July 1, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

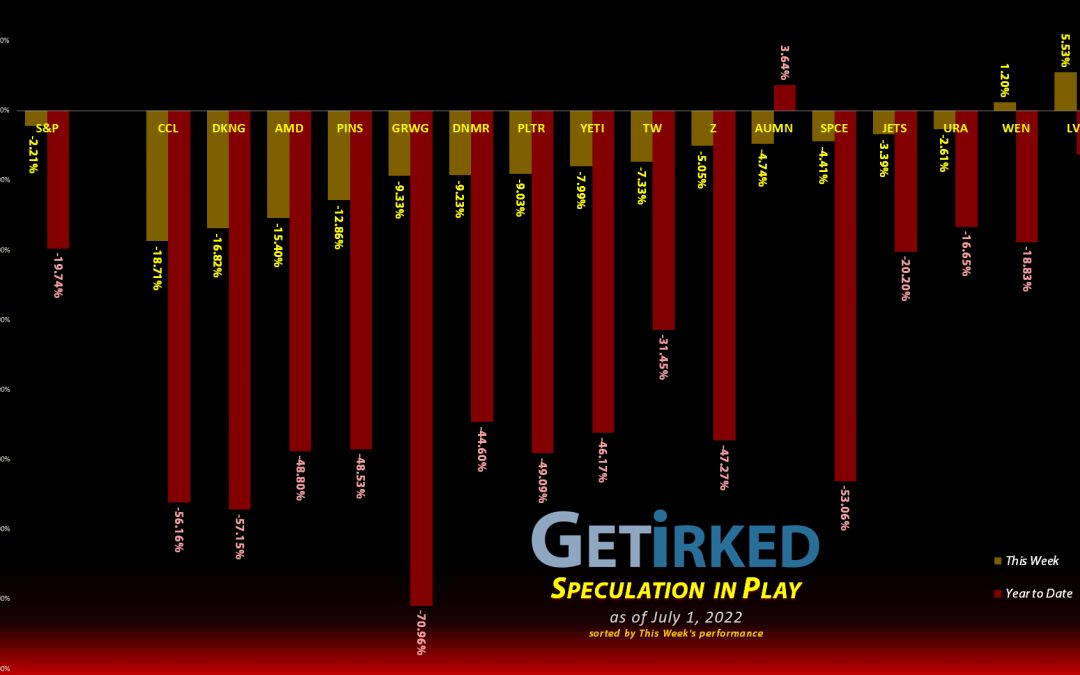

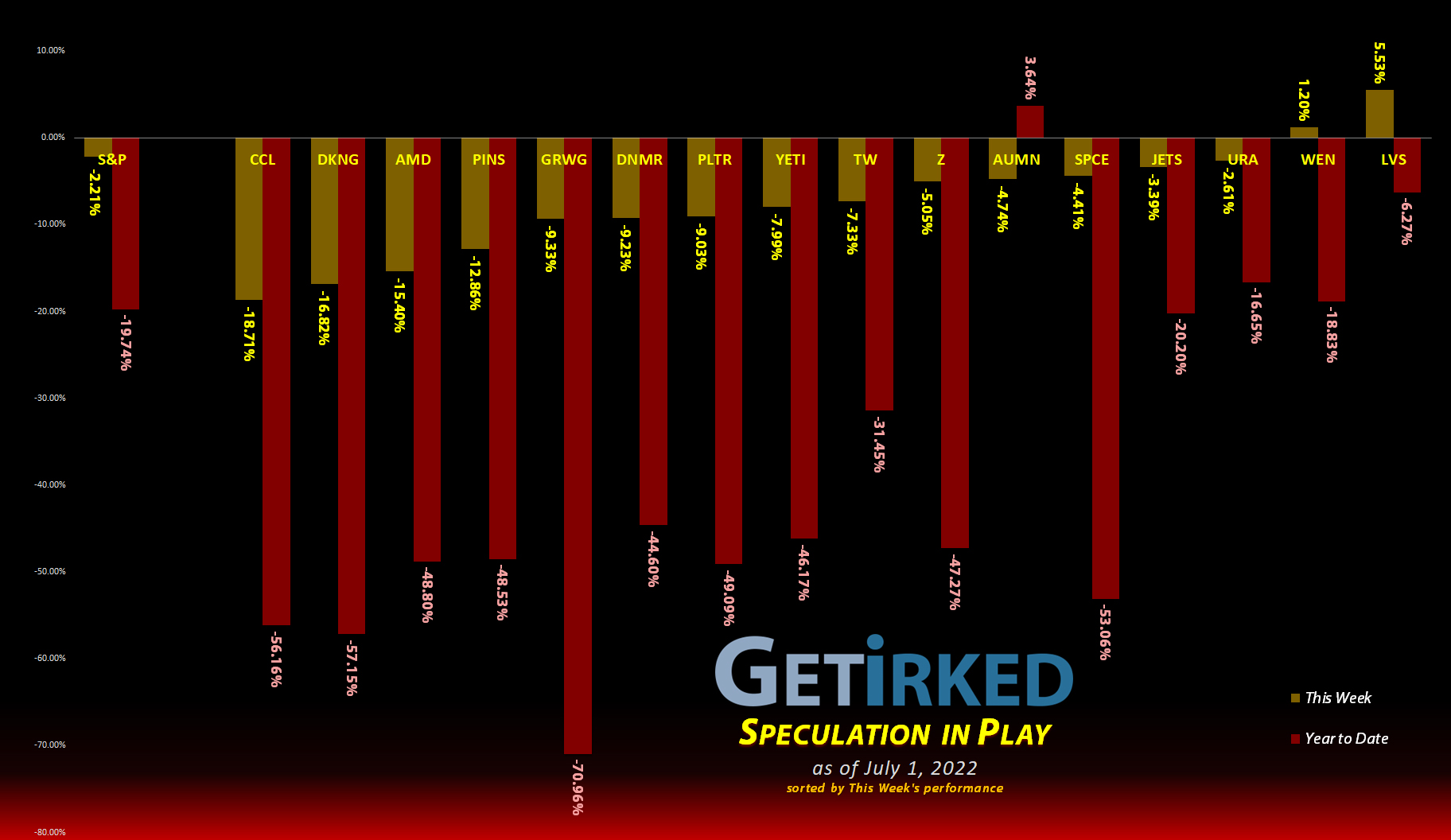

The Week’s Biggest Winner & Loser

Las Vegas Sands (LVS)

Despite inflationary pressures everywhere, turns out people still enjoy going to casinos and betting their brains out. This goes double for Macao as China finally started reopening. Las Vegas Sands (LVS), with its Chinese exposure, really had a good week despite the sea of red, closing up +5.53% and earning itself the spot of the Week’s Biggest Winner.

Carnival Cruise Lines (CCL)

Cruise lines did not fare well this week as inflation concerns beat on the debt sheets of the major cruise lines. To make matters worse, a Morgan Stanley (MS) analyst came out with a report which showed that a potential bear case for Carnival Cruise Lines (CCL) was, well, complete collapse with the stock going to $0. While not a certainty, this news did not inspire confidence in CCL’s shareholders who dumped the stock to the tune of a -18.71% weekly loss and earning it the spot of the Week’s Biggest Loser. YOWTCH!

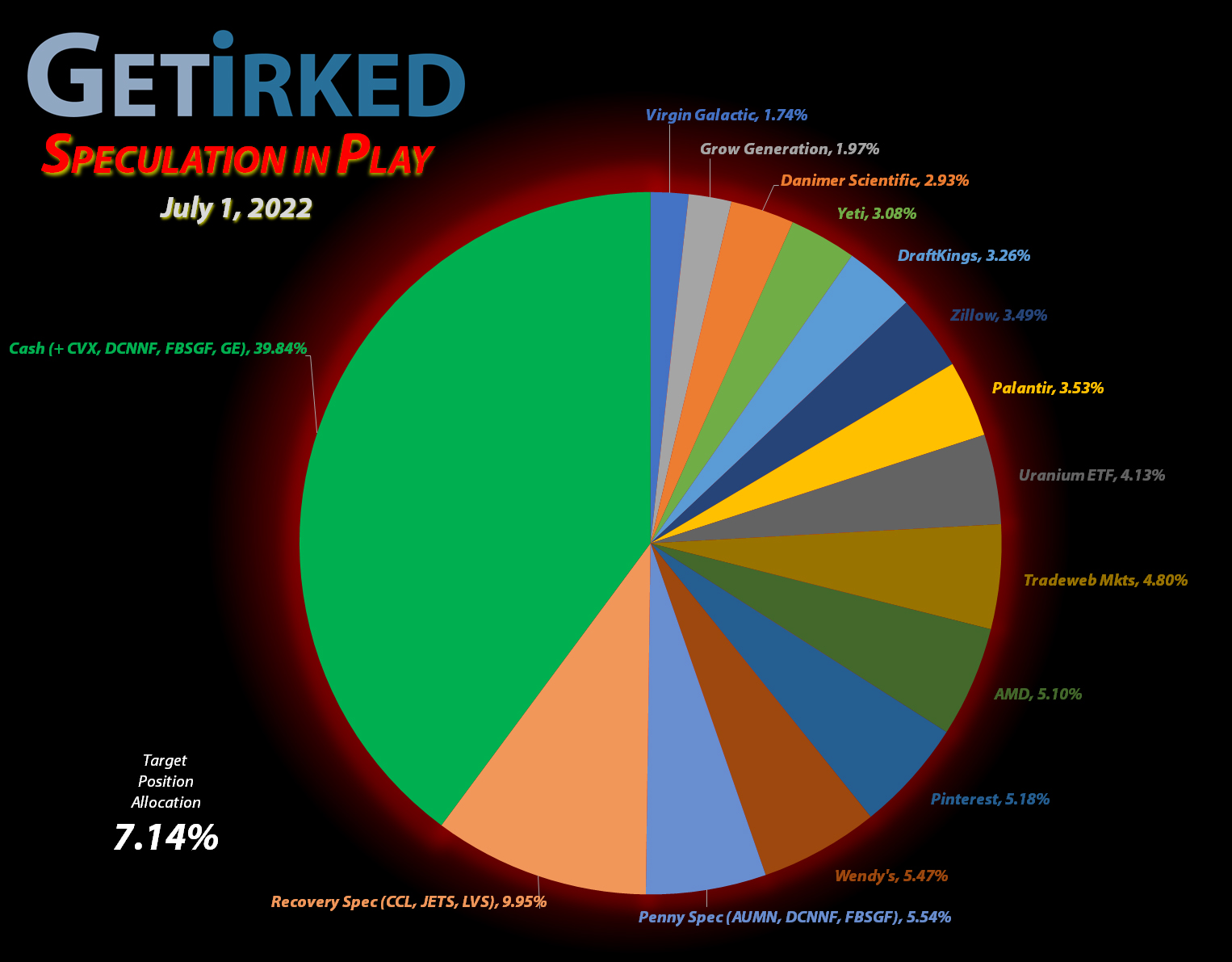

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+450.70%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+382.88%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+293.39%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($8.85)*

Virgin Galactic (SPCE)

+171.84%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$5.65)*

Tradeweb Mkts (TW)

+157.37%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.54)*

Airlines ETF (JETS)

+61.84%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $10.40

Carnival Cruise (CCL)

+15.57%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $7.64

Las Vegas Sands (LVS)

+9.74%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $32.15

Uranium ETF (URA)

+2.32%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $18.60

Golden Mine. (AUMN)

-18.53%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4443

Wendy’s (WEN)

-18.76%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $23.83

Zillow (Z)

-37.76%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $54.10

Palantir (PLTR)

-45.15%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.90

Danimer Sci (DNMR)

-52.90%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $10.00

DraftKings (DKNG)

-57.81%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $27.90

Grow Gen. (GRWG)

-76.97%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+224.48%*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

General Electric (GE)

+62.11%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.21)*

Canadian Pal (DCNNF)

-24.03%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Fabled Gold (FBSGF)

-48.30%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Actual Cash

31.42%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

Excruciating price action makes speculation worse…

Another week with absolutely no moves in the Speculation in Play portfolio despite some truly bad price action as the market can’t wrap its ahead around all of the headwinds facing stocks.

Despite nearly every position heading lower, none of them hit any of the price targets where I would add more to them. The result is an excruciating week of watching the portfolio lose value with no opportunity to capitalize on the “sale prices” seen nearly across the board.

However, therein lies the key to speculation. You keep your bat on your shoulder and don’t swing until you see the perfect pitch. Or, in Civil War parlance, “don’t fire until you see the whites of their eyes.” As always, I’d prefer to miss an opportunity altogether than jump the gun, buy early, and watch helplessly as the stock collapses to ever lower prices with me with no additional cash to put to work.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.