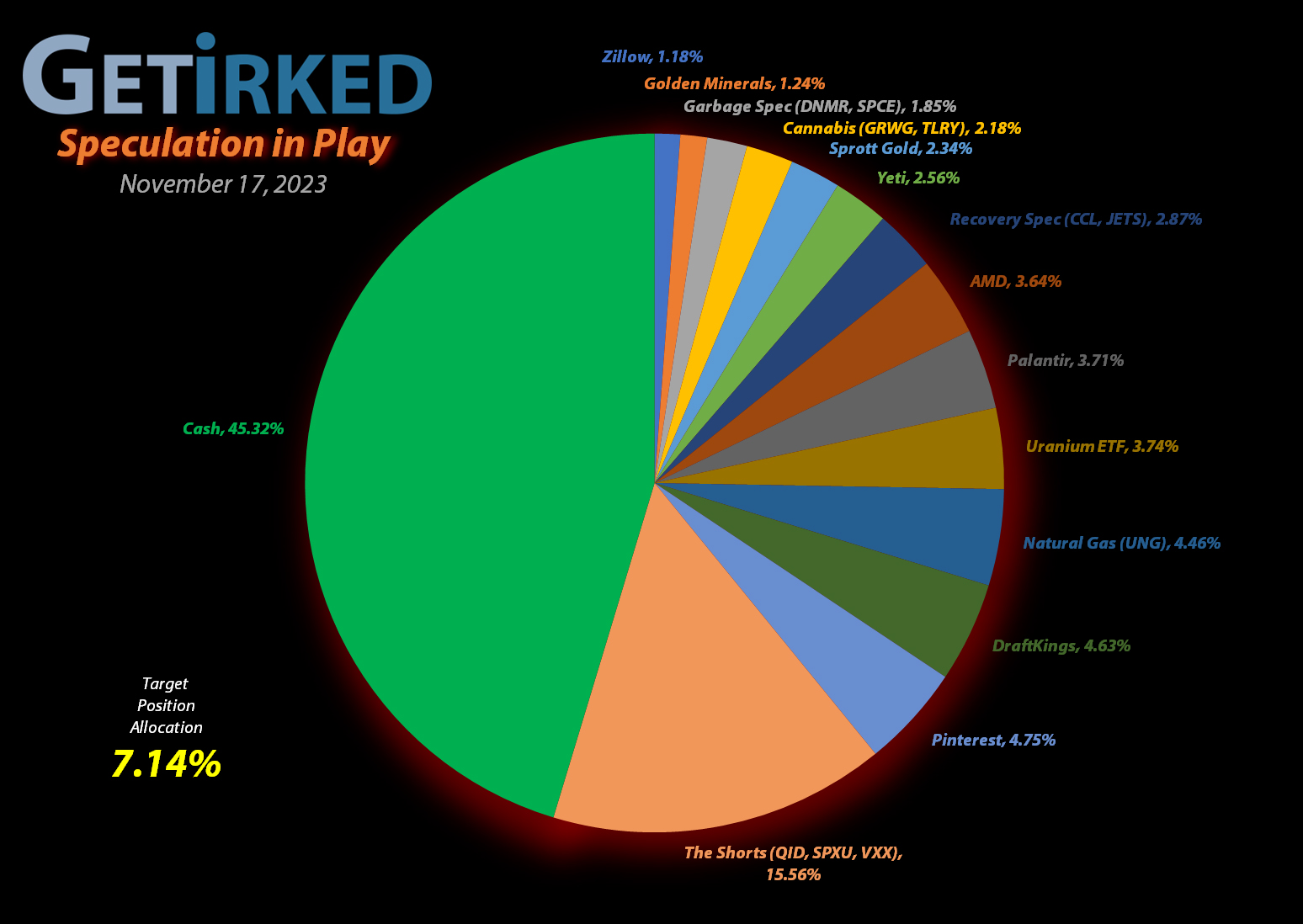

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Airlines ETF (JETS)

+1757.75%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $0.90

AMD (AMD)

+653.28%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+403.39%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$29.14)*

Yeti (YETI)

+373.82%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+102.87%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Uranium ETF (URA)

+81.22%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+65.15%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+47.59%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

Palantir (PLTR)

+30.69%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.69

DraftKings (DKNG)

+16.87%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $32.84

Sprott Gold Trust (PHYS)

+6.16%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Short SPY (SPXU)

-8.24`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $11.19

The “VIX” (VXX)

-11.15%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $20.90

Zillow (Z)

-18.03%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Short QQQ (QID)

-20.80%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.27

U.S. Natural Gas (UNG)

-20.95%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.80

Grow Gen. (GRWG)

-79.78%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

Danimer Sci (DNMR)

-82.67%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.25

Golden Mine. (AUMN)

-92.29%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Short Nasdaq-100 ETF (QID): Added to Position

When the markets exploded on Tuesday, I decided to use trailing stops orders to add to my Proshares UltraShort QQQ ETF (QID) position with a buy which added 3.43% to my position at $12.15.

This buy lowered my per-share cost -0.84%, down from $15.40 to $15.27. From here, my next buy target is $11.82, a price calculated using Fibonacci Method, and my next sell target is slightly above my cost basis at $15.29 where I will substantially reduce the size of this position.

QID closed the week at $12.09, down -0.49% from where I added Tuesday.

Natural Gas Fund (UNG): Added to Position

Oil prices dropping caused everything everything related to fall as well, so the U.S. Natural Gas Fund (UNG) triggered my next buy order which added 5.21% to my position at $6.14 on Friday.

The buy lowered my per-share cost -1.89%, down from $7.95 to $7.80. From here, my next buy target is $5.21, a price calculated using a combination of the Fibonacci Method and a particular downward trendline that’s provided support throughout the course of the year. I will reduce my position substantially if UNG reaches $7.92, below its recent high from October.

UNG closed the week at $6.16, up +0.33% from where I added Friday.

Short S&P 500 ETF (SPXU): Added to Position

When the markets rocketed higher on Tuesday, I decided to use trailing stops orders to add to my Proshares UltraPro Short S&P 500 ETF (SPXU) position with a buy which added 4.39% to my position at $10.35, locking in a -16.46% discount replacing shares I sold for $12.39 on October 23.

This buy lowered my per-share cost -0.53%, down from $11.25 to $11.19. From here, my next buy target is $10.20, slightly above a level of support calculated using the Fibonacci Method, and my next sell target is $13.35, below the high SPXU saw in October.

SPXU closed the week at $10.25, down -0.97% from where I added Tuesday.

VIX – The Volatility Index (VXX): Added to Position

The Volatility Index (VIX) remains one of the most poorly-named instruments available to traders; after a 2% rally in the S&P 500 in a single day on Tuesday, the layman would think the VIX, a supposed measurement of volatility, would skyrocket higher… not so much.

In fact, on Wednesday, the VIX continued dropping, triggering my next buy in the iPath S&P 500 VIX ETN (VXX) which added 6.28% to my position, filling at $19.10 and lowering my per-share cost -2.11% from $21.35 to $20.90.

From here, my next buy target is $18.50, a price calculated using the Fibonacci Method, and my next sell target is $22.70, below a key point of resistance VXX has seen several times in the last couple of months.

VXX closed the week at $18.56, down -2.83% from where I added Wednesday.