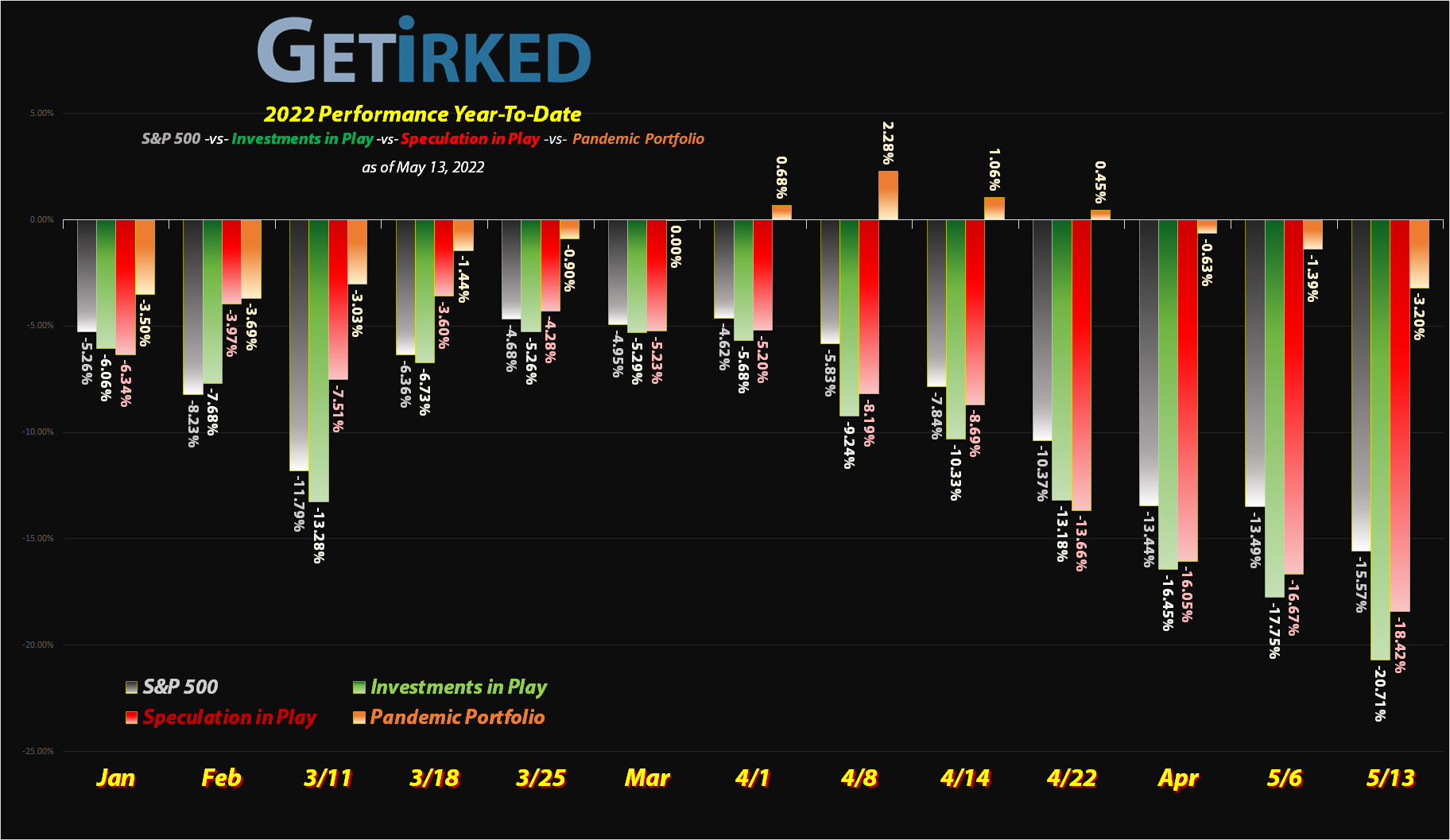

May 13, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Zillow (Z)

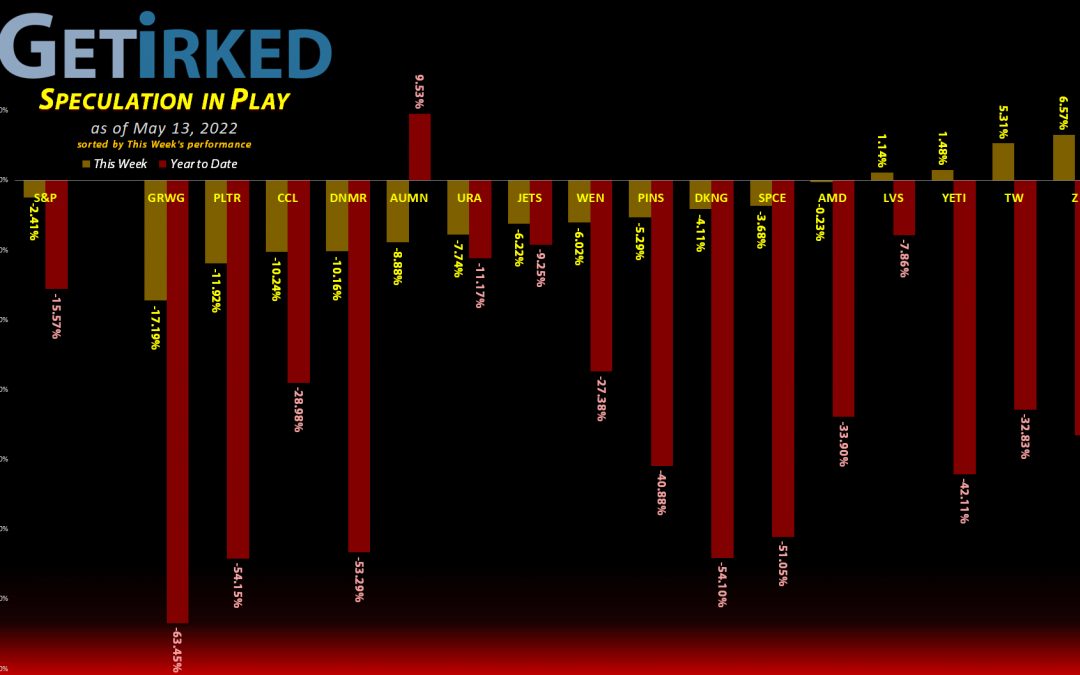

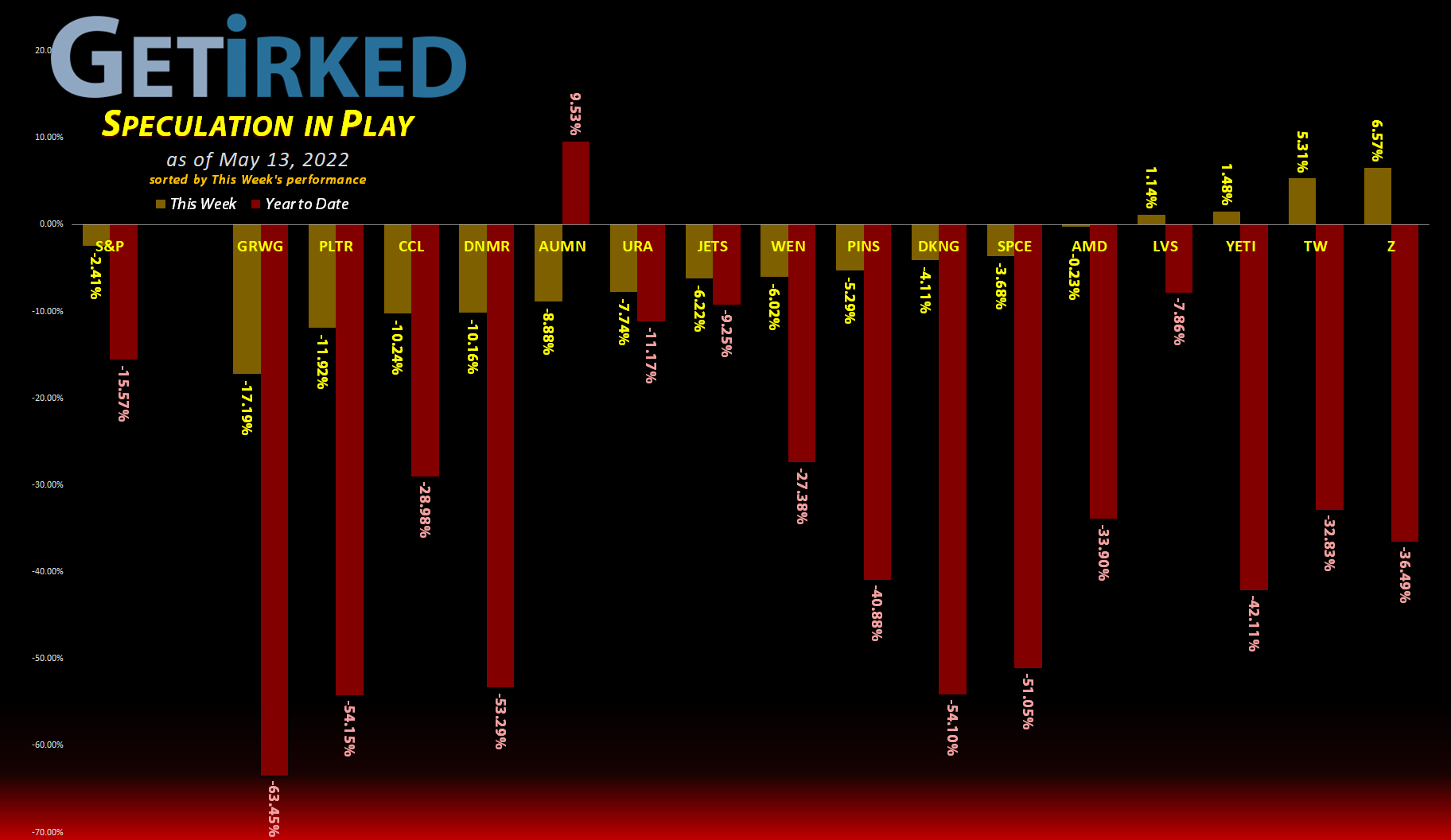

In a week that saw nothing but red for the vast majority of the stock market, it’s impressive for a stock to finish slightly higher or even flat. However, Zillow (Z) outperformed remarkably – it closed the week up +6.57%, easily locking in the spot of the Week’s Biggest Winner.

GrowGeneration (GRWG)

All speculative, high-growth names got slammed again this week, and they don’t come growthier (pun intended) than the cannabis sector with GrowGeneration (GRWG) taking the crown as the Week’s Biggest Loser, down -17.19% for the week (and -63.45% Year-to-Date… ugh).

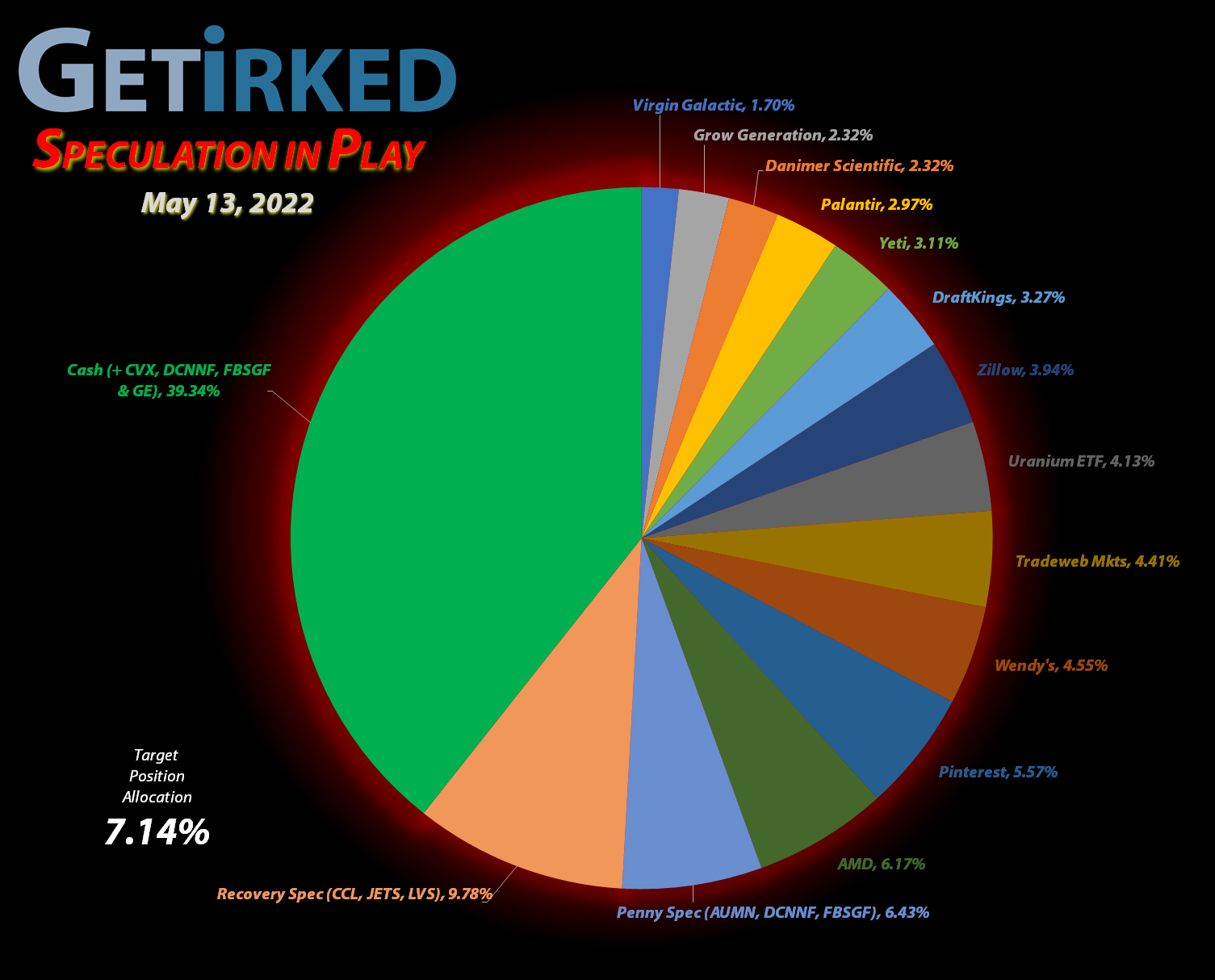

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+560.34%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+397.03%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+322.77%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($8.85)*

Airlines ETF (JETS)

+212.83%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.00

Virgin Galactic (SPCE)

+175.59%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$5.65)*

Tradeweb Mkts (TW)

+154.88%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.57)*

Carnival Cruise (CCL)

+105.47%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $6.95

Uranium ETF (URA)

+8.98%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $18.60

Las Vegas Sands (LVS)

+7.87%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $32.15

Golden Mine. (AUMN)

-14.41%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4443

Zillow (Z)

-25.03%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $54.10

Wendy’s (WEN)

-27.79%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $24.00

Palantir (PLTR)

-50.62%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.90

DraftKings (DKNG)

-54.80%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $27.90

Danimer Sci (DNMR)

-60.20%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $10.00

Grow Gen. (GRWG)

-71.09%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+255.02*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

General Electric (GE)

+67.75%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.21)*

Canadian Pal (DCNNF)

-5.51%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Fabled Gold (FBSGF)

-23.69%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Actual Cash

30.28%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

Carnival Cruiselines (CCL): Added to Position

Carnival Cruiselines (CCL) crashed down with the rest of the market on Monday, triggering a buy order of mine at $15.20, slightly above its past 2022 low at $14.94.

The buy raised my per-share cost +$1.65 from $5.30 to $6.95, still a -59.70% reduction from my first buy at $17.25 on March 12, 2020. From here, my next buy target is $12.20, above a past point of support, and my next sell target is $22.95, just under the high of CCL’s most recent bull run.

CCL closed the week at $14.28, down -6.05% from where I added Monday.

Danimer Scientific (DNMR): Added to Position

Danimer Scientific (DNMR) made a run for its 2022 low on Thursday, triggering my next buy order which filled at $3.25. The buy lowered my per-share cost -11.89% from $11.35 to $10.00. From here, my next buy target is $2.30, a price calculated using the Fibonacci Method, and my next sell target is $11.70, slightly below a past point of resistance.

DNMR closed the week at $3.98, up +22.46% from where I added Thursday.

DraftKings (DKNG): Added to Position

DraftKings’ (DKNG) selloff continued this week as the stock dropped to new lows, triggering a buy order I had in place which filled at $10.40 on Wednesday. The buy lowered my per-share cost -8.22% from $30.40 to $27.90.

From here, my next buy target is $8.10, a price calculated using the Fibonacci Method, and my next sell target is $29.65, below a key point of past resistance as well as below the psychological resistance of the $30.00 mark.

DKNG closed the week at $12.61, up +21.25% from where I added Wednesday.

Las Vegas Sands (LVS): Added to Position

Las Vegas Sands (LVS) sold off with the rest of the market and saw deeper losses thanks to its exposure to the always-on-lockdown Chinese market. On Tuesday, LVS triggered a buy order I had in place at $31.55 which lowered my per-share cost -0.62% from $32.35 to $32.15.

From here, my next sell target is quite a bit lower at $25.15, a past point of support from the Great Financial Crisis in 2008, and my next sell target is $45.05, below a key level of resistance from prior bull rallies.

LVS closed the week at $34.68, up +9.92% from where I added Tuesday.

GrowGeneration (GRWG): Added to Position

GrowGeneration (GRWG) collapsed after a disappointing earnings report featuring depressing forward guidance, falling through the $4.00 mark and triggering my next buy order which filled at $3.88 on Wednesday. The order lowered my per-share cost -5.17% from $17.40 to $16.50.

From here, my next buy target is $2.50, around a past point of distant support, and my next sell target is around $18.00, below a past point of resistance.

GRWG closed the week at $4.77, up +22.94% from where I added Wednesday.

Palantir Technologies (PLTR): Added to Position x 2

Palantir Technologies (PLTR) continued to melt down this week following a disappointing earnings report on Monday, triggering a buy order I had in place which filled at $7.80. On Thursday, PLTR broke down even further, triggering my next buy order at $6.55 which gave me a $7.18 average buy price.

The combined orders lowered my per-share cost -11.29% from $19.05 to $16.90. From here, my next buy target is $5.55, a price calculated using the Fibonacci Method, and my next sell target is $17.25, below a past point of resistance.

PLTR closed the week at $8.34, up +16.16% from my $7.18 average buy.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.