November 19, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

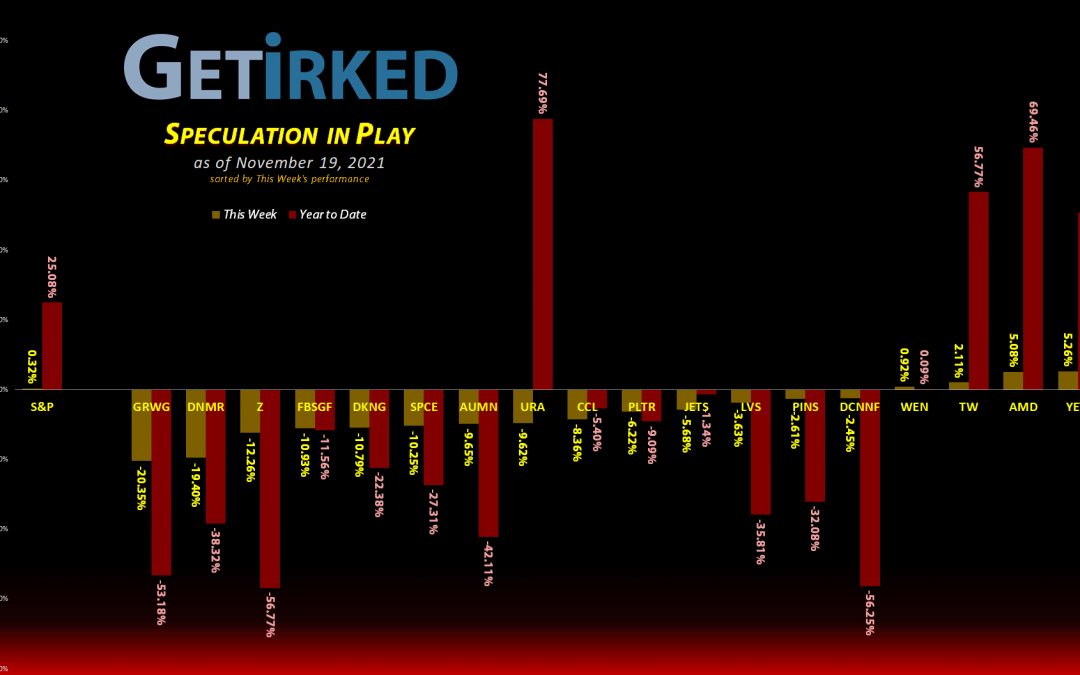

The Week’s Biggest Winner & Loser

Yeti (YETI)

It doesn’t matter the weather or if there’s even a pandemic, everyone enjoys going outdoors and it showed in Yeti’s (YETI) numbers. Yeti locked in a +5.26% gain during a week that saw almost nothing but red for the rest of the Speculation in Play portfolio which makes YETI this Week’s Biggest Winner.

Grow Generation (GRWG)

Grow Generation (GRWG) simply isn’t… growing. After offering a middling-to-bad earnings report, investors realized that an organic hydroponic supply play in the middle of a cannabis wasteland isn’t that nice a place to be and bailed in huge numbers. GRWG dropped -20.35% this week, easily landing itself the spot of the Week’s Biggest Loser.

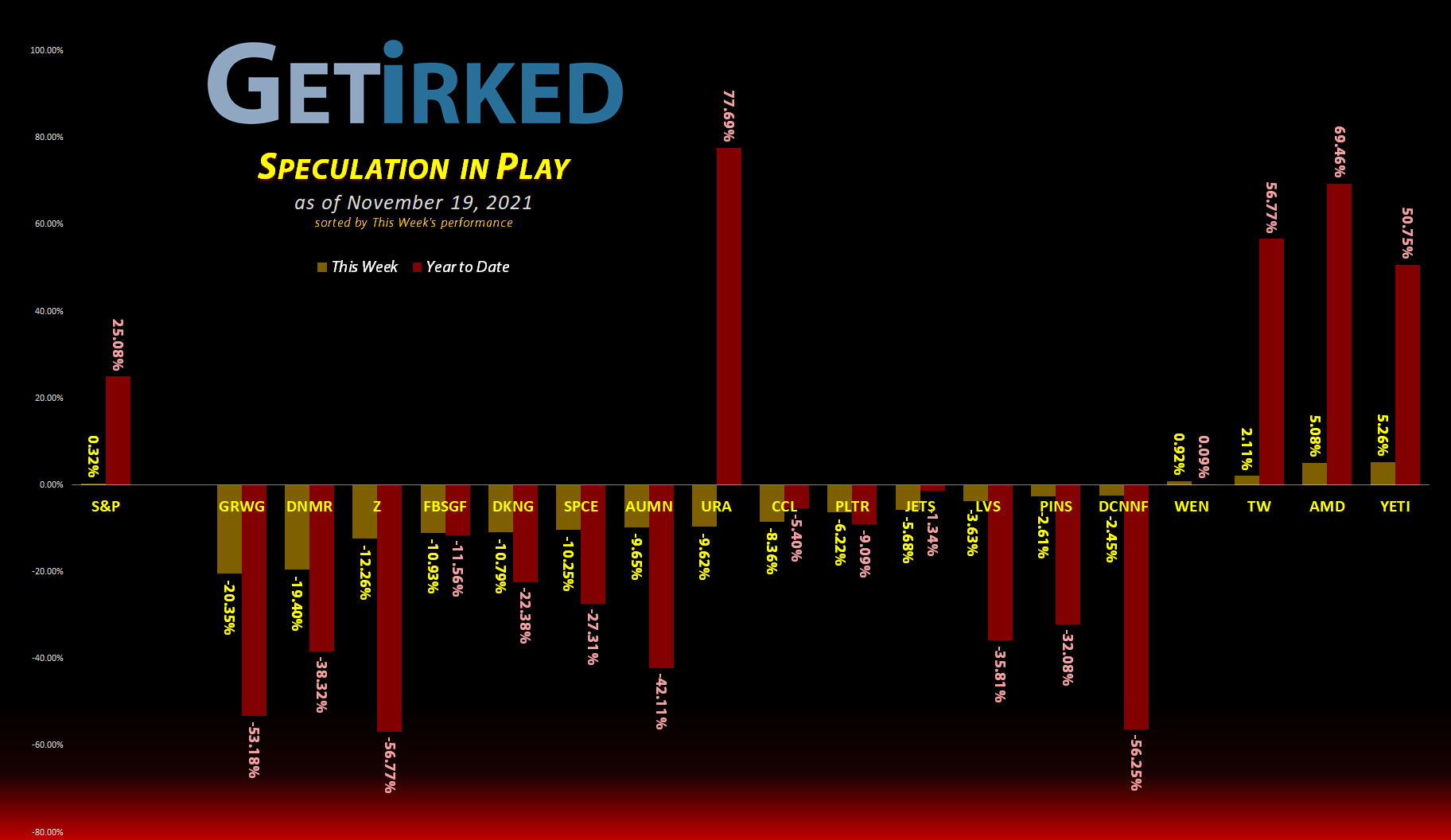

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+868.49%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Pinterest (PINS)

+522.24%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($20.65)*

Yeti (YETI)

+519.76%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+439.21%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $3.80

Virgin Galactic (SPCE)

+261.16%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$31.10)*

Airlines ETF (JETS)

+223.65%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+206.81%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.60)*

Uranium ETF (URA)

+37.96%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $19.75

Las Vegas Sands (LVS)

+6.54%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.91

Zillow (Z)

-1.79%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $57.13

Danimer Sci (DNMR)

-2.36%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $14.85

Palantir (PLTR)

-5.12%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

Golden Mine. (AUMN)

-7.04%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4734

Wendy’s (WEN)

-12.24%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $25.00

Fabled Co. (FBSGF)

-15.35%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.0886

DraftKings (DKNG)

-17.30%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $43.70

Grow Gen. (GRWG)

-29.87%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $26.85

Can. Palladium (DCNNF)

-32.67%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0770

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

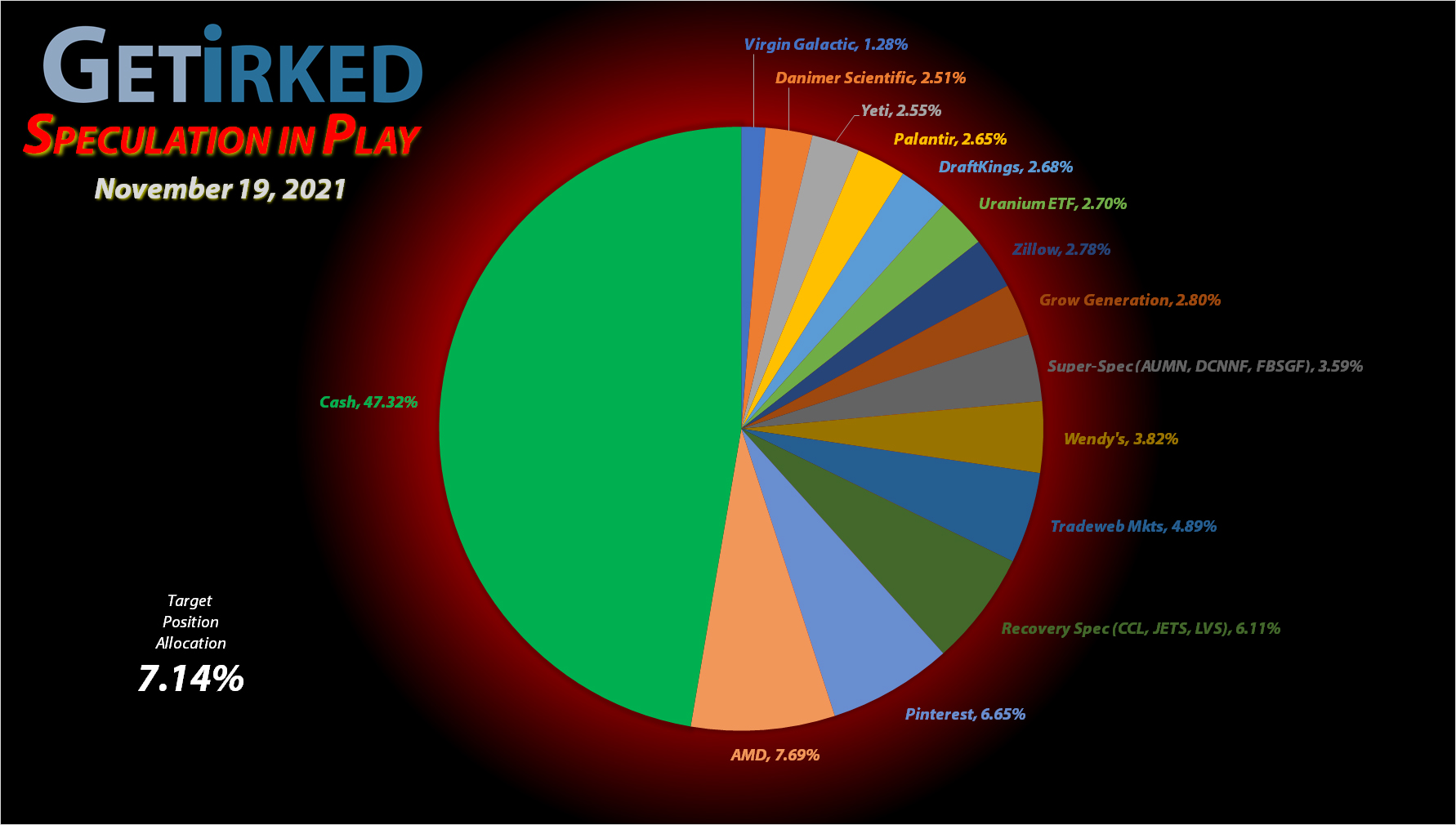

Carnival Cruise Lines (CCL): Added to Position

Inflation and consumer-spending concerns led the vacation stocks lower with a particular focus on the cruise lines. Carnival Cruise Lines hit a buy target on Tuesday, with an order filling at $21.45.

The order locks in a -8.49% discount on the shares I sold for $23.44 back on September 1 and raises my per-share cost $5.89 from -2.09 to $3.80, putting capital back into the position. From here, my next buy price target is $18.05, above a past point of support, and my sell target is $31.40, just below CCL’s recent high.

CCL closed the week at $20.49, down -4.48% from where I added Tuesday.

Danimer Scientific (DNMR): Added to Position

Danimer Scientific (DNMR), the portfolio’s newest position, has been nothing short of insanely erratic since I first opened the position less than a month ago. Since then, it rocketed up more than 50% and has now pulled back below my buying price – a drop of more than -30% from its new high – triggering a buy order on Thursday which filled at $13.95.

The small buy lowered my per-share cost -1.00% from $15.00 to $14.85. From here, my next buy price target is $13.25, slightly above a past point of support, and my next sell target is $29.25.

DNMR closed the week at $14.50, up +3.94% from where I added Thursday.

Grow Generation (GRWG): Added to Position

Grow Generation (GRWG) continued to experience selling pressure this week, and a buy order of mine filled at $21.10 on Thursday, lowering my per-share cost -4.107% from $28.00 to $26.85.

From here, my next buy target is $16.65, above a past point of support, and my next sell target is $50.00, below a point of resistance where I plan to remove all of the capital from the position.

GRWG closed the week at $18.83, down -10.76% from where I added Thursday.

Uranium ETF (URA): Added to Position

I decided to add to my position in the Uranium ETF (URA) when it pulled back on Wednesday with a buy order that filled at $28.29. The order raised my per-share cost +$2.85 from $16.90 to $19.75. While I normally hate buying up my per-share cost basis, I feel that the uranium sector has a lot of upside so I want to increase my position.

From here, my next buy target is $26.00, above a past point of support, and I have no sell targets at this time as I feel there is a significant amount of long-term potential in uranium.

URA closed the week at $27.24, down -3.71% from where I added Wednesday.

Zillow (Z): *New Position*

It’s nearly a sure bet that you’ve heard of the real estate website, Zillow (Z). You may even be aware that they tried entering into the house-flipping space a few years ago. And, if you’re acutely paying attention, you may have also heard that, earlier in October, Zillow announced that the real estate market is FUBAR’ed, they have no idea what they’re doing due their crappy algorithm, and that they shut down their house-flipping division.

In the long run, shutting down house-flipping – a high-risk, asset-rich endeavor – in favor of Zillow’s extremely lucrative, low-risk, low-inventory online website is a brilliant move, however, in the short run, the decision has caused Zillow to drop more than -72% from its $208.11 all-time high set nine months ago in February to where I picked it up this Thursday at $57.13.

Why speculate in this disaster? Because I believe that management has the capability to bring back the success of Zillow once they get rid of the literal billions in dollars of crappy, overpriced real estate they bought.

In the meantime, I’m taking this position slowly with my next buy target down at $49.10, a past point of support, and a nearly -15% drop from where I opened the position. Like I said, I’m approaching this insanely volatile stock very slowly.

Z closed the week at $56.11, down -1.79% from where I opened Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.